The goal of every business is to make money. And for the person holding a top position, specifically in a financial role, this responsibility bears heavily on them.

The CFO title is so much more than just simple financial duties, and over the past few years, CFOs have found that their role has evolved beyond what it ever encompassed before.

Today the world of finance and accounting is moving at a much faster pace, and it may be overwhelming which areas are more critical to focus on. From industry demands to workforce developments and technological transformations, we have chosen to highlight the most significant challenges that CFOs are facing in 2022., and the best ways to combat them.

Below, we have reviewed the latest research, surveys, and reports to summarize the current global challenges impacting the CFO, according to experts in the industry.

Top 4 most significant global challenges for CFOs in 2022.:

- Digital transformations

- Disparate systems and data

- Talent hiring and retention

- Traditional financial challenges

1. Digital transformations

There is no doubt that almost every industry is changing. Traditional methods are taking on major transformations and that brings new obstacles and opportunities. It is therefore clear to see why one of the top challenges CFOs are facing today is adjusting to this new shift in the industry.

Between digital, innovation and workforce transformations to financial consolidation, as well as a change in the way we need to focus on security and compliance, and more, the adjustment is profound.

If you are a CFO, quickly adapting to these changes isn’t enough. Expectations from other stakeholders would demand you have foreseen this new path, thoroughly researched and evaluated the way forward, assessed all risks, and implemented a strategy accordingly. All while maintaining a steady cash flow to ensure the business can afford this adaptation and improve profits.

Why this is a challenge:

Unfortunately, with this comes even more responsibilities. In fact, based on a pre-pandemic Brainyard report, “38% of CFOs found their biggest challenge to be juggling too many responsibilities.”

And, in the post-pandemic world, the risks are a lot higher.

What can you do:

The keyword to combat this challenge is agility. CFOs need to become more agile in their responses to transformations.

- Identifying opportunities in your environments – for example, the digital transformation in the financial sector alone offers an abundance of new prospects. Finding the right technology for your business needs allows you to efficiently adapt, and it can also provide the best protection against fraud while mitigating other risks and ensuring compliance.

- Very quickly exploit the identified opportunity – continuing with the example above, after finding the best technology, you need to get full use out of it and benefit from this business prospect. Adjust corporate strategies to leverage this as quickly as possible.

- Put a substantial amount of focus and effort into this opportunity – technology alone does not simply just work, so placing some emphasis on this will align all of your goals for a smooth transition.

Once you have adjusted to your new processes, the responsibilities and expectations placed on you as a CFO should dramatically change for the better.

2. Disparate systems and data

This next challenge follows from the previous one. The digital transformation has created an abundance of systems that assist in enhancing the CFO and financial departments’ roles, however, this has also opened the job up to further issues.

The challenge now is that to meet different needs, companies have invested in multiple solutions to have the best of every service. This however often means that not all of your data is in one place.

Why this is a challenge:

Data is the driver for growth and decision-making. Without it, a CFO can not accurately forecast, manage risk or understand the business. So it is safe to say that data that is split into different systems and spreadsheets is a time-consuming challenge.

Let us also not forget that in this new day / post-pandemic time, a point we will discuss in more detail further on in this article, a new type of workforce exists. Remote work can make data even harder to navigate if different systems are being used and not easily accessible online.

What can you do:

Luckily, as Yaron Morgenstern continues in his article, “in recent years, partnerships, mergers and acquisitions have consolidated those offerings to deliver more value.” The financial services industry—and its customers—have benefited from this.”

- Invest in a solution that does everything. As the saying goes, yes, you shouldn’t put all your eggs in one basket, but what you should do is take control of your data and put all your work in one, unified solution for fast and efficient retrieval and accurate reporting and communication.

- Take note of the above-mentioned mergers, acquisitions, and consolidated offerings. Today’s technologies offer incredible integrations between systems for seamless transfers of information. So to ensure you keep your costs down, you do not need to reinvent the wheel and change every system, but rather find add-ons to current systems that can create the flow of data that you need.

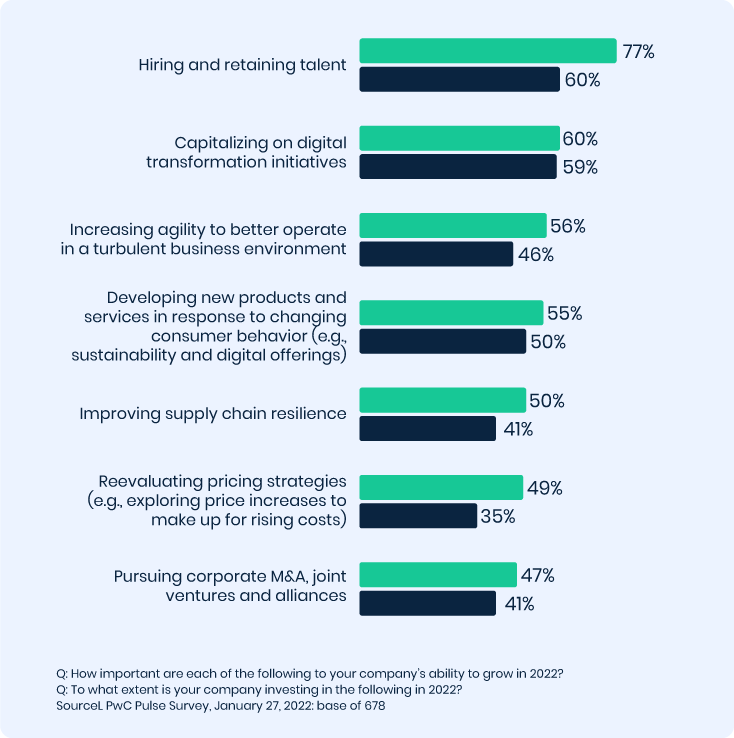

3. Talent hiring and retention

The pandemic had an effect on everyone and has changed the course of businesses around the world. Sudden shift to remote working environment has caused burnout for many and created labor shortages.

On the other hand, positives of a remote working environment, specifically for a CFOs, include reduced operational costs and improved workflows, overwhelming improvement in productivity and performance.

Why this is a challenge:

As much as the benefits may outweigh the cons in most research reports conducted during the pandemic, there are many reasons why navigating this post-pandemic world is difficult, especially for a CFO and his team.

For a CFO, there is a lot of work needed to re-imagine the new work structure and implement it accordingly. From decision-making to cost reallocation, and the overarching requirement for continuous productivity and talent retention.

Sarah Roberts, head of finance and operations at a branding and content agency was quoted in an article about How CFOs are reimaging the office post-pandemic. She explained, “where we would have had 5% of our revenue going to pay rent, we redirected those funds to tools and resources that enable the company to remain in compliance, and our team to perform optimally.”

Another challenge to note from the previously mentioned article is “compliance and security challenges.”

Sheamus Toal, CFO at Saatva was quoted as saying, “While the remote work environment provides tremendous flexibility, it does come with certain risks and challenges, primarily around data security and computer access controls, which need to be properly monitored and addressed.”

What can you do:

There is no simple answer to this question. The decision for a CFO is entirely company and goal dependent.

However, our recommendation is to focus on two areas in particular – people and technology.

As a CFO, it is important to improve productivity within your organization. Make use of a system and structure that can only enhance the experience of your team.

- A remote workforce has also provided the opportunity to recruit top talent globally. One is not simply limited to those people available within their close environment. Along with the benefit of being able to find the best person for the job, this can also present a cost reduction with the ability to only pay market related salaries in specific locations.

- While during the pandemic, you may have allocated efforts towards technological improvements, there is most likely so much more that you can do. Today’s technology incorporates intuitive AI and automation that is the largest benefit to an organization today.

Streamlined processes and proactive work is the most efficient way to accelerate business growth and increase productivity. In Accentures global research report, they estimate that 60 to 80 percent of backward-looking accounting activity can be automated.

The path is set and it can only benefit a CFO to place great emphasis on automation to gain the most value from your business functions.

4. Traditional financial challenges

Age-old issues of inflation and expense reduction, management of taxes and regulations, reporting with accurate and auditable data, and cash flow management are challenges always present for a CFO and remain a top priority.

Global and economic uncertainty are at the forefront of these challenges. These areas are constantly causing ups and downs when it comes to pricing and taxes. The basic economic principles of supply and demand, as well as expectations are forever evolving.

The pandemic and other global conflicts also play a big part in this current challenge as they present more uncertainty for current and future situations.

All together these uncertainties place a great impact on CFO responsibilities, cash flow and forecasting.

Why this is a challenge:

Organizations are affected in so many ways by uncertainty. From hindering expansion of products and services to reducing staffing and operational costs and preventing further investment in what is needed for growth. A CFO has to make these hard decisions and justify their actions to deal with the unknown.

McKinsey & Company’s ‘Global Economics Intelligence executive summary’ in August 2022, highlights the main global challenges that CFOs need to address specifically in terms of staggered growth. There are so many economic uncertainties today and it is up to the CFO to navigate these.

What can you do:

As per the previously mentioned CFO and Oracle Netsuite survey “to combat inflation, finance executives’ top two tools are to:

- reduce costs (60%) and

- increase the end prices on goods and services (56%)

While these efforts will always work if done properly, there is more to ensure that you can sail through this challenge. The best way that we believe a CFO can succeed is to have a well-oiled machine behind them, that is to say, a well-functioning financial system and structure with accurate and up to date data to advocate for their decisions and actions.

Summary

The CFO’s role has and is evolving and will continue to have many challenges as the role of one of the most important in a business. However, if as a CFO you are focusing your efforts on what you know is best for your business and taking advantage of the opportunities your new role presents, you are sure to succeed.

Our final tip is to amplify your involvement in the transformation that is around you to make your business more agile and productive. Invest in digital transformation, enhance your cyber security and ensure your people are working in the best environment for them to strive.

Find out how Dokka can help you with digital transformation or book a 30 minute demo to learn more about managing your accounting data.