Auditing is a cornerstone of effective corporate governance, ensuring that organizations maintain transparency, accountability, and operational efficiency. And as the demand for corporate transparency and accountability rises, auditors play an essential role in guaranteeing the accuracy and fairness of financial statements.

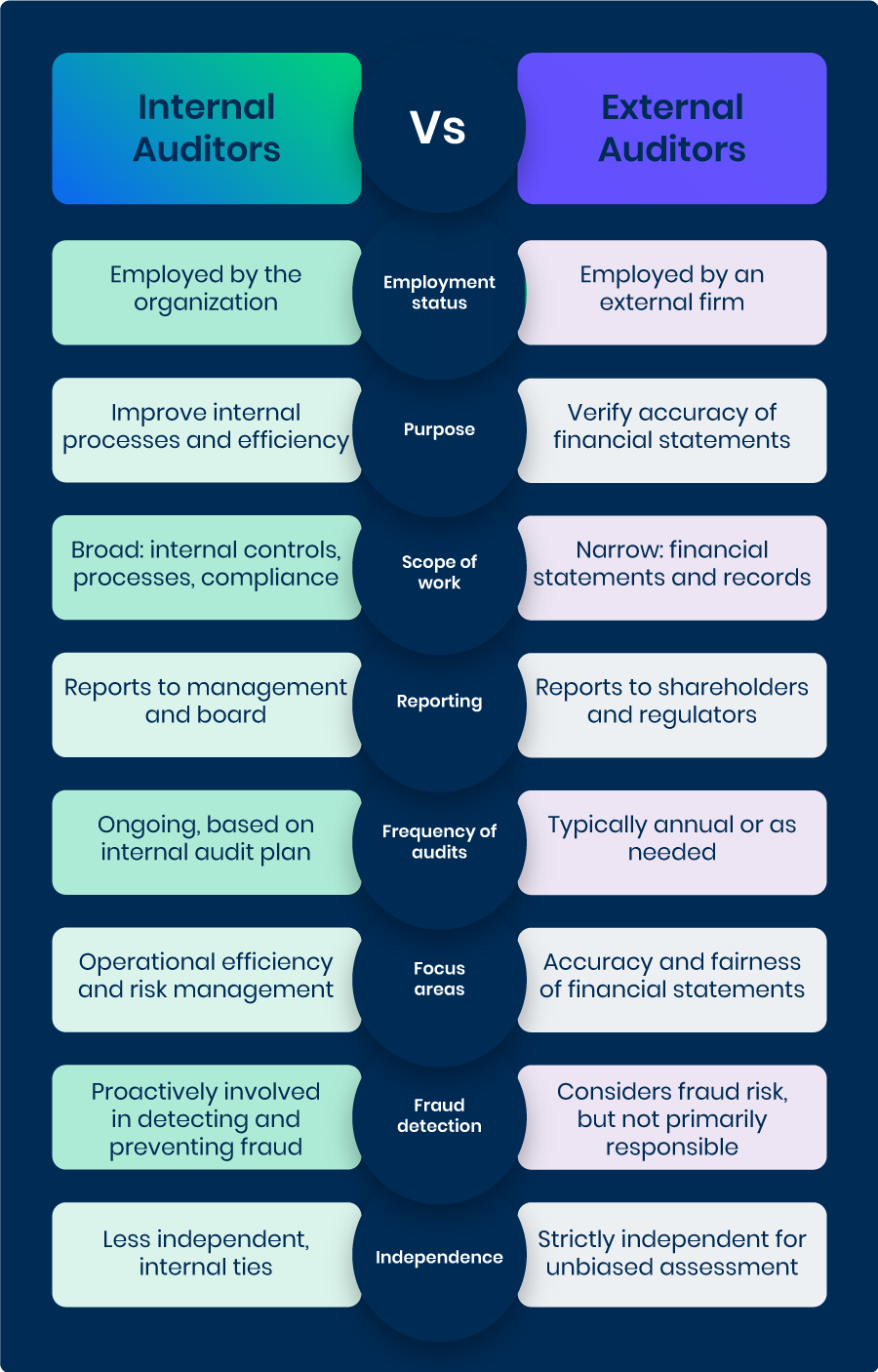

There are two primary types of auditors: internal and external. While both play vital roles, their functions, objectives, and methodologies differ significantly.

Understanding the key differences between these two types is essential for appreciating how they collectively contribute to the integrity and success of an organization. In this article we will explore the 8 key differences between internal and external auditors to provide a clear understanding of their unique contributions.

What are Internal Auditors?

Internal auditors are like an organization’s in-house detectives and advisors. They work within a company to closely examine its operations, checking for any potential issues or risks that could affect how the business runs. Their job is to help the company improve its operations by offering insights and recommendations.

Think of internal auditors as a second pair of eyes for management, ensuring everything is running smoothly and according to plan. They collaborate with different departments to understand the company’s processes and ensure compliance with laws and regulations.

Here’s what internal auditors typically do:

- Assess internal controls: Check how well the company’s internal controls are working to safeguard assets and ensure accurate financial reporting.

- Identify improvement areas: Look for ways to make processes more efficient and effective.

- Evaluate risk management: Examine how the company identifies and manages risks.

- Detect and prevent fraud: Help uncover any fraudulent activities or misuse of resources.

- Recommend cost savings: Suggest ways the company can save money and use its resources more efficiently.

In essence, internal auditors are there to make sure the company is running as efficiently, effectively, and honestly as possible.

What are External Auditors?

External auditors are independent professionals hired by an organization to provide an unbiased and objective opinion on its financial statements. They have no affiliation with the company they are auditing and are typically engaged by shareholders or regulators.

Their main job is to determine if the company’s financial statements are accurate and provide a true picture of its financial performance and position. They meticulously review financial records to ensure everything is correct and complies with accounting standards and regulations.

Some specific responsibilities of external auditors include:

- Review financial records: Examine and test the company’s financial records for accuracy and completeness.

- Verify compliance: Ensure the company follows all relevant accounting standards and regulations.

- Assess internal controls: Evaluate whether the company’s internal controls are sufficient and effective.

- Highlight risks and discrepancies: Point out any potential risks or discrepancies found in the financial statements.

It is important to note that while external auditors provide independent opinions on a company’s financial statements, they do not take responsibility for detecting fraud or mismanagement within the organization. This remains the responsibility of internal auditors.

Internal vs External Auditors: 8 Key Differences

1) Employment Status

When discussing internal and external auditors, one of the most fundamental differences lies in their employment status.

Internal: Internal auditors are the organization’s in-house experts. They are employed directly by the company, making them integral parts of the team. This internal connection provides them with a deep understanding of the company’s culture, processes, and internal dynamics. Their day-to-day role involves navigating through the company’s internal systems, helping to improve efficiency and address any internal issues.

External: On the other hand, external auditors come from outside the organization. This external perspective is crucial because it ensures that their assessments and opinions are unbiased and impartial. Since they are not part of the company, they offer a fresh, objective view, which is essential for providing a true and fair assessment of the company’s financial health.

2) Purpose

Internal: The purpose of internal auditors is closely aligned with enhancing the company’s internal processes. They focus on ensuring that internal controls are robust, operational efficiency is maximized, and risks are effectively managed.

Think of internal auditors as the organization’s problem-solvers. They are always looking for ways to refine processes, improve compliance, and bolster internal controls. Their insights help the company operate more smoothly and effectively.

External: External auditors serve a different but equally important purpose. Their primary role is to evaluate whether the company’s financial statements accurately reflect its financial position and performance. They provide an independent opinion on the financial health of the organization, ensuring that the financial reports comply with accounting and regulatory requirements. This external validation is important for stakeholders who rely on these reports to make informed decisions.

3) Scope of Work

Internal: The scope of work for internal auditors is broad and varied. They delve into numerous aspects of the organization, assessing everything from internal controls and operational processes to compliance with internal policies. Their work often involves regular reviews and audits of different departments, helping to identify areas for improvement and ensuring that the organization adheres to its own rules and regulations.

External: In comparison, the scope of external auditors is more focused. Their primary task is to audit the financial statements and records to confirm their accuracy and completeness. They scrutinize financial transactions, balances, and disclosures to ensure that the reports comply with accounting standards.

External auditors are concerned with the overall fairness of the financial statements and whether they present a true and fair view of the company’s financial condition.

4) Reporting Structure

Internal: The reporting structure for internal auditors involves communicating their findings to the organization’s management and board of directors or audit committee. Their reports are integral to internal decision-making processes, offering recommendations for improving internal controls and operational efficiencies. These reports help guide management in making informed decisions and addressing any issues identified during the audits.

External: Conversely, external auditors produce a formal audit report addressed to shareholders, regulators, and the public. This report includes their opinion on the financial statements and highlights any significant findings or discrepancies. The external audit report is a key component of the company’s public financial disclosures, providing transparency and assurance to external stakeholders about the accuracy of the financial reports.

5) Frequency of Audits

Internal: Internal auditors perform their duties on a regular basis as part of ongoing monitoring and evaluation. Their audits are scheduled according to the organization’s internal audit plan and can vary in frequency depending on the area being audited. This continuous oversight allows internal auditors to promptly identify and address issues, ensuring that the organization remains compliant and efficient throughout the year.

External: External auditors typically conduct their audits annually or as needed, focusing primarily on the year-end financial statements. Their work is tied to the annual reporting cycle, providing a snapshot of the company’s financial health at a specific point in time. The annual audit helps ensure that the financial statements are accurate and complete for the period in question.

6) Focus Areas

Internal: When it comes to focus areas, internal auditors have a diverse range of interests. They evaluate operational efficiency, review internal controls, and assess compliance with internal policies. Their goal is to improve the organization’s processes and risk management practices. Internal auditors are proactive in identifying potential problems and offering solutions to enhance the organization’s overall performance.

External: External auditors, on the other hand, concentrate primarily on the accuracy and fairness of the financial statements. Their focus is on verifying that the financial reports comply with accounting standards and regulations.

7) Responsibility for Fraud Detection

Internal: In terms of fraud detection, internal auditors play a proactive role. They are actively involved in identifying and preventing fraudulent activities within the organization. By implementing and monitoring internal controls, internal auditors help safeguard the organization’s assets and integrity. They also investigate any suspicious activities and work to prevent fraud before it becomes a significant issue.

External: External auditors, while they do consider the risk of fraud during their audit, are not primarily responsible for detecting fraud. Their focus is on assessing whether the financial statements are free from material misstatement, including those that might be due to fraudulent activities. The responsibility for addressing and managing fraud largely falls to internal auditors, who are better positioned to detect and prevent such issues through their ongoing involvement in the organization.

8) Independence

Internal: The concept of independence is central to understanding the roles of internal and external auditors. Internal auditors are part of the organization and, while they strive to maintain objectivity, their close relationship with management can sometimes affect the perceived independence of their work. They operate within the organizational structure, which can influence their approach and findings.

External: External auditors are required to maintain strict independence from the organization they audit. This independence is crucial for ensuring that their audit opinions are unbiased and credible. External auditors follow professional standards and regulations designed to preserve their impartiality, thereby providing stakeholders with a reliable assessment of the financial statements.

How to Improve Internal Audit

Lastly, we bring you several strategies to elevate the effectiveness of internal audits:

Adopt AP automation tools

Leveraging accounts payable (AP) automation tools can significantly improve the internal audit process. Automation streamlines invoice processing, reduces errors, and ensures compliance with internal policies and regulations. Key benefits include:

- Enhanced Accuracy: Automated systems minimize human error in invoice handling and data entry.

- Real-Time Monitoring: Continuous tracking of transactions helps auditors quickly identify discrepancies and potential issues.

- Comprehensive Audit Trails: Automation provides detailed records of all transactions, making it easier to trace and review financial activities.

Enhance auditor training and development

Continuous professional development is vital for internal auditors to stay updated with the latest auditing standards, technologies, and best practices. Encourage auditors to pursue certifications and attend relevant workshops and seminars.

Implement data analytics

Incorporating data analytics into the audit process allows auditors to analyze large volumes of data quickly and identify patterns, anomalies, and trends that might indicate risks or inefficiencies. This data-driven approach enhances the accuracy and depth of audits.

Strengthen risk assessment

A robust risk assessment framework helps prioritize audit activities based on the potential impact and likelihood of risks. By focusing on high-risk areas, internal auditors can allocate resources more effectively and address critical issues promptly.

Utilize advanced audit software

Investing in advanced audit software can streamline the audit process, from planning and execution to reporting. These tools can automate repetitive tasks, facilitate document management, and provide real-time insights into audit progress and findings.

Regularly update audit plans

Audit plans should be dynamic and regularly updated to reflect changes in the organizational environment, regulatory landscape, and emerging risks. A flexible audit plan ensures that the internal audit function remains relevant and focused on the most pressing issues.

By adopting these strategies, organizations can significantly enhance the effectiveness of their internal audit functions, leading to improved operational efficiency, stronger risk management, and better compliance with regulatory requirements.

For a comprehensive checklist on conducting effective internal AP audits, please refer to the Internal AP Audit Checklist.