Do you find it challenging to juggle your daily tasks during the month-end close period? If you’re nodding in agreement, then you’re not alone. The manual month-end close is an exhaustive process that can be overwhelming, especially when there are multiple levels of sign-off for each account and numerous financial reports to review.

A growing number of finance teams has recognized that an automated process is crucial in achieving a precise and efficient month-end close. Instead of wasting hours on tedious data entry, smart companies of the future put the books on autopilot and free up their time and energy for more important tasks.

But it’s not just about having an organized system, it’s also about having the right tools in place to make it happen. Digital solutions like cloud-based ERP systems and automation software are key for ensuring you have an effective month-end close every single time.

In this blog post, we’ll provide a comprehensive overview of month-end close, explain why it’s crucial to automate it, and give you practical tips on how to get started. But first, let’s examine why manual month-end close process can be a headache.

What Is Month-End Close?

The month-end close is a crucial process for every healthy, growing business. During this time, finance teams work to reconcile every aspect of the business’ accounting processes, to resolve any fiscal discrepancies. This ensures that financial statements are precise and that the business’ financial status is true and accurate for record-keeping, auditing, and reporting.

Closing out the month’s books can be challenging and time-consuming, particularly if your business has not fully adopted automation processes. To ensure the smooth running of operations, there are a number of steps that need to be fulfilled in accounting month-end closing procedures.

Main Steps of the Month-End Close Process:

- Accounts reconciliation – matching account statements to those of suppliers and banks

- Inventory recording – making sure inventory is at the correct count for month-end

- Money-in records – all payments received must be cataloged and aligned to client payment records to ensure nothing is missed

- Money-out recording – all money paid in the accounts payable process, must be recorded and aligned to invoices and bills due

- Preparation of financial statements – when accounts are reconciled, income statement, balance sheet and cash-flow statement must be prepared

- Monitoring and decision-making – after the month-end closing process is complete, it is important to review and analyze the financial statements to get an overall view of the company’s financials and to identify any trends or issues

Why You Should Automate Month-End Close Process

Automation in finance isn’t exactly a novel concept, it has been around for quite some time. In fact, as early as the 1980s, machine learning technology had found its way into financial applications, and has developed into intuitive, fast and powerful tool that benefits many finance teams today.

Using AI to automate the month-end close process offers many advantages, such as reducing the risk of errors, improving accuracy, and expediting reporting, so that your business has quicker access to reliable financial information. Automation provides accurate reporting faster and enables your team to analyze data more quickly, making more effective decisions. On top of that, automating processes means less manual labor, so you can allocate resources in smarter ways while still producing accurate results in a timely manner.

Automating month-end close can save your business time, money and stress. With automation and some best practices for stress-free month-end close, you no longer have to worry about manually validating account balances or reconciling accounts each month. Instead, the process is automated, saving you time and reducing errors.

The Benefits Of Automating Month-End Close

An automated accounting month-end close process improves operations, business-wide, by enhancing speed, transparency and efficiency through smart artificial intelligence (AI). Automating month-end close can be a game changer for any business.

It helps to eliminate cumbersome manual processes and provides you with faster insights on financial performance, making your month-end close easier and more efficient. Instead of weeks in Excel data entry, it brings the entire process together into one place with fewer errors, less frustration and faster accurate reporting.

Automating the month-end close process also allows for greater transparency, quick access to real-time financial documents and significantly less paperwork – all of which makes it easier to quickly make decisions that are backed by data. All of this creates significant time savings and boosts productivity, giving businesses the edge they need to stay competitive in today’s market.

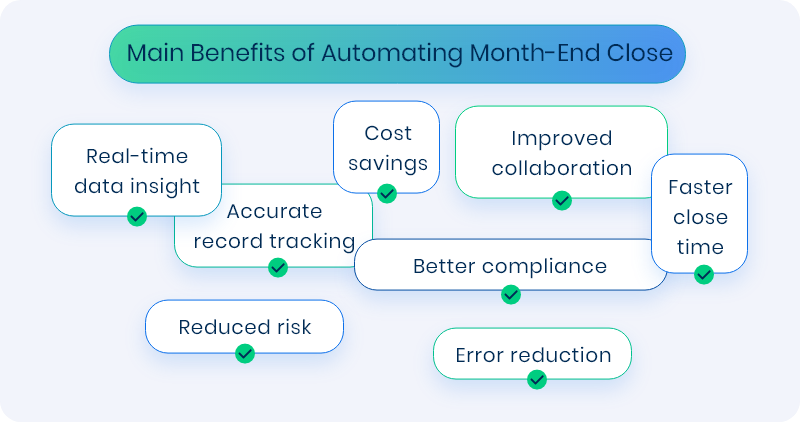

Top Benefits of Automating Month-End Close:

- Real-time data insight

- Accurate record tracking

- Error reduction

- Cost savings

- Faster close time

- Better compliance

- Reduced risk

- Improved collaboration

Real-time data insight

The ability to track progress in real-time is one of the biggest benefits of automating month-end close. With automated processes, you can easily view account balances, transactions and reconciliations as they happen in real-time, track progress and pinpoint any potential issues before they become a problem. Built-in, data-rich dashboards can give better visibility and detailed insight into business performance through numbers, to bring about better, informed decision making.

Accurate record tracking

By automating repetitive tasks like data entry and reconciliation, you can reduce the risk of errors and ensure greater accuracy in financial reporting. Again, this happens in real-time: detailed, transparent tracking of the month-end tasks allows stakeholders a bird’s-eye view of processes, and thus speeds up corrections and the overall workflow.

Error reduction

Human errors are common in manual processes, and mistakes that occur during the month-end can be costly and complicated to identify and amend. An automated process assigns data capture, cataloging, and accounts processing in the month-end cycle, to AI software that drastically reduces, and even prevents errors in the procedure. The result is improved accuracy

of the data that is recorded each month. This makes it easier to audit your financial statements and ensure numbers are correct.

Cost savings

Automating month-end close can help you save money in the long run. Streamlined processes reduce the need for manual labor and cuts employee costs down the line. Additionally, because automated processes are more accurate than manual ones, you can also save money by avoiding costly mistakes.

Faster close time

To give you the idea of how fast the AI works, let’s check out the time it takes to manually process a single invoice. On average, AP clerk wastes five minutes to process, while AP software does the same work in under 10 seconds. By automating routine tasks like data entry, journal entries, and reconciliation, businesses can reduce the time required for the month-end close process. Automation can also help to identify errors and discrepancies more quickly.

Better compliance

Another benefit of automating month-end close is improved compliance with regulatory requirements. Automating financial reporting and other compliance-related tasks can reduce the possibility of errors and keep your finances in line with all regulatory requirements. Automation can help you avoid penalties, fines, or other costly and time-consuming legal consequences.

Reduced risk

Streamlining processes and data entry can lead to a more secure and controlled environment for your financials. Automation gives accurate and real-time data, reduces the risk of fraud or other financial irregularities, and it can help you identify and flag suspicious activity. It also reduces the risk of unauthorized access or other security breaches.

Improved collaboration

Finally, automation can help improve collaboration between team members involved in the month-end close process. Streamlined and standardized processes reduce the risk of miscommunications or errors caused by differing procedures or approaches. Most of automation software include tools for real-time communication and feedback between team members, which reduces the need for manual coordination and follow-up.