Today, many organizations operate through a network of subsidiaries, divisions, and affiliated entities. These entities often conduct transactions with one another, ranging from simple service fees to large-scale transfers of goods and funds.

As a result, intercompany reconciliation has become a very important function for businesses. It plays a key role in ensuring the accuracy and consistency of financial statements across corporate entities, while also supporting regulatory compliance, discrepancy identification, and overall transparency.

Despite its significance, intercompany reconciliation can be time-consuming and complex. The challenge intensifies for companies managing multiple entities across different countries, each using various currencies and adhering to distinct accounting standards. Fortunately, automation offers a more efficient and accurate approach to handling this task.

In this guide, we offer a comprehensive overview of intercompany reconciliation—from its definition and real-life examples to a step-by-step breakdown of the process and the advantages of automating it.

What Is Intercompany Reconciliation?

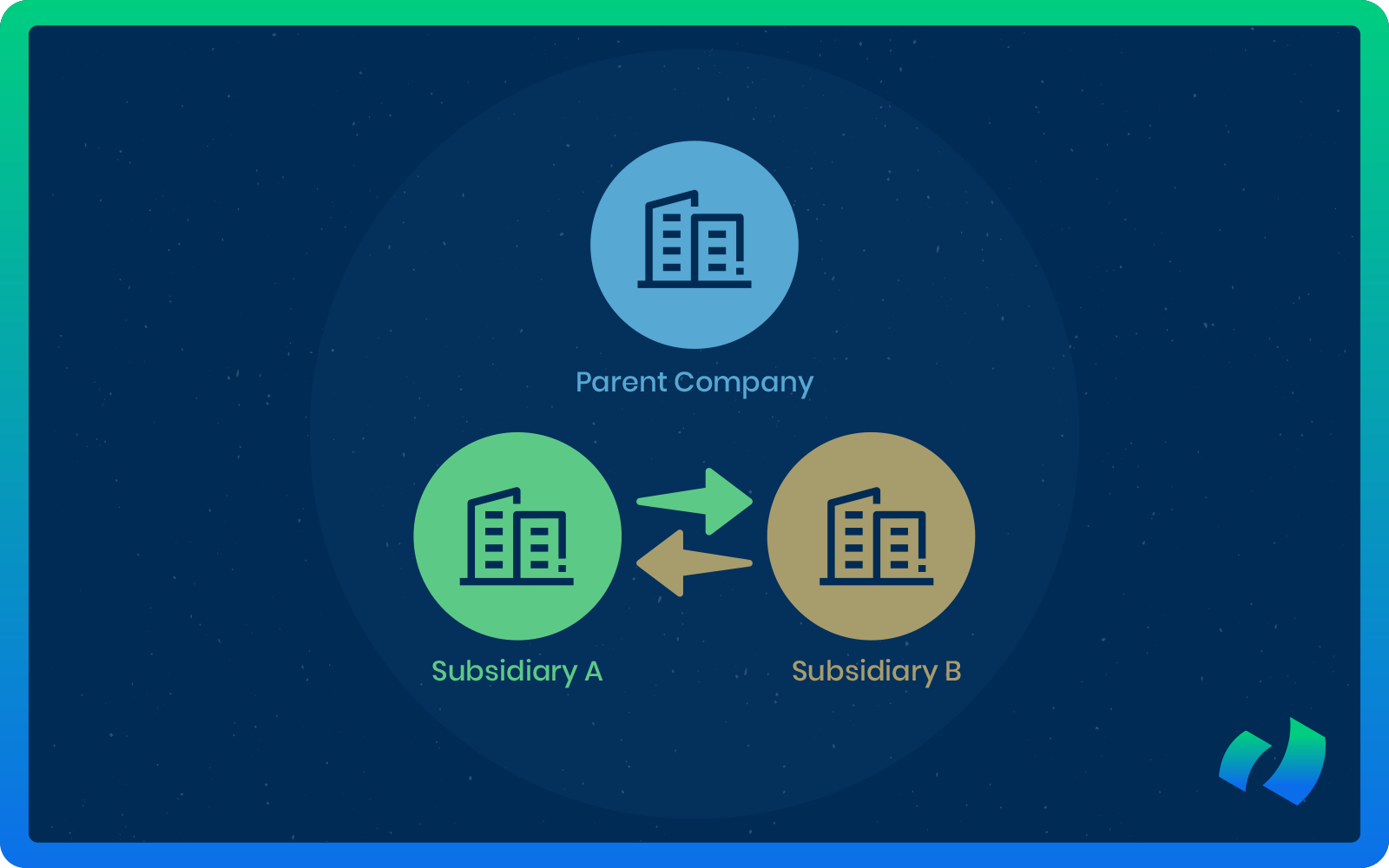

Intercompany reconciliation involves matching and eliminating financial transactions between two or more entities within the same corporate group. It ensures that transactions—such as loans, sales, purchases, or shared expenses—are consistently recorded across all involved entities.

The primary goal is to exclude these internal dealings from consolidated financial statements to prevent double-counting and provide an accurate representation of external business activities.

During the preparation of consolidated financial reports, eliminating intra-group transactions is essential, as they do not reflect actual inflows or outflows for the group as a whole.

For example, when Company A sells products to Company B, and both are subsidiaries of the same parent company, the transaction must be excluded from consolidated revenue and expenses.

The need for intercompany reconciliation arises from consolidation accounting principles, which require the removal of intra-group activity. Failure to properly reconcile these transactions can lead to inconsistencies, financial misstatements, and potential regulatory penalties.

Examples of Intercompany Reconciliation

- Example 1: Internal transactions

To illustrate the concept, consider a multinational corporation with three subsidiaries: a manufacturing company, a logistics provider, and a retail chain. When the manufacturing arm sells products to the retail unit, the transaction is logged as revenue for the manufacturer and as an expense for the retailer. However, it should be excluded from the consolidated financial statements, as it is an internal transaction.

- Example 2: Intercompany loans

Intercompany loans provide another example. If the logistics provider borrows funds from the manufacturer, one entity records a receivable while the other records a payable. Without proper reconciliation, the parent company’s balance sheet could incorrectly reflect both amounts, distorting the group’s actual financial position.

- Example 3: Shared services

Shared services, such as IT support or HR, often result in internal charges. For example, a corporate headquarters might provide HR services to its subsidiaries and allocate costs accordingly. Both the service provider and the recipient must record the transaction accurately to ensure proper elimination during consolidation.

How to Do Intercompany Reconciliation: A Step-by-Step Process

An effective intercompany reconciliation process consists of several essential steps designed to identify, match, and resolve discrepancies.

While specific approaches vary depending on organizational size, complexity, and reporting requirements, the following general process serves as a solid foundation for conducting accurate and timely reconciliations:

Step 1: Data Collection

Each participating entity must gather relevant financial records, including invoices, journal entries, payment confirmations, contracts, and other supporting documentation.

Accuracy, completeness, and consistency in reporting periods across all entities are essential to ensure meaningful comparisons. Centralizing the data—ideally within a shared platform or ERP system—helps streamline access, minimize errors, and reduce delays in subsequent steps.

Step 2: Transaction Identification

All intercompany transactions must be clearly identified and appropriately categorized, whether involving sales, loans, shared service charges, royalties, dividends, or reimbursements.

Each transaction should be tagged as “intercompany” within the accounting system using a standardized coding structure. Proper classification supports accurate matching while also facilitating easier tracking, auditing, and future reconciliation efforts.

Step 3: Data Matching

Each transaction recorded by one entity should correspond to a matching entry in the counterparty’s records.

For example, if Subsidiary A books a $50,000 intercompany sale, Subsidiary B should reflect a $50,000 purchase for the same goods or services. Using automated reconciliation tools accelerates the process through matching rules such as date ranges, amounts, and transaction IDs, enabling rapid identification of both exact and near matches.

Step 4: Discrepancy Resolution

Discrepancies often arise from timing mismatches, foreign currency conversions, differing tax treatments, or input errors.

Close collaboration among entities is essential to investigate these issues and agree on corrective actions, such as adjusting journal entries or reclassifying transactions. A clearly defined escalation path and ongoing communication between finance teams help resolve issues promptly and prevent future occurrences.

Step 5: Intercompany Eliminations

After verifying all matching transactions, they must be eliminated from the consolidated financial statements to prevent overstating the group’s revenue, expenses, assets, or liabilities.

Eliminations ensure that only third-party, external activities are reflected in the final reports. This process typically occurs during the consolidation phase and should be carefully documented to support transparency and audit readiness.

Step 6: Documentation and Review

A thorough record of the entire reconciliation process is critical to maintaining a reliable audit trail and ensuring strong internal controls.

Documentation should include the rationale behind adjustments, notes on exceptions or unresolved items, and records of relevant communications. Conducting regular reviews (monthly or quarterly) enables organizations to spot inefficiencies, monitor recurring issues, and enhance the speed and accuracy of future reconciliations.

Challenges in Intercompany Reconciliation

Intercompany reconciliation often presents several challenges that significantly complicate the process and hinder timely, accurate financial reporting. Here are the most common ones:

- Data Inconsistency

Subsidiaries frequently operate with different accounting systems, charts of accounts, and financial reporting frameworks. The absence of standardization makes it difficult to align and reconcile data across these varied systems. Even when transactions are similar, differences in classification or reporting can result in mismatches that are time-consuming to resolve. Finance teams often spend excessive time reformatting or translating data before reconciliation can even begin due to the lack of a unified data structure.

- Timing Differences

Entities involved in transactions may record them in different periods, requiring careful tracking and adjustments to align reporting timelines. Such mismatches often stem from differing cut-off policies, invoice receipt delays, or misaligned fiscal calendars. When not promptly identified and addressed, these discrepancies can persist across reporting cycles, causing accumulated variances and added complexity during consolidation.

- Currency Conversion Issues

Accurate application of exchange rates at the time of recording is essential for multinational transactions. Inconsistent conversion practices and currency fluctuations across entities often lead to mismatched values, even when the underlying transaction is correct. Additional complications arise when different exchange rate sources are used (e.g., daily vs. monthly rates) or when exchange rates are undocumented.

- Communication Barriers

Timely, clear communication between entities is critical to effective reconciliation. Collaboration can be hindered by misunderstandings, time zone differences, language barriers, and varying levels of financial expertise. Without a structured communication process or a shared platform for managing discrepancies, delays in resolution are common and can jeopardize month-end or year-end close deadlines.

- Manual Processes

Spreadsheets and emails are often used to manage reconciliations, but these manual methods are time-consuming and very prone to human error. Real-time visibility is lacking, making it difficult to track progress, enforce accountability, or identify bottlenecks. As transaction volumes grow, manual reconciliation becomes increasingly unsustainable, putting additional pressure on finance teams and increasing the risk of missed deadlines or incomplete reconciliations.

- Lack of Documentation

Poor audit trails hinder the ability to demonstrate how discrepancies were resolved, elevating the risk of regulatory penalties and audit failures. Inadequate documentation makes it challenging to validate reconciliation processes during internal or external audits. Without a record of past issues, organizations are less able to analyze root causes and implement improvements to prevent recurring errors.

Why Automate Intercompany Reconciliation?

Manual reconciliation cannot keep up with the pace, volume, and complexity of modern intercompany activity. Automation improves accuracy, speed, and control through intelligent transaction matching at scale and by eliminating the tedious work of searching for discrepancies.

Automated solutions apply consistent rules, exchange rates, and accounting treatments across entities, reducing errors caused by manual entry or inconsistent practices.

Centralized dashboards and real-time visibility make monitoring progress, identifying bottlenecks, and maintaining accountability easier, supported by built-in audit trails.

As organizations expand in size and geographic reach, automated reconciliation tools provide the scalability that spreadsheets and manual methods cannot, handling higher volumes and complexity without increasing workload or risk.

How DOKKA Makes Intercompany Reconciliation Simple

DOKKA streamlines intercompany reconciliation through automation of every major step in the process:

- Unified data collection: DOKKA pulls information from all entities and ERPs into a single location, ensuring consistent classification and eliminating manual data gathering.

- Automated matching: Intelligent algorithms match intercompany transactions across entities, currencies, and systems, dramatically reducing manual work.

- Exception handling: Any discrepancies or timing differences are flagged instantly, allowing teams to focus on resolving true exceptions instead of searching for them.

- Automated journal entries: Adjustments and eliminations can be created directly in the system, with full audit trails supporting compliance and internal control.

- Real-time visibility: Dashboards display the status of every intercompany balance, providing transparency for controllers, CFOs, and auditors.

- Scalability for growing groups: Whether an organization has a few subsidiaries or dozens, DOKKA manages increasing volume without adding complexity or headcount.

Replacing spreadsheets and manual coordination with intelligent automation allows DOKKA to accelerate the financial close, improve accuracy, and provide finance teams with confidence that intercompany balances are reconciled correctly every time.

Ready to Streamline Intercompany Reconciliation?

If manual reconciliation slows down your close, creates errors, or consumes valuable team resources, DOKKA can transform the way your finance function operates. DOKKA automates data collection, matching, exception handling, and eliminations, giving you faster closes, cleaner books, and complete confidence in your intercompany balances.

See it in action. Book a demo today and discover how effortless intercompany reconciliation can be.