As a company grows, the AP process becomes time-consuming, involving multiple stakeholders, teams, and departments. From the initial purchase order to the final payment, every step requires accuracy, coordination, and careful oversight to ensure invoices are processed on time.

Why does it matter? A well-managed AP process is essential for maintaining strong supplier relationships, optimizing cash flow, and protecting the business from fraud or financial loss. Strict adherence to internal controls and company policies is a must.

The full cycle accounts payable process spans several important stages: invoice verification, matching with purchase orders, confirming receipt of goods, and completing payment processing. Each stage contributes directly to the financial efficiency and stability of the company.

This article takes a deep dive into the full cycle accounts payable process, uncovers its challenges, and explores why automation could be the key to transforming and improving AP operations.

What Is the Full Cycle of Accounts Payable?

The accounts payable (AP) process is an integral part of the procure-to-pay business cycle and covers the entire life cycle, from receiving, verifying, and approving invoices to making payments to vendors for their products or services.

Full cycle AP oversees and manages every detail within invoice processing. It refers to the set of activities involved in managing a company’s payment obligations to vendors, suppliers, and other external parties.

The cycle begins with recording invoices or bills received from vendors and concludes with making payments to them.

The AP process ensures that a company pays its vendors and suppliers accurately and on time, which is vital for maintaining goodwill and sustaining strong relationships. But a well-functioning AP process also helps companies manage cash flow efficiently, ensuring funds are available to meet obligations as they come due.

Full Cycle Accounts Payable: The 3 Key Stages

1) Invoice Receipt and Verification

The first phase in the AP process involves receiving and verifying invoices sent by vendors for goods or services provided.

Invoices must be checked for accuracy, including price, quantity, and terms of payment. Once verified, they are recorded in the company’s accounting system, which generally involves data entry and coding of the invoices.

2) Approval and Payment Authorization

The second phase covers approval and payment authorization, ensuring that invoices are approved by the relevant personnel within the company.

This step typically includes routing invoices through the appropriate approval channels, which may involve several parties or departments depending on the company’s organizational structure.

Once authorized, payment is scheduled and initiated, usually via the company’s online banking system.

3) Payment Reconciliation

The third and final phase ensures that all outstanding invoices are paid accurately and on time.

Payments are matched against invoices to confirm amounts, and any discrepancies or errors are reconciled with necessary adjustments.

Vendor accounts are also reconciled to ensure payments align with agreed-upon terms, typically within 30 days of receiving the invoice.

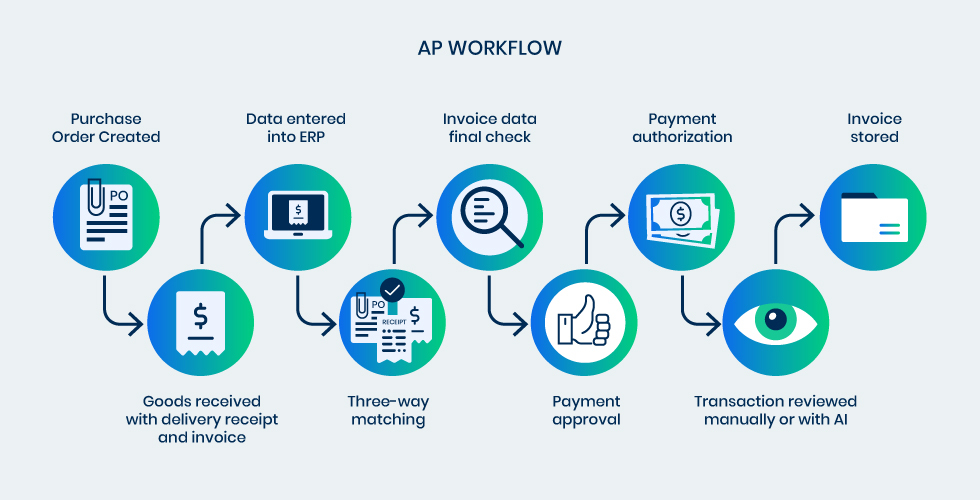

Accounts Payable Process Workflow

Now, let’s break down the full AP cycle into practical steps.

Here is what a typical AP workflow looks like:

- Purchase Order (PO) Creation: The first step in the AP cycle is to create a purchase order for a good or service that the company wants to buy from a supplier. A PO is a document that outlines the terms and conditions of the purchase, like quantity, price, and delivery date.

- Receiving of Goods/Services: After the items or services are received, the recipient assesses that they meet the requirements in both quantity and quality as specified in their purchase order.

- Invoice Processing: The supplier then sends an invoice to the buyer. The invoice should contain details such as the amount due, payment terms, and the goods or services provided. The AP department enters the invoice data in the accounting system, checks it against the PO and receiving documents to ensure accuracy.

- Approval of Invoice: Once the invoice is verified, it goes through an approval process to ensure that the goods or services were received and that the amount invoiced is accurate.

- Payment Processing: Payment authorization is issued with approved invoices. Payment processing involves issuing payment to the supplier, which can be done via eCheck, electronic payment, or wire transfer.

- Reconciliation: After payment is issued, the AP department reconciles the payment with the invoice and other related documents.

- Vendor Account Maintenance: The final step involves maintaining the vendor account by regularly updating it with any changes in payment terms, contact information, or other relevant details.

The Flow of Full Cycle Accounts Payable

Accounts payable is more than just ensuring payments are made on time to vendors, it also plays a crucial role in procuring goods and services as part of the “procure-to-pay” pipeline.

Responsibilities within the AP department involve managing both upstream processes (purchase requests) and downstream workflows (vendor invoices).

Upstream

The upstream process includes activities involved in procurement, such as identifying suitable vendors who can provide the necessary products or services for your business. It also involves establishing strong relationships with third-party organizations and forming procurement contracts.

Effective management of upstream processes ensures that each purchase order is assigned to the vendor offering the most favorable pricing, quality, and delivery conditions. As a result, upstream management is a critical aspect of the full accounts payable cycle.

Downstream

Downstream refers to all activities that occur after a company makes a purchase, beginning with invoice processing.

During this phase, the AP department is responsible for verifying the receipt of goods and the corresponding vendor invoice linked to the purchase order (PO), tracking invoices, and ensuring they receive the necessary approvals for payment.

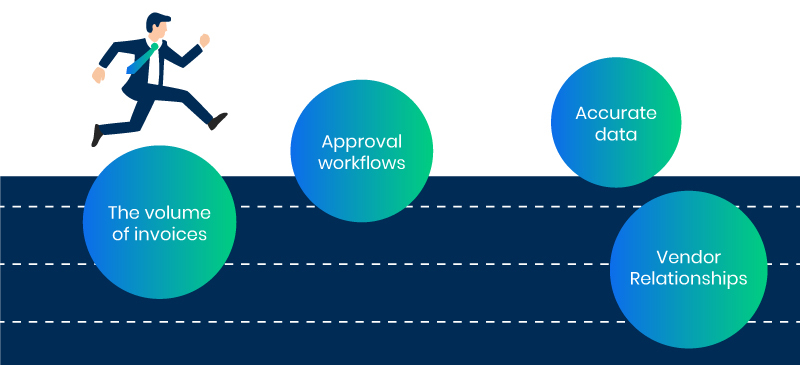

Challenges of Manual Full Cycle Accounts Payable

Even the most diligent finance teams can struggle when managing a manual full cycle accounts payable process. Paper-based workflows and spreadsheet-dependent systems create bottlenecks that slow invoice processing, increase the risk of errors, and tie up valuable staff time.

Some of the most common challenges include:

- High error rates: Manual data entry and invoice matching are prone to mistakes, which can lead to payment delays, duplicate payments, or vendor disputes. Maintaining accurate and consistent data is critical, as even small errors can result in significant issues, including incorrect financial statements.

- Time-consuming approvals: Routing invoices through multiple departments for approvals can take days or even weeks, especially when documents are lost or misplaced. Large, multinational organizations often face multiple approval levels across subsidiaries and regions, making the workflow even more complex.

- Limited visibility: Without centralized digital systems, it’s difficult to track payment status in real time, leaving finance teams reactive rather than proactive. The sheer volume of invoices received, particularly in large companies, makes it challenging to monitor all incoming payments and ensure they are processed on time.

- Compliance risks: Manual processes make it harder to enforce internal controls and policies, increasing the risk of fraud or regulatory violations.

All these challenges highlight why relying solely on manual processes is no longer sustainable for growing businesses.

5 Signs It’s Time to Automate Your AP Process

Recognizing the signs that your AP process needs optimization is the first step toward improving efficiency and financial control. Look for these indicators:

- High invoice volume: When your team processes hundreds or thousands of invoices each month, manual tracking becomes overwhelming.

- Frequent late payments or missed discounts: Delays in approvals or payment processing may indicate bottlenecks in the workflow.

- Compliance pressures: If audits are becoming stressful or internal controls are difficult to enforce, automation can help ensure accuracy and traceability.

- Overstretched AP staff: When employees spend more time on data entry than on strategic tasks, it signals a need for automation.

- Inconsistent reporting: Lack of real-time visibility into invoices and cash flow can make financial planning and forecasting difficult.

If your business faces one or more of these challenges, it is likely time to explore the best AP automation solutions.

How to Automate Full Cycle Accounts Payable

AP automation streamlines the full cycle accounts payable process by digitizing invoices, automating approvals, and integrating seamlessly with accounting systems. The benefits are immediate and measurable:

- Faster processing: Automation reduces manual data entry and accelerates approval workflows, ensuring invoices are processed on time.

- Reduced errors and fraud risk: Intelligent systems can flag duplicates, discrepancies, or suspicious activity, minimizing financial risk.

- Improved visibility and reporting: Digital dashboards provide real-time insights into cash flow, outstanding liabilities, and vendor performance.

- Better vendor relationships: Timely and accurate payments strengthen trust and can unlock early payment discounts.

- Employee empowerment: AP staff can focus on higher-value tasks such as strategic analysis instead of repetitive administrative work.

Technologies driving AP automation include optical character recognition (OCR), machine learning for intelligent invoice matching, and ERP integrations that centralize financial data for easier access and control.

Why DOKKA Is Your Best AP Automation Solution

When it comes to streamlining the full-cycle accounts payable process, not all automation solutions are created equal.

DOKKA stands out as a best-in-class platform that combines advanced technology with practical usability, making it an ideal choice for businesses of all sizes. Here’s why:

1) AI-Powered Document Processing

DOKKA leverages artificial intelligence to automatically capture and extract data from invoices, purchase orders, and receipts. The result is reduced manual data entry, minimized errors, and an accelerated approval process.

2) Seamless Integration with Accounting Systems

Whether your organization uses ERP software or other accounting tools, DOKKA integrates smoothly to ensure all financial data flows accurately and efficiently. Duplicate work is eliminated, providing a single source of truth for your accounts.

3) Real-Time Analytics and Visibility

Finance teams gain instant insight into cash flow, outstanding liabilities, and payment status. DOKKA’s dashboards make monitoring AP performance, detecting bottlenecks, and making informed decisions quick and easy.

4) Enhanced Compliance and Security

Rigorous standards for data security and audit trails help businesses comply with internal controls and regulatory requirements while reducing the risk of fraud.

5) User-Friendly Interface

Designed for both finance teams and approvers, DOKKA’s intuitive interface minimizes training time and ensures smooth adoption across the organization.

6) Scalability and Flexibility

Whether invoice volume is increasing or AP processes are becoming more complex, DOKKA scales with business needs to maintain consistent performance and reliability.

DOKKA transforms accounts payable from a manual, error-prone task into a streamlined, strategic function, giving finance teams the control, visibility, and efficiency.

Don’t just take our word for it—see what our customers are saying in their case studies.

To learn more about how it can help your team, book a demo call to see DOKKA in action.