Managing accounts payable is all about finding the right balance: you need to pay vendors on time, keep records accurate, and control costs, all while juggling the day-to-day demands of the finance function.

As pressure grows to streamline financial operations, having a solid AP management strategy has become essential for any finance team.

Consistency plays a big role in making AP processes run smoothly. Clear policies and procedures help everyone understand their responsibilities, reduce confusion, and keep the whole team aligned.

In today’s post, we’ll walk through seven practical accounts payable tips that can help you stay in control and improve your workflow. From strengthening your invoice processing system to making the most of AP automation technology, these recommendations will give you the tools and knowledge you need to take your AP management to the next level.

What Is Accounts Payable Management?

Accounts payable (AP) management refers to the system that deals with a business’s financial obligations to third-party vendors or suppliers for goods or services bought on credit.

In simpler terms, it involves tracking and paying off the money a company owes to its suppliers in a timely and organized manner.

Key components include:

- Invoice processing: receiving, verifying, and approving invoices before payment.

- Payment processing: scheduling and issuing payments while considering early-payment discounts and potential penalties.

- Vendor management: maintaining strong vendor relationships, understanding payment terms, and resolving issues quickly.

- Record keeping: maintaining accurate, current records of invoices, payments, and vendor details for reporting, audits, and dispute resolution.

The process begins when a company receives an invoice from a supplier. The invoice is then reviewed and verified against the delivered goods or services and corresponding purchase orders in a process called 3-way matching. Once approved, the payment is scheduled according to the agreed credit terms.

AP management process goes beyond just paying bills. It is vital for maintaining good vendor relationships, as timely and accurate payments reflect positively on a company’s reputation. It also plays a significant role in cash flow management, as strategic timing of payments can help optimize the use of available funds.

With the advancement of technology, many businesses are automating their accounts payable processes. This not only reduces manual effort and errors but also provides better visibility into the company’s outstanding liabilities, aiding in more accurate financial planning and decision-making.

Is AP Management Really Important?

The simple answer is yes, because without proper management, a company may end up paying bills too early or too late.

If a company consistently pays its invoices late or makes errors in payments, it can damage relationships with suppliers, potentially leading to less favorable credit terms or even loss of supply. Paying too early means the company is essentially providing suppliers with free credit and not optimizing its own cash flow. Both scenarios can negatively impact the financial health of a company.

Inefficient AP processes incur higher operational costs, such as more time spent on manual data entry and resolving invoice discrepancies.

Failure to accurately track and report accounts payable could lead to non-compliance with tax laws and accounting standards, resulting in penalties and potential legal issues.

Without strong controls, a company becomes more vulnerable to fraud, including duplicate payments or payments for fraudulent invoices.

Accounts payable represent a significant portion of a company’s liabilities. If they are not accurately managed and recorded, it can lead to inaccuracies in the company’s financial statements, misleading both management and stakeholders.

How to Properly Manage Accounts Payable

Managing accounts payable is often challenging for growing businesses facing more invoices and tighter cash flows. Manual processes increase the risk of errors, inefficiencies, and fraud. To address these issues, many businesses are turning to automation and adopting best AP practices to enhance efficiency, accuracy, and control.

So, what does it take to manage accounts payable effectively?

- Centralize the Accounts Payable Process

- Automate Where Possible

- Prioritize Invoices

- Maintain Accurate Records

- Build Strong Vendor Relationships

- Regularly Review Your Accounts Payable Process

- Implement Strong Internal Controls

1) Centralize the Accounts Payable Process

Having a centralized accounts payable department with streamlined operations can ensure consistency across the board. It creates a single point of contact for vendors, making communication more efficient. It also simplifies training and reduces the risk of errors or discrepancies in handling invoices and payments.

2) Automate Where Possible

Automation can greatly improve the efficiency and accuracy of AP management. Software tools can automate repetitive tasks such as data entry, invoice matching, payment scheduling, and report generation. This not only saves time but also minimizes human error, leading to more accurate accounting and better financial control.

3) Prioritize Invoices

Not all invoices are created equally. Some may be more critical than others, based on factors such as due date, discount offers for early payment, or penalties for late payment. Prioritizing these invoices enables you to utilize your cash resources optimally, take advantage of discounts, and avoid unnecessary fees.

4) Maintain Accurate Records

Keeping detailed and accurate records of all invoices, payments, and vendor information is crucial for effective accounts payable management. These records provide a clear picture of your outstanding liabilities and payment history, helping you to make informed financial decisions. They also come in handy during audits or when resolving disputes with vendors.

5) Build Strong Vendor Relationships

Building and maintaining good relationships with your vendors can give you an edge in negotiations and problem resolution. Regular communication helps you stay updated on their payment terms and understand their expectations. Prompt responses to their queries and timely resolutions of issues can enhance your reputation and potentially lead to better credit terms.

6) Regularly Review Your Accounts Payable Process

Just like any other business process, your AP process should be regularly reviewed and updated. This can help identify bottlenecks, inefficiencies, or areas of risk that need to be addressed. Regular reviews also ensure that your process evolves with changes in your business environment, regulatory landscape, or technology.

7) Implement Strong Internal Controls

Implementing strong internal controls is essential for preventing fraud and ensuring compliance with accounting standards. This includes the segregation of duties (where different people are responsible for approving invoices, making payments, and reconciling accounts) and regular internal audits. A robust control environment enhances the reliability of your financial reporting and reduces the risk of fraud.

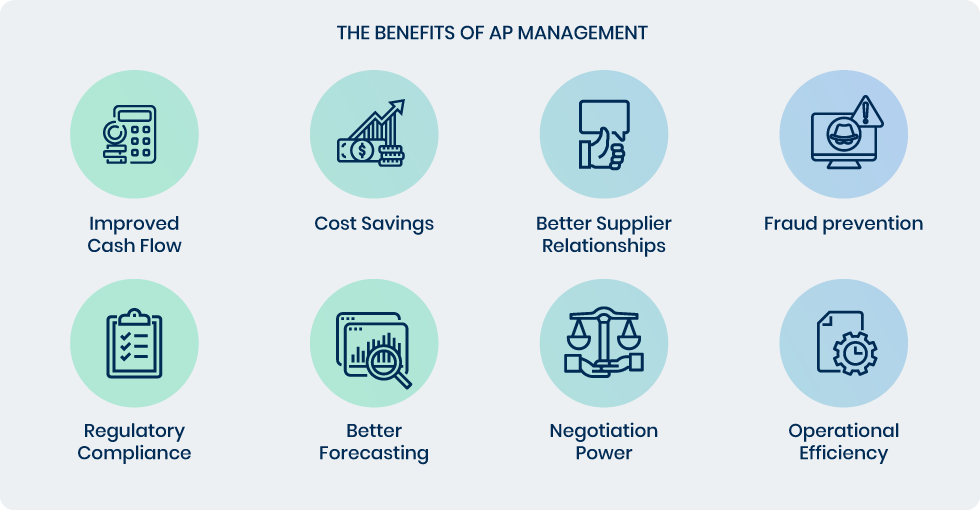

The Benefits of AP Management

- Improved Cash Flow

Efficient AP management supports healthier cash flow. Managing payment schedules and using early payment discounts helps businesses maintain sufficient capital, invest in growth, and handle unexpected expenses.

- Cost Savings

Timely payments and adherence to negotiated terms can produce meaningful savings. Companies may secure early payment discounts and avoid late payment penalties that increase costs.

- Better Supplier Relationships

Positive supplier relationships are essential for favorable terms, priority service, and long-term trust. Effective AP management promotes timely, accurate payments that strengthen vendor relationships and can lead to improved agreements in future transactions.

- Fraud Prevention

A well-structured AP system reduces the risk of errors and fraudulent activity. Segregation of duties, invoice verification, and regular reconciliations help prevent financial discrepancies and fraud.

- Regulatory Compliance

Strong AP oversight supports compliance with financial regulations and accounting standards. Accurate, up-to-date payable data allows for more precise reporting and better-informed business decisions.

- Better Forecasting

Effective AP management provides valuable information for cash flow forecasting. Insights into future payment obligations and expected inflows help companies prepare for potential liquidity challenges.

- Stronger Negotiation Power

A consistent record of timely payments enhances credibility with suppliers. Vendors are more inclined to offer favorable terms to companies viewed as reliable and creditworthy.

- Operational Efficiency

Streamlined AP processes reduce administrative workload and limit the need for manual intervention. This improves overall efficiency, enabling finance teams to focus on other critical business priorities.

Accounts Payable Management FAQ

- How often should accounts payable be reviewed?

Monthly or quarterly reviews are generally recommended. Regular reviews help identify issues such as delayed or duplicate payments and invoicing errors. They also support compliance with accounting and regulatory requirements.

- How can businesses optimize their cash flow through AP management?

Effective cash flow optimization requires balancing timely supplier payments with the use of available early-payment discounts. Careful planning and forecasting ensure sufficient funds for obligations without straining working capital. Waiting until due dates to pay invoices also preserves flexibility for investment in core operations and growth initiatives.

- How can automation help in AP management?

AP automation has many benefits: improves efficiency and accuracy by handling tasks such as data entry, invoice matching, payment scheduling, and reporting. It reduces manual workload, minimizes errors, and supports better financial control. Automated systems offer real-time updates and reminders to prevent missed or late payments. They also produce reports and analytics that highlight spending trends, vendor performance, and process efficiency.

DOKKA: The Smarter Way to Manage Accounts Payable

Managing accounts payable does not have to be time-consuming or a bottleneck for your business. DOKKA’s AI-powered platform automates and streamlines the entire AP workflow, giving finance teams more control, visibility, and efficiency than ever before.

- Intelligent Invoice Capture: DOKKA automatically extracts and validates invoice data, regardless of format. Say goodbye to manual entry, reduce errors, and free your team to focus on higher-value work.

- Automated Approval Workflows: Set up multi-level, rule-based approval processes. DOKKA ensures invoices move quickly, approvals happen on time, and bottlenecks are eliminated.

- Centralized AP Visibility: All invoices, approvals, and communications are stored in one searchable hub. Your team can track payment statuses in real time and collaborate seamlessly without endless email threads.

- Seamless ERP Integration: DOKKA integrates directly with your existing accounting systems, syncing invoices, journal entries, and payment statuses. There is no redundant data entry, no mistakes—just smooth financial operations.

- Built-In Controls and Audit Readiness: Every action is tracked, creating a complete audit trail. Strengthen internal controls, reduce fraud risk, and stay prepared for audits effortlessly.

- Fast Deployment and Scalability: Go live in days with minimal IT involvement. DOKKA scales as your business grows, handling high invoice volumes without increasing headcount.

Ready to revolutionize your AP process? Book a free demo with DOKKA today and discover how effortless accounts payable can be.