In one of our previous posts, we defined accounts payable as company’s short-term debt and obligations to vendors or suppliers for the goods and services bought on credit.

When you receive an invoice from your supplier you might not want to pay it right away, but with a delay of 30 or up to 90 days. And let’s imagine you have hundreds of those bills to manage.

It makes it challenging to plan monthly budgets, doesn’t it?

There is a simple formula that can helps calculate how many days on average it usually takes for a company to pay its suppliers. This metric can show you how good is your AP process and how fast your payments are.

We understand that as a CFO or financial controller, having efficient AP processes in place can help save your company’s money, as well as provide peace of mind and convenience when dealing with bills.

So read on, because in this blog post we will outline what is accounts payable days, how to calculate it with a simple formula, and why you should measure it in the first place.

What Is Accounts Payable Days?

Accounts payable days, also called Days Payable Outstanding (DPO), is a financial metric that can help you keep track of your company’s AP performance. DPO measures the average number of days the company takes to pay its bills.

If this number is high, that means it takes longer for the company to pay its suppliers. This delay can potentially harm the relationship with, or it can even lead to additional costs like penalties for overstepping due dates.

Vice-versa, a lower number means the invoices are paid faster and on time. Certainly, this builds trust and improves supplier relationships, and in some cases, it can lead to new opportunities like early discounts.

Knowing your DPO is important since it gives you insight into how efficient your business is at settling debts with its suppliers.

So how do you get to this number?

How To Calculate Accounts Payable Days?

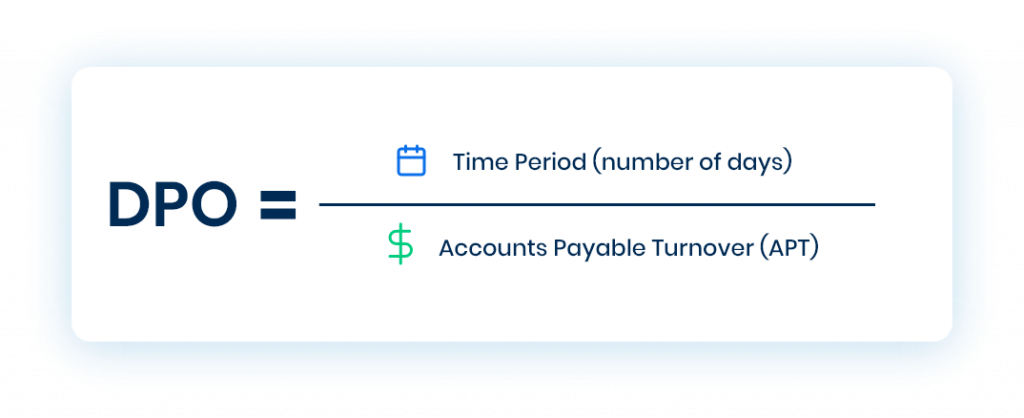

Calculating DPO is easy if you break it down into a few individual components. The formula takes all purchases from suppliers during the specified time and divides them by the accounts payable turnover.

So to get DPO, first you have to know what is your accounts payable turnover.

Accounts payable turnover (APT) is a ratio of the total supplier purchases and the average amount of accounts payable. To calculate the average amount of accounts payable take the beginning balance of accounts payable, add the ending balance, and then divide that number by two.

Here is the formula to get APT:

Let’s calculate accounts payable days based on the following assumptions:

- The calculation is for the period of 30 days (1 month)The company’s accounts payable balance at the beginning of the year is $200,000The company’s accounts payable balance at the end of the year is $250,000The total amount of all purchases from the suppliers is $1,000,000

First, let’s see what’s the AP turnover. For that, we’ll apply the above formula using the total amount of all purchases and the average amount of accounts payable:

($200,000 + $250,000) /2 = $225,000

The average amount of accounts payable is $225,000. We know that the total purchase amount is $1,000,000, so our APT is:

1,000,000 / 225,000 = 4,44

To get accounts payable days or DPO, we’ll divide the 30-days period with APT:

DPO = 30 / 4,44 = 6,75

In this example, it takes 6,75 days on average for the company to pay the suppliers.

Benefits Of Calculating Accounts Payable Days

Keeping tabs on accounts payable days is good for ensuring your company’s financial health. This calculation can help you spot potential cash flow issues by assessing how rapidly your bills are paid out.

Calculating accounts payable days helps you maintain a healthy balance and familiarize yourself with what is owed at any given time.

The information collected can also be used to negotiate better payment terms from suppliers or alert them when payment will be delayed. It’s a great way to stay on top of company finances and avoid unnecessary disruptions. Here are some of the main benefits of tracking AP days:

Improve budget planning

Understanding how much time it takes to pay your suppliers can help you make better plans for budgeting and gives you better control over your AP processes.

Improve supplier relations

If you’re paying your invoices on time it will certainly keep your suppliers happy, and it’s a good foundation to build trust and improve supplier relations.

Keep a good reputation

Bad news travels fast, and if the word gets out that you’re not paying your suppliers on time or you frequently have payment delays it can seriously harm your reputation. Monitoring the accounts payable days can help you stay one step ahead of potential trouble, and guard your good reputation.

Optimize AP workflows

If you discover that your accounts payable days number is unusually high month after a month, this can suggest that there is a problem with your AP process. It’s a great tool to help you identify potential omissions within the AP workflow so that you can improve and optimize invoice processing.

Get early discounts

Nurturing good relations with suppliers can lead to cost savings as well. Many vendors offer special, discounted prices for customers that regularly pay their invoices on time.

How You Can Optimize DPO With AP Automation

A good way to improve your accounts payable days is to use AP software and automate your AP workflow.

Automation solutions help streamline processes, reduce manual data entry, and ensure timely payments. Additionally, automated systems provide organizations with a full view of their AP metrics, which can empower teams to make more informed decisions about supplier relationships and take proactive steps toward financial optimization.

With automated accounts payable, companies can rest assured knowing their suppliers are being paid on time and that their finances remain organized and up-to-date.