Effective financial management is essential for companies striving to grow, adapt, and succeed in competitive markets. Among the various tools available to executives and finance teams, agreements such as notes payable play a role in securing funds to support operations, expansion, and other business needs.

These types of arrangements typically include agreed-upon terms, such as repayment schedules and interest rates, offering a structured approach to managing financial obligations.

For accountants, understanding these is vital for accurately recording liabilities and ensuring the company’s balance sheet reflects its true financial position.

In this article, we will delve into the concept of notes payable, explore its different types, compare it to similar financial instruments, and provide practical examples to illustrate its significance in finance.

What Are Notes Payable?

Also known as promissory notes or loans payable, notes payable represent a type of liability that involves a written promise to repay a specified amount either on a set date or on demand.

Generally, notes payable arise from agreements between two parties: the borrower (the company borrowing the funds) and the lender (such as banks, financial institutions, or other organizations providing the financing).

Notes payable can be classified as either short-term or long-term liabilities, depending on their maturity dates. Short-term notes have a duration of one year or less and are repaid in a lump sum or through installments. Long-term notes have maturity dates extending beyond one year and are repaid over an extended period.

Advantages of Notes Payable

Notes payable can be a useful source of financing for companies, especially during times when they need quick access to cash. Advantages of using notes payable include:

- Lower interest rates compared to other forms of financing, such as credit cards or lines of credit.

- Flexible repayment terms that can be negotiated with the lender.

- Can help improve a company’s financial leverage by increasing its debt-to-equity ratio.

- Can provide tax benefits through deductible interest payments.

Disadvantages of Notes Payable

While notes payable can offer certain advantages, such as providing a clear structure for debt repayment and potentially improving credit ratings, there are also potential downsides. These may include the risk of accruing significant interest over time and the possibility of restrictive covenants that can limit financial flexibility.

- Higher interest rates compared to other forms of financing if the borrower has a poor credit history.

- Stricter repayment terms that can put pressure on a company’s cash flow.

- Potential loss of assets if the borrower defaults on a secured loan.

4 Types of Notes Payable

- Single-payment notes

- Amortized notes

- Interest-only notes

- Negative amortization notes

1) Single-Payment Notes

Single-payment notes require the borrower to repay the entire principal balance, along with any accrued interest, in a single lump sum at the end of the agreed term.

This straightforward structure is ideal for short-term financing needs, especially when the borrower expects adequate cash flow to cover the repayment. Single-payment notes are commonly used for purchasing inventory, covering temporary cash flow gaps, or financing small-scale projects.

The simplicity of the structure reduces administrative complexity, and no periodic payments are required during the term. However, the downside is that borrowers face the risk of financial strain if anticipated funds are not available at maturity.

2) Amortized Notes

Amortized notes involve regular, scheduled payments that include both principal and interest. Over the life of the note, these payments gradually reduce the outstanding debt until the loan is fully repaid by the end of the term.

Regular payments help borrowers manage cash flow effectively, avoid large lump-sum repayments, and steadily reduce the debt. Borrowers also benefit from financial predictability, as payments are typically equal throughout the term.

Amortized notes are used for long-term or medium-term financing, such as equipment purchases, business expansions, or other large investments.

3) Interest-Only Notes

Interest-only notes require borrowers to pay only the accrued interest during the loan term, with the principal amount due in full at maturity. This structure offers flexibility for businesses with irregular or seasonal income and is often used in real estate development, agriculture, or by startups that anticipate future income to cover the principal.

Lower initial payments allow borrowers to allocate resources toward growth or other priorities.

Borrowers may also choose to make optional payments toward the principal, reducing the lump sum due at maturity. That said, they must carefully plan for the lump-sum principal repayment, as failure to secure sufficient funds could lead to financial default.

4) Negative Amortization Notes

Negative amortization notes result in an increasing loan balance over time, as payments are intentionally set lower than the interest owed. The unpaid interest is added to the principal, compounding the debt.

These notes carry significant risk, as the growing debt burden can become unsustainable if anticipated income does not materialize. Lenders typically reserve these arrangements for borrowers with strong future earning potential.

Negative amortization notes are often used in specialized cases, such as real estate development or high-risk loans, where borrowers expect a significant increase in income or asset value in the future.

Examples of Notes Payable

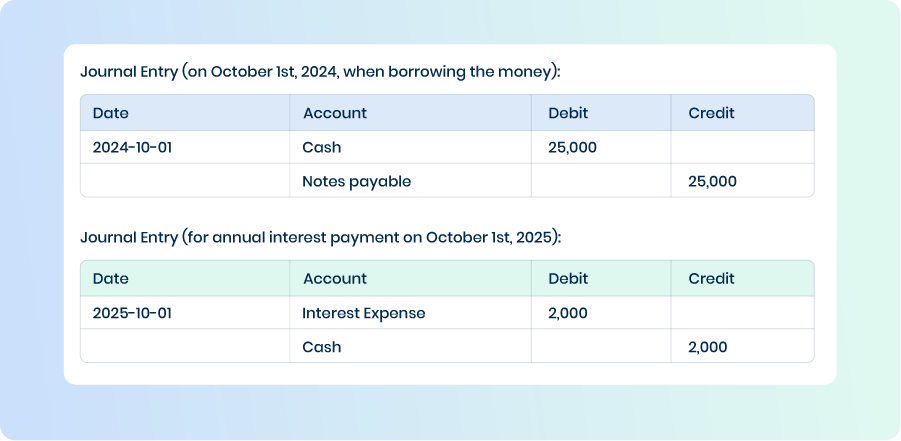

To better understand the role and significance of notes payable in finance, let’s consider a few examples and how their journal entries would look like. For the purpose of these examples, we’ll assume that each note payable was issued on October 1st, 2024.

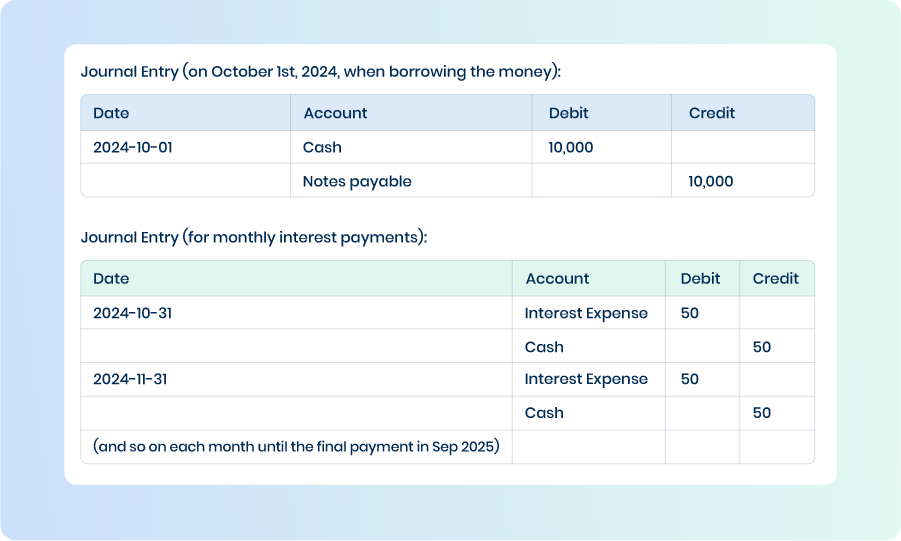

Example 1: Borrowing from a Bank

On October 1st, 2024, the company borrows $10,000 from a bank at an interest rate of 6% per annum, with the loan to be repaid in full after one year. The bank requires the company to make monthly interest payments, with the principal due at the end of the year.

Monthly interest calculation: Interest = $10,000 × 6% ÷ 12 = $50 per month

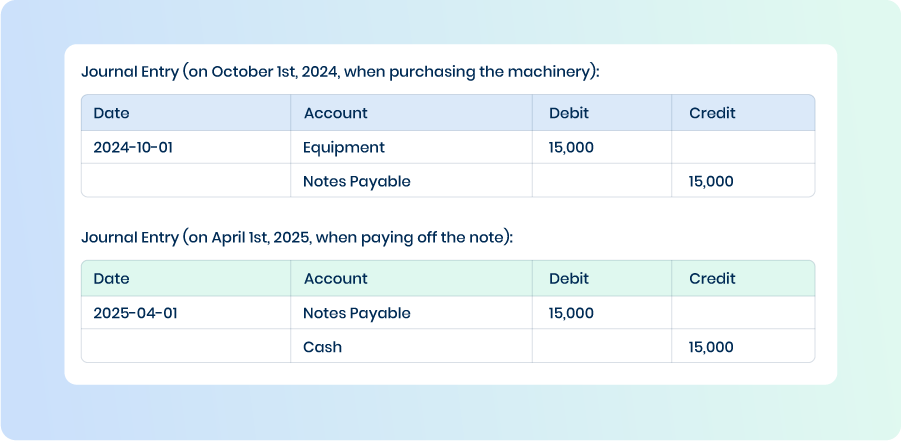

Example 2: Purchasing Equipment on Credit

The company buys new machinery worth $15,000 on a 6-month note, with no interest charged. The equipment will be paid for in full at the end of 6 months.

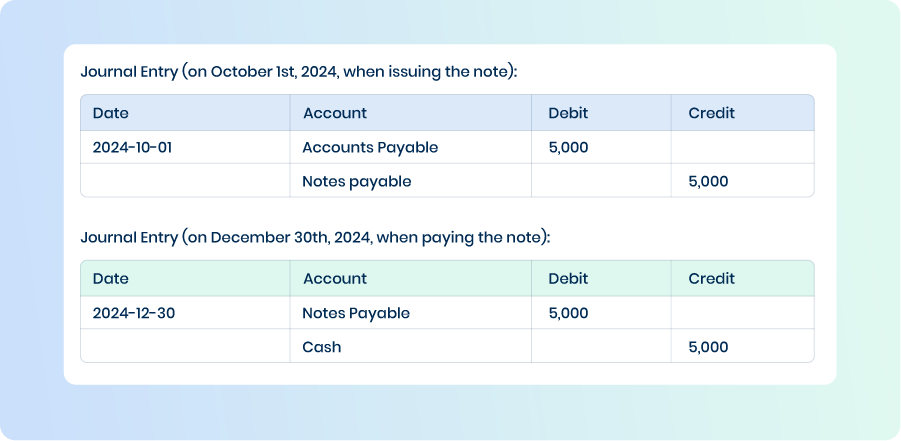

Example 3: Issuing a Promissory Note to Settle Accounts Payable

The company owes a supplier $5,000 and decides to issue a 90-day note payable to settle the debt. The company plans to pay the full amount on December 30th, 2024.

Example 4: Loan from an Investor

The company borrows $25,000 from an investor at an 8% annual interest rate, with the principal due in two years. Interest will be paid annually, and the company will pay the full principal in two years.

Interest payment calculation: Interest = $25,000 × 8% = $2,000 annually

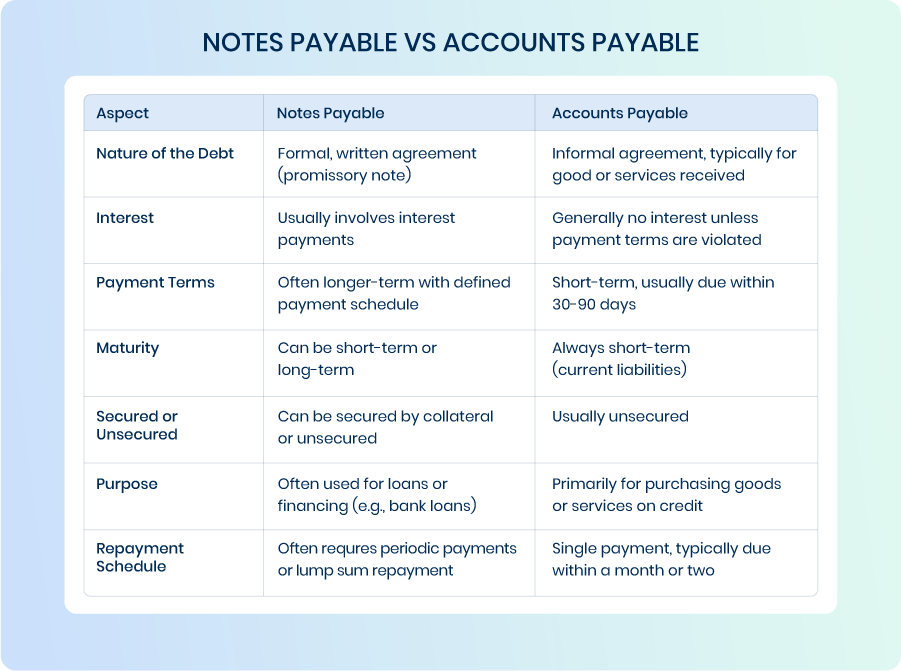

Notes Payable vs Accounts Payable

Notes payable and accounts payable are both types of liabilities that a business incurs in the course of its operations. While both represent money owed by a business, they serve different purposes and differ significantly in their nature, terms, and how they are recorded on a company’s financial statements.

Notes payable are formalized loans with defined terms, often involving interest and longer repayment periods. Accounts payable are short-term obligations arising from purchasing goods or services on credit, typically due within a short timeframe and without interest.

Key Features of Notes Payable:

- Written agreement: A note payable involves a formal written agreement that outlines the terms, such as the principal amount, interest rate, repayment schedule, and maturity date.

- Interest: Notes payable usually incur interest, and the borrower must repay both the principal and any accrued interest.

- Maturity date: The note has a specific maturity date, and repayment is made either at the end of the term (lump sum) or through periodic payments.

- Can be secured or unsecured: Notes payable can be secured by collateral (such as property or assets) or unsecured (based purely on the borrower’s creditworthiness).

- Long-term or short-term: Depending on the repayment terms, notes payable can be classified as either short-term (less than one year) or long-term (more than one year).

Key Features of Accounts Payable:

- Informal: Accounts payable are usually less formal than notes payable and are based on agreements to purchase goods or services. There is no written promise of repayment, and no interest is typically charged.

- No interest: In most cases, accounts payable do not carry an interest charge, as they are short-term liabilities that are expected to be settled quickly.

- Short-term: Accounts payable are considered current liabilities, as they are generally due within one year or less.

When to Use Notes Payable vs. Accounts Payable

Notes payable are used when a company needs formal financing or loans, often for major purchases, long-term investments, or cash flow management.

Accounts payable are used when a company buys goods or services on credit with the intention of paying the supplier within a short period. These are usually everyday business transactions and are paid off quickly, without interest.

How They Appear on the Balance Sheet

Both notes payable and accounts payable appear as liabilities on a company’s balance sheet, but they are classified differently.

Notes Payable:

- If the note is due within one year, it is classified as a current liability.

- If the note is due after more than one year, it is classified as a long-term liability.

- The amount of the loan, plus any accrued interest, is recorded in the liabilities section under Notes Payable.

Accounts Payable:

- Always classified as a current liability on the balance sheet, since it is expected to be settled within the operating cycle (usually 30 to 90 days).

- It is typically listed as Accounts Payable under current liabilities, with no accrued interest.