Reconciling invoices is a crucial element in maintaining financial stability. Reconciliation is the process of comparing and reconciling invoices with receipts, purchase orders, and other relevant documents to ensure that all transactions are accurately recorded and billed. We refer to this process as a crucial element, as it helps to detect discrepancies and resolve issues related to billing errors, fraud, and other financial malpractices.

It also helps in improving cash flow management by providing accurate and timely information on outstanding payments and collections, and helps to maintain compliance with tax regulations and accounting standards. By keeping proper records of invoices and receipts, you can easily calculate tax liabilities, claim credits, deductions, and avoid costly penalties and fines. In short – establishing an effective accounts payable (AP) reconciliation process is a key to avoiding financial mistakes.

In this blog post, we’ll dive into the essential steps needed to master your AP reconciliation, providing you with practical tips and best practices to help streamline the process, reduce errors, and save time and resources. Whether you’re new to reconciliation or a seasoned professional looking to brush up on your skills, this post has everything you need to stay ahead of the curve!

What Is Accounts Payable Reconciliation?

Account payable reconciliation is a method of verifying that a company’s financial records are accurate and complete, ensuring that no errors or fraudulent transactions have occurred in accounts payable. This process compares a company’s financial records to bank statements or other third-party sources of financial data.

It is important to reconcile all financial records, such as income statements and balance sheets, to identify discrepancies and prevent potential financial fraud. By performing regular reconciliations, companies can keep their finances healthy and achieve long-term growth and success. Therefore, every accounts payable (AP) team must assign experienced financial experts to perform regular account reconciliations.

When AP teams do not reconcile their financial records regularly, they run the risk of missing fraudulent transactions or other errors that can lead to misreporting of financial data. The inability to identify these can result in significant financial consequences, like lost revenue or the need for costly litigation.

The AP reconciliation process can be complicated, especially for large and complex organizations with numerous bank accounts and transactions. However, many modern accounting and AP software programs can help automate much of the AP reconciliation process, making it easier and more efficient.

Why Is It Important To Reconcile Accounts Payable?

Reconciling accounts payable is an important aspect of maintaining accurate and up-to-date financial records. It involves verifying that the amount owed to vendors and suppliers matches the corresponding account payable balance recorded in the accounting ledger. It is important to ensure that no discrepancies exist, and that all outstanding bills have been accurately accounted for.

AP reconciliation can be a serious challenge for many AP teams, especially when they do not have an efficient and streamlined process. If your AP processes are disorganized or inefficient, you may find yourself dealing with late payments, duplicate payments, and incorrect payment amounts.

The accounts payable reconciliation process demands vital attention to detail. Getting it wrong can lead to a lower bottom line, penalties or even legal action. While keeping track of unpaid bills and matching them to corresponding invoices may seem like a straightforward process, mastering the accounts payable reconciliation process is a challenging feat that requires a delicate balance of time, expertise, and resources.

Reconciling accounts payable on a regular basis provides several advantages:

- helps to identify and resolve any billing discrepancies, including incorrect pricing, duplicate invoices, or unauthorized charges

- ensures that all payments are accounted for properly, preventing any missed or late payments that could result in late fees or damage to vendor relationships

- helps in forecasting cash flow, inventory management, and budgeting

How Often Should You Reconcile Accounts Payable?

The frequency which an organization reconciles accounts payable should largely depend on the complexity of its financial transactions, the number of vendors, and the size and scale of its operations. Regardless of the size of the business, it is crucial to schedule regular reconciliations to maintain accurate financial records and avoid any discrepancies that could lead to errors or financial losses.

For small businesses with straightforward financial operations, reconciling AP once a month may be sufficient. This allows for an adequate time frame to collect and confirm all invoices, receipts, and bills. For larger businesses with multiple departments, vendors, and suppliers, more frequent reconciliations may be necessary. In these cases, a weekly or bi-weekly schedule may be more appropriate to maintain accurate records and prevent errors from accumulating over time.

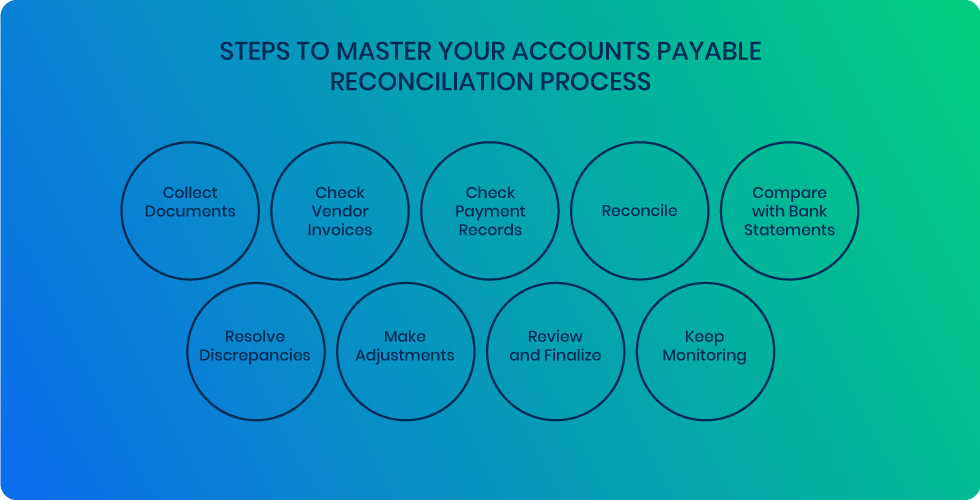

Steps To Master Your Accounts Payable Reconciliation Process

1) Collect The Documents

Make sure to gather all the necessary documents such as invoices from vendors, payment receipts, and bank statements. Verify that you have comprehensive and precise records for every transaction related to accounts payable within the reconciliation period.

2) Check Vendor Invoices

Review the vendor invoices to make sure that they are correct and contain all necessary information. Look for errors such as incorrect vendor names, invoice numbers, payment amounts, and payment terms. Also, ensure that all vendor invoices have been properly entered into the accounts payable system.

3) Check Payment Records

Verify that payment records, including checks or electronic payment confirmations, match the corresponding vendor invoices and entries in the AP system. Confirm that all payments are accurately recorded, and check for any duplicate payments or missing entries.

4) Reconcile

Examine vendor statements to ensure that the outstanding balances are the same as the accounts payable records. If you come across any differences, like missing payments or invoices, resolve the issues.

5) Compare with Bank Statements

Cross-check the payment records in the accounts payable system with the entries in the bank statements. Confirm that all payments are correctly recorded in the bank statements and that they match with the payment records in the AP system.

6) Resolve Discrepancies

Promptly investigate and resolve any discrepancies found during the reconciliation process. This may require communicating with vendors, reviewing payment documentation, or reconciling payment records with bank statements. Make sure to keep detailed documentation of all discrepancies and resolutions.

7) Make Adjustments

Record any necessary adjustments to correct discrepancies or errors in the AP system. These adjustments may involve recording missing invoices, correcting payment amounts, or updating payment terms.

8) Review and Finalize

After resolving any discrepancies, review the records of accounts payable that have been reconciled to ensure that they are both accurate and complete. Write a report on the reconciliation, summarizing the adjustments made and the findings, and obtain the necessary approvals.

9) Keep Monitoring

To make sure the accounts payable records are accurate and complete, it is important to regularly check and review them. You can also reduce the risk of errors and fraud in the AP process by implementing internal controls, such as using automation tools and separating duties.

How AP Automation Can Help You in Reconciling Accounts Payable?

Reconciling accounts payable can be a time-consuming and challenging task for AP teams, often resulting in errors and delays. AP automation refers to the implementation of software systems that streamline different financial processes, including payment processing and invoice matching. With AP automation, AP teams can significantly reduce the amount of time and effort spent on reconciling accounts payable, while also minimizing the likelihood of errors.

AP automation software can automate the matching process between invoices and purchase orders, ensuring that purchases are accurately recorded and verified against existing orders. The automation software can also identify discrepancies or errors in the invoice, alerting the accounting team to rectify these issues before processing payment.

The cloud-based AP automation software offers real-time visibility to the accounting department, allowing them to monitor payment processing and approvals from anywhere, anytime. This visibility empowers AP teams to review and approve invoices quickly, minimizing delays and ensuring vendors are paid on time.

In conclusion, AP automation is an essential tool that can help businesses streamline their accounts payable reconciliation process. By automating the matching process, identifying discrepancies or errors, and providing real-time visibility, AP automation software can significantly reduce the time and effort spent on accounts payable reconciliation.