AP Automation ROI Calculator

This AP automation ROI calculator provides a simple and convenient way to estimate the benefits of AP automation, allowing you to make data-driven decisions that can improve your financial efficiency and save both time and resources.

Interested in financial close automation? Then be sure to check out our Close Automation ROI calculator as well.

Optional assumptions (more realistic estimate)

Explore AP Automation by DOKKA

-

AI-Powered

Invoice Processing -

Automated

Approval Workflows -

Native

ERP Integration -

Error &

Duplicate Prevention -

Centralized

AP Workspace

AI-Powered

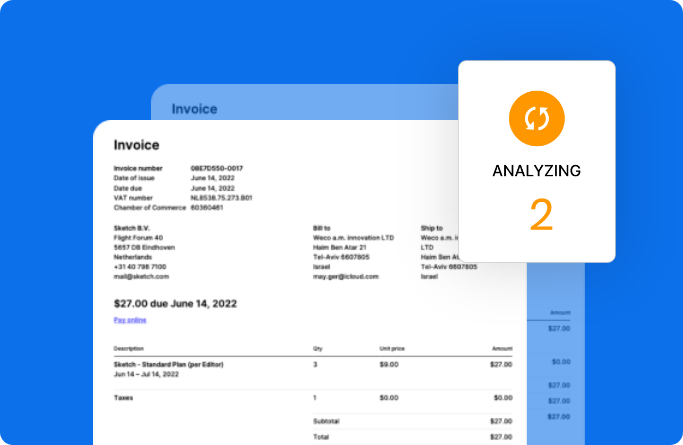

Invoice Processing

- Reads any invoice layout - no templates required.

- Extracts every field and line item with precision.

- Suggests journal entries instantly and posts them to your ERP.

Smart

Approval Workflows

- Route invoices automatically based on rules.

- Built-in reminders and escalation keep things moving.

- Approvals tracked with a full audit trail.

Native

ERP Integration

- Approved invoices post directly into your ERP.

- Vendor data and payments synced instantly.

- Eliminate double entry and reconciliation gaps.

Error &

Duplicate Prevention

- Detect duplicate invoices before they’re paid.

- Match POs, invoices, and receipts automatically.

- Spot mismatches and anomalies early.

Centralized

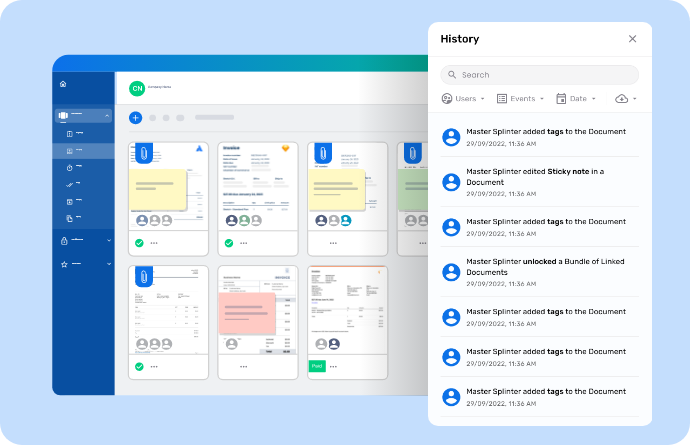

AP Workspace

- Google-style search across every document.

- Sticky notes, chat, and version control for collaboration.

- Everything in one hub — no lost emails or folders.

Understanding the ROI of AP Automation

Understanding the Return on Investment (ROI) of AP automation is vital for businesses considering this transformation. By automating AP processes, companies can not only streamline workflows but also realize significant financial benefits.

1. Cost Reduction Through Process Efficiency

The most direct impact of AP automation on ROI is through the reduction of processing costs. Manual AP processes are labor-intensive and prone to errors, leading to higher operational costs and increased chances of financial discrepancies. Automation significantly reduces the time and resources required to process invoices. It minimizes the need for manual data entry, verification, and reconciliation, thereby slashing operational costs. The efficiency gained translates into direct cost savings, a crucial component of the ROI.

2. Enhanced Accuracy and Reduced Fraud Risks

AP automation improves the accuracy of financial transactions. Automated systems are less prone to the errors that plague manual processing, such as duplicate payments or incorrect data entry. This accuracy is pivotal in maintaining financial integrity and avoiding costly mistakes. Additionally, AP automation includes security features that mitigate fraud risks, further safeguarding the company’s financial interests. The reduction in financial losses contributes positively to the overall ROI.

3. Improved Cash Flow Management

An often-overlooked aspect of AP automation ROI is the improvement in cash flow management. Automated systems provide real-time visibility into payable and spending, enabling more strategic cash flow decisions. Companies can leverage early payment discounts and avoid late payment penalties, improving their financial standing. This strategic cash flow management is a key factor in realizing a higher ROI from AP automation investments.

4. Enhanced Vendor Relationships

AP automation streamlines vendor payments, leading to improved vendor relationships. Timely and accurate payments foster trust and can lead to more favorable payment terms in the future. This aspect, while not directly quantifiable in terms of ROI, is significant for long-term business sustainability and growth.

5. Scalability and Future-Proofing

Investing in AP automation positions a company for scalable growth. As the business expands, the automated system can handle increased volumes without the need for proportional increases in staff or resources. This scalability ensures that the ROI of AP automation improves over time, making it a future-proof investment.

Ready to Automate AP with Confidence?

DOKKA isn’t just another OCR tool. Our AI understands your documents in context—no templates, no rules.