Automated invoice processing is a concept that involves using specialized software to automate time-consuming accounts payable tasks like data entry, calculations, filing, approvals, creating journal entries and payments.

By eliminating time-consuming manual tasks and reducing human error, automated invoice processing solutions revolutionize how organizations handle their accounts payable – delivering faster journal entries, quicker payment approvals, enhanced visibility into the cash flow, improved vendor relationships and a higher data accuracy.

How Automated Invoice Processing Works

Automated invoice processing uses software (like DOKKA, Stampli, Tipalti, and others) to eliminate about manual, repetitive data entry tasks.

Not only is it more accurate than manual invoice processing, but it also saves time and helps reduce dozens of administrative tasks in one go. With an automated system you can be sure that every transaction is accounted for and recorded easily, with all costs accurately calculated each time.

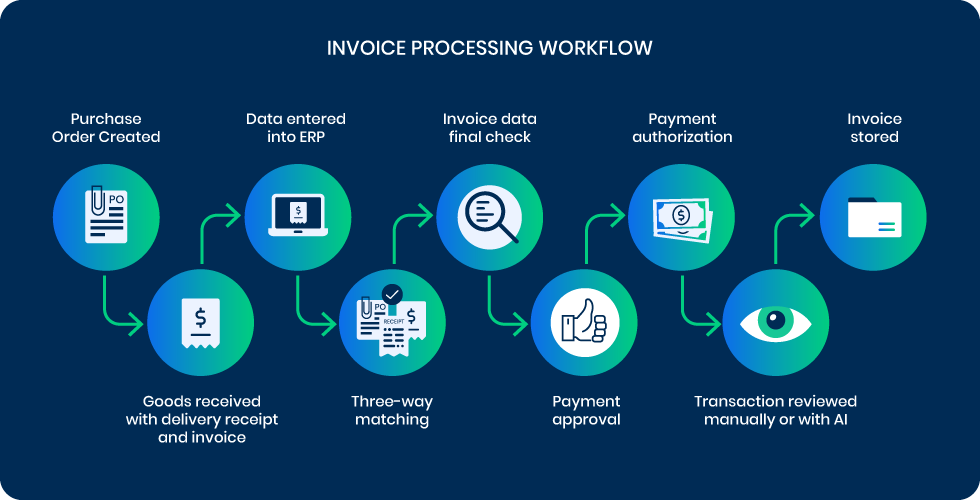

Regardless of the type of software that you use, the typical automation process for AP involves several steps:

Step 1: Invoice Received

Automated invoice processing begins when a company’s accounts payable department receives a vendor’s invoice. The invoice is scanned into the system, which reads and captures any relevant data as it appears on the document. Technology like optical character recognition (OCR) converts scanned documents into digital text and can be used to gather data from an invoice quickly and efficiently.

Step 2: Invoice Validated

Once the data is collected, the software validates the accuracy of the data and checks whether all required information has been captured from the invoice. The validation process compares the data against predetermined standards and cross-references with existing supplier records to confirm accuracy, such as purchase orders (PO).

Step 3: Invoice Approved For Payment

In the next step the invoice is routed for approval based on predefined criteria and user-defined rules set up by company’s accounting team. This process can include routing invoices to multiple people to approve, based on dollar amounts or cost center categories. For example, invoices with a certain amount may require additional approval from higher level management before they are processed further.

Step 4: Payment Made

Upon approval, the AP software will send out notifications to confirm that payment has been accepted and processed. In most cases this includes electronic transfer of funds directly from company’s bank account to the vendor’s account.

Step 5: Invoice Stored

After the payment, the invoice is archived in a digital library so that it can be retrieved at any time for future reference if needed.

Which Invoice Processing Tasks Can You Automate?

Here is a list of invoice processing tasks that can be automated:

- Data Entry: Automated invoice processing can save considerable time in data entry. By enabling AP teams to quickly and accurately capture details from invoices, automated invoice processing dramatically cuts the amount of manual data entry. This allows staff more time to perform other important tasks within their roles.

- Coding: Automated invoice processing automatically assigns specific codes to line items on an invoice. This allows easy reference and analysis of expenses and also simplifies reporting these expenses to tax authorities or other stakeholders. Automation gives businesses a crucial edge when it comes to tracking their spending down to the last line item.

- Matching: Automated invoice processing can also help detect duplicate payments or bills for the same purchase, preventing double payments and saving money for small businesses or those with large volume transactions. It does this by using algorithms that identify when two invoices match due to similar vendor information, description of goods/services, quantity purchased and total price charged.

- Approval Processes: With automated invoice processing, companies are able to automate the approval process, significantly reducing the time associated with manually reviewing each invoice before approving payment. It is possible to implement predefined rules that route invoices directly into the correct workflow, thus enabling quick approvals without having employees spending hours waiting for them.

- Tracking & Reporting: Automated invoice processing makes it easy to track payments and generate reports on spending, as well as overall financial trends such as where most money is being spent or how much debt a company owes at any given time to its suppliers or vendors. This comprehensive view increases visibility into the finances, so key decisions can be made quickly and with confidence, knowing that all the facts are at hand.

6 Key Benefits Of Automated Invoice Processing

1. Improved Accuracy and Reduced Errors

Automated invoice processing utilizes advanced software algorithms which can detect and correct errors, typos, and other inconsistencies to ensure 100% accuracy, eliminating the chance for human input mistakes that may result in inaccurate or delayed payments.

2. Increased Efficiency

Eliminates manual data entry tasks, freeing up time for employees to focus on higher-level responsibilities. Furthermore, automated invoice processing can significantly reduce the manual workload associated with AP operations by enabling AP teams to process invoices at a much faster rate.

3. Streamlined Process

With automated invoice processing, AP teams can configure their systems so that incoming invoices are automatically sorted according to preset criteria and routed directly to the right department or individual for approval and payment processing. This increases efficiency and reduces the amount of time it takes to get an invoice approved and processed.

4. Enhanced Visibility

Automated invoice processing provides enhanced visibility into AP operations by providing real-time visibility into the status of each invoice as it moves through its various stages within the system. Better track payments, spot trends in late payments, and quickly identify any potential issues with invoices prior to payment being made.

5. Cost savings

Automation minimizes the need for additional personnel resources dedicated solely to managing accounts payable. This will lead to cost savings that can be used elsewhere in company’s operations. Additionally, automating the entire process means fewer errors, resulting in reduced costs related to bad debt write-offs due to incorrect information being entered or processed incorrectly during manual data-entry tasks.

6. Easier Compliance Management

Through automated invoice processing , organizations are better equipped to remain compliant with changing regulations because they know exactly what is happening with each document throughout its life cycle at any given moment. This also allows for improved internal audit abilities as financial records are easier to access due to improved visibility within documents.

Main Features Of Automated Invoice Processing Software

- Automated Data Entry: Software can capture, read and extract information from incoming invoices using optical character recognition (OCR) technology, allowing for the automatic entry of data into the system.

- Customizable Workflows: Software allows you to set up custom workflows and rules so that different types of invoices are routed to the correct personnel in a timely manner. This helps to ensure efficient management of all invoice processing activities.

- Document Matching: Automated invoice processing software is capable of matching documents by comparing purchase orders and packing slips with corresponding invoices to verify accuracy and completeness.

- Multi-Currency Support: Multi-currency support allows users to enter and manage invoices in any currency, allowing for flexibility when dealing with international payments and transactions.

- Vendor Portal/Self-Service Portal: Software includes a vendor portal where vendors can easily upload invoices for quick approval without having to go through manual processes or paper-based systems.

- Reporting & Analytics: Software can generate customized reports providing an overview of your accounts payable performance, highlighting areas where improvements could be made in the process or revealing potential cost savings opportunities along the way.

- Automation & Integration with ERP Systems: Software can be integrated with enterprise resource planning (ERP) systems, giving better control over the operations while streamlining accounts payable processes and reducing paperwork clutter.

How To Choose The Best Automated Invoice Processing Software For Your Needs?

Choosing the best AP software requires careful consideration of various factors like scalability, speed, security, and cost.

Consider the features that you need in an AP software. Do you need automation for invoice processing, approval workflows, and payment processing? Do you need the ability to generate reports, manage vendors, and reconcile accounts? Make a list of the features that are important to your business and evaluate software options based on how well they meet your needs.

Look for AP software that integrates seamlessly with your existing accounting software or ERP (Enterprise Resource Planning) system. Integration will ensure that data is transferred smoothly between systems, reducing the risk of errors and minimizing the need for manual data entry.

Look for software that is intuitive and easy to use, with a clean and user-friendly interface that requires minimal training to get started.

Think about how much you can customize the software to meet your specific needs. Some software offers extensive customization options, while others are more limited. Make sure that the software you choose has strong security measures in place to protect sensitive financial data.

Consider the cost of the software, including any setup fees, licensing fees, and ongoing support costs. Compare pricing from different vendors and evaluate the value of the features offered against the cost. Research the software vendor’s reputation and read reviews from other customers who have used the software to get insight into how well the software performs in real-world scenarios and how responsive the vendor is to customer needs.

How DOKKA Helps with Automating Invoice Processing

DOKKA streamlines invoice processing by automating the entire flow—from data capture to approval routing and ERP posting—eliminating the manual steps that slow finance teams down. Invoices are ingested from any source, instantly classified, and extracted with high accuracy using DOKKA’s AI engine.

Coding, allocation, and matching rules are applied automatically, while exceptions are flagged for quick review instead of time-consuming investigation. Approvals move through smart workflows with full visibility, and once finalized, invoices sync directly to your ERP with no retyping or duplication.

Trusted by more than 3,500 companies across 14 countries, DOKKA delivers a faster, more controlled AP process that reduces errors, boosts productivity, and frees teams to focus on higher-value accounting work.

To get started, book a personalized demo of DOKKA.