Managing accounts payable requires a fine balance between ensuring timely payments to vendors and suppliers, maintaining accurate records, and keeping costs under control. With the increasing pressure to optimize financial processes, it has become more critical than ever for businesses to have an effective AP management strategy in place.

Consistency is the cornerstone of efficient AP management. Establishing clear and comprehensive policies and protocols ensures that all stakeholders within the organization understand their roles and responsibilities, creating a unified approach to managing payables and minimizing confusion while ensuring adherence to best practices. Transparent guidelines also foster a culture of accountability, in which compliance with financial regulations and ethical standards is upheld at every step.

In today’s post, we’ll share 7 essential accounts payable management tips that can help you stay on top of your AP game. From implementing a robust invoice processing system to making the most of automation technology, these tips will equip you with the tools and knowledge you need to take your AP management to the next level.

What Is Accounts Payable Management?

Managing a company’s financial obligations is critical to ensure smooth operations and maintain strong relationships with suppliers.

Accounts payable (AP) management refers to the system that deals with a business’s financial obligations to third-party vendors or suppliers for goods or services bought on credit. In simpler terms, it involves tracking and paying off the money a company owes to its suppliers in a timely and organized manner.

The process begins when a company receives an invoice from a supplier. The invoice is then reviewed and verified against the delivered goods or services and corresponding purchase orders in a process called 3-way matching. Once approved, the payment is scheduled according to the agreed credit terms.

This management process goes beyond just paying bills. It is vital for maintaining good vendor relationships, as timely and accurate payments reflect positively on a company’s reputation. It also plays a significant role in cash flow management, as strategic timing of payments can help optimize the use of available funds.

With the advancement of technology, many businesses are automating their accounts payable processes. This not only reduces manual effort and errors but also provides better visibility into the company’s outstanding liabilities, aiding in more accurate financial planning and decision-making.

Why Is AP Management Important?

Without proper management of accounts payable, a company may end up paying bills too early or too late. If a company consistently pays its invoices late or makes errors in payments, it can damage relationships with suppliers, which can potentially lead to less favourable credit terms or even loss of supply.

Inefficient AP processes have higher operational costs, such as more time spent on manual data entry and resolving invoice discrepancies. Failure to accurately track and report accounts payable could lead to non-compliance with tax laws and accounting standards, resulting in penalties and potential legal issues. Without strong controls in place, a company is more vulnerable to fraud, including duplicate payments or payments for fraudulent invoices.

It is important to keep in mind that accounts payable represent a significant portion of a company’s liabilities. If these are not accurately managed and recorded, it can lead to inaccuracies in the company’s financial statements, misleading both management and stakeholders.

How to Properly Manage Accounts Payable

Managing accounts payable can be challenging, particularly for growing businesses dealing with an increasing volume of invoices and tighter cash flows. Manual processes can lead to errors, inefficiencies, and increased risk of fraud. Therefore, businesses are increasingly looking to automate their accounts payable processes and implement best practices to improve efficiency, accuracy, and control.

So, what does it take to manage accounts payable effectively? Here are some best practices to consider:

- Centralize the Accounts Payable Process

- Automate Where Possible

- Prioritize Invoices

- Maintain Accurate Records

- Build Strong Vendor Relationships

- Regularly Review Your Accounts Payable Process

- Implement Strong Internal Controls

1) Centralize the Accounts Payable Process

Having a centralized accounts payable department with streamlined operations can ensure consistency across the board. It creates a single point of contact for vendors, making communication more efficient. It also simplifies training and reduces the risk of errors or discrepancies in handling invoices and payments.

2) Automate Where Possible

Automation can greatly improve the efficiency and accuracy of accounts payable management. By using software tools, one can automate repetitive tasks such as data entry, invoice matching, payment scheduling, and report generation. This not only saves time but also minimizes human error, leading to more accurate accounting and better financial control.

3) Prioritize Invoices

Not all invoices are created equally. Some may be more critical than others, based on factors such as due date, discount offers for early payment, or penalties for late payment. Prioritizing these invoices enables you to utilize your cash resources optimally, take advantage of discounts, and avoid unnecessary fees.

4) Maintain Accurate Records

Keeping detailed and accurate records of all invoices, payments, and vendor information is crucial for effective accounts payable management. These records provide a clear picture of your outstanding liabilities and payment history, helping you to make informed financial decisions. They also come in handy during audits or when resolving disputes with vendors.

5) Build Strong Vendor Relationships

Building and maintaining good relationships with your vendors can give you an edge in negotiations and problem resolution. Regular communication helps you stay updated on their payment terms and understand their expectations. Prompt responses to their queries and timely resolutions of issues can enhance your reputation and potentially lead to better credit terms.

6) Regularly Review Your Accounts Payable Process

Just like any other business process, your accounts payable process should be regularly reviewed and updated. This can help identify bottlenecks, inefficiencies, or areas of risk that need to be addressed. Regular reviews also ensure that your process evolves with changes in your business environment, regulatory landscape, or technology.

7) Implement Strong Internal Controls

Implementing strong internal controls is essential for preventing fraud and ensuring compliance with accounting standards. This includes the segregation of duties (where different people are responsible for approving invoices, making payments, and reconciling accounts) and regular internal audits. A robust control environment enhances the reliability of your financial reporting and reduces the risk of fraud.

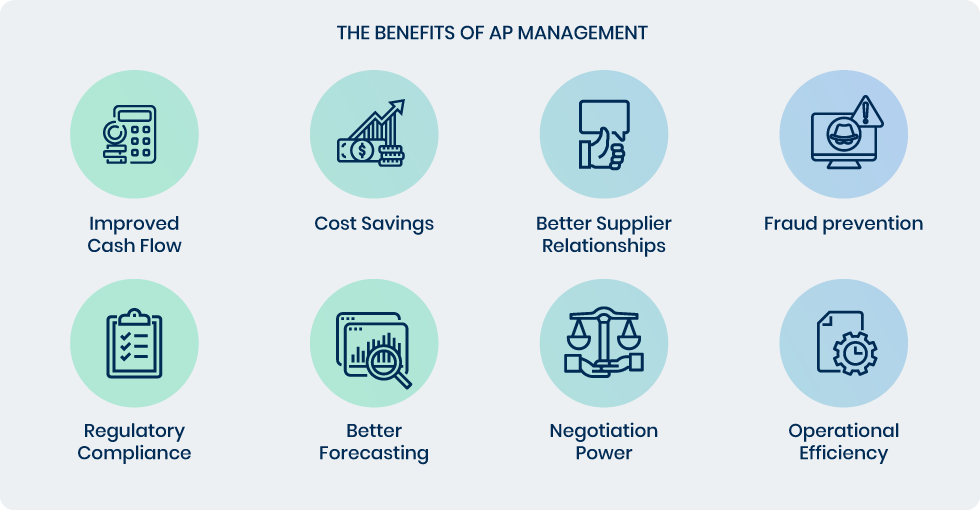

The Benefits of AP Management

- Improved Cash Flow: One of the primary benefits of efficient AP management is improved cash flow. By managing payment schedules and taking advantage of early payment discounts, businesses can ensure they have enough capital on hand to meet their financial obligations, invest in growth opportunities, and manage unexpected expenses.

- Cost Savings: Timely payments and adherence to negotiated payment terms can lead to cost savings. Companies may qualify for early payment discounts, reducing the overall amount paid to suppliers. Moreover, avoiding late payment penalties can save money that would otherwise be lost due to delays.

- Better Supplier Relationships: Maintaining a positive relationship with suppliers is crucial for securing favourable terms, getting priority service, and building trust. Effective AP management ensures timely and accurate payments, which in turn strengthens the vendor relationship and may lead to better agreements and conditions in future transactions.

- Fraud prevention: A well-structured AP management system reduces the risk of errors and fraudulent activities. By implementing segregation of duties, invoice verification processes, and regular reconciliations, businesses can mitigate the chances of financial discrepancies and potential fraud.

- Regulatory Compliance: AP management ensures compliance with financial regulations and accounting standards. Accurate and up-to-date accounts payable data facilitates more precise financial reporting, which is crucial for meeting regulatory requirements and making informed business decisions.

- Better Forecasting: Proper AP management provides valuable data for cash flow forecasting. With insights into future payment obligations and expected cash inflows, companies can plan for potential liquidity challenges.

- Negotiation Power: A strong track record of timely payments and responsible AP management can increase negotiation power with suppliers. Vendors are more likely to offer good terms and conditions to companies they perceive as reliable and creditworthy.

- Operational Efficiency: Efficient AP processes reduce administrative overhead and minimize the need for manual interventions. This streamlines operation, allowing the finance team to work more productively and allocate resources to other critical areas of the business.

Accounts Payable Management FAQ

What are the key components of AP management?

The key components of AP management include:

- Invoice processing – involves receiving, verifying, and approving invoices before they are paid.

- Payment processing – involves scheduling and making payments to vendors in a timely manner, taking into account any early payment discounts or late payment penalties.

- Vendor management – involves maintaining good relationships with vendors, understanding their payment terms, and resolving any issues promptly.

- Record keeping – involves maintaining accurate and up-to-date records of all invoices, payments, and vendor information. These records are essential for financial reporting, audits, and dispute resolution.

How can automation help in AP management?

Automation can significantly improve the efficiency and accuracy of AP management. It can automate tasks like data entry, invoice matching, payment scheduling, and report generation. This reduces the time and effort required for these activities, allowing staff to focus on more strategic tasks. Automation also minimizes the risk of errors that can occur with manual processes, leading to more accurate accounting and better financial control. Most automated systems can provide real-time updates and reminders, ensuring that no payments are missed or delayed. They can also generate reports and analytics that provide valuable insights into spending patterns, vendor performance, and process efficiency.

How often should accounts payable be reviewed?

It’s generally a good practice to review it regularly, such as monthly or quarterly. Regular reviews can help identify any issues or inefficiencies in the AP process, such as delayed payments, duplicate payments, or errors in invoicing. They can also help ensure compliance with accounting standards and regulatory requirements, as these can change over time. In addition, regular reviews provide an opportunity to assess the effectiveness of your accounts payable controls and to look for opportunities to improve efficiencies, such as through increased automation or better vendor management.

How can businesses optimize their cash flow through AP management?

To optimize cash flow, they must strike a balance between paying suppliers promptly and taking advantage of any early payment discounts available. Careful planning and forecasting help ensure that sufficient funds are available to cover payment obligations without compromising the company’s working capital. Delaying payments until they are due also provides businesses with the flexibility to invest in core operations and expansion projects.