As businesses grow and expand, the AP process becomes increasingly complex and time-consuming. From the initial purchase order to the final payment, the AP process requires engagement of multiple stakeholders, teams and departments working together to ensure accurate and timely payment of invoices. The process is critical to maintaining strong supplier relationships and cash flow management, and requires strict adherence to internal controls and policies to prevent fraud and financial losses.

The full cycle of AP process includes various steps: invoice verification, purchase orders, receipt of goods, and payment processing. Read on, because we’ll explore the full cycle of accounts payable process in detail and discuss how it impacts the financial efficiency of a business.

What Is The Full Cycle Of Accounts Payable?

The accounts payable (AP) process is an integral component of the procure-to-pay business cycle and involves the entire life cycle from receiving, verifying and approving invoices to making payments to vendors for their products or services.

Full cycle AP oversees and manages every detail within invoice processing. It refers to the set of different activities involved in managing a company’s payment obligations to its vendors, suppliers, and other external parties. The full cycle of accounts payable process starts with recording invoices or bills received from vendors and concludes with the payment to the vendors.

The AP process ensures that the company pays its vendors and suppliers accurately and on-time which is vital for the company’s goodwill and for sustaining good relationships with vendors. A well-functioning AP process also helps companies manage their cash flow efficiently, ensuring that they always have the funds to pay their obligations when they are due.

The 3 Main Phases That Make a Full Cycle of Accounts Payable

- Invoice receipt and verification

The first phase in the AP process is receiving and verifying invoices sent by vendors for goods or services provided. These invoices must be checked for accuracy, including such items as price, quantity, and terms of payment. Once the invoices are verified, they need to be recorded in the company’s accounting system, which generally involves data entry and coding of the invoices.

- Approval and payment authorization

The second phase is approval and payment authorization, which involves ensuring that the invoices are approved by relevant personnel within the company. This step usually includes routing invoices for approval through the appropriate channels, which may involve several different parties or departments, depending on the company’s organizational structure. Once authorized, payment is scheduled and initiated, typically via the company’s online banking system.

- Payment reconciliation

The third and final phase in the AP process is payment reconciliation, which involves ensuring that all outstanding invoices are paid on time and accurately. This includes matching payments against invoices and making sure that the payment amounts are correct. Any discrepancies or errors must be reconciled, and adjustments must be made as necessary. This step also includes reconciling vendor accounts and making sure that vendors are paid according to the agreed-upon terms, typically within 30 days of receiving the invoice.

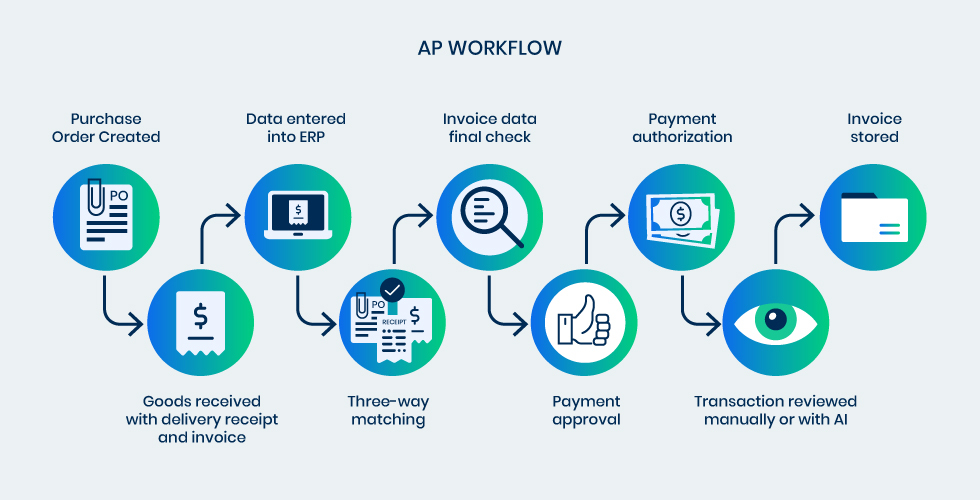

Accounts Payable Process Flow Chart

Now, let’s break down the full AP cycle into practical steps. Here is what a typical AP workflow looks like:

- Purchase Order (PO) Creation: The first step in the AP cycle is to create a purchase order for a good or service that the company wants to buy from a supplier. A PO is a document that outlines the terms and conditions of the purchase, like quantity, price, and delivery date.

- Receiving of Goods/Services: After the items or services are received, the recipient assesses that they meet the requirements in both quantity and quality as specified in their purchase order.

- Invoice Processing: The supplier then sends an invoice to the buyer. The invoice should contain details such as the amount due, payment terms, and the goods or services provided. The AP department enters the invoice data in the accounting system, checks it against the PO and receiving documents to ensure accuracy.

- Approval of Invoice: Once the invoice is verified, it goes through an approval process to ensure that the goods or services were received and that the amount invoiced is accurate.

- Payment Processing: Payment authorization is issued with approved invoices. Payment processing involves issuing payment to the supplier, which can be done via check, electronic payment, or wire transfer.

- Reconciliation: After payment is issued, the AP department reconciles the payment with the invoice and other related documents.

- Vendor Account Maintenance: The final step involves maintaining the vendor account by regularly updating it with any changes in payment terms, contact information, or other relevant details.

The Flow of Full Cycle Accounts Payable

Accounts Payable is more than just making sure payments are made on time to vendors, it also plays a crucial role in procuring goods and services as part of the “procure-to-pay” pipeline. The job responsibilities within the AP department involve managing both upstream processes (purchase requests), and downstream workflows(vendor invoices).

Upstream

The upstream process is a set of activities involved in procurement, which comprises finding suitable vendors who can provide the necessary products or services for your business. The process involves establishing robust relationships with third-party organizations and forming procurement contracts.

Effective management of upstream processes ensures that each purchase order is allocated to the vendor that offers the most favorable pricing, quality, and delivery conditions, and is therefore a critical aspect of the complete accounts payable cycle.

Downstream

The downstream refers to all activities that take place after a company makes a purchase. It starts with the invoice processing. During this phase, the AP department is responsible for verifying the receipt of goods and the corresponding vendor invoice linked to the purchase order (PO), tracking invoices, and ensuring they obtain the necessary approvals for payment

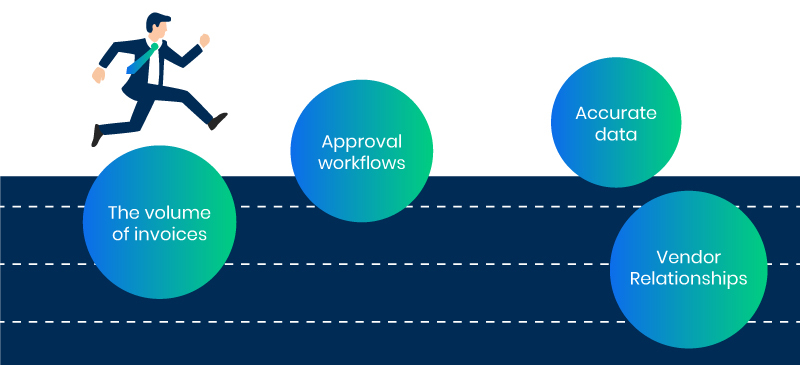

Challenges of The Full Cycle Accounts Payable

- The volume of invoices

The full cycle of AP involves a complex process of receiving, recording, and processing all incoming invoices before making payments to vendors. One of the main challenges of this process is managing large volumes of data accurately and efficiently. The sheer volume of invoices received, particularly for large organizations, can make it difficult to keep track of all incoming payments and ensure that they are processed in a timely manner.

- Approval workflows

Another challenge is managing the approval workflow for invoices. Companies may have multiple levels of approval required before payment can be made, and ensuring that each invoice is properly approved can be a time-consuming process. This is particularly true when dealing with large, multinational organizations with multiple subsidiaries and different levels of approval needed for different regions.

- Accurate data

Data accuracy and consistency are also major concerns in the AP process. Even small errors can lead to significant issues down the line, potentially resulting in delays in payment or incorrect financial statements. Effective record-keeping and accurate data entry are therefore essential aspects of successful AP management.

- Vendor relationships

Managing vendor relationships can also be a challenge for AP departments. Vendors may have different payment terms, and ensuring that payments are made on time and in accordance with the agreed-upon terms can be a complex process. Additionally, negotiating with vendors to ensure that invoiced amounts are accurate and ensuring that contracts are fulfilled can be a time-consuming task.

How to Automate the Full Cycle Accounts Payable?

The process of manually managing and recording AP data is both time-consuming and error-prone, leading to unnecessary expenses and financial discrepancies. However, businesses can simplify the process and streamline their financial management by utilizing an AP automation software solution.

AP automation software offers a robust set of tools that help AP departments better manage the full cycle accounts payable process. These tools include e-invoicing, automated data entry, invoice matching, and approval workflows. The software is designed to minimize the manual effort required while increasing the speed and accuracy of processing financial transactions.

With an AP automation software, companies can easily integrate invoices into their ERP systems, reduce data entry errors, and have real-time tracking of transactions. The automated workflows send the invoices directly to their designated managers for approval, thereby reducing processing times. Additionally, the AP automation software can ensure that proper checks and balances are in place by providing accurate financial data, thus reducing the risk of fraud and compliance violations.

Moreover, AP automation software offers various benefits, including increased efficiency and lower costs. It eliminates the need for manual data entry, freeing up valuable time and resources that can be utilized elsewhere. Also, since the software reduces the risk of errors and simplifies the approval process, AP automation can help save the company money by avoiding costly expenses.

In conclusion, using an AP automation software can significantly improve the full-cycle AP process by eliminating inefficiencies and reducing errors. This solution provides a simple way to streamline the AP process while improving accuracy and compliance. By using an AP automation software, businesses of all sizes can benefit from increased efficiency, lower costs, and better financial management.