With advancements in technology, artificial intelligence (AI) has become integral across various industries, particularly in finance. AI-powered finance is a rapidly expanding field that merges financial expertise with intelligent algorithms to automate and enhance financial processes.

AI technology has revolutionized financial operations in many ways. From data capture and invoice processing to fraud detection and risk management, AI has proven to be a powerful tool that allows finance teams to attain unparalleled efficiency and accuracy, streamlining processes, minimizing errors, and accessing real-time insights for data-driven decisions.

The emergence of AI-powered accounting systems brings significant implications for finance leaders, shifting the landscape from mere technology adoption to securing the organization’s financial future.

This transition positions finance teams as innovators, ensuring a competitive advantage. Conversely, resistance to this change results in inefficiencies, errors, and missed opportunities. Outdated practices impede productivity, heighten compliance risks, and leave organizations struggling to compete with technologically advanced peers.

Embracing AI-powered accounting is imperative to avoid a future burdened by repetitive tasks and forgone growth prospects.

The Evolution of Accounting Technology: From Computers to AI

Accounting has undergone several major transformations over the decades, each bringing increased efficiency and capabilities. Starting in the 1980s, the field has progressed from computerized accounting to integrated enterprise resource planning (ERP) systems, then to cloud-based solutions, and now, to the era of AI-powered accounting.

In the 1980s, computerized accounting emerged, driven by personal computers and accounting software, replacing manual bookkeeping with streamlined computer-based solutions. The 1990s witnessed a significant leap with integrated ERP systems, which merged accounting with various business functions, enhancing efficiency and decision-making.

Before the advent of AI, accountants primarily focused on manual data entry and processing, routine compliance, basic analytical tasks, and client interaction. The skillsets required for these tasks were foundational to the profession but often repetitive and time-consuming:

- Manual data entry and processing: Accountants relied heavily on their attention to detail and accuracy to ensure that financial records were meticulously maintained. This involved extensive use of accounting software and spreadsheets to manage transaction data, process invoices, and reconcile bank statements.

- Routine compliance and reporting: A thorough knowledge of accounting standards and regulations was essential. Accountants prepared financial statements, tax returns, and conducted audits to ensure compliance with financial regulations.

- Basic analytical tasks: Analytical thinking and basic data analysis were employed to identify trends, prepare budgets, and forecast financial performance. These tasks, while crucial, were often limited in scope due to the manual nature of data handling.

Cloud-based accounting took center stage in the early 2000s, enabling access to financial data anywhere and automating tasks like reconciliations and expense management. By 2023, AI and machine learning advanced data analysis and cost reduction. Today, AI-powered accounting systems are transforming the landscape, automating intricate tasks with minimal human intervention, and continually learning and adapting for heightened precision and efficiency.

AI-Powered Accounting: Unlocking the Full Potential of Finance Teams

AI-powered accounting transforms finance teams by automating mundane and repetitive tasks, allowing them to focus on value-adding activities. Automated data capture and processing eliminate the need for manual intervention in tasks like invoice processing, freeing up time for more strategic work.

AI technology brings an unprecedented level of precision, quickly analyzing vast amounts of financial data with high accuracy and minimizing errors. This enables finance teams to uncover trends, patterns, and insights that might not be immediately apparent. With AI-driven analysis, organizations can base decisions on real-time data rather than outdated reports.

Additionally, AI revolutionizes risk management and compliance by detecting anomalies in financial data and flagging issues for further investigation. This reduces the risk of fraud and errors, safeguarding the financial health of organizations.

AI-powered accounting also empowers finance teams to assume a more strategic role in driving business growth. With automated processes freeing up time and resources, accountants can focus on analyzing data and providing valuable insights that guide decision-making across the organization.

How AI Unleashes the Full Potential of Your Finance Team

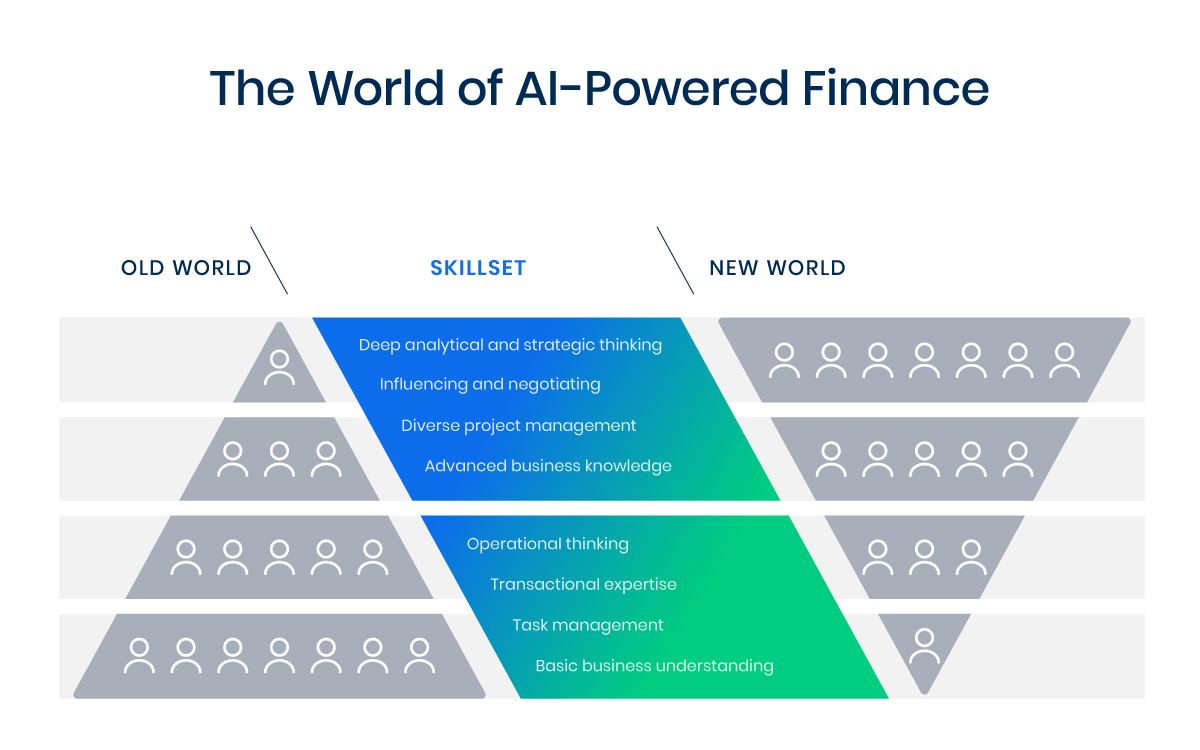

The advent of AI has redefined the accounting profession, automating routine tasks and elevating accountants to strategic advisors. This shift demands new and enhanced skill sets, transforming how accountants operate in an AI-powered finance landscape.

Advanced Data Interpretation and Strategy

With AI handling routine data entry and processing, accountants now interpret AI-generated insights. Proficiency in advanced data analysis, statistical knowledge, and critical thinking is essential for performing predictive analytics and offering strategic business advice based on data trends.

Persuasion and Communication

As accountants take on more advisory roles, their ability to influence and negotiate becomes crucial. They must effectively communicate AI-driven insights to stakeholders, advocating for strategic decisions and guiding businesses toward optimal financial outcomes.

Multifaceted Project Coordination

AI enables accountants to manage diverse projects more efficiently. Proficiency in AI tools and advanced accounting software is vital for overseeing multiple financial tasks and ensuring seamless integration of AI solutions into daily operations.

In-Depth Business Acumen

Leveraging AI for real-time compliance monitoring and risk assessment requires a deep understanding of both AI compliance tools and evolving regulations. Accountants use their advanced business knowledge to mitigate financial risks and maintain regulatory compliance.

Strategic Operational Planning

Strategic thinking and business acumen are crucial as accountants provide high-level financial advice and assist in long-term planning. AI-powered tools offer the data-driven insights needed for making informed strategic decisions.

Core Financial Expertise

Despite automation, a strong foundation in transactional expertise remains important. Accountants must verify AI-generated data to ensure accuracy in automated processes and maintain high standards of financial integrity.

Process and Task Oversight

AI enhances task management by automating routine financial processes, allowing accountants to focus on higher-value activities. Effective task management skills are necessary to oversee these automated processes and ensure alignment with business objectives.

Fundamental Business Insight

While AI handles routine tasks, a basic understanding of business fundamentals is still necessary. This foundational knowledge supports the interpretation of AI-driven insights and their application to practical business scenarios.

Advantages of Adopting AI-Powered Accounting

AI-powered accounting has revolutionized the field by eliminating manual data entry and basic analytical tasks, enabling accountants to concentrate on high-value activities such as strategic planning and sophisticated analysis. Consequently, finance teams can:

- Boost Efficiency: Automating routine tasks like reconciliation, invoice processing, and compliance checks significantly reduces the time required for these activities. This allows finance teams to reallocate their time and resources towards critical decision-making functions that demand human judgment.

- Enhance Accuracy: AI’s capability to process vast amounts of data swiftly and precisely minimizes the potential for human error. This leads to more accurate financial records, mitigating the risk of reporting errors or regulatory non-compliance.

- Gain Real-Time Insights: Machine learning algorithms enable AI-powered accounting systems to analyze extensive data in real-time, providing finance teams with immediate insights and predictive analytics. This facilitates faster, data-driven decision-making and improved risk management.

- Achieve Cost Savings: Automating processes and reducing the need for manual labor cuts costs associated with hiring additional staff or outsourcing tasks. Over time, these savings can be substantial for organizations.

- Speed Up Closing Cycles: Enhanced accuracy and expedited processing reduce compliance risks and bolster confidence in financial reporting.

- Enable Proactive Financial Management: Freed resources foster innovation and drive strategic growth.

- Improve Collaboration and Transparency: Consolidating finance technology into a unified platform enhances team collaboration and transparency.

Embracing AI-powered accounting not only streamlines operations but also positions finance teams at the forefront of financial innovation and strategic decision-making. Conversely, resisting the shift to autonomous AI-powered accounting leads to inefficiencies, errors, and missed opportunities.

Manual processes continue to plague workflows, hindering productivity and draining resources. Inaccuracy in financial reporting, compliance risks, and an inability to swiftly adapt to market changes become significant threats. Organizations that fail to embrace this change will struggle to keep up with technologically advanced competitors.

DOKKA’s AI-Powered Accounting Platform

DOKKA’s autonomous accounting platform uses sophisticated algorithms to automate the record-to-report process for financial controllers and bookkeepers. The DOKKA Brain, a complex system of algorithms, learns and reasons with your financial data, automating tasks and providing contextual insights on errors. The features include:

- Automated Controls and Checklists: Highlight inaccuracies and provide options to resolve them on the spot.

- Streamlined Financial Close Process: Automatically reviews trial balances and creates customized financial close checklists.

- Accurate Financial Reports: Generates comprehensive financial reports at the click of a button.

- Journal Entry Recommendations: Offers recommendations for additional journal entries and posts them to the ERP seamlessly.

DOKKA provides finance teams with unprecedented efficiency, transparency, and accuracy, enabling faster book closing, easier audits, and unified finance tech stacks. By reducing the onboarding period for new employees, DOKKA empowers teams to become productive contributors quickly. With DOKKA, organizations achieve real-time visibility into financial data, ensuring compliance and strategic decision-making.

AI-powered accounting systems not only enhance efficiency and accuracy but also position finance teams as trailblazers in the era of innovation. The stakes are high, and the rewards are transformative.

Final Thoughts

While AI hasn’t replaced accountants, it has significantly transformed their roles, allowing them to focus on more strategic and value-added activities. The integration of AI into finance necessitates continuous learning and adaptation, as accountants must keep pace with technological advancements and effectively integrate AI tools into their skill sets.

In an AI-powered finance world, accountants evolve from mere number crunchers to strategic advisors, data analysts, and tech-savvy professionals.

As AI continues to advance, the accounting profession will undergo further transformations. Therefore, it is crucial for accountants to embrace lifelong learning and continuously update their skills to stay ahead in this dynamic landscape.

AI-powered accounting is revolutionizing finance teams, enabling them to concentrate on strategic decision-making, deliver financial insights, and drive business growth.