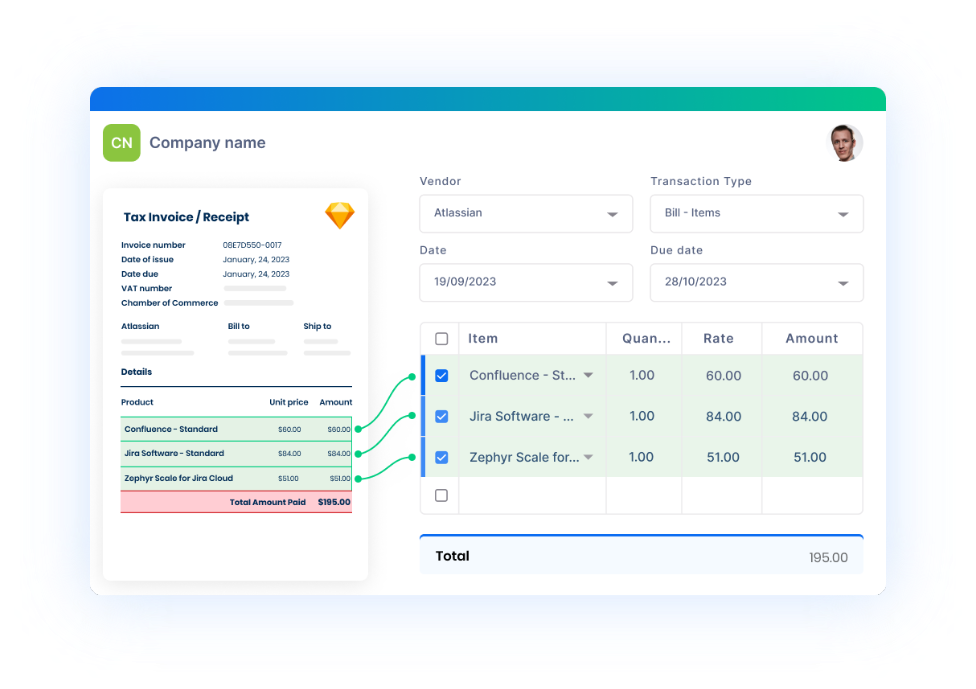

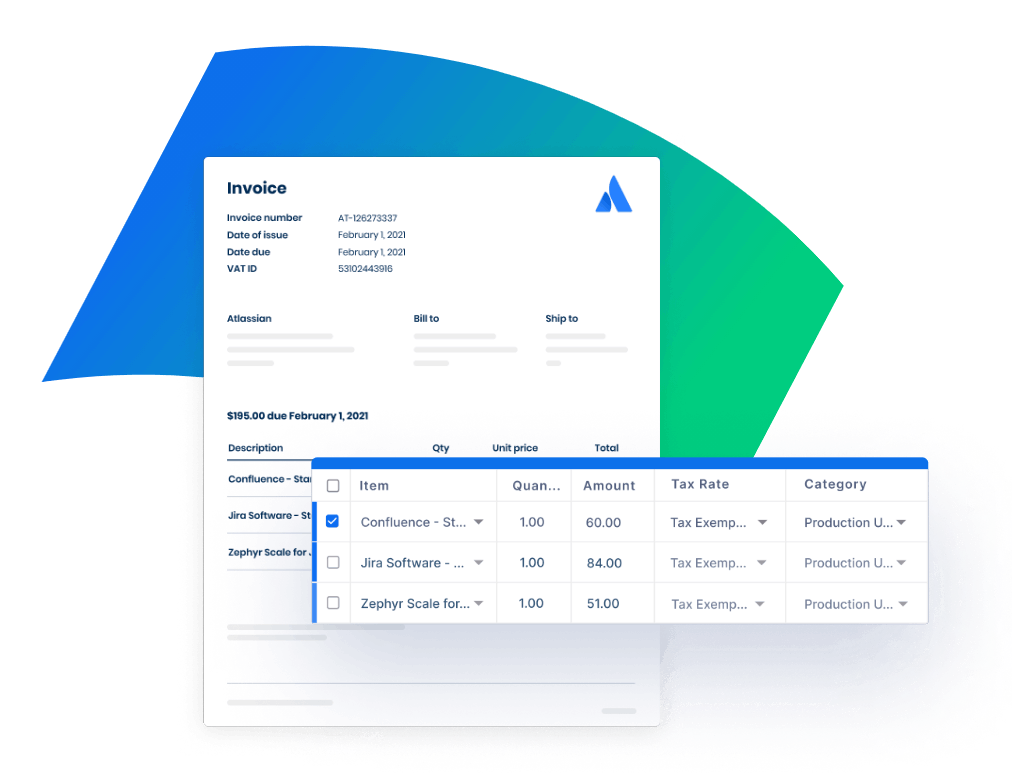

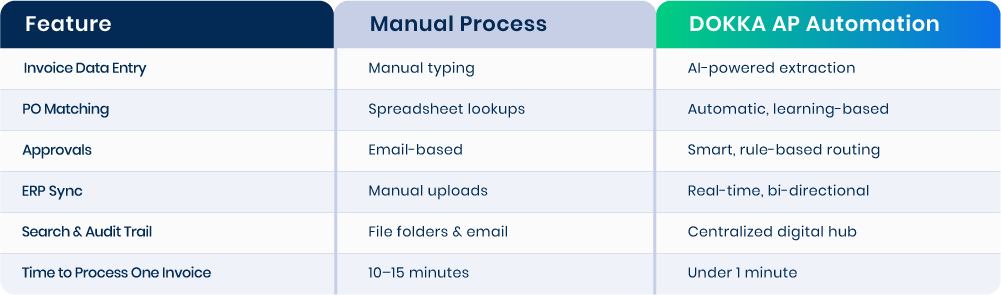

The All-in-One AP Automation Software

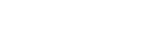

Automate the capture, validation, and processing of invoices, with DOKKA’s AI-powered AP automation software.

- Cut AP processing time by up to 80%

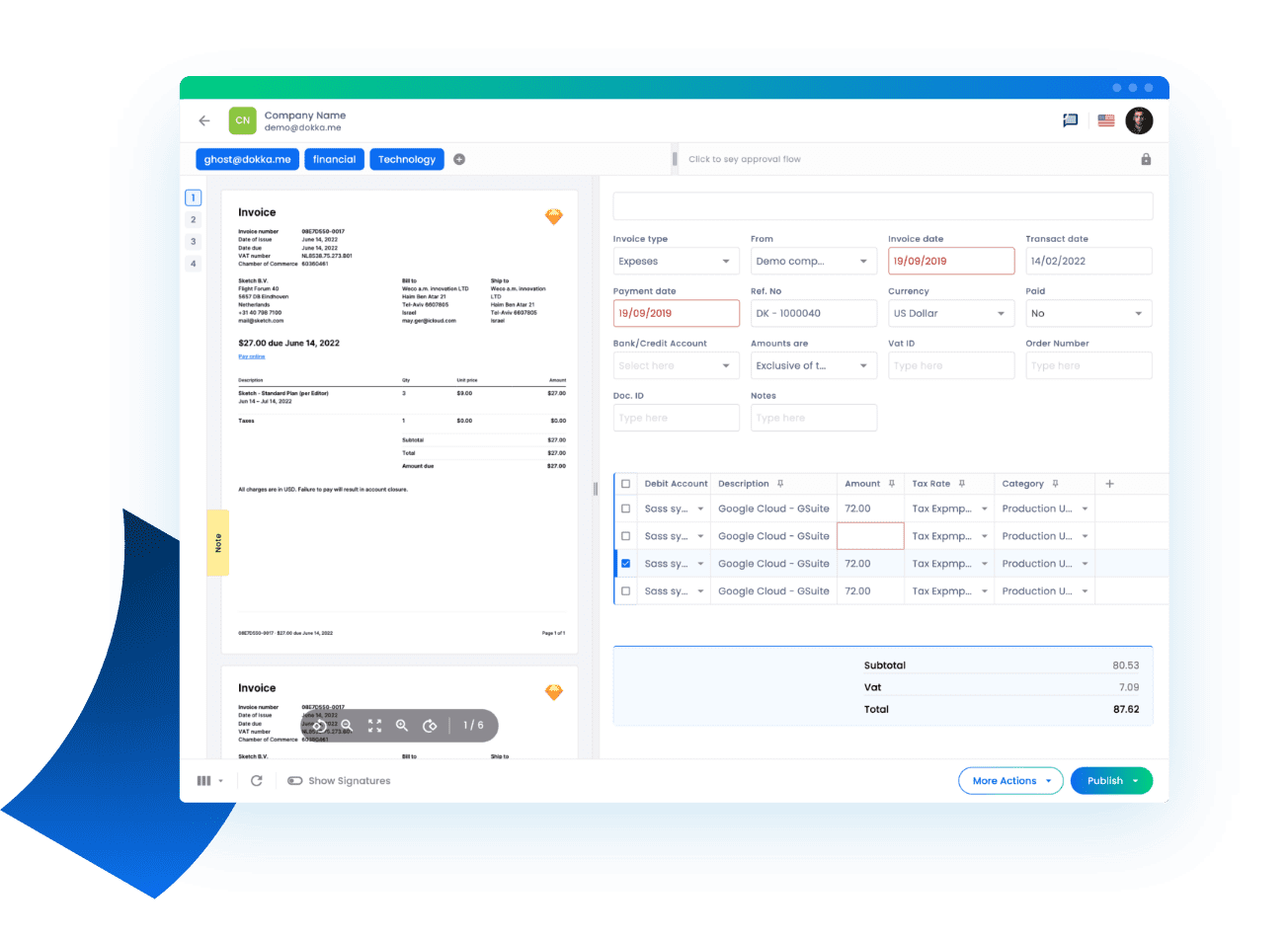

- Automate invoice entry, approvals, and ERP sync

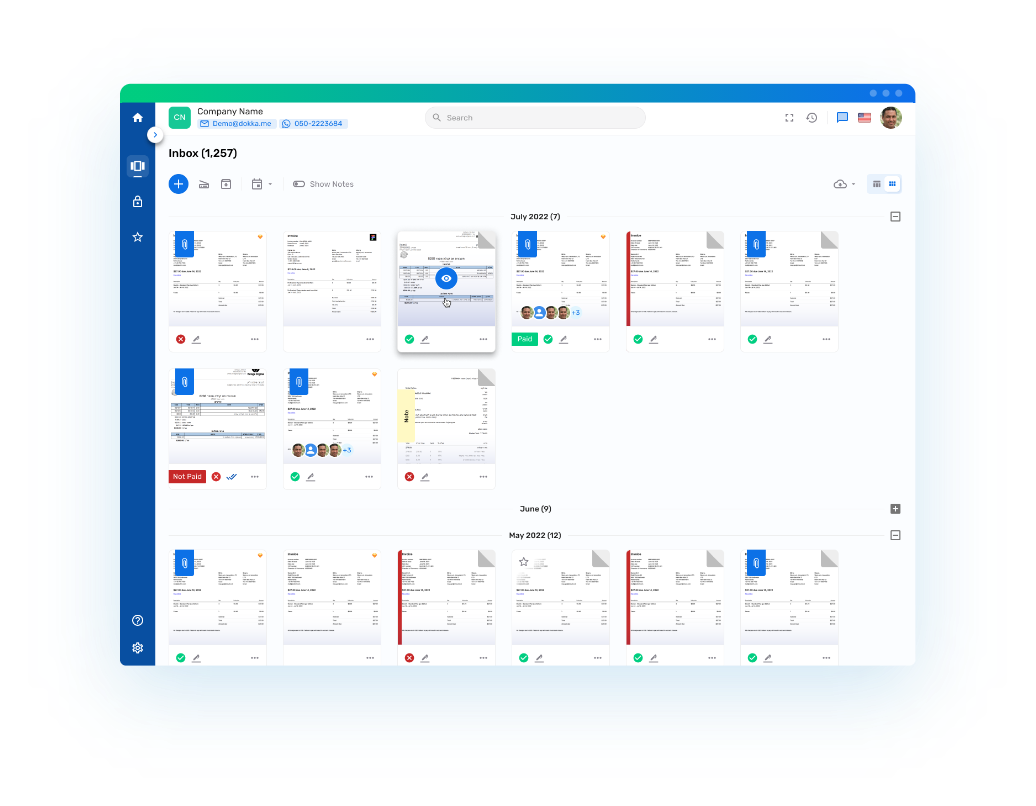

- Centralize all AP data in one platform

- Go live in just 2 weeks