In 2026, the pressure on CFOs is more intense than ever before. Far from simply managing costs and ensuring financial compliance, CFOs are increasingly positioned at the heart of strategic transformation.

They are expected to drive growth, operational resilience, digital integration, and stakeholder trust, all while navigating unpredictable economic, political, and technological terrain.

Today’s CFO is a growth architect, risk strategist, and digital pioneer rolled into one. As revealed in SAP Concur’s CFO Insights Report, CFOs are stepping up to lead their organizations through turbulent times with clarity and vision.

The report, based on responses from over 580 senior leaders across finance, IT, and HR in eight global markets, reveals a clear narrative: CFOs are embracing a broader mandate. They are transitioning from guardians of the balance sheet to architects of enterprise value.

To succeed, CFOs must balance near-term efficiencies with long-term vision, harness data to uncover opportunity, and foster collaboration across the C-suite.

Let’s dive into the key takeaways and explore how finance leaders can turn these insights into action.

Key Takeaways:

- CFOs are becoming enterprise growth leaders, expanding their role beyond finance to drive strategy, digital transformation, and resilience.

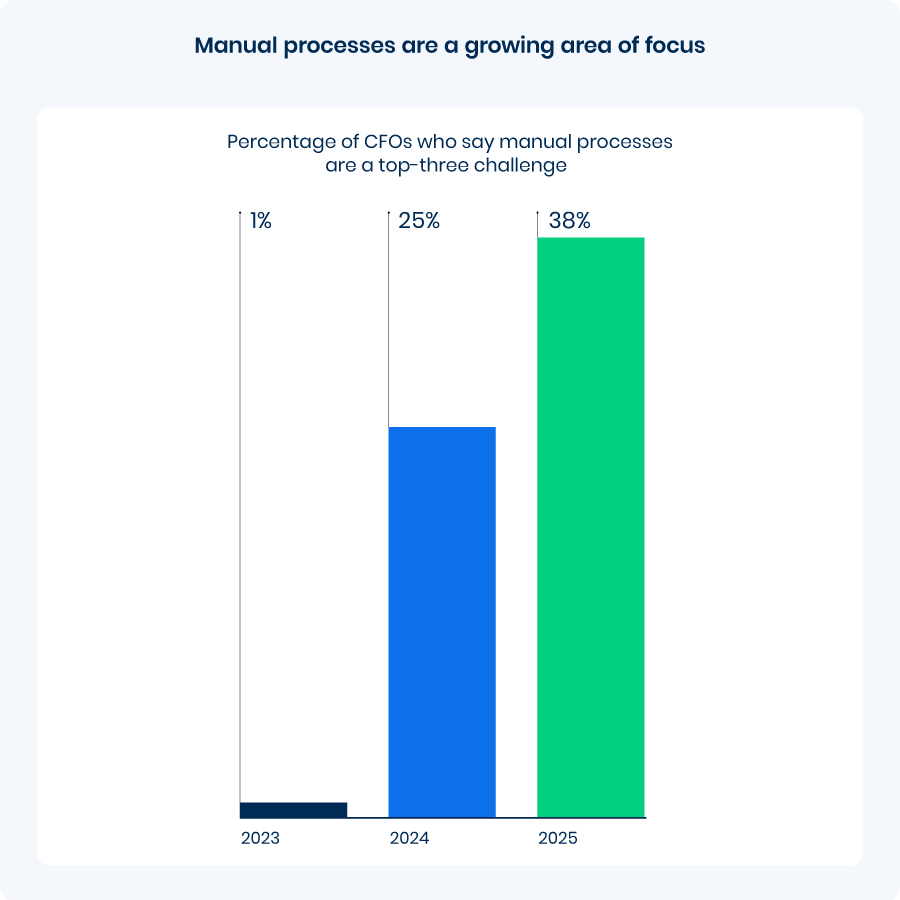

- Manual processes are a major bottleneck—38% of CFOs now cite them as a top issue, prompting a shift toward AI and automation for efficiency and agility.

- Cross-functional collaboration is underused, despite strong interest from IT and HR; only 9% of CFOs see growth leadership as a shared responsibility.

- AI adoption is accelerating, improving decision-making, cost control, and fraud detection—though challenges around ESG impact and data privacy persist.

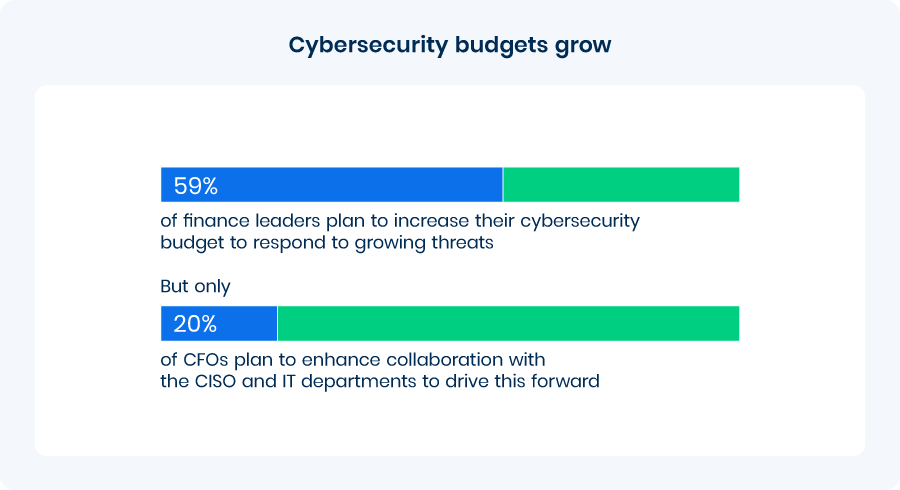

- Cybersecurity is now a CFO concern, with 59% increasing budgets, but stronger collaboration with IT is needed to manage evolving risks.

- ESG is shifting from a compliance burden to a business driver, with most CFOs increasing investments to attract investors and support sustainability goals.

Manual Processes Are Holding Back Strategic Progress

Finance leaders face a range of complex external challenges. While worsening economic conditions remain a primary concern in 2026, the sense of urgency has slightly diminished compared to previous years.

In contrast, geopolitical tensions have intensified significantly—rising from 11% in 2024 to 37% this year as a top concern for CFOs. Regional instability, trade restrictions, and economic fragmentation have collectively escalated the stakes.

Internally, manual processes have emerged as a particularly painful bottleneck. Two years ago, only 1% of finance leaders identified them as a top challenge; today, 38% consider them a critical issue. In an environment where accurate forecasting and agile cost control are essential, inefficient, hands-on workflows are falling behind.

Inefficiency affects more than just productivity. It also compromises accuracy, slows responsiveness, and ultimately weakens competitiveness. CFOs recognize that eliminating these bottlenecks is essential for overcoming key obstacles and driving sustainable growth.

Cost optimization and efficiency improvements remain at the heart of the growth agenda. To that end, a growing number of CFOs are turning to AI and automation technologies to eliminate routine manual tasks—freeing finance teams to focus on strategic, value-added initiatives.

Collaboration Could Be the Game-Changer CFOs Need

Despite the increasing complexity of their role, many CFOs still perceive themselves as the sole architects of growth. In fact, 81% of surveyed CFOs believe they are the primary drivers of organizational success.

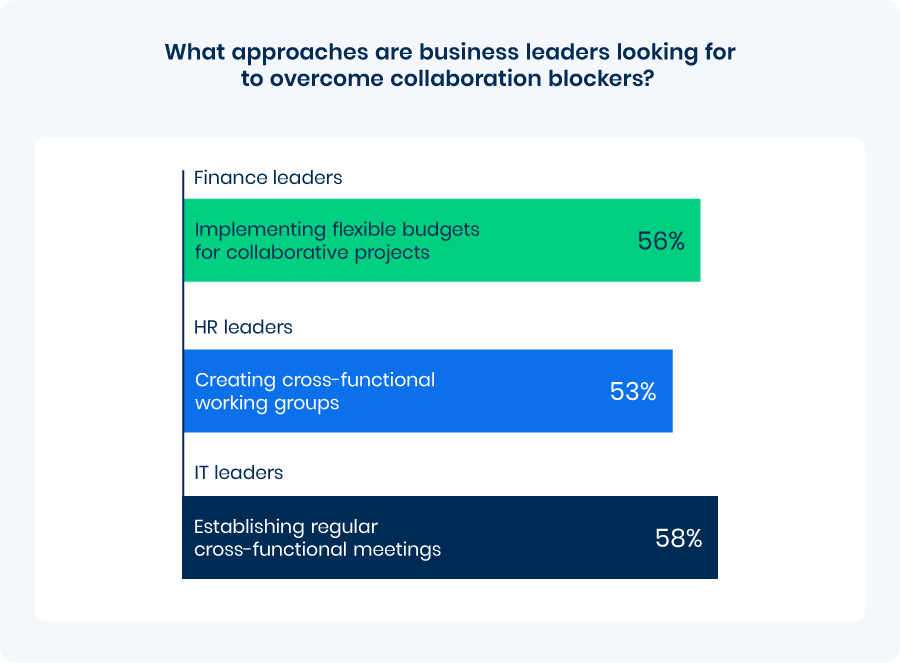

Yet the data tells a more nuanced story. Collaboration remains one of the most underutilized tools in a CFO’s strategic arsenal. Leaders in IT and HR frequently express a strong interest in partnering more closely with finance on critical initiatives, including digital transformation, cybersecurity, and ESG.

Cross-functional synergy holds considerable potential. For instance, IT leaders often view cost management and technology investments as shared responsibilities. At the same time, HR leaders identify opportunities to align performance incentives, DEI goals, and workforce planning with financial objectives. Still, only 9% of CFOs believe that growth leadership should be distributed across the C-suite.

This viewpoint may be limiting the full potential of strategic collaboration. The report reveals that IT and HR leaders are eager to partner more closely with finance.

52% of IT leaders want greater involvement in managing costs and making tech investment decisions. HR leaders similarly see opportunities in shared KPIs and cross-functional projects.

Despite strong communication skills among finance executives, true collaboration often stalls due to conflicting departmental priorities. Finance teams view this as the biggest barrier to cross-functional success, while HR leaders point to insufficient data sharing and lack of transparency.

Bridging these divides requires more than intent. Establishing shared goals, creating regular touchpoints between departments, and using collaborative technology platforms can pave the way for deeper, more strategic engagement.

AI Adoption Is Gaining Momentum in Finance

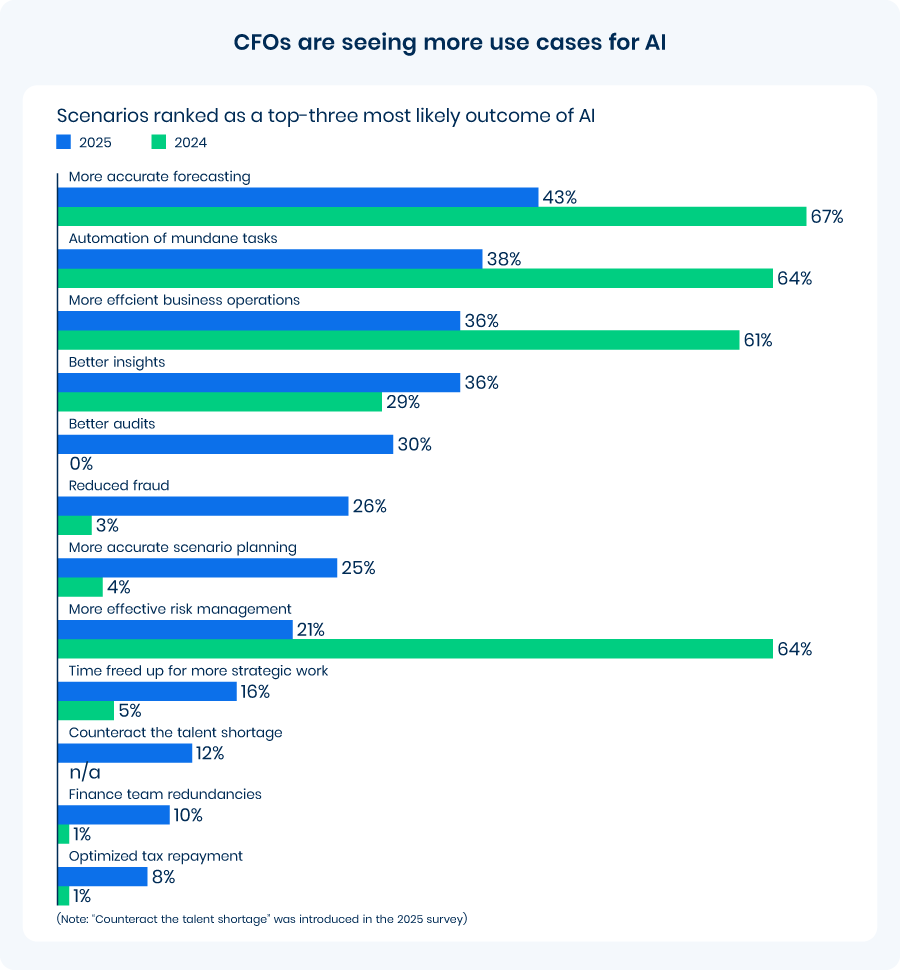

The report highlights a key shift: AI is no longer regarded as a buzzword but is now embraced as a practical tool for finance transformation. A surge in awareness around automation has prompted finance leaders to prioritize the enhancement of repetitive, time-consuming tasks. Such a change in focus signals a broader evolution in operational strategy.

More than 94% of CFOs report that AI has already improved decision-making within their departments, and 73% indicate a positive impact on cost and risk reduction.

One of AI’s most compelling applications involves automating routine tasks. In 2024, only 7% of finance leaders reported high levels of AI automation for general office functions such as summarizing documents or generating emails. That figure rose sharply to 57% in 2026.

Beyond basic tasks, AI is making significant progress in more complex areas.

Automation in pricing models climbed from 5% to 22%, while fraud monitoring increased from 28% to 45%. CFOs are increasingly recognizing AI’s ability to improve accuracy, uncover actionable insights, and liberate teams to concentrate on high-value strategic initiatives.

Despite these advancements, the path to AI maturity is not without challenges. While many report gains in efficiency and decision-making, skepticism remains. Around 15% of finance leaders cite negative impacts on ESG due to AI’s high energy consumption. Data privacy and security concerns persist as well, with 12% identifying them as notable drawbacks.

Overall, the sentiment is clear: CFOs now view AI as a driver of transformative outcomes. Improvements in audits, scenario planning, risk management, and even complex strategic work—once considered beyond the reach of automation—are now within sight.

Cybersecurity is Becoming a CFO Priority

Finance leaders are no longer passive observers of cybersecurity. A growing number (59%) plan to increase cybersecurity budgets this year, and 27% already share some level of responsibility for cybersecurity initiatives.

With cyber threats evolving rapidly and finance systems serving as prime targets, CFOs now recognize that a security breach in finance represents more than an IT issue. It poses a significant business risk with potential financial, reputational, and operational consequences.

Yet collaboration remains limited. Only 20% of finance leaders plan to strengthen their partnerships with CISOs and IT departments. Such a lack of coordination is concerning, particularly as cloud adoption and automation continue to merge finance and IT systems.

Larger enterprises are setting the pace: 48% of CFOs at organizations with more than 1,000 employees are investing in advanced security technologies. In contrast, smaller firms often face resource constraints that leave them more vulnerable to cyber risk.

To address modern threats, finance leaders must treat cybersecurity not just as a protective measure but as a catalyst for innovation. Engaging strategically with IT on initiatives like AI-driven threat detection, secure cloud infrastructure, and blockchain integration can shift cybersecurity from a cost center to a source of competitive advantage.

ESG is Shifting from Burden to Business Driver

ESG is undergoing a significant transformation. Once viewed as a major internal challenge—cited by 59% of finance leaders in 2024—only 16% now consider it a top-three concern in 2026. Increasingly, ESG is recognized as a pillar of strategic growth.

Shifting investment patterns highlight this evolution. Nearly 87% of CFOs plan to boost ESG spending in response to evolving regulations. Many emphasize ESG’s value in attracting investors, building customer loyalty, and creating market differentiation. In the U.S., a remarkable 98% of CFOs report increased ESG investments, despite ongoing regulatory fluctuations.

The repositioning of ESG as a driver of value is prompting CFOs to assume greater leadership in sustainability efforts. Financial reporting now increasingly incorporates ESG metrics, while data from expense systems is being harnessed to track emissions and support more sustainable operations.

Despite the momentum, several obstacles persist. Regulatory complexity, challenges in measuring ROI, and internal capability gaps remain key barriers. Tackling these issues will demand strong cross-functional collaboration to acquire necessary talent and implement effective tools.

Rather than questioning ESG’s relevance, forward-thinking CFOs are now focused on integrating it seamlessly into core business planning and execution.

Technology Is the Key to Smarter Forecasting and Cost Control

Forecasting and cost control have always been essential finance functions, but they have grown more complex due to geopolitical risks, supply chain disruptions, and inflationary pressures.

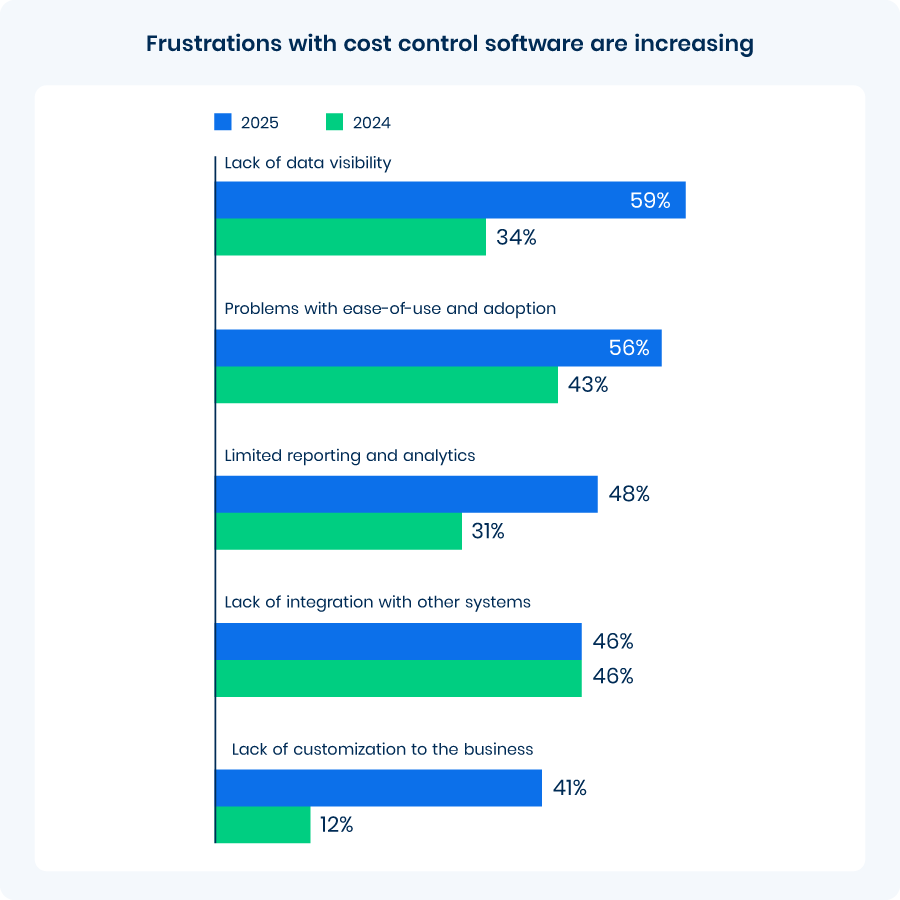

According to the report, 61% of finance leaders cite inaccurate forecasting as a top challenge, followed by concerns related to pricing and vendor management. Additionally, 73% report lacking real-time visibility into spend, while 68% face difficulties in managing costs effectively.

These challenges highlight the limitations of traditional finance tools. Emerging technologies present a promising path forward. AI-powered forecasting tools can analyze historical data, identify trends, and simulate scenarios with unprecedented precision.

With reduced reliance on guesswork, finance teams gain agility and can respond more quickly to change. Currently, 30% of finance departments are highly automated in planning functions, and 43% of CFOs believe AI will significantly enhance forecasting accuracy in the near future.

AI-enabled expense and invoice management platforms can detect anomalies, ensure compliance, and even provide predictive insights into future spending. Automation of this kind allows CFOs to transition from reactive problem-solving to proactive strategy development.

To realize these benefits, companies need to prioritize not only technology adoption but also training and integration. Equipping teams with the right skills and ensuring seamless system interoperability are essential to unlocking holistic, data-driven insights.

The Modern CFO: Driving Growth Beyond Finance

SAP Concur’s March 2026 CFO Insights Report highlights a compelling reality: the CFO role is evolving at an unprecedented pace. Today’s finance leaders are expected to influence nearly every aspect of the organization—from technology and risk management to ESG initiatives and innovation strategy.

Success in this environment requires more than traditional cost-cutting measures. It calls for a reimagining of finance as a strategic growth engine. That means adopting automation, fostering cross-functional collaboration, prioritizing cybersecurity and ESG investments, and harnessing data-driven technologies for smarter decision-making.

CFOs who rise to meet these expectations won’t simply manage complexity—they will shape the future of their organizations. Sustainable growth in 2026 and beyond will favor leaders who operate with agility, bold vision, and a spirit of collaboration.

How DOKKA Can Help CFOs Accelerate Growth

DOKKA empowers CFOs to overcome manual bottlenecks and drive strategic growth through intelligent automation. Streamlining document processing, expense management, and financial workflows frees finance teams from routine tasks—boosting accuracy, speed, and control.

Seamless integration with leading ERP systems delivers real-time data visibility and ensures compliance. Built-in collaboration tools make cross-functional alignment easier than ever.

As CFOs embrace broader leadership roles in 2026, DOKKA provides the technology foundation needed to support smarter decision-making, enhanced forecasting, and operational resilience—allowing finance teams to focus on what truly matters: accelerating growth.

To find out more about how DOKKA can help your business, book a free demo call.