Any business, whether it’s big or small, has expenses. And how you manage those expenses can make a huge difference in your balance sheet and your relationship with suppliers.

Paying your suppliers on time is crucial for several reasons. If you pay your invoices on time, you can get early discounts and avoid late payment fees and other charges that can increase your costs. If you’re frequently making late payments, it could hurt your credit rating and make other forms of financing harder and more expensive to obtain in the future.

Finally, a good reputation goes a long way, and paying on time is the only way to ensure that you have a prominent partnership with your suppliers and a reliable source of the goods and services you need to run the business.

So how can you improve your invoice approval workflow to ensure that invoices are paid on time?

One way to do it is by addressing the things that make it slow and inefficient.

Manual invoice approvals are a problem

The standard, very manual process of approving an invoice typically begins with the initial review and approval of an invoice by the relevant stakeholder before being passed onto an authorized signer or accounts payable team.

From there, it is checked further to ensure accuracy and then moved on to payment.

This involves several stakeholders, including financial departments like accounts payable, budgeting and finance managers, as well as managers of other departments who need access to information about payments or expenditures.

For example, a marketing department can order a specific marketing service for the company and collect the invoice from a supplier. In that case, marketing staff will be responsible to check the invoice before sending it to the AP department to process the payment.

Even with an established, but a very manual, invoice approval workflows in place, invoices can get lost in the shuffle, and payments could end up delayed or forgotten entirely. Setting up the right processes around invoice approvals is important to avoid those issues while ensuring that payments are made on time.

What goes into approving an invoice? These 5 steps

- Receiving the invoice

- Validating the invoice

- Resolving discrepancies

- Collecting approvals

- Processing the payments

1) Receiving the invoice

A supplier usually delivers an invoice electronically via email or in the form of a physical document.

2) Validating the invoice

Validating or verifying the accuracy of the invoice means checking that the goods or services listed on the invoice were received or provided and that the prices are correct. In this step, invoices are matched with purchase orders (PO) or delivery receipts (DS) in a 3-way matching.

3) Resolving discrepancies

If the invoice doesn’t pass verification because of any missing information or inconsistency, it should be sent back to the supplier to fix the mistakes, and after discrepancies are resolved the approval process starts again from the beginning.

4) Collecting approvals

Making sure that invoices are approved quickly and don’t get stuck in lengthy approval processes is essential for paying suppliers on time. Getting approvals from someone with the authority to authorize payments or from various people can prolong the whole process, especially if it’s done manually and includes back-and-forward email communication.

5) Processing the payments

When the invoice is approved, it can be processed for payment. The accounts payable department prepares the transaction, initiates an electronic payment, or uses a company credit card to pay the supplier.

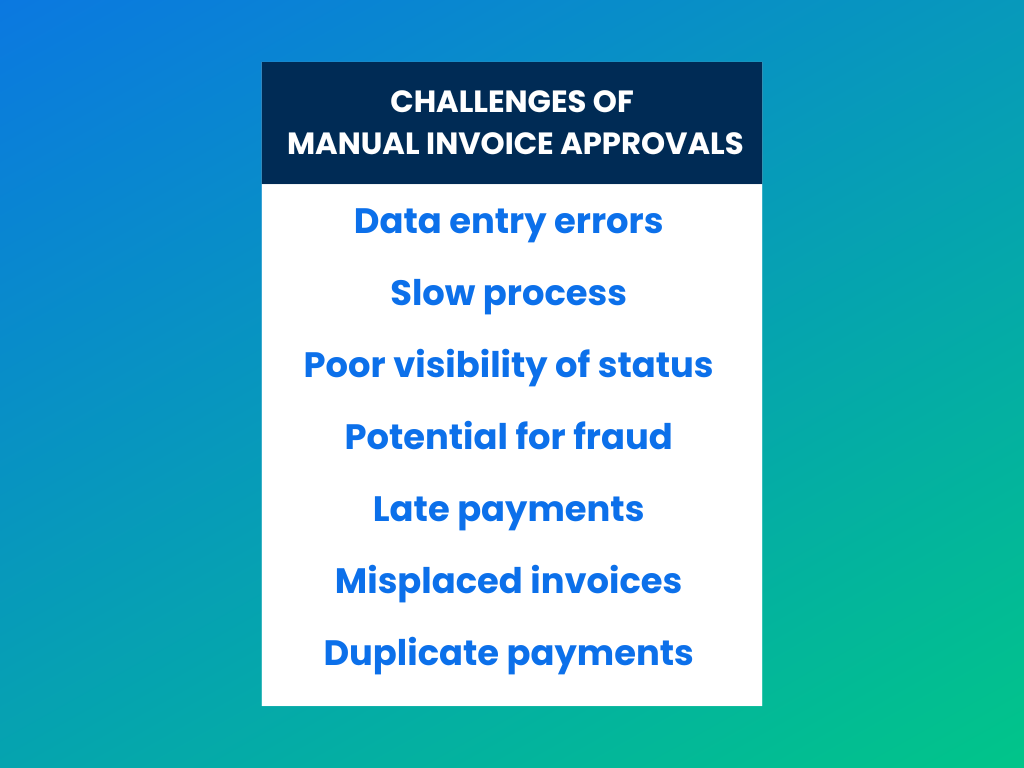

Why you should move away from manual invoice approvals?

There are still companies that manage accounts payable manually, which makes the whole process from data capturing to payment very slow and prone to errors.

While manual invoice approval can provide more control over the decision-making, automated processing allows you to quickly review a large number of invoices at scale, making it more efficient overall.

Automated invoice approval utilizes technology like artificial intelligence (AI) to scan and assess invoices according to predetermined rules. On top of that, AI can reduce human error, meaning fewer mistakes in data capturing.

Benefits of automating your invoice approvals

Automating invoice approval workflows can be a major transformation for any business.

Successful implementation of this process can lead to improved efficiency, cost savings, and better audit controls. Having the right process in place assures accuracy and completeness, reduces manual efforts associated with collecting documentation for approvals, and increases transparency between all stakeholders.

Here are some of the main benefits of automated invoice approval workflow:

Improved accuracy

By following a structured, predetermined process for reviewing and approving invoices, companies can reduce the risk of paying for goods or services that were not received or were overpriced. The automated, streamlined process also improves efficiency in terms of the time it takes to approve invoices.

Enhanced control over cash flow

With the invoice approval process companies can make sure that invoices are accurate and complete before any payments are made. This saves time and money in the long run, avoids fees for potential late payments, and helps to manage the cash flow more effectively through faster payment processing cycles.

Increased efficiency

Automating the invoice approval process not only saves time but also reduces the risk of errors. By reviewing and approving invoices electronically, mistakes can be quickly resolved without any costly delays.

Enhanced compliance

A well-set and structured invoice approval process can help companies meet regulatory requirements and avoid penalties or fines. Automation also secures improved compliance with company policies, enhanced audit control, and reduced administrative costs within finance departments.

Improved supplier relationships

Paying suppliers promptly and accurately leads to a good reputation and helps companies maintain good relationships with their suppliers.

How to get started with invoice approval automation?

The fastest option is to use a specialized software that automates approvals. For example, DOKKA. In addition to following the approval automation rules you create, it uses advanced AI engineering to suggest approvers and further aid you in automating your manual workflows.