In the world of finance, data holds the key to informed decision-making and sustained growth.

Effectively managing a company’s finances requires constant vigilance. This is why financial KPIs play a critical role in the financial sector, enabling regular tracking, monitoring, and analysis of a company’s performance.

Financial Key Performance Indicators (KPIs) emerge as the guiding beacons for all organizations seeking to gain deep insights into their financial performance, make strategic choices, and unlock their true potential. By harnessing the power of these KPIs, they can gain a holistic understanding of their financial landscape.

How does it work? In short, financial KPIs enable organizations to identify areas of strength, pinpoint potential weaknesses, and strategically allocate resources to drive optimal results. In essence, financial KPIs empower decision-makers with actionable insights, facilitating agile decision-making and the ability to course-correct swiftly when needed.

In this blog post, we will explore the importance of KPIs in financial analysis, and uncover the key KPIs that organizations should consider to gain a comprehensive understanding of their financial health, efficiency, and growth potential. Additionally, we will examine how advancements in technology and data analytics have transformed the way financial KPIs are tracked, analyzed, and utilized to drive strategic decision-making.

What Is a Financial KPI?

A financial key performance indicator (KPI) is a quantifiable metric that organizations use to evaluate their financial performance and track progress toward specific financial objectives. KPIs are essential tools for monitoring the effectiveness of financial management strategies, identifying areas for improvement, and supporting informed decision-making to enhance overall financial health.

Financial KPIs encompass a wide range of metrics that reflect various aspects of a company’s financial performance, including profitability, cash flow management, debt management, operational efficiency, and shareholder value creation. By consistently tracking these indicators, organizations can gain valuable insights into their financial strengths and weaknesses, enabling them to refine their strategies to maximize growth and sustainability.

To harness the full potential of financial KPIs, organizations should establish a robust framework for selecting, monitoring, and analyzing relevant metrics. This involves defining clear financial objectives, choosing KPIs aligned with those goals, setting achievable targets, and regularly reviewing performance to drive continuous improvement in financial outcomes.

Why are Financial KPIs Important?

Here are the main reasons why financial KPIs can benefit any business:

- Evaluation of the financial performance: KPIs are used to evaluate the financial performance from revenue and profitability to liquidity and efficiency. These indicators are crucial to a company’s success because they allow decision-makers to make informed and effective decisions. For instance, identifying a decline in revenue from one quarter to another might indicate the need to adjust sales strategies or focus on customer retention.

- A better understanding of financial health: KPIs provide businesses with a better understanding of the financial health of their organization. For example, tracking KPIs such as gross profit margin and return on investment can provide insights into a company’s profitability and financial stability. By keeping a close eye on these metrics, businesses can identify potential issues before they become significant problems.

- Clear communication of financial data: In addition to aiding internal decision-making processes, financial KPIs also play a crucial role in communicating the company’s financial performance to external stakeholders, such as investors, creditors, and regulators. Transparent reporting of financial KPIs helps build trust and confidence among these stakeholders, ensuring continued support and investment in the company’s operations.

- Setting realistic goals and benchmarks: KPIs provide businesses with a way to measure and track their financial performance against their goals and objectives. Financial KPIs can be utilized as benchmarks to compare a company’s performance against industry peers or historical data. This comparative analysis helps organizations identify best practices, uncover competitive advantages, and set realistic targets for future growth.

10 Key Financial KPIs

1) Gross Profit Margin

The gross profit margin is a financial metric that measures the percentage of revenue remaining after accounting for the cost of goods sold (COGS). It is an essential indicator of a company’s profitability and efficiency, as it reflects how well the company can generate profits from its core operations.

A higher gross profit margin indicates that the company is generating more profit from each unit of revenue, which contributes to its overall profitability. The gross profit margin helps assess the efficiency of a company’s production process by showing how much of the revenue is retained after covering direct production costs. An improvement in the gross-profit margin may signify better management of production costs or more effective pricing strategies.

The formula for calculating the gross profit margin is:

Where:

- Gross Profit = Net Sales – Cost of Goods Sold

- Net Sales = Total sales revenue minus returns, allowances, and discounts

By multiplying the result by 100, the gross profit margin is expressed as a percentage, making it easier to interpret and compare with other companies or industry benchmarks.

2) Current Ratio

The current ratio is a vital metric that measures a company’s liquidity by evaluating its ability to cover short-term obligations with current assets. A higher current ratio signifies strong liquidity, ensuring the company can meet immediate financial obligations. Moreover, a healthy current ratio enhances solvency and reduces the risk of default on long-term commitments. Lenders and creditors consider the current ratio when assessing creditworthiness, with a higher ratio indicating lower credit risk and potentially facilitating more favourable financing terms.

The formula for calculating the current ratio is:

Where:

- Current Assets are assets that can be easily converted into cash within one year, such as cash, marketable securities, accounts receivable, and inventory.

- Current Liabilities are short-term obligations that are due within one year, such as accounts payable, short-term debt, and accrued expenses.

A current ratio of 1 or higher generally indicates that a company has enough current assets to cover its current liabilities. However, it is essential to consider industry norms and the company’s unique circumstances when interpreting the current ratio.

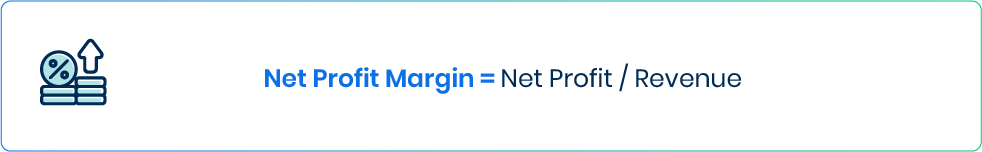

3) Net Profit Margin

The net profit margin measures the percentage of revenue remaining after accounting for all expenses, including operating costs, taxes, and interest. It is an indicator of a company’s overall profitability and financial performance, as it reflects how much profit the company generates from its total revenue.

A higher net profit margin indicates that the company is more efficient in converting its revenue into net income, contributing to its overall profitability. The net profit margin helps assess the effectiveness of a company’s cost-management strategies. An improvement in the net profit margin may signify better control over operating expenses, more efficient use of resources, or successful pricing strategies.

The formula for calculating the net profit margin is:

Where:

- Net Profit is the remaining income after accounting for all expenses.

- Revenue is the total income generated from a company’s core business activities, excluding any gains from non-operating activities.

By expressing the net profit margin as a percentage, it allows for easier interpretation and comparison with other companies or industry benchmarks.

4) Accounts Payable Turnover

The Accounts Payable Turnover is a financial metric that measures the number of times a company pays its suppliers within a specific period, usually a year. It is an indicator of a company’s liquidity and its ability to manage short-term obligations towards suppliers.

A higher ratio suggests strong supplier relationships and effective management; timely payments foster continued access to goods and services. Lenders and creditors assess the accounts payable turnover ratio to gauge creditworthiness—a higher ratio indicates lower credit risk and potential for favorable financing terms. Additionally, the ratio provides insights into operational efficiency, with a consistently high ratio reflecting streamlined procurement processes and effective working capital management.

The formula for calculating the accounts payable turnover is:

Where:

- Total Supplier Purchases is the total amount spent on purchasing goods and services from suppliers during a specific period, usually a year.

- Average Accounts Payable is the average balance of accounts payable during the same period, calculated as (Beginning Accounts Payable + Ending Accounts Payable) / 2.

A higher accounts payable turnover ratio indicates that a company is paying its suppliers more frequently, while a lower ratio suggests that the company is taking longer to pay its suppliers. However, it is essential to consider industry norms and the company’s unique circumstances when interpreting the accounts payable turnover ratio.

5) Accounts Receivable Turnover

The accounts receivable turnover is a financial metric that measures the number of times, within a specific period (usually a year), that a company collects its average accounts receivable. It is an indicator of how efficiently a company manages the credit it extends to customers and collects payments on outstanding invoices.

The accounts receivable turnover ratio helps assess the effectiveness of a company’s credit policies and collection efforts. Monitoring the accounts receivable turnover ratio can provide insights into customer payment behavior and help identify potential issues with specific customers or market segments. A consistently high accounts receivable turnover ratio demonstrates the company’s ability to effectively manage credit risks and maintain healthy cash flow.

The formula for calculating the accounts receivable turnover is:

Where:

- Net Credit Sales are the total sales revenue generated on credit during a specific period, usually a year, excluding cash sales.

- Average Accounts Receivable is the average balance of accounts receivable during the same period, calculated as (Beginning Accounts Receivable + Ending Accounts Receivable) / 2.

A higher accounts receivable turnover ratio indicates that a company is collecting payments from customers more frequently, while a lower ratio suggests that the company is taking longer to collect outstanding invoices.

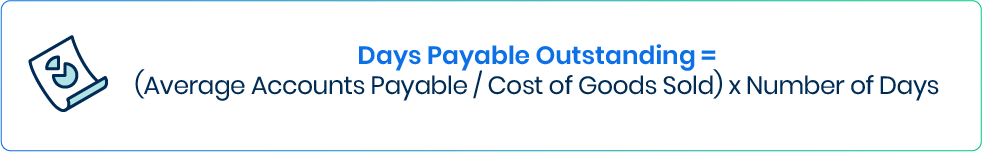

6) Days Payable Outstanding

The days payable outstanding (DPO) measure the average number of days a company takes to pay its suppliers after incurring a payable. It is an indicator of a company’s cash flow management and its ability to effectively manage short-term obligations towards suppliers.

The formula for calculating the days payable outstanding is:

Where:

- Average Accounts Payable is the average balance of accounts payable during a specific period, calculated as (Beginning Accounts Payable + Ending Accounts Payable) / 2.

- Cost of Goods Sold (COGS) is the total direct cost of producing the goods or services sold by the company during the same period.

- Number of Days represents the number of days in the period being analyzed, typically 365 days for an annual calculation.

A higher DPO indicates that a company is taking longer to pay its suppliers, while a lower DPO suggests that the company is paying suppliers more quickly. It is essential to consider industry norms, the company’s unique circumstances, and the impact on supplier relationships when interpreting the DPO.

7) Cash Conversion Cycle

The cash conversion cycle (CCC) measures the time it takes for a company to convert its investments in inventory and other resources into cash flow from sales. The CCC helps assess the efficiency of a company’s operations by measuring the time taken to sell inventory, collect payments from customers, and pay suppliers. A shorter CCC may signify better inventory management, more efficient collection processes, or favorable credit terms with suppliers.

The formula for calculating the CCC is:

Where:

- Days Inventory Outstanding (DIO) measures the average number of days a company takes to sell its inventory. It is calculated as (Average Inventory / Cost of Goods Sold) x Number of Days.

- Days Sales Outstanding (DSO) measures the average number of days a company takes to collect payment from customers after making a sale. The formula for DSO is calculated as (Average Accounts Receivable / Net Credit Sales) x Number of Days.

- Days Payable Outstanding (DPO) measures the average number of days a company takes to pay its suppliers after incurring a payable (Average Accounts Payable / Cost of Goods Sold) x Number of Days.

A shorter CCC indicates that a company is more efficient in managing its working capital and cash flow, while a longer CCC suggests that the company takes more time to convert its investments in inventory and other resources into cash flows from sales.

8) Payroll Headcount Ratio

The payroll headcount ratio measures the average payroll expenses per employee within a specific period, usually a year. It is an indicator of a company’s efficiency in managing its human resources and controlling labor costs. Monitoring the payroll headcount ratio can provide insights into a company’s operational efficiency. A consistently low ratio may suggest streamlined processes, effective workforce management, or higher productivity levels. Comparing the payroll headcount ratio with that of industry peers can offer valuable insights into a company’s competitive position in terms of labour cost management and operational efficiency.

The formula for calculating the payroll headcount ratio is:

Where:

- Total Payroll Expenses is the total amount spent on payroll, including wages, salaries, bonuses, benefits, and other employee-related expenses during a specific period, usually a year.

- Average Number of Employees is the average number of employees during the same period, calculated as (Beginning Number of Employees + Ending Number of Employees) / 2.

A lower payroll headcount ratio indicates that a company is spending less on payroll expenses per employee, which may signify better labor cost management or higher operational efficiency.

9) Debt to Equity Ratio

The debt-to-equity ratio measures the proportion of a company’s total debt to its shareholders’ equity. It is an indicator of a company’s financial leverage and risk profile, as it reflects the extent to which a company relies on borrowed funds to finance its operations and growth. The debt-to-equity ratio helps evaluate a company’s capital structure and financing strategy. A lower ratio may indicate a more conservative approach, relying primarily on equity financing, while a higher ratio suggests a greater reliance on debt financing.

The formula for calculating the debt-to-equity ratio is:

Where:

- Total Debt includes all short-term and long-term liabilities owed by the company.

- Shareholders’ Equity represents the net assets of the company, which are calculated as total assets minus total liabilities.

A higher debt-to-equity ratio indicates that a company has a higher proportion of debt relative to equity, signaling increased financial risk. A higher ratio may also suggest that the company is more vulnerable to economic downturns or fluctuations in interest rates.

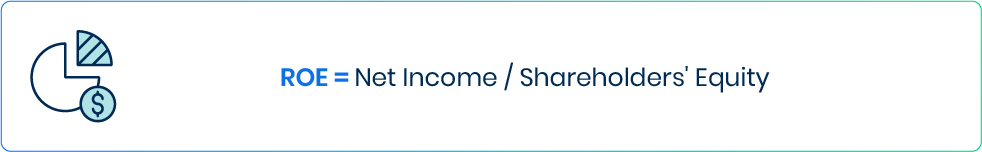

10) Return on Equity (ROE)

The return on equity (ROE) ratio measures a company’s ability to generate profits from its shareholders’ investments. It is an indicator of a company’s financial performance and efficiency in utilizing shareholders’ equity to generate earnings. The ROE ratio can help evaluate the effectiveness of a company’s capital allocation decisions, and investors often consider a company’s ROE when making investment decisions as it provides insights into the company’s ability to generate returns on its investments.

The formula for calculating the return on equity ratio is:

Where:

- Net income is the company’s total revenue, minus expenses, taxes, and costs during a specific period, usually a year.

- Shareholders’ Equity represents the net assets of the company, which is calculated as the total assets minus total liabilities.

A higher ROE indicates that a company is more efficient in generating profits from its shareholders’ investments, while a lower ROE suggests that the company is less efficient in using shareholders’ equity to generate earnings.

How to Leverage Technology to Analyze Financial KPI’s

Advancements in technology and data analytics have significantly transformed the way financial KPIs are tracked, analyzed, and utilized for strategic decision-making. These changes have enabled businesses to access real-time insights, automate processes, and make data-driven decisions to improve their overall performance. Here are some ways these advancements have impacted the tracking and utilization of financial KPIs:

- Real-time monitoring: Modern data analytics tools and technologies allow organizations to track and monitor their financial KPIs in real-time. This enables businesses to identify trends, detect anomalies, and react quickly to any changes in financial performance, allowing for more agile decision-making.

- Enhanced data visualization: Data visualization tools have made it easier for businesses to represent complex financial data in easily understandable formats like charts, graphs, and dashboards. These visual representations help decision-makers to quickly grasp the information, analyze trends, and make informed decisions based on the insights derived from financial KPIs.

- Improved accuracy and automation: The integration of advanced technologies like artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) has led to increased accuracy in financial KPI tracking and analysis. Automation helps eliminate manual errors, streamlines processes and reduces the time spent on repetitive tasks, allowing finance professionals to focus on strategic decision-making.

- Predictive analytics: With the help of machine learning algorithms and advanced data analytics techniques, organizations can now use historical financial KPI data to predict future outcomes. Predictive analytics enables businesses to forecast trends, identify potential risks, and make proactive decisions to optimize financial performance.

- Integration with other data sources: The ability to integrate financial KPIs with other data sources, such as operational and customer data, allows organizations to gain a holistic view of their business performance. This comprehensive understanding helps businesses identify correlations between financial metrics and other aspects of their operations, leading to more informed and strategic decision-making.

- Customization and scalability: Modern data analytics tools are highly customizable and scalable, allowing organizations to tailor their financial KPI tracking and analysis to their specific needs. This flexibility enables businesses to focus on the most relevant KPIs for their industry and objectives, ensuring that decision-making is aligned with their overall strategy.