For years, the role of the CFO focused on stewardship: protecting assets, managing costs, and ensuring regulatory compliance. Yet as organizations face growing complexity, from digital disruption to global uncertainty, finance leaders are stepping into a fundamentally different role—as strategists, innovators, and architects of transformation.

That shift is the central narrative of the 2025 Global CFO Survey by FTI Consulting, a study based on insights from 655 senior finance executives around the world.

Spanning industries and geographies, the report offers a rich, data-driven view into the evolving priorities, challenges, and imperatives reshaping the finance function in large enterprises with over $1 billion in annual revenue. The findings show that today’s CFOs aren’t satisfied with incremental improvements; they are preparing their organizations for radical change.

![]()

Key Takeaways:

- 72% of CFOs expect double-digit revenue growth in 2025. Strategic planning is now central—growth requires intentional design, not passive optimism.

- 84% of CFOs prioritize finance tech & automation, with 87% planning to deploy AI. Yet outdated systems and manual processes still slow progress, making digital maturity both urgent and uneven.

- With rising inflation and market volatility, 85% of CFOs are focused on forecasting accuracy, leveraging real-time data, predictive analytics, and scenario modeling to improve agility.

- 36% prioritize hiring, while only 14% focus on upskilling—signaling a shift toward external recruitment. Hybrid work is the dominant model (61%), and flexibility is key to retention.

- CFOs are expanding outsourcing—not just for cost, but for specialized capabilities and agility. Functions like accounts payable, cash management, and collections are top candidates.

- CFO tenures are growing, and their role as CEO successors is rising. With 56% prioritizing business model optimization, CFOs are now core architects of transformation and enterprise leadership.

![]()

![]()

6 Key Focus Areas CFOs Should Prioritize in 2025

- Revenue Growth

- Digital Finance Evolution

- Modern Financial Forecasting

- The Talent Challenge: Hiring & Retention

- Strategic Partnerships & Outsourcing

- CEO Pathways & Tenure Trends

![]()

1) Revenue Growth

Despite the economic turbulence that defined much of the early 2020s—rising inflation, supply chain shocks, and geopolitical tension—CFOs today remain far from pessimistic. In fact, 72% expect revenue growth of 10% or more in 2025. Although slightly down from 75% in 2024, such optimism signals resilience more than retreat.

Optimism is especially strong among larger enterprises: 77% of CFOs at companies with revenues over $5 billion project double-digit growth. That confidence stems from more stable supply chains and favorable macroeconomic conditions. Still, even amid these bright spots, CFOs are not taking growth for granted.

Mid-market companies are adopting a slightly more cautious stance. CFOs from companies in the $100 million to $1 billion revenue range are tempering their growth expectations, with just 67.5% anticipating double-digit gains, compared to 76% in 2024.

The nearly 9% decline is driven by a combination of persistent talent shortages, escalating costs, and intense competitive pressure. Even so, mid-market companies continue to see growth potential—particularly in areas where strategic investments in digital transformation and operational efficiency have been made.

One key takeaway: strategic planning has become a central focus, with 66% of CFOs naming it a top priority. Growth is no longer just a target, it is a challenge that requires deliberate design and action.

![]()

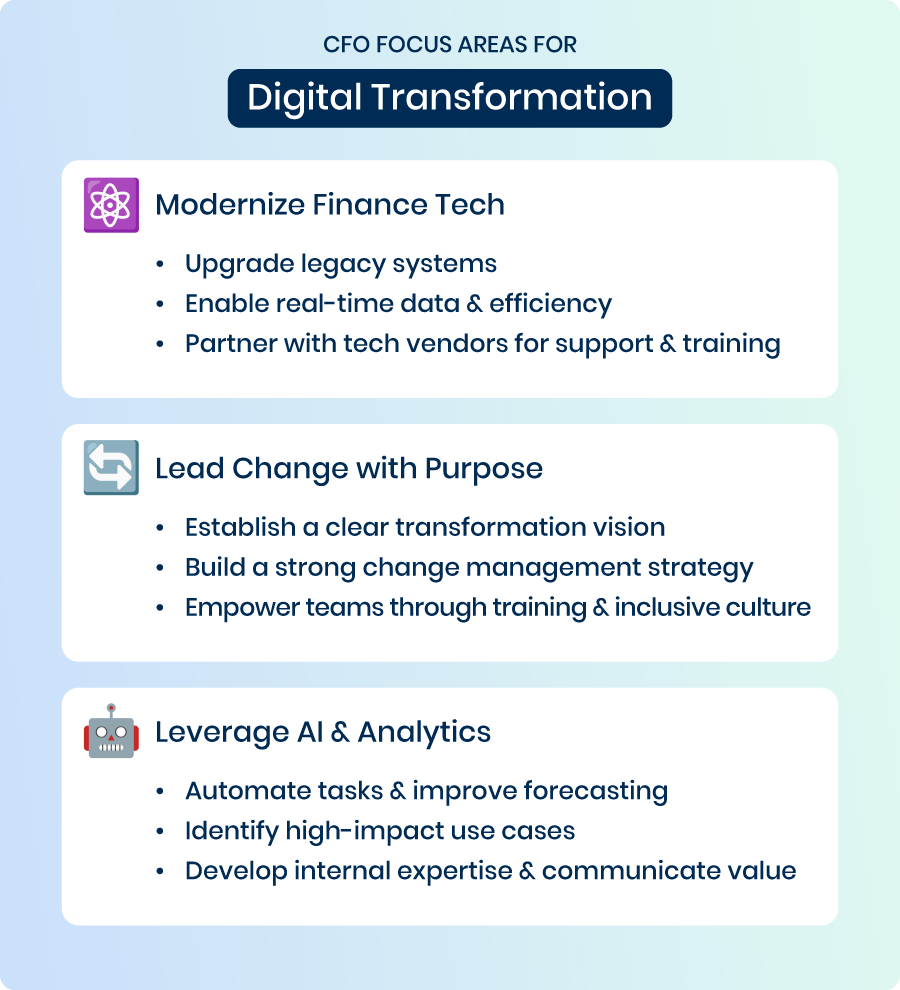

2) Digital Finance Evolution

Digital transformation remains a dominant force reshaping the finance function. The report finds that 84% of CFOs identify finance technology and automation as a top priority, with 79% actively planning to invest in it for 2025.

At the core of this momentum is artificial intelligence. A remarkable 87% plan to use AI within the next 12 months, and 74% are already leveraging tools like ChatGPT to enhance data analysis and decision-making.

However, transformation is not without friction. Outdated systems are cited by 79% of CFOs as a major barrier, while 82% point to manual processes as a drag on efficiency. These challenges highlight a broader theme: although ambition for digital maturity is high, many finance teams are still working through foundational constraints.

The report emphasizes that technology investments must be supported by effective change management, robust training programs, and strong leadership buy-in. Transformation is not a software upgrade, it’s a cultural shift.

![]()

3) Modern Financial Forecasting

In an environment of uncertainty, forecasting is taking center stage. This year, 85% of CFOs are prioritizing forecasting accuracy, with 57% investing in improvements and 79% upgrading their FP&A software.

Why the urgency? CFOs are navigating a web of macroeconomic threats:

- High inflation: cited by 72% as a top concern.

- Supply chain volatility: 60% believe disruptions can lead to unforeseen costs and delays.

- Rising competitive pressure: 72% emphasize the need for flexible forecasting models that can quickly adapt to changing conditions.

Global forces like these are rendering static planning obsolete. CFOs are turning to scenario modeling, real-time data integration, and predictive analytics to stay ahead of the curve.

Equally important, the report highlights the need for cross-functional collaboration. Nearly 80% of CFOs see opportunities to strengthen their teams’ ability to partner effectively with business units.

![]()

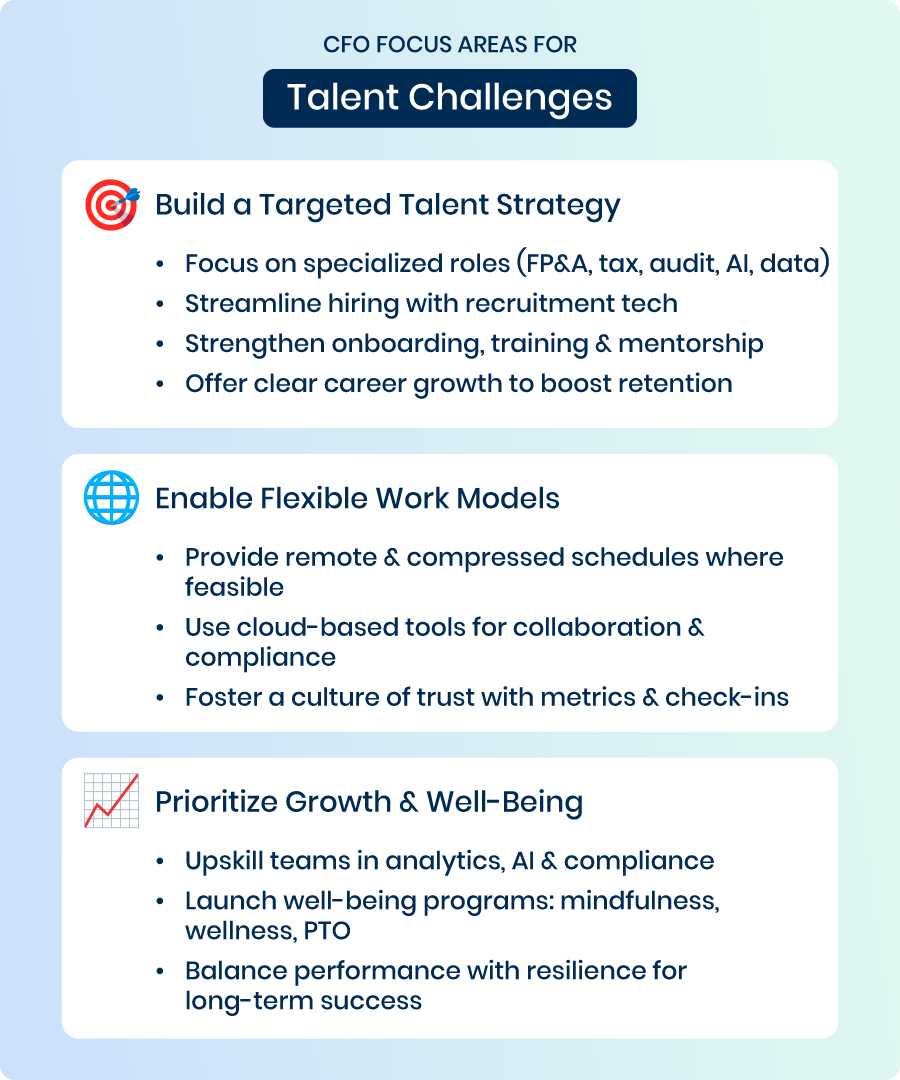

4) The Talent Challenge: Hiring & Retention

If technology is the engine of transformation, then talent is the fuel—and right now, it’s in short supply. 24% of CFOs cite talent shortages as a top concern, up 3% points from 2024. At the same time, 36% are prioritizing talent acquisition, making it one of the most urgent strategic initiatives.

Only 14% of CFOs are focusing on upskilling, a decline from 18% a year ago. The drop indicates that, despite a strong demand for new capabilities, internal training is being overshadowed by external recruitment efforts.

The hybrid work model remains dominant, with 61% of CFOs favoring a hybrid setup over fully remote (10%) or fully in-office (29%) arrangements. Flexibility is becoming a cornerstone of retention strategies, especially in high-pressure finance roles.

Amid intensifying competition for skilled professionals, CFOs’ emphasis on employee well-being, engagement, and structured career development will serve as key differentiators in the talent marketplace.

![]()

5) Strategic Partnerships & Outsourcing

Outsourcing has taken a significant leap forward. The report finds an 11% increase in outsourced finance functions since 2024, with 40% of CFOs now outsourcing accounts payable (up from 30% the previous year).

The change goes beyond cost savings. It focuses on unlocking capacity, accessing specialized skills, and allowing finance teams to concentrate on high-value, strategic work. According to the report, more than half of finance and accounting activities are now considered suitable for outsourcing.

Functions such as cash management (37%) and credit & collections (35%) are gaining traction as outsourcing candidates, especially when third-party providers bring automation platforms, AI analytics, and global delivery models to the table.

To ensure these partnerships deliver value, CFOs are encouraged to implement robust Service Level Agreements (SLAs) and governance frameworks. In an era where time is the scarcest resource, strategic outsourcing is becoming a critical lever for agility.

![]()

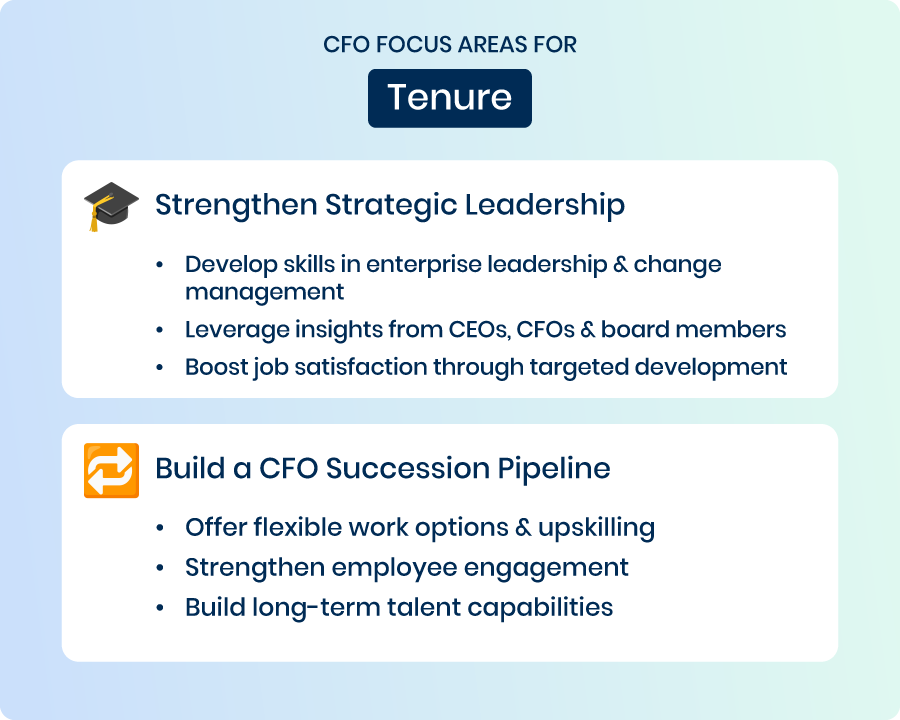

6) CEO Pathways & Tenure Trends

The tenure of the CFO is shifting. 42% now believe the average CFO remains in the role for more than five years, a 5% increase from 2024. The trend reflects a growing appreciation for long-term financial leadership as a stabilizing force during periods of transformation.

CFOs with extended tenure are increasingly viewed as strong CEO candidates, thanks to their deep institutional knowledge and broad enterprise influence. As organizations navigate growing complexity, the operational fluency and strategic insight of finance leaders are in high demand at the highest levels.

The report encourages organizations to invest in leadership development and strengthen succession pipelines within finance. Long-term vision depends on long-term leadership—and CFOs are stepping confidently into that role.

![]()

2025 CFO Outlook: Regional Perspectives

Asia-Pacific (APAC)

- Working capital efficiency is a top priority for 82% of CFOs.

- Talent retention challenges remain acute, with 71% citing concerns.

- Digital transformation efforts are gaining pace, driven by automation and analytics.

Europe, Middle East & Africa (EMEA)

- Forecasting accuracy leads the agenda for 83% of CFOs.

- Manual processes remain prevalent, underscoring a lag in automation.

- Geopolitical instability and energy cost volatility continue to pose major headwinds.

North America

- Cash flow management is a key priority for 78% of CFOs.

- Cybersecurity concerns are increasing, with 62% ranking it among their top challenges.

- Nearly 75% are accelerating automation and investing in technologies such as AI and blockchain.

Across all regions, the core themes remain consistent: technology investment, strategic agility, talent optimization, and risk management. The weight and urgency of these themes, however, differ depending on local conditions and economic realities.

![]()

Optimizing Business Models: The Key to Success in 2025

If there’s a central theme to this year’s survey, it’s this: CFOs are rethinking the fundamental shape of their businesses.

A full 56% cite business model optimization as a top priority, making it the most widely held strategic focus. And the reasons are clear. Rapid technological change, evolving customer expectations, and disruptive competitors are driving organizations to reinvent how they deliver value.

This shift goes beyond cost-cutting or restructuring—it’s about embedding agility into the core of the organization. Whether reimagining service delivery, reshaping go-to-market models, or embedding analytics into customer engagement, CFOs are stepping up as architects of strategic change.

In 2025, CFOs are building smarter, faster, more resilient companies—not in theory, but in action. Their ability to bridge long-term strategy with near-term execution, while confidently navigating complexity, will define the winners in the years ahead.

As FTI Consulting rightly concludes: “CFOs are positioned at the forefront of organizational transformation… shaping the future of their businesses.”