If you’re struggling to keep up with the increasing complexity of your invoices, or you want to make your organization’s invoice management process more efficient, this guide is for you.

Businesses have long used invoices as a way to track and manage customer and supplier payments. The rise of digital commerce has created new challenges, as everyone expects to receive electronic invoices. To meet these challenges, businesses are turning to smart software to automate their invoice processing workflows.

Do you know how many steps it takes to process a single invoice? Or how long it takes when you do it manually?

Read on to find out everything you need to know about invoice processing and learn some tips and tricks that will help you get you take control of your invoice management.

What is Invoice Processing?

Invoice processing is the business process of managing invoices from receipt to payment. It’s usually done by the accounts payable department and is a key element of the procure-to-pay process as the final step of any procurement.

Invoice processing is the act of receiving, reviewing, approving, paying, registering, and storing invoices. The invoice processing starts when you receive an invoice from a supplier. That invoice must be reviewed to ensure that it’s accurate and complete, and if needed matched and compared with purchase and delivery orders. Then it needs to be approved for payment. Payment approval is signing the invoice or authorizing an electronic payment. Once the invoice is approved, it is processed through the accounting system and the supplier receives electronic payment. The process finishes with recording the transaction to the general ledger and storing the invoice for audits.

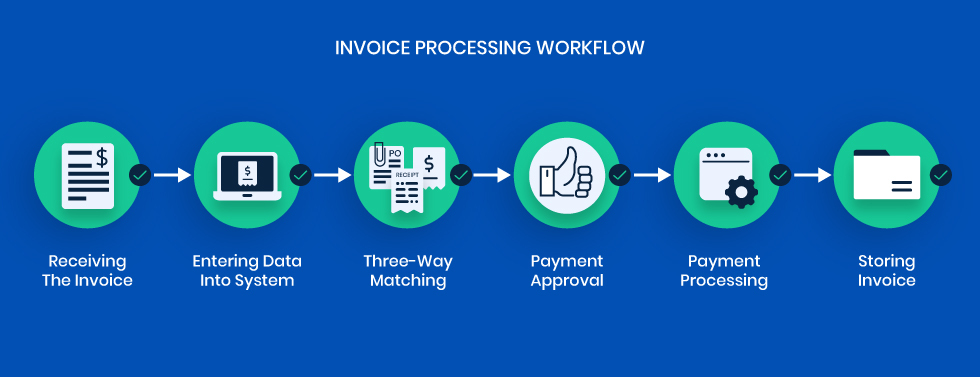

6 Steps of Invoice Processing

Step 1. Receiving The Invoice

You made an order to your supplier and they delivered the goods and the accompanying invoice. The invoice processing starts the moment when you receive the invoice, even if the goods or services that you bought are delivered on some other occasion.

You can get a supplier invoice via mail or fax, but most frequently they arrive by email.

First, you should check it to make sure that all the necessary information is included: the date, the amount owed, the account number, and the billing period. If any of this information is missing, the invoice should be sent back to the sender for clarification.

If everything is verified, the invoice can be entered into the accounting system.

Step 2. Entering Data Into System

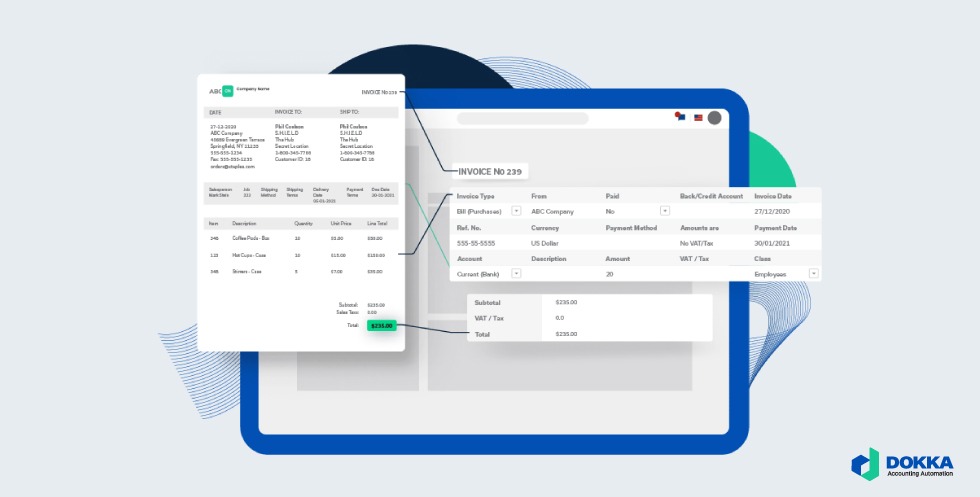

Now here’s the tricky part. If you still manage invoices manually, you need to enter all of the relevant data into the system by hand, and you have to be very careful not to make a mistake. This part of the process is the most sensitive, as it can cause many errors and further disturbances across the general legder. Manual data entry is time-consuming and very prone to errors.

That is why automated solutions use scanning and optical character recognition (OCR) technology to accurately capture data. OCR scans different formats of invoices like PDF or even image JPG formats.

Some AP processing solutions, like DOKKA, develop AI that learns how to read scans and secure fast transaction data entry with high accuracy.

Once the data is entered into the system, the original invoice is checked against other sources, like the purchase order that you made to the supplier before the invoice.

Step 3. Three-Way Matching

The 3-way matching process is a quality control measure to ensure that the three documents in an invoice paying process correspond:

- Purchase Order (PO) – the order or request for goods/services

- Delivery Receipt – the confirmation of delivery/receipt

- Invoice – the supplier’s invoice at the end of a transaction

Manually, you would take these three papers, put them in front of you and compare the details. Quantities and prices on a purchase order need to match those delivered and the ones that are listed on the invoice. Fortunately, DOKKA does this automatically, presenting you with discrepancies in seconds.

If the invoice data doesn’t correctly match the purchase order or delivery receipt, then the process stops and cannot continue until the supplier corrects the issue.

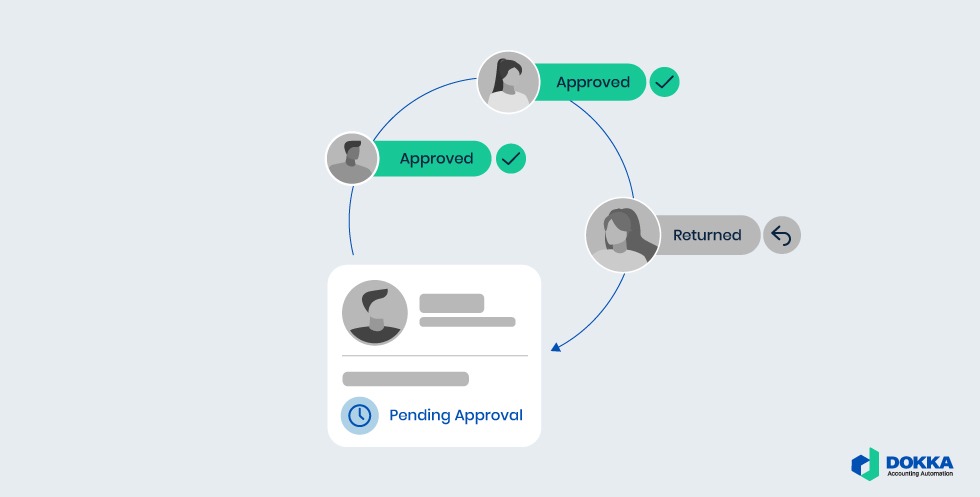

Step 4. Payment Approval

After you enter the invoice into the system and the 3-way matching is correct, the invoice is ready to be paid, so your next step is to get payment approval. Accounts Payable departments usually have authorized individual who formally approves payments.

Approval may involve the permission to release the company’s funds, write a check or initiate an electronic funds transfer, or authorize a supplier to charge the company’s credit card.

With an AP processing solution like DOKKA, the approval process is fast and effective, and it happens in just a few clicks.

Step 5. Payment Processing

After all the approvals, the invoice is paid on the terms that are agreed upon with the supplier. It could be a wire transfer, credit card charge, or any other method that was determined before the conditions and terms took place.

In a manual process, you would send payment details to the adequate person who is in charge to do the transaction. Depending on the internal company structure, payments are usually the responsibility of AP departments, or in some cases of the purchasing department that issued the purchase order.

In automated solutions, workflows are predefined and the payment process happens when the system gets all the approvals.

Step 6. Storing The Invoice

The only thing left is to record the transaction into the general ledger and store the invoice properly to keep it organized and accessible for audits.

There are a few different ways to store invoices, but the most important thing is to ensure that they are stored in a way that makes them easy to find and retrieve. One option is to create a dedicated folder for each supplier, which can help to keep invoices organized and easy to find. Another option is to have an automated solution that takes care of that for you.

Automating Invoice Processing

Invoice processing is a critical, but often tedious task for businesses.

When organizations need to process hundreds of invoices a month, it can become extremely time and resource intensive.

Fortunately, there are now many AP software solutions that can automate this process, and save a lot of time and money. The purpose of invoice automation is to address issues like inefficiencies and inaccuracies in the manual accounts payable.

For example, AP software can automatically capture data from invoices, populate fields in the accounting software, and process payments. It helps to ensure accuracy, avoid late payments and even to take advantage of early payment discounts and improve cash flow. With so many benefits, it’s no wonder that more and more businesses are automating their invoice processing.

But in case you still have some doubts, here is an example of a situation that can easily happen in practice when invoices are handled manually:

You receive an invoice in your email inbox. It takes you around 5 minutes to print it out and retype the data into the accounting system. You spend another 3 minutes trying to find where the PO for that invoice is stored to check if the numbers on the PO and the invoice match. Let’s say they do. Now you know that the data is correct and you just need the approval to process the payment. You send an email to your next-door colleague John, who replies that you need to contact Mary from the 2nd floor because she manages that supplier. An hour later you get a response from Mary, saying that you have her approval, but you also need Stacy’s and when you have both, send it to Daniel to make a payment.

Sounds familiar?

Benefits of AP Automation

Time-Savings

With AP automation most of manual tasks are eliminated, which frees up time for employees to focus on high-value tasks that drive business growth.

Automation speeds up invoice processing because invoices can be directly uploaded and matched to corresponding documents in just a few clicks. It also streamlines communication between parties, allowing for faster approval and payment processing. All of this results in significant time-savings, improved efficiency, and productivity within the organization.

Cost-Savings

Automating AP processes can significantly reduce expenses and costs for your company. Manual data entry, document printing and mailing, and reconciliation take up valuable time and resources. With automation, these tasks can be streamlined and completed faster and more efficiently.

Additionally, automating invoice processing can help catch errors and duplicate payments, and it can detect early discounts and savings opportunities, leading to decreased spending and cost-savings.

Better Accuracy

Data entry is not just faster with automation, but more accurate as well. Human errors happen all the time with manual data entry, and it can cause major disturbances in company’s accounting books.

To solve this problem, AP automation solutions use OCR (optical character recognition) technology that precisely reads data from the invoices and automatically uploads it into the system. Manual check of data is still needed after the upload to confirm that all data is correctly recognized by the software, but OCR speeds up the entire data entry process and hardly ever makes character recognition mistake.

Audit Readiness

With AP automation documents are centralized and easily accessible if needed for audit.

Documents like purchase order, delivery receipt and invoice can be interlinked together with all the relevant communication regarding that transaction. The entire accounts payable workflow is recorded in the system, so every step of the process is visible and traceable. With organized and efficient system, audits are less stressful for AP teams.

Better Control

AP automation helps to keep all your workflows at your fingertips. Providing real-time insights into payment status, supplier relationships, and spending patterns can greatly enhance visibility and control for a business. With a centralized system for managing invoices and payments, there is less room for error or missed deadlines. Finance leaders can track spending and monitor cash flow in real time. Enhanced visibility also helps with decision making, as all financial information is easily accessible in one place.

Invoice Processing FAQ

What is Invoice Processing Software?

Invoice processing software is a type of business software that helps companies automate the process of creating, sending, and managing invoices. It typically includes features for data entry, invoicing, payments, and reporting. Invoice processing software can save businesses time and money by reducing the need for manual work and speeding up processes.

With automated invoice processing or AP software, the accounts payable department doesn’t have to dedicate as much time and resources, giving accounting teams a chance to focus on higher-priority tasks.

Some key features of automated invoice processing software include standardized coding, automated approval workflows, and dashboards that display which suppliers have been paid, what invoices are scheduled for payment, and which ones still require approval.

What Is the Average Invoice Processing Time?

It can be difficult to pin down an exact answer because there are a lot of factors that can affect how long it takes to process an invoice.

For example, the number of invoices that the company receives daily can play a role in how quickly invoices are processed. The type of software for managing invoices also impacts processing times.

On average, it takes at least 5-10 minutes to process a single invoice manually, assuming there are no setbacks in approvals. With the AP solution, the entire processing of the invoice can be done in 7 seconds and just a few clicks.

What To Check Before Processing an Invoice?

- The Supplier’s Information (name, company name, email address, phone number)

- The Purchase Order Number

- Invoice Number

- Quantities

- Description Of Delivered Goods/Services

- Pricing

- Payment Terms (due date and payment method)

Tips For More Effective Invoice Processing

You already know it’s important to efficiently process invoices to keep things in order and maintain healthy cash flow and relationships with suppliers. To make your processing invoices even more efficient, here are some extra tips:

- Develop a standardized system for organizing and tracking invoices. This can include assigning each invoice a unique identifier and setting up a system for recording payments.

- Set clear guidelines and timelines for approving invoices before they are paid, like requiring multiple levels of approval or specific time frames for review.

- Create efficient processes for entering invoices into your financial system and making timely payments to suppliers. This may involve automating certain steps or utilizing software to streamline the process.

All of this can be achieved with cloud-based invoice automation tools such as DOKKA.