The World of AI-Powered

Accounting is Here

There is a massive shift happening in

finance and accounting.

Here's how to

end up on the winning side.

Written by Eric Edelstein

Co-founder at DOKKA A.I.

Finance and accounting have undergone three major evolutionary stages since the 1980s. Now, we are on the verge of experiencing the most significant shift in history.

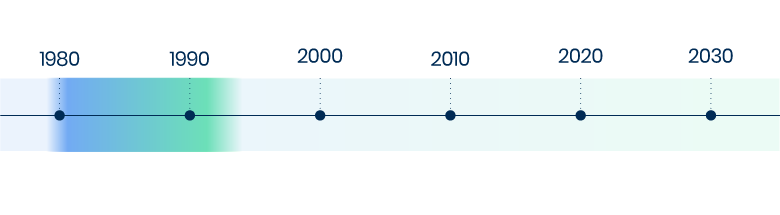

Era of Computerized Accounting

The 1980s marked the beginning of computerized accounting systems. With the rise of personal computers and accounting software, organizations started transitioning from manual bookkeeping to computer-based solutions.

Basic accounting tasks such as data entry, calculations, and report generation became more streamlined and efficient with the aid of software. However, these early systems had limited functionalities and required significant human involvement for data input and analysis. Unfortunately, many organizations today are still dealing with the very same 1980s workflows.

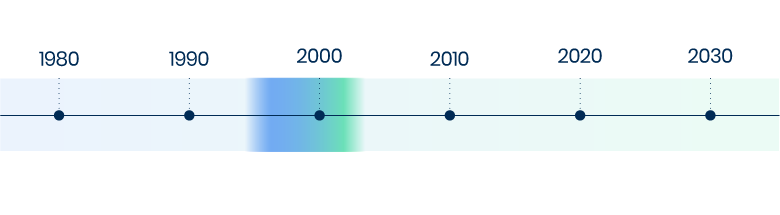

Era of Integrated Enterprise Resource Planning (ERP) Systems

During the 1990s, accounting underwent a major transformation with the advent of integrated ERP systems. These systems combined accounting modules with other business functions like inventory management, procurement, and customer relationship management. Integrated ERPs provided a holistic view of organizational data, streamlining processes, and enabling better coordination between departments.

Finance teams could access real-time financial information, improving decision-making capabilities. This era witnessed the integration of accounting within the broader context of enterprise-wide systems.

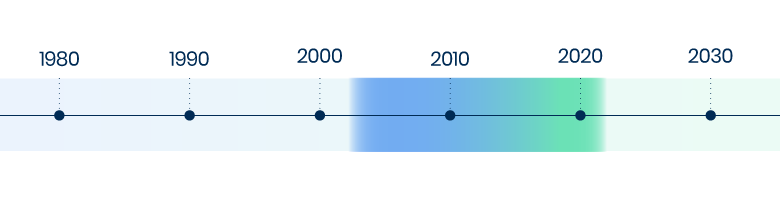

Era of Cloud-Based Accounting and Automation

In the early 2000s, cloud computing emerged as a game-changer for accounting. Cloud-based accounting software offered anytime, anywhere access to financial data, facilitating collaboration and remote work.

This era witnessed the automation of various accounting tasks such as bank reconciliations, invoice processing, and expense management.

Machine learning algorithms and AI-powered features started gaining traction, enabling predictive analytics and enhanced data analysis. Organizations started leveraging automation to streamline operations, reduce costs, and improve accuracy.

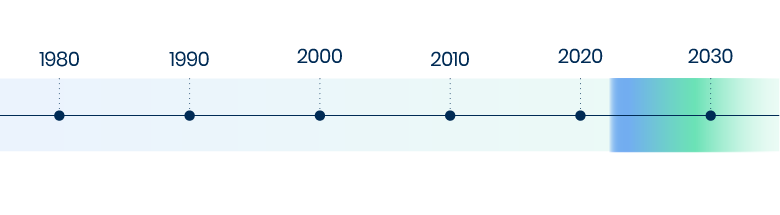

Era of AI-Powered Accounting

Now, accounting enters its most transformative phase with the advent of autonomous AI-powered accounting. These systems, pioneered by DOKKA, utilize advanced AI algorithms, natural language processing, and machine learning to automate complex accounting processes.

Next-gen accounting systems are autonomous. They continuously learn and adapt, improving accuracy, efficiency, and the ability to handle complex scenarios. They can perform tasks like data entry, financial analysis, audit preparation, and compliance monitoring with minimal human intervention.

The era of autonomous accounting is a paradigm shift that revolutionizes the role of the finance team, allowing them to focus on strategic decision-making, providing financial insights, and driving business growth.

Why You Shouldn't Settle for Status Quo

The rise of autonomous AI-powered accounting systems has created stakes that finance leaders simply cannot ignore.

And with the advent of autonomy, those stakes have skyrocketed.

No longer is it merely a matter of staying up to date with the latest technology — it’s about securing the financial future of the entire organization.

By embracing this shift, you’re unlocking a world where your finance team operates with unrivaled efficiency and accuracy, propelling your organization to new heights.

With next-generation accounting, you’ll streamline processes, reduce errors, and gain real-time insights that empower you to make data-driven decisions. By adapting to this change, you secure your financial future, positioning your team as trailblazers in the era of innovation.

However, the alternative is unacceptably negative.

Sticking with outdated accounting practices and resisting the autonomous AI-powered revolution means subjecting your team to inefficiencies, errors, and missed opportunities.

Without automation, manual processes will continue to plague your workflows, hindering productivity and draining valuable resources.

Inaccuracy in financial reporting, compliance risks, and the inability to swiftly adapt to market changes become lurking threats.

Your competitors, armed with cutting-edge technology, will gain a decisive advantage, leaving you struggling to keep up.

Not embracing autonomous accounting is embracing a future where your team is mired in repetitive, error-prone tasks, overshadowed by missed growth opportunities and an ever-widening gap between your organization and industry leaders.

AI is Not About Replacing You: It's About Unleashing the Full Potential of Finance Teams

Picture a land where you no longer grapple with sleepless nights, endless Excel spreadsheets, and nerve-wracking deadlines – a world where repetitive manual tasks become a thing of the past as cutting-edge automation takes center stage.

Take accounts payable for example: Instead of spending minutes coding an invoice you are now spending 7 seconds. In this transformed landscape, manual data entry, PO-matching, and invoice approvals are no longer tedious bottlenecks—they’re seamlessly orchestrated by intelligent systems.

Advanced AI handles every detail, from recognizing vendor-specific nuances to matching line items flawlessly, freeing up your team to focus on higher-value activities like analyzing spend patterns, negotiating better terms, and driving cost efficiency.

This panoramic perspective provides both financial controllers and CFOs with complete transparency, enabling them to make informed decisions with unparalleled speed and precision.

It doesn’t stop there. The ability to close the books faster, with enhanced accuracy, reduces compliance risks and provides stakeholders with increased confidence in financial reporting.

Furthermore, by liberating valuable time and resources, this process facilitates a shift towards proactive financial management, fostering innovation, and driving strategic growth.

The end result is a massive change for the better: Financial leaders take the center stage to become the architects of financial excellence, navigating their organizations towards success.

However, even though this land is yours for the taking, you’ll need some help to get there unscathed.

How AI Changes the Finance Skillset

In the “Old World,” routine tasks like transactional expertise and task management form the wide base of a traditional skills pyramid, with only a select few climbing to roles requiring strategic thinking and advanced business acumen.

Enter the “New World,” where AI flips this structure on its head. With automation taking over repetitive tasks, the focus shifts upward—empowering finance professionals to lead with deep analytical insights, strategic decision-making, and diverse project management. It’s not just a reshuffle—it’s a reimagination of what finance teams can achieve in an AI-driven era.

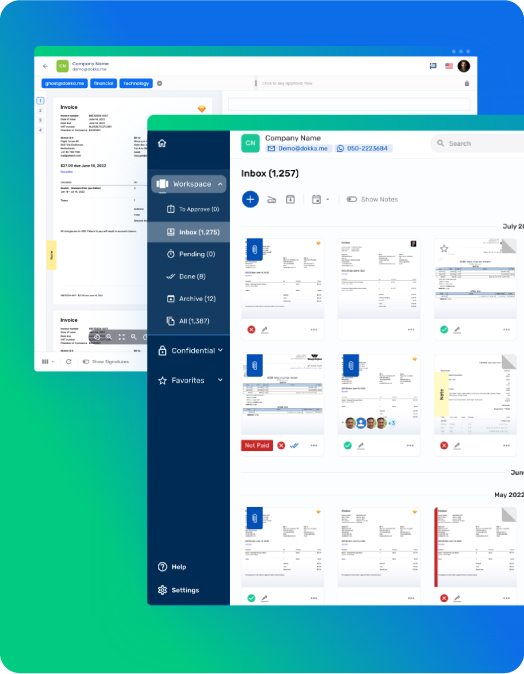

DOKKA's AI-Powered Accounting Automation Platform

DOKKA is the leading accounting automation platform that transforms traditional finance teams into streamlined, AI-powered powerhouses.

By significantly reducing time spent on repetitive tasks, DOKKA empowers over 3,500 companies—including NASDAQ-listed enterprises—to achieve unmatched precision and efficiency in their accounting operations.

Our cutting-edge platform features two core modules: Accounts Payable (AP) Automation and Financial Close Automation.

With AP Automation, DOKKA reduces accounts payable processing time by up to 80%, allowing you to handle vendor invoices in as little as 10 seconds through automated processing, PO-matching and approval workflows, setting a new standard for speed and accuracy.

DOKKA’s Financial Close Automation module shortens your financial close cycle by days, centralizing data, automating reconciliation, and streamlining journal entries, consolidation, and reporting. This accelerates closings while ensuring enhanced quality, transparency, and compliance at every step.

DOKKA’s proprietary AI-driven technology is reshaping the landscape of modern finance, enabling CFOs and financial controllers to seamlessly transition from manual to automated processes with confidence.

Your Unfair Advantage

Put AP processing on autopilot

Stop wasting time on manual processing of vendor invoices. DOKKA automatically creates journal entry recommendations from email attachments, automates approvals, PO-matching and much more.

Close your books twice as fast

DOKKA automates checklist creation, control execution, and account cut-off management that’s fully customizable to suit your preferences. Run global pre-set controls or create your own from scratch.

Centralize all your finance data into one platform

Unify your disparate finance tech stack into one sleek platform, improving collaboration and transparency across your whole team. No more awkward finger-pointing when it comes to discrepancies and a complete picture of your financial, at all times.

Accelerate onboarding and training of new employees

Empower new team members with intuitive software that does the hard work for them, enabling them to become productive contributors in record time, reducing the onboarding period from months to just days.

Your Key to Unlocking

Accounting Efficiency

Over 3,500 companies are automating their accounts payable and financial close with DOKKA. Use the button below to sign up for a personalized, 1 on 1 demo.