Any business, no matter how big or small, needs someone to keep an eye on the finances.

For many small companies, a bookkeeper will do the job, but what if your company outgrows the scope of bookkeeping and needs a dedicated person to manage the finances? That’s where the roles of Chief Financial Officers (CFOs) or Finance Controllers come into play.

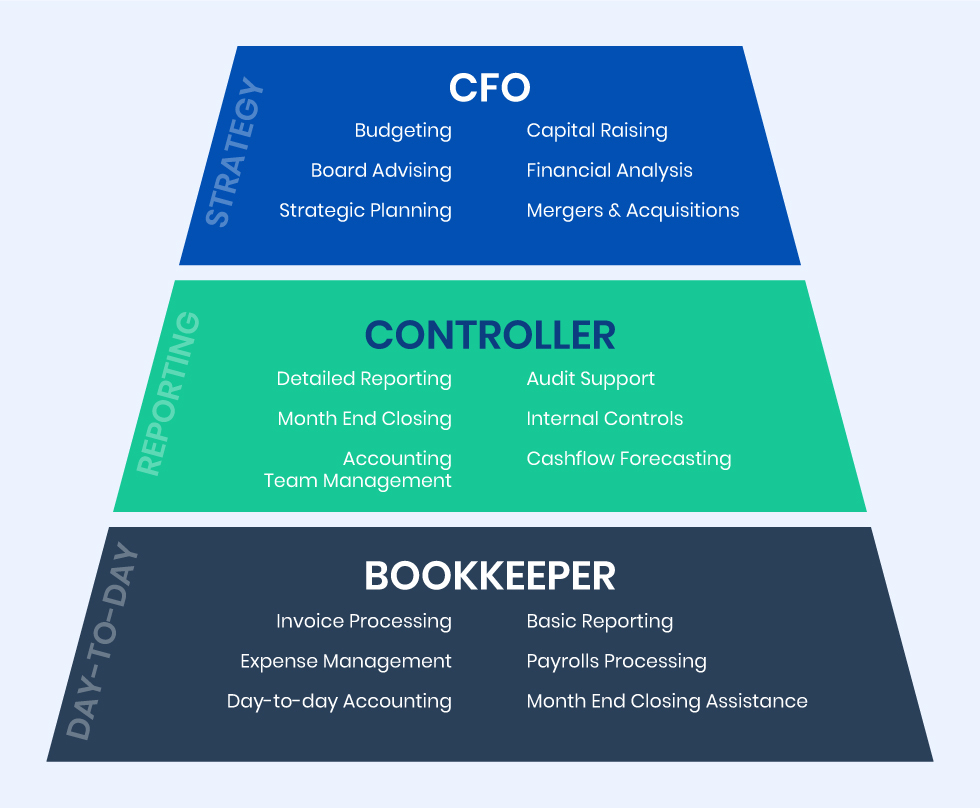

CFOs and financial controllers may have overlapping responsibilities within a company, but they each have specific roles that differ from one another. This can be confusing for business owners who are trying to figure out which position they need to fill.

What are the responsibilities of CFOs and financial controllers? How do these roles differ? What skills do they need to manage the role?

Lots of questions to go through so we better start right off.

What Is a CFO?

The CFO or Chief Financial Officer is the senior executive responsible for managing the financial affairs of a company.

The CFO’s primary responsibilities include developing and implementing financial strategies, overseeing financial planning and reporting, and managing the company’s investment activities. The CFO is also typically responsible for managing the company’s treasury function, overseeing tax compliance and risk management.

As a member of the senior management team, the CFO reports directly to the CEO.

CFO’s main responsibilities:

- Acting as the primary financial advisor for the company

- Advising the board of directors or CEO on financial matters

- Managing finance controllers and the finance department

- Developing financial strategies

- Developing a plan to increase revenue

- Managing debt, equity, and investments

- Supervising security, risk management, insurance, and various types of fraud mitigation

- Implementing technology solutions for accounting automation

What is a Financial Controller?

Financial controller is a senior financial officer who supervises the financial department of a company and is responsible for its financial accuracy, performance, and compliance.

The financial controller position is typically found in larger organizations and reports directly to the CFO.

Financial controllers are responsible for the day-to-day management of the finance department and may also be involved in strategic planning, forecasting, and budgeting. They ensure that the organization’s financial statements are accurate and comply with applicable laws and regulations.

Financial controllers also develop and implement policies and procedures to safeguard the organization’s assets and minimize risk. They often work closely with auditors to ensure that the organization’s financial statements are free of material misstatements.

Main tasks of financial controllers:

- Managing the accounting department

- Managing accounts payable and receivable

- Processing payrolls

- Ensuring that invoices are accurate and approved for payments

- Managing financial accounts

- Managing collections and debts

- Managing external audits

- External financial reporting (financial statements, tax statements, and tax filings)

- Conducting internal financial analyses and

- Preparing reports for CFO

10 Key Differences Between Financial Controller and CFO

- Education

- Responsibilities

- Oversight

- Reporting

- Focus

- Skills

- Experience

- Salary

- Job Outlook

- Career path

1) Education

Financial controllers typically hold a bachelor’s degree in accounting or finance and bring several years of professional experience to the role. Additional certifications, such as Certified Public Accountant (CPA), can significantly enhance their career prospects and are often considered a strong asset.

CFOs, while not confined to a specific educational path, generally share a similar foundation with a bachelor’s degree in finance or accounting. Many CFOs, however, pursue advanced education, such as an MBA or other graduate-level qualifications, to develop the strategic and leadership skills essential for managing complex financial operations.

2) Responsibilities

CFOs bear the responsibility of shaping the company’s financial vision and direction, focusing on high-level strategies to drive long-term growth. They play a pivotal role in negotiating and managing major financial deals, including mergers, acquisitions, investments, and securing loans.

Financial controllers, on the other hand, are deeply involved in the operational side of finance, ensuring accurate bookkeeping, accounting, and compliance with financial regulations. They prepare detailed financial reports, oversee budgets, and provide the CFO with critical data for informed strategic decision-making. Together, these roles safeguard both the short-term and long-term financial health of the company.

3) Oversight

The financial controller plays a pivotal role in managing the accounting department, ensuring smooth and efficient operations. Their primary focus is on achieving short-term objectives, such as closing the books at the end of each month or year, preparing financial statements, and meeting regulatory deadlines.

In contrast, the CFO has a broader scope, combining immediate operational oversight with the development of long-term financial strategies. Beyond managing finances, the CFO often collaborates with other executives to align financial goals with the company’s overall mission and vision. While the financial controller ensures precision and compliance today, the CFO charts the course for the future.

4) Reporting

CFOs hold one of the highest positions within an organization, typically reporting directly to the CEO or Board of Directors. This reporting structure highlights their strategic role in shaping the company’s financial direction and influencing major decisions.

Financial controllers, on the other hand, usually report to the CFO, providing detailed data such as accounting summaries and key performance metrics to support the CFO’s strategic planning. This distinction in reporting underscores their differing focuses—controllers prioritize operational accuracy, while CFOs emphasize strategic influence.

5) Focus

Financial controllers focus on maintaining accurate historical records, ensuring regulatory compliance, and managing the intricate details of financial operations. Their attention to detail ensures that past performance is thoroughly documented, offering a clear and precise picture of the company’s financial health.

While CFOs also depend on historical data, their primary focus is forward-looking. They forecast future trends, develop strategies for growth, and analyze market conditions to identify risks and opportunities that could shape the company’s trajectory. This dual approach enables CFOs to drive innovation while maintaining stability.

6) Skills

Financial controllers excel in analytical and problem-solving skills, often working under tight deadlines to deliver accurate financial reports and ensure compliance. Their expertise includes proficiency in accounting systems such as ERP or AP automation software, a strong understanding of regulatory standards, and the ability to resolve discrepancies efficiently.

CFOs build on these competencies by adding exceptional communication and leadership skills to their repertoire. They must articulate complex financial concepts to stakeholders, inspire their teams, and collaborate effectively with other executives. This blend of technical expertise and interpersonal ability enables CFOs to influence and drive the company’s success at the highest levels.

7) Experience

Most financial controllers have 5-10 years of experience in accounting, often advancing through roles such as senior accountant or accounting manager before assuming their position. This experience equips them to handle the operational challenges of financial management with confidence.

CFOs typically have 10-15 years of experience, with backgrounds that include leadership in finance, strategic planning, and possibly roles across different industries. Their depth of experience enables them to navigate the complexities of high-level decision-making, risk management, and long-term financial planning.

8) Salary

Compensation reflects the differences in responsibilities and experience between these roles. Financial controllers earn competitive salaries, typically aligned with their operational expertise and the level of responsibility they hold within the accounting department.

In contrast, CFOs generally command significantly higher salaries due to their strategic influence and the critical nature of their role in the company’s overall success. Additional benefits, such as bonuses and equity, are often included in CFO compensation packages, further reflecting their impact on company growth.

9) Job Outlook

The demand for financial controllers remains robust, as their role is essential in ensuring accurate financial management across businesses of all sizes. Candidates with strong educational backgrounds, relevant experience, and certifications such as CPA or CMA are highly sought after.

CFO roles, though less abundant, are critical for organizations aiming for sustained growth and strong financial leadership. Companies approach CFO hiring with great care, seeking individuals who demonstrate both exceptional financial expertise and visionary leadership. Some companies, however, may not require a full-time CFO and opt to hire fractional CFOs instead. Both roles offer promising opportunities, though the path to becoming a CFO generally involves greater scrutiny and higher expectations.

10) Career Path

A financial controller’s career path often leads to becoming a CFO, as their experience managing financial operations provides a strong foundation for assuming strategic responsibilities. Controllers aspiring to advance must develop broader skills, such as leadership and strategic planning, to prepare for this transition.

For CFOs, the next step might involve becoming a CEO, leveraging their financial expertise to lead an entire organization. Alternatively, CFOs may move to larger companies or more complex organizations, taking on even greater challenges. These career trajectories highlight the progressive nature of finance roles and the expanding scope of influence at each stage.

CFO vs Controller FAQ

When to hire a CFO?

For small businesses, the question of when to hire a CFO can be a difficult one. A CFO can provide invaluable insights into financial planning and management, but also hiring a CFO can be a significant expense, and many small businesses lack the resources to support an additional senior executive.

Ultimately, the decision of when to hire a CFO depends on the specific needs of the business. If the business is experiencing rapid growth or working with complex financial products, then a CFO can be a valuable asset. But if the business is relatively small and simple, then it may be best to wait until the company is more established before hiring a full-time CFO. If you’re not sure whether your business is ready to take on a CFO, here are a few things to consider.

First, take a look at your revenue. If your business is still in the startup phase, it may not be generating enough income to justify the expense of hiring a CFO. However, if you’re seeing steady growth and your revenue is starting to plateau, bringing on a CFO can help you take things to the next level.

Another thing to consider is the complexity of your finances. If you have multiple income streams and are starting to see some serious cash flow, it’s time to start thinking about hiring a CFO. They can help you develop budgets and forecasting models, as well as manage investments and debt.

Finally, ask yourself whether you have the time to focus on strategic planning. A CFO can free up your time by handling all the financial details of running your business, so you can focus on growing the company.

When to hire a Financial Controller?

If you are thinking about hiring a financial controller, there are a few things to keep in mind.

First, consider the size of your organization and the complexity of your financial affairs. In general, larger organizations with more complex financial needs will benefit from having a dedicated financial controller on staff.

It is important to consider the stage of development your company is in. If you are a startup or early-stage company, you may not need a full-time financial controller; however, as your business grows and becomes more complex, it may be time to consider hiring one.

Finally, be sure to verify that the candidate you are considering has the necessary skills and experience to effectively manage your finances.

With these factors in mind, you will be well on your way to finding the right financial controller for your organization.