Do you remember the ’80s and ’90s, when everyone was using paper checks? Back then, they were an innovative yet simple solution for making payments. All you had to do was take out your checkbook, write the amount in words and numbers, sign it, and then hand it over at the store or send it through the mail.

With the advancement of technology, digital payment methods have gained popularity, and debit cards, credit cards, and eWallets have become common payment methods. However, paper checks still exist in a new form: electronic checks, or eChecks.

In today’s post, we’ll discuss what eChecks are, how they work, and what advantages they offer compared to other digital payment solutions.

What Is an eCheck?

An electronic check, or eCheck, is the digital counterpart of a traditional paper check, designed for making payments online. Like a paper check, an eCheck authorizes the transfer of funds from one bank account to another, but the entire process is conducted electronically.

In recent years, eChecks have gained some traction as more businesses embrace digital solutions for financial transactions. Traditional checks involved manual handling, postal delays, and the risk of being lost or damaged. In contrast, eChecks eliminate these challenges entirely.

The growing popularity of eChecks reflects a broader shift toward paperless and digital financial solutions, appealing to those seeking more reliable and environmentally friendly payment methods. They are particularly valuable for business transactions, recurring payments, and scenarios where speed and accuracy are essential.

Simply put, eChecks act as a bridge between the familiarity of traditional checks and the advanced capabilities of modern digital payment systems.

How Do eChecks Work?

The basic process of using an eCheck is similar to writing a traditional paper check.

The user provides their bank account information and authorization to transfer funds to the recipient. But instead of physically handing over or mailing the check, the user authorizes the payment through an online form or by sharing bank account details over the phone.

Once authorization is complete, the funds are transferred from the user’s bank account to the recipient’s bank account via the Automated Clearing House (ACH) network. This entire process typically takes 3–5 business days to complete.

Steps for Processing eChecks

- Authorization

- Payment Information

- Bank Transfer

- Clearing

Step 1: Authorization

The process begins with the payer providing explicit authorization for funds to be withdrawn from their bank account.

Authorization can be granted in several ways, including signing an online agreement, completing an electronic form, or giving verbal consent over the phone. In some cases, businesses may also use a checkbox for acknowledgment during an online checkout process.

Authorization is crucial to comply with banking regulations and to prevent unauthorized transactions. This step serves as the payer’s legal consent for their funds to be debited.

Step 2: Payment Information

Once authorization is secured, the payer must provide their bank account details. This includes their routing number, which identifies their bank, and their account number, which specifies the account from which the funds will be withdrawn.

These details are typically entered into a secure online form or shared directly with the payment processor. Accuracy at this stage is critical, as incorrect information can lead to failed transactions or delays in processing.

Step 3: Bank Transfer

After the payer’s information is collected, the payment processor takes over. The processor creates an electronic file representing the eCheck and submits it through the ACH network. The ACH acts as an intermediary, facilitating the transfer of funds from the payer’s bank to the recipient’s bank.

To improve efficiency and lower costs, the transfer stage often involves batching the eCheck with other transactions. This is why the process may take one to two days to complete.

Step 4: Clearing

In the final step, the recipient’s bank receives the eCheck and initiates the clearing process.

The bank verifies the transaction details, ensuring that the payer has sufficient funds in their account to cover the payment.

Once the eCheck clears, the funds are deposited into the recipient’s account. Depending on the banks involved and the ACH network’s processing schedule, this step may take 1–3 business days. Both the payer and the recipient are usually notified once the transfer is successfully completed.

What Are the Benefits of eChecks?

- Cost-effective

eChecks are often more affordable than processing credit card payments or handling paper checks, reducing operational costs for businesses. Additionally, they help companies save on expenses like postage, paper, and printing.

- Convenient

The entire process is handled electronically, eliminating the need for writing, mailing, or depositing paper checks, which saves time and effort for both payers and recipients. Businesses can also streamline recurring payments, such as payroll or subscription billing, with ease.

- Secure

eChecks incorporate encryption and authentication measures, reducing the risk of fraud and unauthorized transactions compared to traditional checks. This level of security ensures compliance with industry regulations and builds trust with customers.

- Fast processing

While paper checks may take several days to clear, eChecks typically process in 3–5 business days, offering a quicker solution for transferring funds. Faster processing allows businesses to improve cash flow and meet financial commitments more efficiently.

- Eco-friendly

By eliminating the need for paper, printing, and transportation, eChecks contribute to reducing waste and carbon emissions, supporting sustainability efforts. This aligns with the growing demand for environmentally conscious business practices.

- Automated tracking

eChecks provide digital records of transactions, allowing both parties to monitor payments easily and reducing the likelihood of errors. Automated tracking also simplifies reconciliation and reporting for accounting teams.

- Widely accepted

eChecks are compatible with most banks and payment processors, making them a versatile option for various payment scenarios. This widespread acceptance ensures businesses can cater to a broader range of clients and customers without worrying about compatibility issues.

Potential Drawbacks of eChecks

- Slower than instant payments

While eChecks are faster than paper checks, they are slower than payment methods like credit cards or instant transfers. Processing can take 3–5 business days, which may be inconvenient for businesses that require immediate access to funds.

- Potential for errors

Incorrectly entered bank account or routing numbers can result in transaction failures or delays. Resolving these issues can take time and effort, especially when large sums are involved.

- Limited availability for certain transactions

Not all merchants or businesses accept eChecks as a payment method, limiting their usability in some scenarios. This can pose challenges for businesses working with vendors or clients who prefer alternative payment systems.

- Dependence on ACH network

The ACH network’s processing schedule, including weekends and holidays, can lead to delays in fund transfers. Companies need to plan around these timing constraints to prevent potential disruptions.

- Risk of insufficient funds

eChecks are not processed in real-time, which means payers could authorize payments without sufficient funds in their accounts. This can result in bounced transactions and associated fees for both the payer and the business.

eChecks vs ACH Transfers

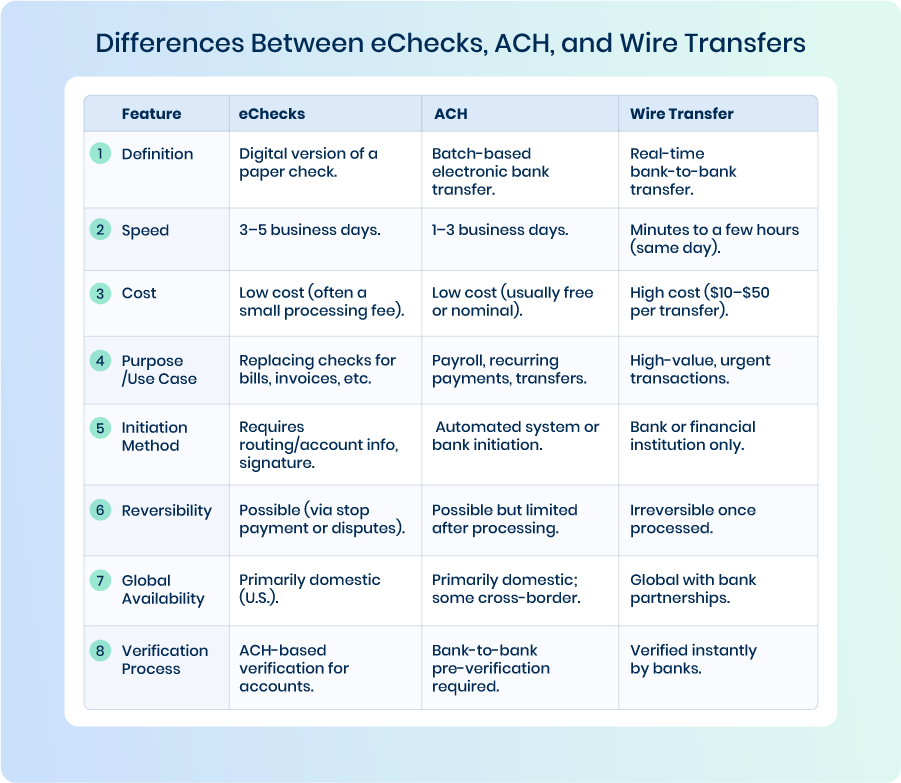

When comparing eChecks and ACH (Automated Clearing House) payments, it’s important to note that both rely on electronic transfers but differ significantly in their processes and use cases.

eChecks are simply the digital form of traditional paper checks. They require the payer to provide routing and account information, after which the transaction is processed by the ACH network in a batch-based format. ACH transactions, on the other hand, are generally used for recurring payments, direct deposits, and bill payments, offering a secure, low-cost alternative to paper checks.

ACH is more streamlined for businesses conducting routine, often large-volume transfers. ACH payments are faster than eChecks and come with a higher degree of automation, as many ACH payments can be set up for automatic withdrawals or deposits. Unlike eChecks, which require manual initiation, ACH transfers can be scheduled to run on a set frequency.

Cost is another area where ACH tends to be more efficient. ACH transfers are usually free or incur minimal fees, while eChecks often have a small processing fee. Additionally, ACH offers more robust features for managing bulk payments or payroll systems, which is why it’s widely used by businesses for these purposes.

eChecks vs Wire Transfer

Although both eChecks and wire transfers are used for electronic payments, they differ greatly in terms of speed, cost, and complexity.

Wire transfers are direct bank-to-bank transactions processed in real-time, typically within hours or even minutes if completed on the same day. They are ideal for high-value transactions or urgent payments, as they offer the fastest processing speed of all digital payment methods.

In terms of cost, wire transfers tend to be much more expensive than eChecks. While eChecks generally incur a low processing fee, wire transfers can range from $10 to $50 per transfer, depending on the bank or financial institution. This cost difference makes eChecks a more cost-effective solution for individuals and small businesses.

Wire transfers also excel in terms of security. Since they are processed in real-time and require bank verification, wire transfers are generally considered more secure and are often used for transactions involving large sums of money or international transfers. In contrast, eChecks are susceptible to delays and may require more oversight to prevent fraud.