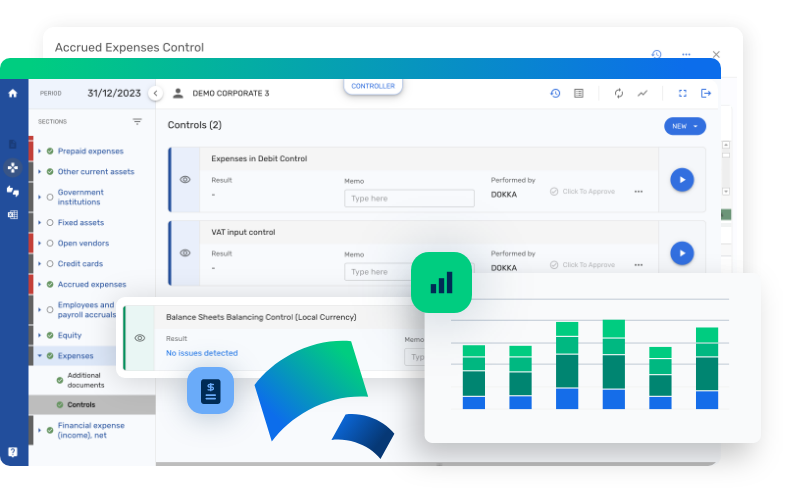

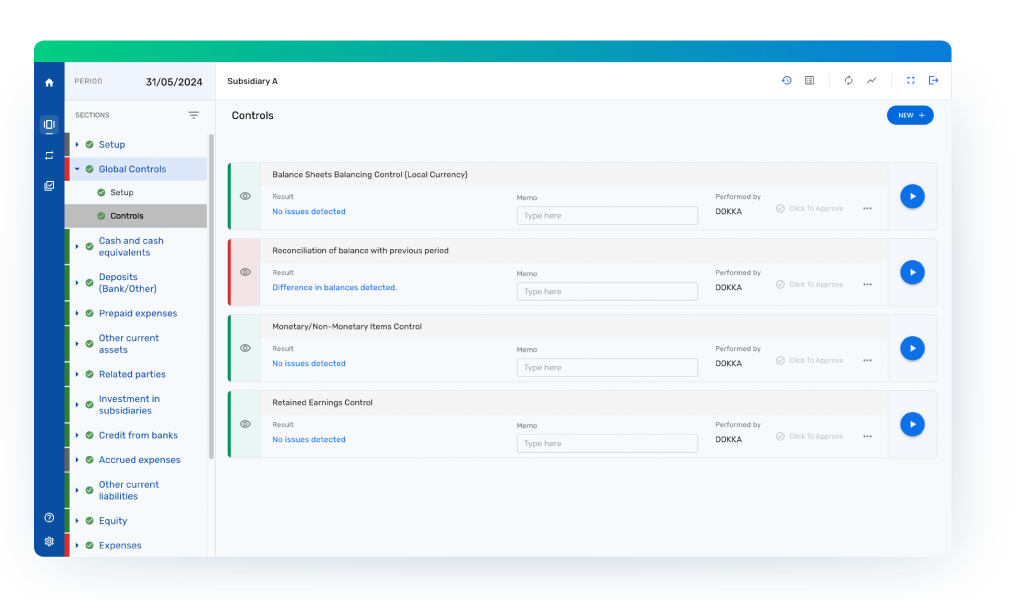

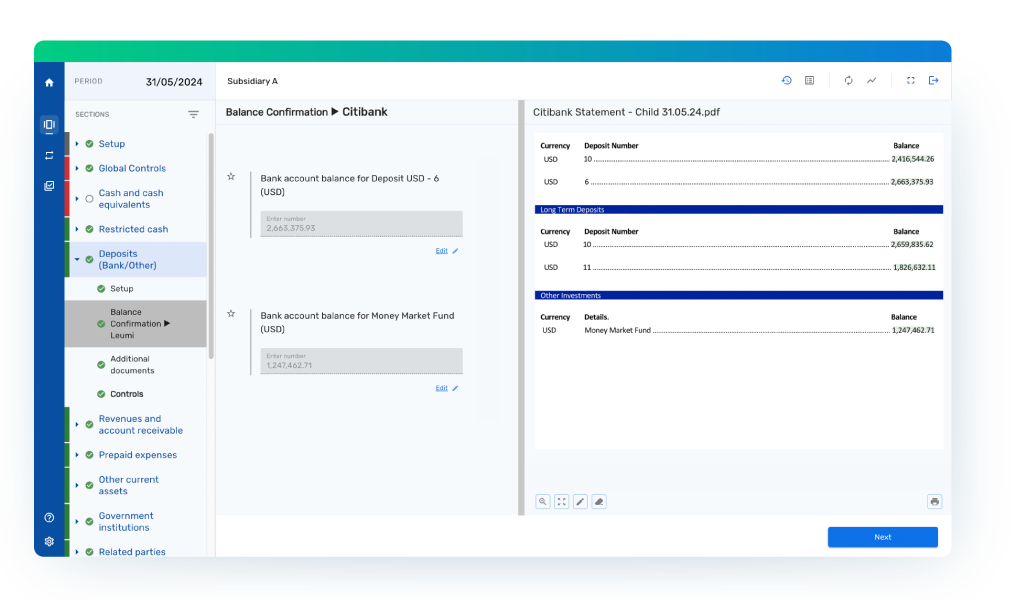

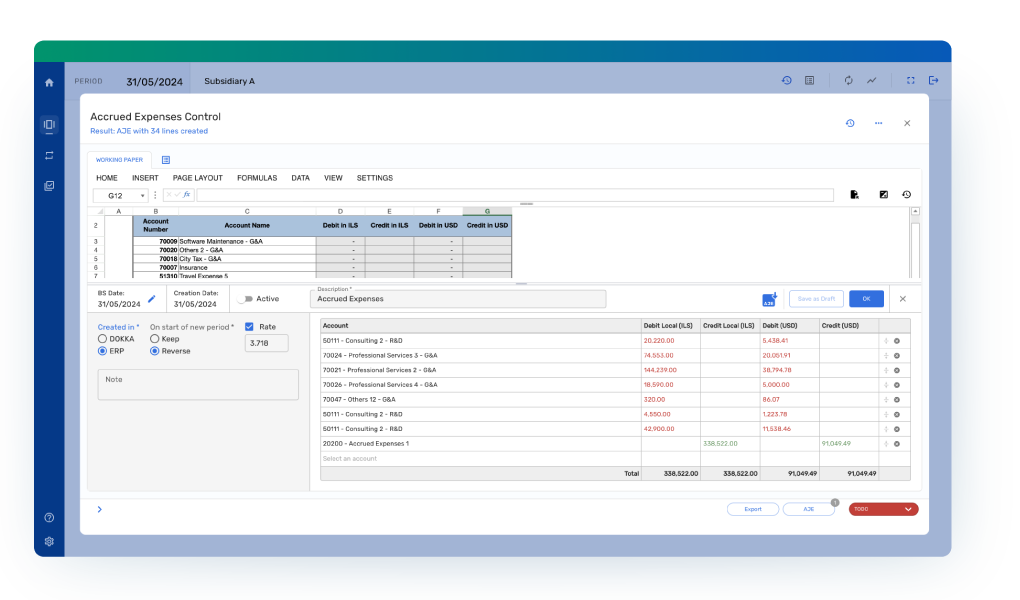

AI-Powered Financial Close Automation Software

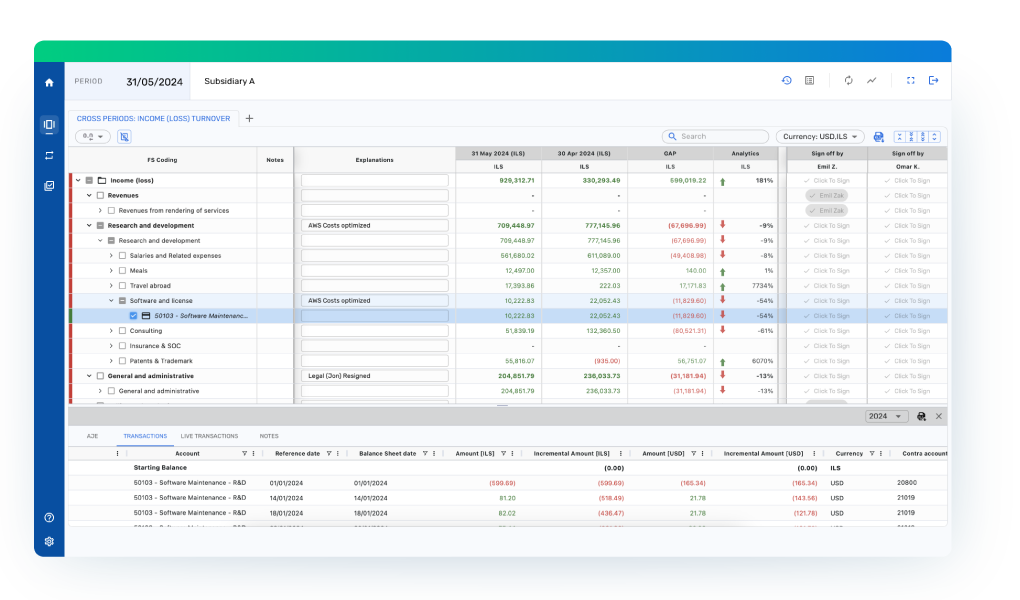

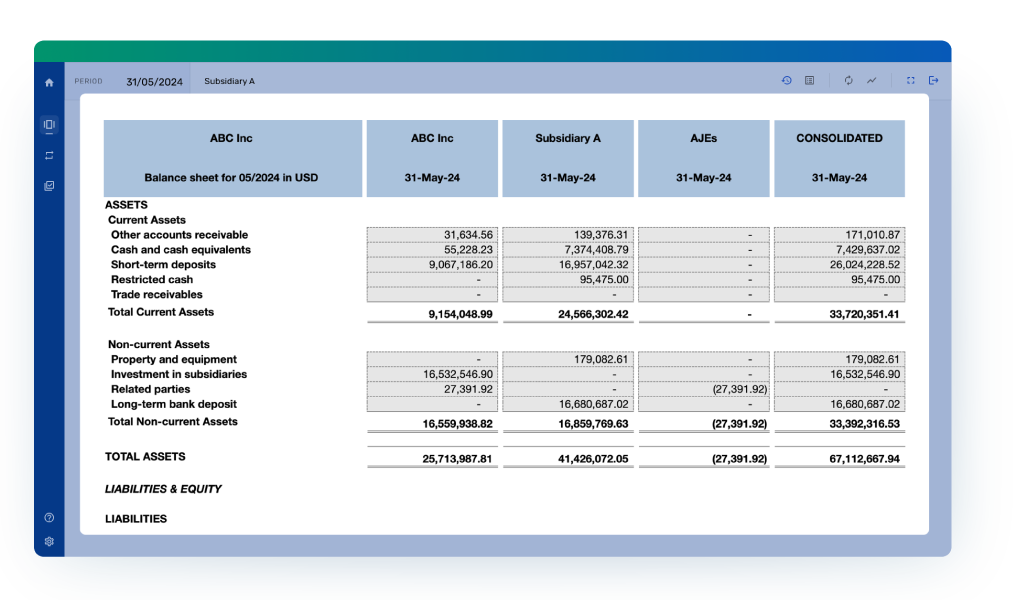

DOKKA streamlines and automates key parts of the financial close process, enabling finance teams to reduce manual work, improve controls, and deliver accurate, consolidated financials faster.

Pick a time and date in seconds.