Pricing in accounts payable automation is often a great mystery for those seeking a new AP solution. Given the complexity of features, scalability, and integration choices available in today’s market, accurately comparing pricing on an apples-to-apples basis can prove to be challenging.

To navigate the landscape of AP pricing, it’s imperative to grasp how platform vendors formulate their charges for their services. Given the multitude of factors that can impact pricing, ranging from usage fees to implementation and training expenses, there isn’t a one-size-fits-all model.

Typically, vendors provide several tiers of services and features contingent on a company’s specific requisites. The provision for customized pricing empowers companies to procure only what aligns with their needs, all the while allowing room for future expansion or the inclusion of supplementary functionalities in tandem with business growth.

Today, we will unravel the structure of charges adopted by AP automation vendors, shedding light on the behind-the-scenes panorama of their tailored pricing models.

Does transparency reign supreme, or do hidden costs obscure the view? We are poised to dissect all that demands your awareness.

AP Industry’s Best Kept Secret: “Custom” Pricing

If you’ve ever evaluated an AP software, then you’re familiar with this conundrum.

When you reach out to a vendor, they will provide pricing quotes that reflect your company’s needs. In most cases, they offer base prices for their core services, alongside supplementary fees for on-boarding and customization. When evaluating a quotation, it is crucial to factor in expenses associated with integration, training, support, and any supplementary services that might be necessary.

Each vendor boasts a distinct array of product features, encompassing data extraction, invoice processing, document management, approvals, payments, reporting, and more, usually available as distinct modules. Medium-sized and large enterprises can reap substantial benefits from a custom pricing model, as it empowers them to cherry-pick modules as needed, paying solely for the functionalities required. This approach not only caters to immediate requirements but also accommodates future scalability.

Here’s What You’ll Be Paying For

Let’s explore the most commonly encountered models:

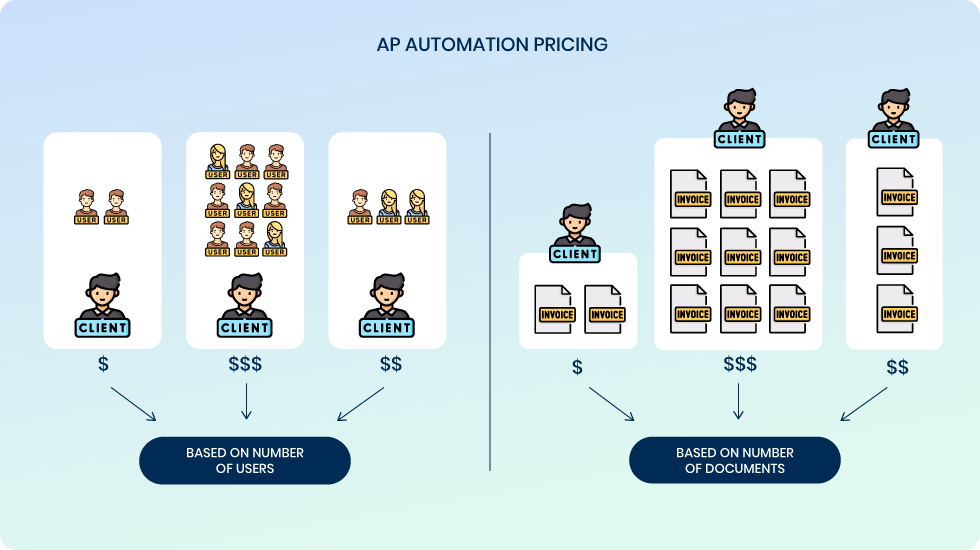

Paying per Processed Document

Pricing per document is based on the number of documents processed in a given time period (a month or a year). Documents can be invoices, purchase orders, delivery receipts or other, but typically usage fees are formed around the volume and number of invoices managed in the software. This model charges a fixed fee for each invoice processed in a month, rendering it highly scalable as the cost per invoice generally decreases with an increase in the number of invoices being processed.

At DOKKA, we call this usage-based pricing and this constitutes our basic pricing philosophy. Usage-based subscription model stands out as the most cost effective model due to its seamless alignment with service utilization.

Paying per User Seat (and per Client)

Another factor that can determine pricing is the number of users that are granted access to the platform. The user-based pricing model takes into account the number of individuals who will have access to and use the software to manage accounts payable processes. Some vendors charge a per-user fee per month or a flat rate for unlimited users.

For companies with a lot of users or clients, this model may not be the most cost-effective option as the subscription fees quickly add up. In addition, some AP vendors charge for both the processed documents and the users (clients), raking up the monthly fees.

Paying a Percentage on Payment Transactions

Many AP automation vendors offer a payment module that allows payment processing directly on their platform. It is a convenient feature for AP process, but can be costly.

In this model, the client and the vendor get charged a percentage of each payment transaction made through the software. For a considerable number of these vendors, pricing per payment stands as a lucrative avenue, constituting a significant source of revenue. Just like with the other two, there are vendors that charge all three of these models in one solution, meaning you’ll be paying for processed documents, end users or clients on the platform and a percentage of transaction fees.

The 3 Main Supplemental Fees

1. On-boarding & Training Fees

In addition to basic usage subscription, some vendors charge implementation and training fees. These costs can differ, but typically include setup fees, onboarding services for custom configurations, and training sessions to get you up and running quickly.

Setup fees are charged to cover the cost of integrating the software with your existing systems, like ERPs. Onboarding can also include training for employees that will be using the platform. Keep in mind that training fees are often based on a per-user basis.

2. Support & Maintenance Fees

Most vendors provide technical and executive support, as well as periodical platform updates and maintenance. Support fees are charged separately from the base subscription or usage fees and may vary depending on the level of service offered. They typically include phone support, email support, one-on-one sessions with customer success teams, and access to a knowledge base. However, often times, vendors are charging for “premium support” as an extra.

3. Customization Fees

Sometimes, the client has a specific need that requires customization of the platform. Some AP automation vendors sell their products as they are, but some are open to work on customized items or features to add upon existing product.

Customization fees may be charged for custom solutions to accommodate the client’s specific business needs, such as additional features, integrations or processes. The cost of customization can vary greatly depending on the complexity of the project.

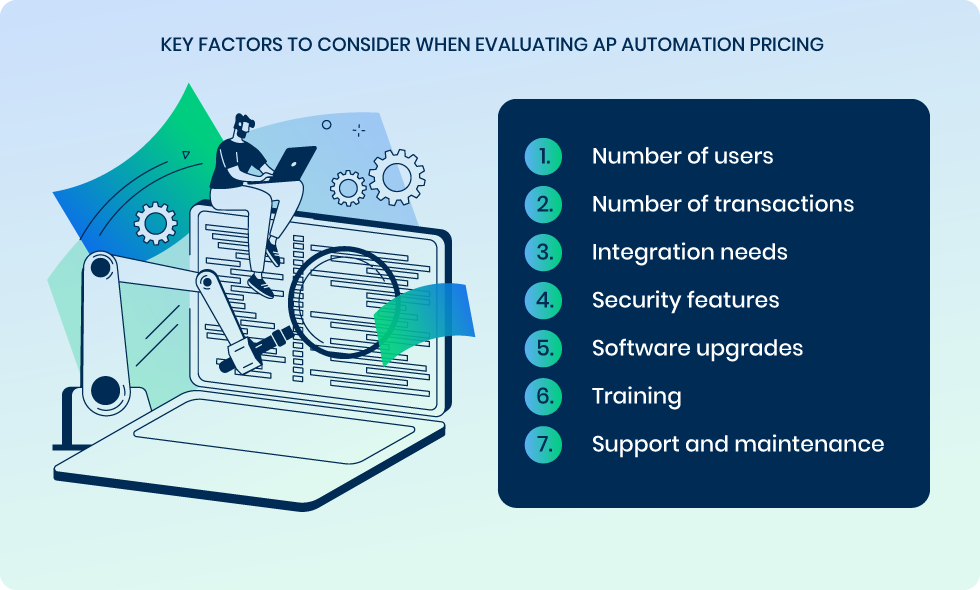

Key Factors To Consider When Evaluating AP Automation Pricing

When it comes to choosing the best pricing plan for your company, you should consider multiple factors that influence the price. Your pricing will most likely depend on the size of your company and features that you need. Keep in mind that procuring accounts payable software is a pivotal decision that significantly impacts the efficiency of your finance team; therefore, conducting thorough research beforehand can yield time and cost savings in the long haul.

By taking the time to analyze the needs of your AP workflow and compare different solutions, you can make a smart purchase that will benefit your company. It’s also important to evaluate how the pricing model will scale as your business grows and changes over time.

Here are a key factors to consider when evaluating pricing to find a best fit for your business:

1. Number of users

How many people from your company will be using the software? Please consider the number of users who will need to have access to the platform, as this will influence the price. Many vendors restrict the number of users who can access the system or charge extra per user. At DOKKA, we don’t charge per user, which will keep your costs down and provide an overall higher return on investment.

2. Number of transactions

How many transactions do you process in a month? The volume of invoices, payments, and other transactions can significantly impact the price. The more invoices you process, the higher the price will be. It is important to consider how many invoices you will need to process on a daily or monthly basis before finalizing a pricing plan.

3. Integration needs

What accounting software do you use: a full-blown ERP or an online accounting software? For accounting companies that use online software like QuickBooks and Xero, integration is much easier because they lack features such as 3-way matching of POs or delivery orders, and they don’t have a complicated inventory setup. However, for large businesses, AP software usually needs to integrate with existing ERP systems like Netsuite, Priority, Sage Intacct or SAP, which can incur extra costs. Some vendors charge for integrating with ERP systems, while others might include this in the basic package.

4. Security features

Accounts Payable solutions are responsible for handling large amounts of sensitive financial data. Therefore, it is important to ensure that the software you choose will maintain the security and safety of your information. Look for providers that offer robust encryption protocols and two-factor authentication to safeguard your data.

5. Software upgrades

Anticipate future needs and contemplate potential upgrades. Some vendors impose charges for significant version upgrades, whereas others incorporate updates within the ongoing subscription. Reflect on this aspect, as it has the potential to considerably influence your long-term expenses. At DOKKA, we roll out platform updates bi-weekly.

6. Training

Implementing new software requires training for your team to effectively use it. Accounts Payable vendors typically provide on-site or online training, which could be either free or available at an additional cost. Verify whether training and support are included in the pricing plan or if they need to be acquired separately. These fees can accumulate rapidly, so it is essential to be mindful of them before making a purchase.

7. Support and maintenance

It’s also crucial to check the costs associated with ongoing support and maintenance, if applicable. Certain Accounts Payable (AP) vendors provide these services for free or include them as part of the initial cost, while others might impose a separate fee.

Stay on the lookout for these situations:

- Overlapping of the on-boarding fee with a monthly subscription: Some vendors charge both an onboarding fee and a regular monthly subscription fee in the same month, leading to a potential double payment. Verify with the vendor whether they initiate the regular subscription charges after the onboarding process is completed or if they begin during the onboarding.

- Yearly discounts: Are you opting for a yearly payment or committing to a yearly subscription while paying on a monthly basis? Frequently, you can secure a discount by making a one-year commitment.

- Level of support: Assess the accessibility of the customer success team, the nature of the training they offer, and the availability of VIP support. Determine the available communication channels – whether it’s through email, a ticketing system, or direct calls.

- Customization requirements: Does your company have specific requirements that are not addressed by standard AP software? Customization often leads to an increase in price, but at times, these requirements can also enhance the platform’s utility, prompting the vendor to consider developing the product in the necessary direction. Explore whether you can negotiate an improved deal if there’s a mutual benefit for both parties.

- Hidden agendas: In the AP industry, pricing commonly revolves around the quantity of documents or users. While some companies might offer lower platform or user fees, this often indicates that a significant portion of the AP vendor’s revenue is generated from a percentage of payments. Exercise caution to avoid becoming entangled in such arrangements.

- Pay as you go model: Some vendors offer credits that can be utilized on a platform to access various features. However, this can become intricate as in certain cases, you might need to expend more credits to process each document. For instance, if you utilize credits for data extraction and subsequent payments, you could potentially end up using 10 credits to process a single document.

Conclusion

Pricing in the AP automation space can be complex and can vary greatly between vendors. Make sure to consider the subscription options available, pricing structure, and any value-added services you may need in order to make the best purchase decision.

Additionally, be sure to read reviews from other customers who have used the software. This will allow you to see how easy it is to use and if there are any bugs or other issues that you should be aware of. Customer feedback can help you make an informed decision about the software’s value for money. With all of these factors taken into account, you can ensure that your AP automation software will meet all of your needs. At the end of the day, remember that purchasing AP software is an investment in your business’s future.