Your business is a working machine made of processes and systems that mesh-like cogs to keep it profitable, agile, and progressing in the market. And the very engine room of that machine has to be the accounting department. It stands to reason then, that if that system in the machine is the most efficient and streamlined, the rest of the cogs will follow suit, turn faster, and mesh more smoothly.

So, how do you streamline your business’s accounts department? Well, step one, would be to introduce invoice approval automation into your accounting processes.

Because, if you’re like most businesses, you probably have a lot of invoices to deal with regularly. And if you’re not using invoice approval software, that can mean a lot of wasted time and money.

So, let’s talk here about why you need to look into invoice approval software, and how it can help you make your business better.

What is invoice approval software?

Firstly, let’s define the established process of invoice approval, in general, as it’s existed as a vital part of every established business’s accounting process, since commerce’s fledgling days.

Simply, invoice approval is the act of reviewing and then signing off supplier invoices, by accounts professionals, before clearing these invoices for payment. The steps in this process are usually set underway when a receipt for an ordered purchase has been received by the buyer, from the supplier. That invoice is entered into a specific catalog and is sent to the relevant stakeholder – usually an accountant – for approval.

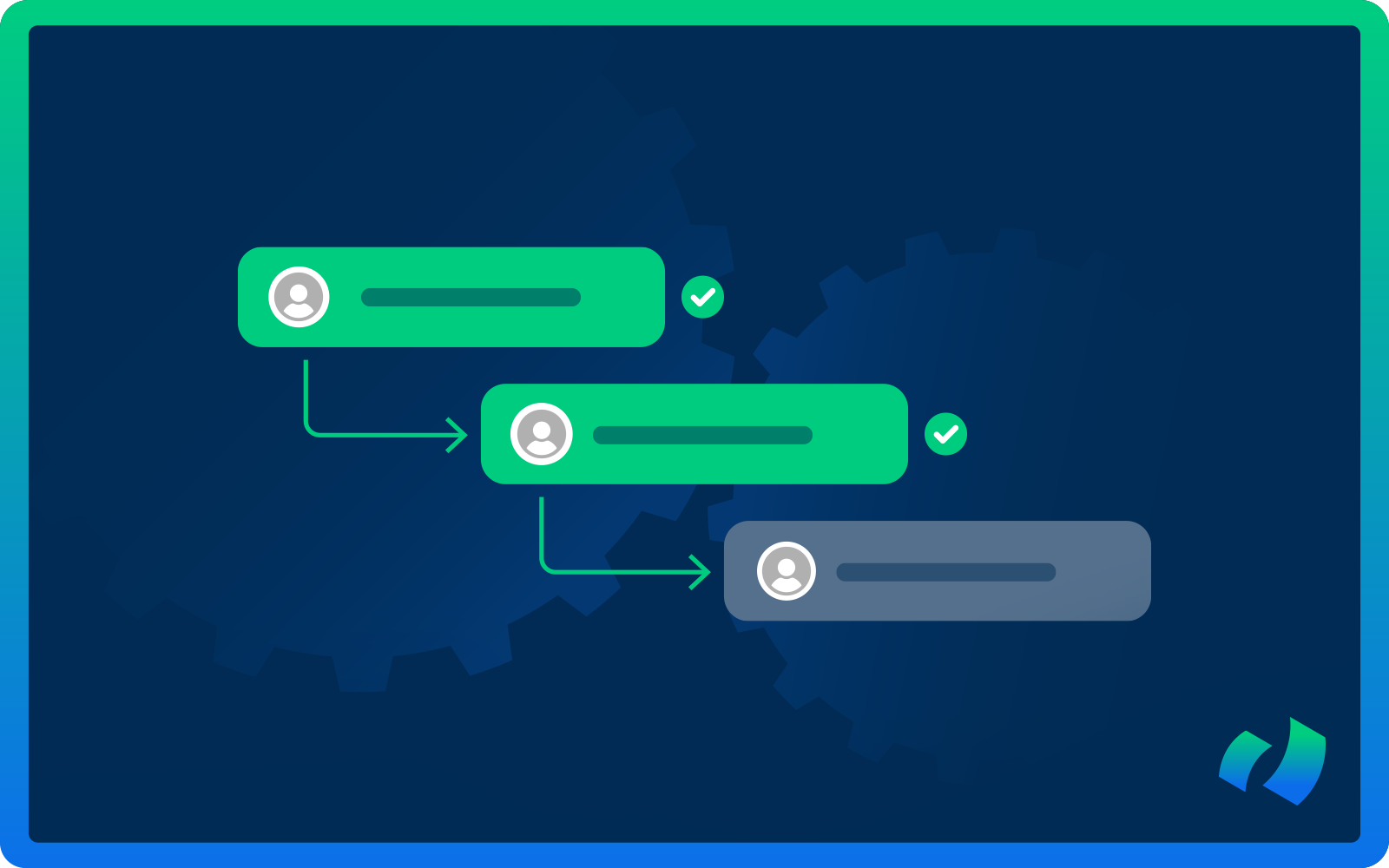

Where previously these steps were manually completed, the advent of accounting software has instilled the automation factor, making the process entirely machine-managed.

How can invoice approval software help your business run more smoothly and efficiently?

Invoice approval software can help you streamline your invoice approval process, saving you time and money. Here’s how:

1. Automated invoice approvals save you time.

When you use invoice approval software, your invoices are automatically routed to the appropriate approvers. That means no more chasing down approvers or waiting for approvals. Your invoices are approved quickly and efficiently.

2. Electronic approvals are more efficient than paper approvals.

With electronic invoice approval, there’s no need to print out invoices and then mail or fax them to approvers. Approvals can be done quickly and easily online. This saves you time and money on printing, postage, and faxing costs.

3. Invoice approval software can help you avoid late payments.

When invoices are automatically routed for approval, they’re less likely to get lost in the shuffle. That means approvers are more likely to review and approve invoices promptly, which can help you avoid late payment fees.

4. You’ll have better visibility into your invoice approval process.

Invoice approval software provides you with real-time reports on the status of your invoices. That way, you can quickly see which invoices have been approved and which ones are still pending. This allows you to keep track of your approvals and ensure that all your invoices are being processed on time.

5. You can customize your invoice approval workflow.

With invoice approval software, you can customize your invoice approval process to match your specific business needs. You can set up approvers, review thresholds, and payment terms to fit the way you do business. This flexibility ensures that your invoice approval process is efficient and effective.

If you’re not using invoice approval software, now is the time to start. Invoice approval software can save you time and money while improving the efficiency of your invoice approval process. And DOKKA’s accounting automation software is powered by smart AI that not only learns your invoices but your overall approval preferences and processes from the start.