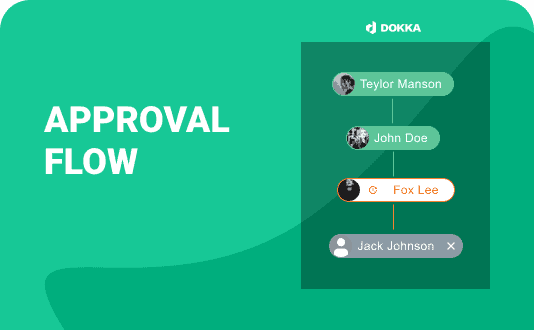

Payment approvals is an important part of any bookkeeping process. Also known as approval flow, this process automation feature allows control over when bills get authorized for payment.

DOKKA recently announced the launch of a new module on the DOKKA platform which allows payment approval flows.

This new payment approvals feature is a paid add-on, but a trial is available if you want to test it out for yourself.

To understand better how the new payment approvals module will benefit DOKKA users, I setup a roundtable with the product team to discuss.

Why is payment approvals important

DOKKA has launched payment approvals. Why was it important for DOKKA to add payment approvals onto the platform?

Payment approvals is an important feature for both businesses and their bookkeeping / accounting offices. If you are a bookkeeping or accounting office, before you make a payment, you want to be sure that you are approved to make this payment. Since the DOKKA platform will get bills from outside the organization, 3rd party vendors can send you whatever bills and documentation they want.

Getting this bill doesn’t mean that you are approved to transfer money. Before you create a transaction in the bank, and transfer money, you want to be sure that you are authorized to make this particular payment, and you are compliant with your corporate policy. That all the necessary people saw this particular bill and said it could be paid.

Sometimes you need one simple answer like “can I pay or not”, and sometimes you need to ask a few people to approve the payment. Until you get the full approval you can not transfer money. We saw that a lot of organizations, especially medium and large organizations, required to be aligned with their internal policies.

Here’s an example so you can see why payment approvals are important.

Lets say you get an electricity bill, and you have a COO in your company, and they will need to approve this bill. Once they approve this bill, you pay it to the company. If you get a bill from one of your other suppliers, and this bill can be large amounts, say more than $20,000, then in this case, you need approval first from people that actually ordered the service.

Payment approvals and authorization levels

It doesn’t always depend on the size of the particular bill. If somebody ordered the service, the next person in the chain will often be a VP because for more than a particular amount of money you need a second approval from the VP. And if this amount is larger, say, more than $50,000, then you also need the approval from the CEO. So until you get all these approvals, you are not allowed to pay this bill.

The DOKKA payment approval process was based on a real-world payment approval process

We developed the DOKKA approval process by analyzing the real-world approval payment process. We saw how it works.

Typically with the payment approval process, the bookkeeper will print the first bill, and take it to the office of the first person. They will put their signature on top of this paper, and this paper will travel to another office. The next person, often at a VP level, will look at the particular bill, and say “alright, I will sign this in 3 days”. It will wait on their table until they look at the bills on their table and approve all these bills. Some of the bills will then travel to the CEO office, and the CEOs office will wait additional time, say an additional week.

Once it is all signed it comes back to the bookkeeping office. The bookkeeping office will check that all the people signed the bill, based on their corporate policy, and then the bill will get paid.

What is special about the payment approval process on DOKKA

So we added this feature of payment approvals to allow people to make it very easy, very simple without going into the ERP, without understanding all those tables, without spending too much time. Just look at the bill, look at the previous person who already signed the bill, and by clicking the button, sign the bill, and forward it to the next person in the chain.

What’s special about the DOKKA approval process is that the whole audit trail of this approval process is actually embedded into the document. Basically, everyone of the signers, is adding a digital and visual signature on top of the document. So lets say after 3 people have signed the document, you download this document as a PDF, this particular PDF will be signed with 3 digital signatures from 3 different people, and you will see visual signatures on top of the paper, which shows you where, and when and who signed this document. And you have the full audit trail of the signers.

So at each and every point of time you can be sure, that this document never changed since the previous person signed the document. So there is absolutely no way to change the document between signers, and if you sign the bill, you know it’s impossible to change the bill after you sign.

Flexibility around the payment approval process

So lets assume I’m a bookkeeper in a bookkeeping or accounting company and I need to make payments. Would I only get to see the document in DOKKA, after it’s gone through this approval process. Or will I see the document before it’s gone through the approval process, but I’m not actually authorized to make payment. How does the visibility of the documents work?

Currently we have 2 options to run the payment approval flow.

The first option to run the approval flow is where the bill will go to the accounting office first. The bookkeeping accounting office will have the policy that they received from the organization that they are providing service to. Every bill, for example more than $100, needs to be approved before payment. It’s a policy. This policy is transferred from the company to the bookkeeping office. The bookkeeper will actually get the bill before it’s signed and will create this approval flow. The bookkeeper will say “we are not paying before somebody signs the bill”. So every bookkeeper can create the approval process flow, and run this flow.

The second option is when the bookkeeper will never look at the document from the payment point of view until it’s signed. The bookkeeper will do all the recording of all the bookkeeping entries for the document. But they will never pay this document until it’s approved, until it’s signed. The company itself will decide who approves the document and how to approve the document. So the company itself will run the approval flow and the bookkeeping firm will pay only after the document has been fully approved.

So both the bookkeeper / accountant or the business executives themselves can create and change the payment approval flow. It depends on your company policy.

Business with internal bookkeeping departments vs outsourced bookkeeping companies

Is the payment approval flow more suitable for outsourced bookkeeping and accounting companies or for businesses with internal finance departments?

The payment approval flow works for both internal finance departments and outsourced accounting companies, but with different reasons.

When speaking about a bookkeeping company, it’s a liability issue. They are not paying until they are explicitly told to pay a specific bill.

We are not paying until we are sure, 100%, that you want us to pay this particular bill.

It’s a liability issue.

When you are running the approval flow on top of emails, it’s very hard to track it because they sent you an email saying “please pay this bill”. You pay the bill, you forget about this email, and then the exec in the business sends you an email asking you why you paid this bill in the first place.

You need something to show and prove that you were authorized to pay the bill. Using the new DOKKA payment approval module, you have the bill, you have the digital signature of the person who signed this bill. So you are 100% sure that this particular bill should be paid.

If we are speaking about the organization , the company itself, then it’s not about liability. It’s about the corporate policy. If you have your policy, then you say:

You need to approve those bills, by sending them to those people

It’s a policy!

So two different things, two different reasons. But the single feature supports them both.

Understanding the digital signatures

Does the digital signatures require a 3rd party signing company incorporated into DOKKA, or is part of the approval process with the digital signatures built into it? What is required to get these digital signatures to work?

No, the approval flow has all been developed by DOKKA as part of the process. DOKKA is generating the digital signatures. It’s all our development. You don’t need any 3rd party development or integration to get our approval payments module to work.

The idea from DOKKA from the beginning was to have one platform. One platform to do everything from the beginning to the end, providing one system for the accounting office to work with their clients. We can not teach people, where we take you from one software to another software.

One Platform

You need to have one look and feel. You need to understand how it works. And everything is connected. You need approval flow to create your books. You need approval flow to pay. You need approval flow to be compliant with the regulations. You need approval flow to be compliant with your corporate policy. It’s all together.

We can definitely integrate the systems which are doing approval flows only. But in this case we will need to take people in their journey from the document. They created a bookkeeping entry. Then they need to run the flow on a different software. And then people will see three different software platforms. They will see DOKKA. They will see approval flows in a different user interface. And then they will see their ERP when they want to see reports. This is all wrong.

We wanted to provide one solution for the client where they see everything. They can run the flow. They can see their documentation. They can see their reports. They can see everything. And they can communicate with their bookkeeper.

Just to clarify, you said DOKKA should be a 1 stop shop, and you prefer to build the payment approvals flow internally but you’re still happy to integrate into 3rd party accounting software solutions, rather than build accounting software into the DOKKA platform?

If you’re looking at the external bookkeeping or accounting companies, they are serving many clients. And some clients have different accounting software. Some clients using Quickbooks, some clients using Xero, some clients using SAGE. The bookkeeping and accounting companies need to be able to support them all.

So DOKKA needs to integrate into these systems and not replace them, because replacing accounting software is close to impossible. You have history in the accounting software. You need to migrate all the data. The movement of clients from one accounting software solution to another is very painful. Even if you like it.

DOKKA decided that because we want to provide one platform for the accounting firm, we need to work with all the different accounting software platforms and not develop our own. Also accounting software is a very big piece of software. Building our own accounting software is a really big task. We are looking at implementing artificial intelligence into old-style accounting software, and we will definitely do this in the future.

Why is the DOKKA approval flow different

What is the difference between the DOKKA approval flow and other companies that have approval flows?

Once you are signing the paper, DOKKA is signing the PDF itself. We are not writing somewhere in our database that this particular document was signed. But you have nothing on the document itself. If you download the document and change something, you can.

Here is an example of the DOKKA approval flow:

You have the document and it says pay $10,000. You sign this particular document. Then in the database somewhere it says that this particular document was signed. Then you download this document, change it to $11,000, and pay. So someone signed a document, but after signing it, it can still be changed. The way the DOKKA approval flow works, is that once you sign something, you can not change this document further. If you change it, your digital signature disappears. And if the digital signature disappears, then no-one will pay it.

DOKKA is keeping all the signatures on top of the document itself, on the actual PDF. Both visually, and digitally.

Using payment approvals process for other approval processes

When you’re speaking about payment approvals, a lot of people have asked whether this process automation technology can be used for other types of approvals as well. One example would be that a document comes in and the senior bookkeeper wouldn’t see the document until the junior bookkeeper has approved it. Or vice versa, the senior bookkeeper would look at the document and approve it, and then the junior bookkeeper would approve it and push it into the accounting software. So can this approval process be used for other types of approvals, or is it specific to payments?

Definitely, the approval process can be used for different reasons. The approval flow can be used with general documents. Or you can create a flow that until the document is approved, you can not push it into the books. We have two options. Segregation between the approval flow / payment flow, and the accounting flow. And you can stick them together. So you can say “until it is approved, I’m not doing the accounting flow as well.”

Other uses for sticky notes

In the past with DOKKA, one of the features that the accountants and bookkeepers used was the sticky notes. These sticky notes can be used to create an approval process. But this approval flow will supersede sticky notes, as it will be easier and more effective to use the approval flow process for general approvals? So what will bookkeepers and accountants then use the sticky note feature for?

The sticky notes are still useful to put information on documentation. Examples are “what needs to be done”, sharing some information about this particular document, and putting notes on top of the document.

Sometimes it’s not just about a bill that should be paid and forgotten. Sometimes a lot of things should be done on a particular document. Since DOKKA doesn’t support just regular small receipts, and supports far more complex types of documentation for accounting, sometimes you need to know which credit card the document belongs to, or that it should be paid (and where and when), basically have a general conversation on top of the document.

So there is definitely still a need for sticky notes on top of the documents. People can use it in so many different ways. The big problem with the accounting process, is that it is so different in the different places. There is no standard way to do bookkeeping. Everybody is doing whatever they want, and everyone is trying to use their own flows, and people need to be able to tag documents, and write information on the documents. Document management features like sticky notes, and tagging is absolutely something that you need to support.

Bookkeepers response to payment approvals

The payment approval feature on DOKKA was launched a few weeks ago. What has been the response from bookkeepers and accountants so far.

Bookkeepers and accountants are really loving the approvals process on DOKKA. Many companies are already using it. We have one large company, you could probably call them an enterprise, that are already using this feature, and we got this requirement that they like it so much, that they want to use this approval flow by itself, as a standalone feature outside of accounting.

They said “we don’t want our bookkeeping company to create an approval flow for us. We want to create the flow by ourselves.”

Future innovation for payment approvals

So the payment approvals process is going to be made even more flexible to cater for different businesses requirements and circumstances? In the future, what else will be added to the payment approvals process to make it more innovative, more flexible? Where do you still want to take the approval payments process in the future?

We will be introducing 2 new features on the payment approvals module in the near future.

One will be the policy editor where you will be able to create automatic policies for your next bills. Instead of creating a flow per bill, you will be able to create your policy. Saying that : “Our company policy says that if you get documents from this particular vendor, which is more than x amount of money, go through this particular chain.” You will be able to create the policy for your organization. So every new bill collected by the organization will automatically assign the flow for approvals.

The second feature is that we will be introducing automatic payments through the bank, so once the document is approved, we will be able to push it through the bank or through the ACH or through the credit card to pay this particular bill.

To test out the DOKKA payment approvals module for yourself, speak to your account manager at DOKKA. If you aren’t yet a DOKKA user, and you want to discuss how the payment approvals module can benefit your company, then get in touch with the DOKKA team.