In 2026, efficiency is not just an advantage, it is a requirement. For modern finance teams, accounts payable automation has shifted from a “nice-to-have” to a strategic cornerstone, essential for eliminating tedious data entry, reducing error rates, and transforming invoice processing into a fast and reliable operation.

Payhawk is one of the leading spend management platforms, combining corporate cards, expense automation, and accounts payable workflows into a single solution.

Although Payhawk offers global capabilities, multi-currency support, and real-time spend insights, it is not the right fit for every finance team.

Some businesses prioritize deeper AP automation, including invoice capture, routing, and vendor payments. Others look for stronger ERP integrations, AI-driven processing, or dedicated reconciliation tools.

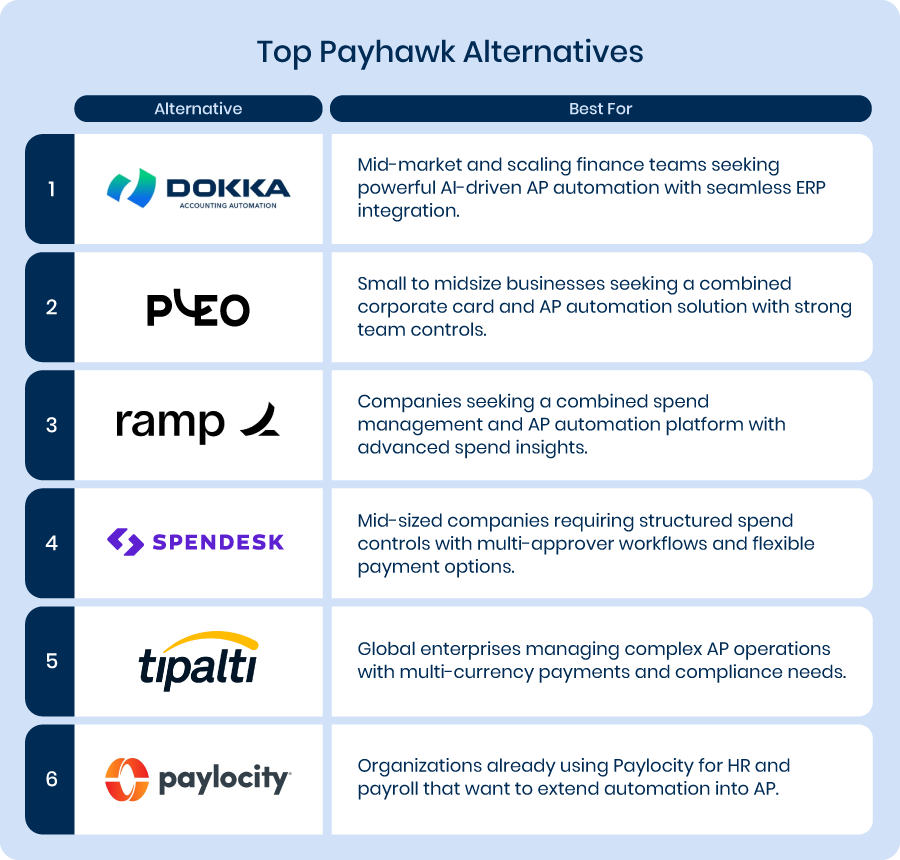

For organizations exploring alternatives that deliver powerful automation alongside unique strengths in workflow design, analytics, and compliance, this guide highlights the six best Payhawk alternatives for AP automation in 2026.

6 Best Payhawk Alternatives for AP Automation

- DOKKA

- Pleo

- Ramp

- Spendesk

- Tipalti

- Paylocity

1) DOKKA

Best For: Mid-market and scaling finance teams seeking powerful AI-driven AP automation with seamless ERP integration.

Overview:

DOKKA is a full-featured AP automation platform that uses artificial intelligence to capture invoice data, automatically match invoices to purchase orders, and manage approval routing and vendor payments.

The platform centralizes AP documents, dashboards, and workflows, helping teams eliminate manual data entry and reduce exceptions. Real-time visibility into invoices, approvals, and cash commitments gives finance leaders confidence and control over cash flow.

Key Features:

- AI-powered invoice data capture and validation

- Custom approval workflows with exception handling

- Seamless integration with major ERPs such as SAP, NetSuite, and Acumatica

- Real-time dashboards for spend, invoices, and approvals

- Audit trails and compliance reporting

Why It’s a Good Alternative to Payhawk:

Payhawk places a strong emphasis on spend management and corporate cards, while DOKKA goes deeper into invoice intelligence and workflow automation for AP. Its AI capabilities accelerate data extraction and reduce manual coding errors.

Unlike platforms that rely on spreadsheet uploads, DOKKA integrates directly with core accounting and ERP systems, making it a strong choice for teams focused on accuracy, automation, and scalability.

Setup Process:

DOKKA onboarding typically includes ERP connection, workflow configuration, and vendor setup. Guided support allows most teams to become operational within days to weeks, which is often faster than legacy AP platforms.

G2 Customer Reviews:

Users consistently praise DOKKA’s intuitive interface, fast implementation, and high AI accuracy. Many report significant reductions in invoice processing times along with improved transparency across AP operations.

2) Pleo

Best For: Small to midsize businesses seeking a combined corporate card and AP automation solution with strong team controls.

Overview:

Pleo offers corporate cards, smart spend limits, and AP automation tools that help teams manage expenses and vendor payments within one platform.

A mobile-friendly app allows employees to capture receipts, allocate expenses, and submit approvals quickly. Integration with accounting software simplifies reconciliation and financial reporting.

Key Features:

- Corporate card issuance with spending rules

- Real-time expense capture and approvals

- Receipt extraction and sorting through a mobile app

- Integration with popular accounting systems

- Spend analytics and policy enforcement

Why It’s a Good Alternative to Payhawk:

Pleo mirrors Payhawk’s approach to unifying spend and AP workflows but stands out for ease of use and rapid employee adoption. Smaller companies or teams with frequent employee spending may find Pleo easier to implement and manage, especially within distributed or hybrid work environments.

Setup Process:

Onboarding includes card setup, policy configuration, and accounting integrations. Pleo is known for quick deployment and a low learning curve, allowing teams to begin managing spend within weeks.

G2 Customer Reviews:

Users frequently highlight Pleo’s intuitive mobile experience and strong spending controls. Faster expense approvals and improved policy compliance are common outcomes after adoption.

3) Ramp

Best For: Companies seeking a combined spend management and AP automation platform with advanced spend insights.

Overview:

Ramp brings together corporate cards, automated AP workflows, and spend analytics in one platform.

The solution helps organizations enforce budgets, consolidate expenses, and streamline invoice processing. AI-driven insights identify cost-saving opportunities and flag unusual transactions that require review.

Key Features:

- Corporate cards with customizable spend limits

- Automated receipt capture and invoice routing

- Real-time spend tracking and analytics

- Budgeting and policy enforcement tools

- ERP and accounting system integrations

Why It’s a Good Alternative to Payhawk:

Ramp offers a similar unified approach to spend and AP management, with additional focus on cost analysis and savings recommendations. Reporting tools help finance teams identify spending patterns and adjust strategies proactively, which can be especially valuable for fast-growing organizations.

Setup Process:

Ramp provides guided onboarding, card issuance support, and workflow configuration. Most teams achieve a smooth go-live within a month, supported by training resources that encourage adoption.

G2 Customer Reviews:

Customers appreciate Ramp’s analytics, visibility, and consolidation of spend channels. Improved budget compliance and stronger spend governance are commonly reported benefits.

4) Spendesk

Best For: Mid-sized companies requiring structured spend controls with multi-approver workflows and flexible payment options.

Overview:

Spendesk combines virtual and physical corporate cards with invoice management, approval workflows, supplier payments, and spend controls.

The platform centralizes all outgoing payments, from invoices to reimbursable expenses, while enabling finance teams to define clear limits and approval policies.

Key Features:

- Flexible corporate cards and virtual payment options

- Invoice capture with automated approval flows

- Multi-tiered approval rules for spend policies

- ERP and accounting system integrations

- Receipt management and spend analytics

Why It’s a Good Alternative to Payhawk:

Spendesk delivers strong control and compliance across spend and AP workflows, particularly for teams with complex approval structures. While Payhawk excels in global reach and multi-currency support, Spendesk’s structured approval logic can be an advantage for organizations with strict governance requirements.

Setup Process:

Onboarding includes card deployment, policy definition, and workflow setup. Spendesk supports rapid implementation with onboarding assistance and user training.

G2 Customer Reviews:

Users frequently mention Spendesk’s ease of use and clear approval visibility. Many report improved spend governance and fewer policy violations after implementation.

5) Tipalti

Best For: Global enterprises managing complex AP operations with multi-currency payments and compliance needs.

Overview:

Tipalti automates supplier onboarding, tax compliance, invoice processing, and payment execution within a single platform.

Support for hundreds of currencies, automated tax form collection, and built-in regulatory compliance make it well suited for international organizations. Reconciliation and payment reporting tools further enhance control.

Key Features:

- Global supplier onboarding with compliance checks

- Mass payments across multiple currencies

- Automated tax compliance, including W-8 and W-9 collection

- ERP integration with reconciliation mapping

- Payment tracking and reporting

Why It’s a Good Alternative to Payhawk:

Payhawk focuses on spend management and corporate cards, while Tipalti specializes in global AP automation and compliance. Organizations with international supplier networks benefit from Tipalti’s ability to reduce manual tax handling and streamline vendor lifecycle management.

Setup Process:

Implementation includes ERP integration, supplier onboarding configuration, and multi-currency setup. Dedicated support helps ensure compliance requirements are addressed from the start.

G2 Customer Reviews:

Users value Tipalti’s ability to handle complex global AP workflows, reduce manual tax reporting, and improve payment accuracy. Greater control over international payments is a frequently cited benefit.

6) Paylocity

Best For: Organizations already using Paylocity for HR and payroll that want to extend automation into AP.

Overview:

Paylocity integrates payroll, HR, and finance workflows, including AP automation, expense reimbursements, and vendor payments. The platform centralizes employee expenses and vendor billing, aligning financial and workforce data within a single ecosystem.

Key Features:

- AP automation for invoice capture and approvals

- Expense management connected to payroll

- Vendor payment scheduling

- Workflow customization and reporting

- Integration with internal HR and finance modules

Why It’s a Good Alternative to Payhawk:

Payhawk excels at spend and corporate card management, while Paylocity offers a broader cross-functional automation suite that spans HR, payroll, and AP. Organizations already using Paylocity can simplify workflows and reduce data silos by extending AP automation within the same platform.

Setup Process:

Configuration includes enabling AP workflows, linking HR and payroll data, and defining vendor payment rules. Onboarding support helps align finance and HR teams during rollout.

G2 Customer Reviews:

Users often highlight Paylocity’s consolidated ecosystem and strong support for expense and payroll integration. Many report simplified administration and improved data consistency.

DOKKA Is the Best Payhawk Alternative in 2026

Among the alternatives listed, DOKKA stands out as the most comprehensive and adaptable AP automation solution for finance teams in 2026.

Payhawk delivers strong unified spend and card management, while DOKKA focuses on intelligent invoice capture, automated reconciliations, deep ERP integrations, and end-to-end workflow automation.

AI-driven data extraction reduces manual entry, improves accuracy, and speeds up invoice processing. Customizable approval workflows and real-time dashboards give finance leaders visibility and control, supporting faster closes and more confident supplier payments.

For organizations aiming to eliminate manual bottlenecks, improve process accuracy, or scale AP operations with intelligent automation, DOKKA offers a modern platform designed to grow alongside the business.

Ready to rethink your AP automation strategy? Schedule a demo with DOKKA and see how it compares to Payhawk and other leading alternatives.

Disclaimer:

All information presented about third-party products, pricing, or features is based on publicly available sources at the time of writing and is intended for general informational purposes only. DOKKA makes no representations or warranties regarding the accuracy, completeness, or currentness of competitor data. All trademarks and brand names are the property of their respective owners.

We encourage readers to verify details with the respective vendors before making any purchasing decisions.