As an introverted efficiency junky with a background in programming, I love how technology helps us get things done. So I decided to give my views on the human element in accounting automation.

Many industries use technology to automate all of the busywork and much of the complicated work. These are the places where human error can be a real problem. Accounting is no exception. We have tools to replace green-bar ledgers that pull in bank feeds and reconcile for us. Accounting automation streamlines recording, completing, reconciling, and reporting.

If we have computers doing the busy work and the computing work, why do we need people? Why should we leave room for human error at all? (Before you get offended, let me say that I know many accountants that can do the work just as accurately as a computer.)

The answer is that computers ARE fallible. Just like a senior manager needs to sign off on a report prepared by junior staff, computers need a person to check for errors. I have spoken to dozens of accountants and bookkeepers using a range of accounting automation products. They agree that human involvement, on some level, is essential in accounting automation.

In that case, how does accounting automation help us? Accountants and bookkeepers can use accounting and pre-accounting tools like DOKKA to handle the time-consuming work. Using technology and AI, we can make completing a bookkeeping entry take seconds instead of minutes. The accounting program can reconcile the bank statement against the inputted entries, marking the discrepancies for human inspection.

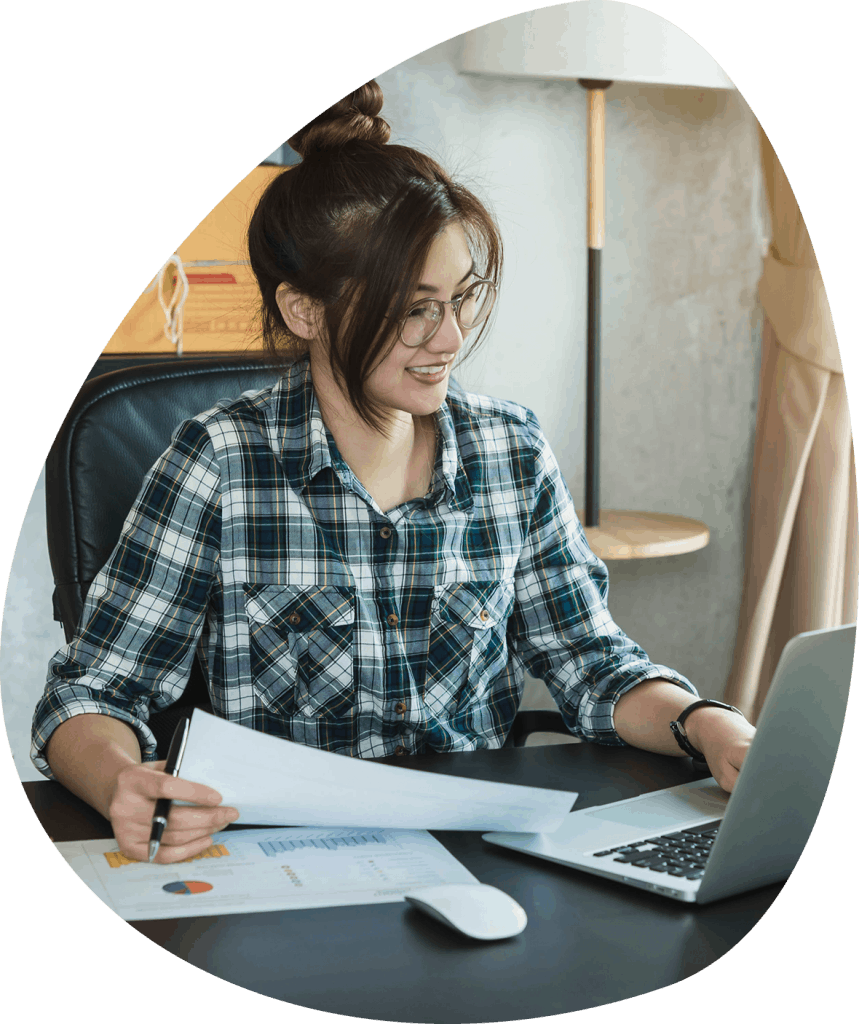

With accounting automation in place people can spend their time helping more clients and providing more services. Instead of carrying the 2 and multiplying by percentage points, the human involvement can be checking the decimal place and make sure that the i’s are dotted and the t’s are crossed. Accounting automation will give accountants more time to do what only people can do.

We can even set up the accounting automation to make the human element as convenient as possible. Once the reports are run, all of the outstanding issues can be organized into a few screens that flow to allow the accountant to easily double check the questionable lines.

In essence, accounting automation will turn accountants into managers and supervisors. They still need to be experts in order to check for errors, but their daily routine will involve less crunching and more scanning. In short, technology is here to make our lives easier, but people are essential.