In today’s rapidly evolving business environment, the finance function is undergoing a profound digital transformation, and the accounts payable process (AP) is no exception. With advanced technologies like artificial intelligence (AI) and machine learning (ML), the concept of autonomous accounts payable is gaining traction, revolutionizing how organizations handle their AP.

As they strive for increased agility, accuracy, and cost-effectiveness, accounts payable automation is emerging as a key driver of transformation. By embracing RPA, AI/ML, OCR, vendor self-service portals, and other advanced technologies, organizations can reshape their AP processes.

The future of efficient AP lies in automation, intelligence, and seamless integration, which will enable finance teams to focus on strategic decision-making, building supplier relationships, and engaging in value-added activities.

Simply put, we’re taking a jump from paper trails to fully autonomous AI wizards!

What Is Autonomous Accounts Payable (AP)?

Autonomous Accounts Payable (AP) is the use of advanced technologies like artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) to automate the accounts payable process. This type of technology is designed to streamline the manual and time-consuming processes involved in managing accounts payable, such as invoice processing, data entry, approvals management and payment processing.

With autonomous AP, invoices can be scanned and processed automatically using optical character recognition (OCR) technology, which reduces the need for manual data entry. The software can also match invoices to purchase orders and receipts in a process called 3-way matching, ensuring accuracy and reducing errors. Payment processing can be automated, with the system scheduling payments to suppliers on time and sending out reminders for unpaid invoices.

Autonomous AP has a major advantage of saving time and cutting costs. It eliminates repetitive tasks, freeing up the time for AP teams to work on more important and productive assignments. It also improves financial accuracy by decreasing human mistakes, preventing expensive errors for businesses.

The autonomous AP provides real-time visibility into the accounts payable process, making it easy to track invoice and payment statuses in real time, allowing AP teams to quickly resolve any issues and maintain better cash flow management. Furthermore, the use of AI and machine learning can help identify areas for improvement of processes and cost reduction.

As the technology continues to evolve, it is likely that more businesses will adopt autonomous AP to stay competitive and increase efficiency.

The Top 7 Trends That Lead to a Fully Autonomous Future of AP

The journey toward fully autonomous accounts payable involves several key trends that are shaping the future of the industry. While full autonomy may not be achieved immediately, these trends are paving the way for its eventual realization. Here are some of the top trends that are leading us to fully autonomous AP:

- Increased Adoption of AI and Machine Learning

- Advancement of Natural Language Processing

- Growing Importance of Real-Time Data

- Rise of Robotic Process Automation

- Need for Automated Regulatory Compliance

- Increased Development of Cloud Computing and SaaS Solutions

- Demand for Remote Work Solutions

1) Increased Adoption of AI and Machine Learning

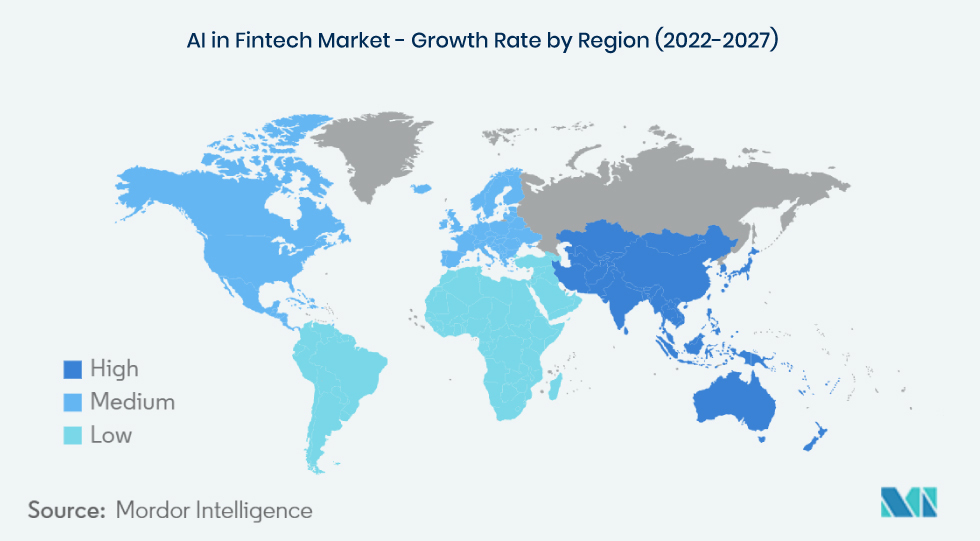

The application of Artificial Intelligence (AI) and Machine Learning (ML) in financial technology is growing rapidly. According to a report by Mordor Intelligence, the AI in the fintech market was projected to grow at a CAGR of around 23.37% between 2023 and 2026.

AI and ML technologies are becoming increasingly sophisticated and capable of handling complex accounting tasks. In accounts payable, these technologies can automate data capture from invoices, match invoices to purchase orders, and even predict future cash flow based on historical data. Advanced AI algorithms can learn from historical data, adapt to changing circumstances, and continuously improve accuracy and efficiency.

As AI and ML technologies evolve, they will be able to analyze and interpret financial data, make informed decisions, and perform autonomous accounting functions.

The adoption of AI and ML in accounts payable has led to significant improvements in financial operations, and implementing these technologies has brought businesses closer to the realization of fully autonomous accounts payable. It is expected that as the technology continues to evolve, businesses will increasingly rely on AI and ML to optimize their financial operations, resulting in more streamlined and cost-effective processes.

2) Advancement of Natural Language Processing (NLP)

Natural Language Processing is a branch of AI that focuses on understanding and interpreting human language. With advancements in NLP, accounting systems can interpret and extract relevant information from unstructured data sources like financial statements, contracts, and emails. NLP enables automation of data entry, analysis, and reporting, reducing the need for manual intervention.

NLP involves the use of artificial intelligence algorithms to understand human language and carry out various tasks such as analyzing invoices, matching payments, and even responding to inquiries. With NLP, businesses can now extract data from invoices much faster than humans can, and with higher accuracy, eliminating the need for manual data entry.

Moreover, NLP can also help businesses to detect anomalies in invoices that would otherwise be difficult for human accountants to catch. For example, with NLP, businesses can detect fraudulent invoices that might be created by scammers who are looking to exploit the accounts payable process.

The advancement of natural language processing has led to the development of fully automated accounts payable systems that are faster, more accurate, and cost-effective. The technology has enabled businesses to replace manual labor with machine intelligence, enhancing the financial management of organizations. As NLP continues to evolve, we can expect to see even more streamlined accounts payable processes that increase productivity.

3) Growing Importance of Real-Time Data

The demand for real-time data is increasing in all areas of business, including accounts payable. A survey by PYMNTS and Amalto found that 84% of firms believe that automating AP processes is key to gaining real-time data visibility. Automation can provide immediate access to data about invoice status, payments, and cash flow.

The availability of vast amounts of financial and non-financial data provides opportunities for accountants to leverage data-driven insights. Integrating data from various sources, such as banking transactions, sales records, and supply chain data, allows for a comprehensive view of financial information. Autonomous accounting systems can use big data analytics to identify patterns, detect anomalies, and generate real-time financial reports.

The benefits of real-time data are numerous. With real-time data analysis, businesses can measure their financial performance in real-time, identify trends, and optimize their financial performance accordingly. An autonomous accounts payable system further eliminates the risk of errors and delays associated with manual processing, reducing the likelihood of missed payments, late fees, or other issues that can negatively impact a business’s financial stability.

4) Rise of Robotic Process Automation (RPA)

Over the past few years, robotic process automation (RPA) technology has revolutionized routine business processes and become a game-changer for various industries.

RPA involves automating repetitive and rule-based tasks using software robots. In accounting, RPA can handle activities such as data entry, reconciliations, and routine reporting. As RPA systems become more advanced, they can integrate with AI and cognitive technologies like OCR to perform increasingly complex accounting processes autonomously.

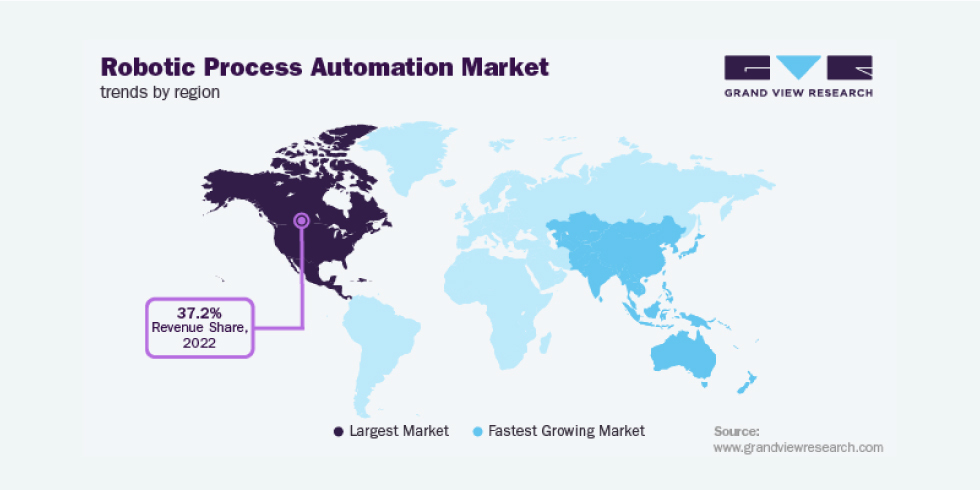

A study by Grand View Research indicated that the RPA market size was expected to reach USD 25.66B by 2027, growing at a CAGR of 40.6% from 2020.

The advanced capabilities of the latest RPA tools and technologies also offer opportunities to move towards fully autonomous accounts payable processing. With the advanced features of RPA, it is now possible to create fully automated workflows for AP tasks, such as invoice capture, validation, and posting without human intervention.

5) Need for Automated Regulatory Compliance

Regulatory requirements continue to become more complex and demanding. Companies are now required to comply with constantly evolving regulatory requirements, which can be overwhelming and difficult to navigate without the help of advanced technology.

Automation technologies can assist in ensuring regulatory compliance by interpreting and applying accounting rules, performing internal audits, and generating accurate financial reports. Autonomous accounting systems can integrate regulatory requirements into their algorithms, and reduce the risk of errors and non-compliance.

AP automation can help companies ensure compliance by providing built-in audit trails, enforcing policy rules, and maintaining up-to-date records. A report by Deloitte highlighted that automation technologies are seen as an important tool for managing risk and compliance.

6) Increased Development of Cloud Computing and SaaS Solutions

Cloud-based accounting platforms and Software-as-a-Service (SaaS) solutions provide scalability, accessibility, and collaboration capabilities. These technologies enable real-time data processing and seamless integration with other systems. Autonomous accounting systems can leverage cloud computing infrastructure to process large volumes of data, perform complex calculations, and deliver insights in real-time.

Before the rise of cloud computing and SaaS, accounts payable was manual and invoices would have to be collected, reviewed, approved, coded, and finally paid, a process that would take days, if not weeks, to complete. The manual entry of data leaves room for errors, which can be costly and time-consuming to correct.

However, with the increased development of cloud computing and SaaS solutions, the AP process has become automated and streamlined. With the use of cloud-based accounting software, businesses can set up automatic workflows that are triggered when invoices are received.

The software can capture the data from the invoice, match it to the purchase order, and automatically code it. SaaS solutions like OCR (Optical Character Recognition) can extract data from scanned documents and convert it into an electronic format that can be processed by the accounting software. Additionally, machine learning algorithms can be used to identify patterns in the data, which can lead to the identification of fraud or anomalies in the invoice.

What these advancements mean is that the AP process can now take minutes instead of days or weeks. The move towards a fully autonomous AP system is now viable, offering a time and cost-saving benefit to businesses, regardless of size or sector.

7) Demand for Remote Work Solutions

The demand for remote work solutions has been on the rise ever since the COVID-19 pandemic hit the world. Companies have been forced to adapt to the new normal by allowing their employees to work from home. This has led to a major shift in how businesses operate, with many of them embracing new technology to facilitate remote collaboration and communication.

A Gartner CFO survey showed that 74% of companies plan to shift some of their employees to remote work permanently. This trend necessitates digital and automated solutions for tasks like accounts payable, which traditionally required physical presence for handling paperwork.

Remote work solutions enable AP teams to access and collaborate on documents and processes from anywhere. Cloud-based platforms and tools allow team members to work on invoices, approvals, and payments remotely, eliminating the need for physical presence in the office. With employees working remotely, there is a greater need for processes that are independent of manual handling and intervention.

The benefits of autonomous AP are clear and will continue to play a crucial role in the future of remote work solutions. The technology is expected to evolve, with more features becoming available to further streamline the AP process. Businesses that embrace this technology and invest in automation will certainly reap significant benefits in terms of efficiency, productivity, and cost savings.

Conclusion

The future of fully autonomous accounts payable will continue to be shaped by the demand for automated and efficient solutions. We can expect further advancements in AI and automation technologies, enabling end-to-end automation of the AP process. This may include intelligent invoice routing, automated payment matching, and predictive analytics for cash flow management. Additionally, emerging technologies like blockchain may play a role in enhancing security, transparency, and efficiency in AP processes.

As organizations embrace remote work and invest in digital transformation, the future of accounts payable is likely to involve even greater levels of automation; leveraging advanced technologies and streamlined processes to achieve increased efficiency, accuracy, and cost savings.

These trends are gradually transforming the accounting landscape, moving us closer to fully autonomous accounting. However, it is important to consider the ethical implications, ensure data privacy and security, and maintain a balance between automation and human expertise. Human accountants will continue to play a vital role in overseeing autonomous systems, interpreting results, making strategic decisions, and providing professional judgment.

To learn more about the exciting advancements and implications of AI in general, these AI blogs are a great starting point.