The financial close process is at the heart of every organization’s accounting function. It’s a crucial operation where companies consolidate financial data, reconcile accounts, and prepare statements that drive business decisions, support compliance filings, and inform investor reporting.

For many finance teams, however, the close remains a labor-intensive, manual effort plagued by tight deadlines, human error, and frequent burnout.

As organizations grow and compliance demands become more complex, traditional closing methods start to show their cracks. Delays in reporting, overlooked mistakes, and a lack of real-time insight can all introduce significant risk.

That’s why a growing number of companies are turning to financial close management software—a modern solution built to streamline the process, remove bottlenecks, and elevate the finance function from reactive number-crunching to strategic leadership.

In this blog post, we’ll explore the most common challenges finance teams face during the close and highlight how automation helps solve them.

![]()

What Is Financial Close Automation?

![]()

Financial close automation refers to the use of specialized software to streamline and automate the complex, time-sensitive tasks involved in the period-end financial close process. It covers month-end, quarter-end, and year-end activities such as account reconciliations, journal entries, task management, and compliance documentation.

In the past, these tasks were performed manually using spreadsheets and email, often leading to inefficiencies and a higher risk of error.

Today, cloud-based automation platforms are transforming how finance teams work. Through direct integration with ERP systems and other financial tools, they provide a centralized environment where all close-related data and workflows are standardized, transparent, and easily trackable in real time.

Financial close automation software helps orchestrate the entire close process — from assigning tasks and collecting sign-offs to performing variance analysis and generating final reports — all with minimal manual input.

![]()

Challenges in the Traditional Financial Close (And How Automation Solves Them)

![]()

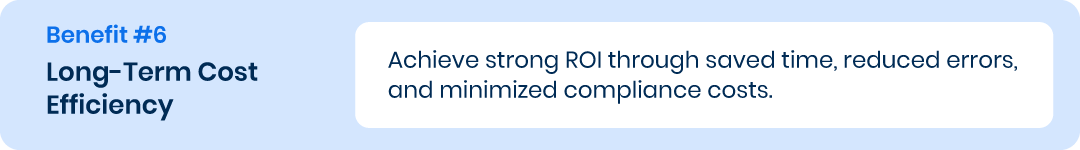

- Manual Processes and Time Delays

- High Risk of Errors and Inconsistencies

- Lack of Real-Time Visibility

- Collaboration Breakdowns Across Teams

- Scaling Challenges with Business Growth

![]()

![]()

- Manual Processes and Time Delays

Financial close cycles rely heavily on spreadsheets, emails, and manual workflows. Teams often work long hours, stretching the process to 15 days or more with minimal time left for meaningful analysis.

- High Risk of Errors and Inconsistencies

Spreadsheets and manual data entry are vulnerable to mistakes—broken formulas, incorrect numbers, and mismatched data are all too common. These issues can result in inaccurate reporting, audit complications, and eroded trust.

- Lack of Real-Time Visibility

When financial close steps are buried in email threads or offline files, finance leaders are often left in the dark about progress. This lack of visibility creates bottlenecks and forces reliance on a handful of individuals to chase updates.

- Collaboration Breakdowns Across Teams

Distributed or cross-functional teams often struggle with coordination when processes are manual. Communication becomes fragmented, steps get missed, and frustrations grow.

Scaling Challenges with Business Growth

Scaling Challenges with Business Growth

Growth introduces new entities, currencies, and compliance requirements that can overwhelm manual systems. As complexity rises, so does the strain on staff and processes.

![]()

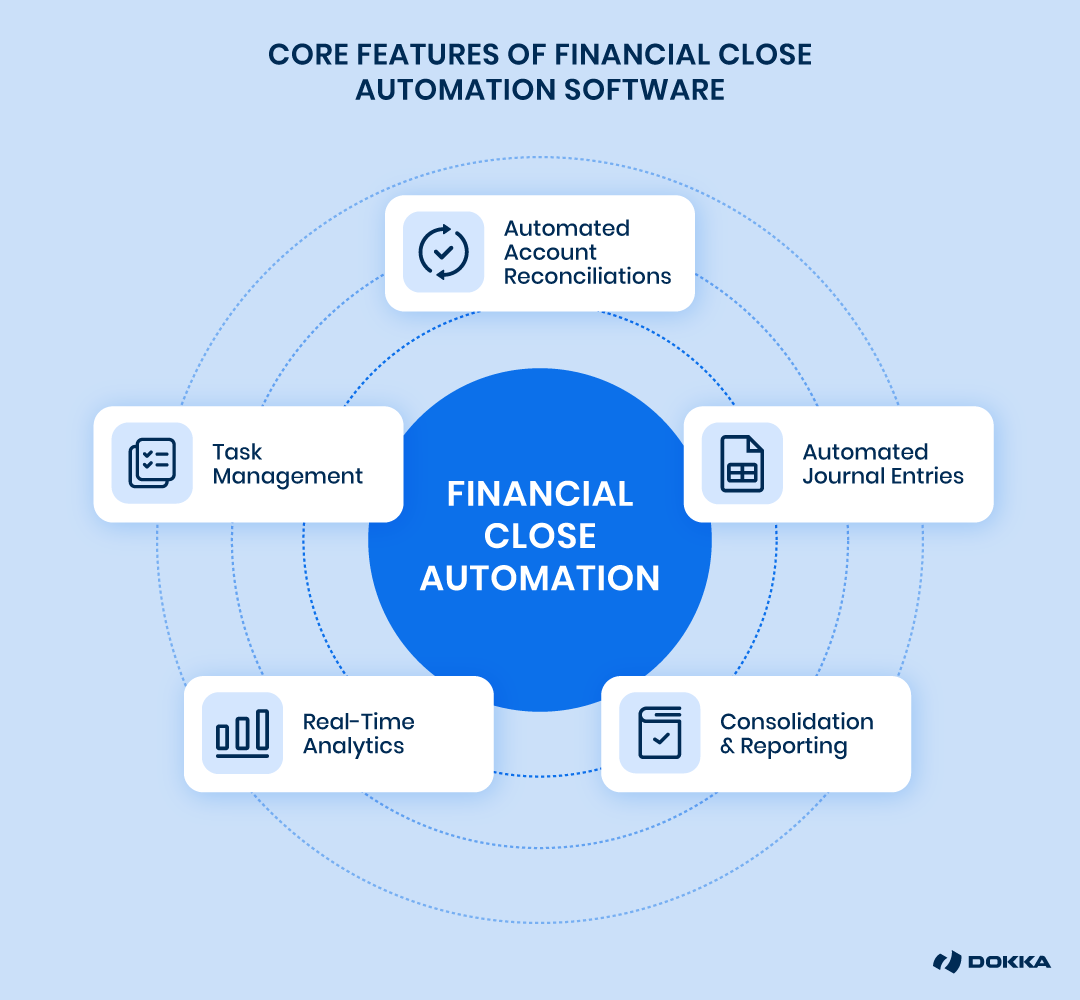

Core Features of Financial Close Automation Software

![]()

- Automated Account Reconciliations

- Task Management

- Automated Journal Entries

- Real-Time Analytics

- Consolidation & Reporting

![]()

![]()

Automated Account Reconciliations

A standout capability of financial close automation software is its power to reconcile accounts automatically.

Transactions from various sources, such as bank feeds, sub-ledgers, and intercompany accounts, are intelligently matched, with discrepancies flagged for review. What once took days or weeks manually can now be completed with greater speed and consistency.

Many platforms utilize advanced algorithms and customizable rules to auto-certify low-risk reconciliations, allowing finance teams to concentrate on exceptions that genuinely require attention.

As a result, organizations can process thousands of reconciliations in a fraction of the time typically required with spreadsheets.

![]()

Task Management

The close process often spans numerous tasks, departments, and time zones.

Automation tools simplify this complexity through centralized task management, where responsibilities, deadlines, and dependencies are clearly outlined and continuously tracked.

Manual trackers are replaced with digital checklists, offering real-time visibility into progress. Built-in notifications and escalation paths help ensure timely completion.

A more structured approach enhances accountability, improves cross-team collaboration, and establishes a comprehensive audit trail critical for both compliance and process improvement.

![]()

Automated Journal Entries

Manual journal entry processes tend to be repetitive, tedious and error-prone.

Automation addresses these challenges through predefined rules that generate recurring and adjusting entries automatically—from accruals and amortizations to allocations and intercompany transactions.

Journal entries can be triggered by events, schedules, or threshold conditions, significantly reducing the need for manual input.

Integrated approval workflows, validations, and audit trails help maintain accuracy and compliance with accounting standards. As a result, month-end processes move faster, errors are reduced, and teams have more time.

![]()

Real-Time Analytics

Understanding the status of a manual close can be time-consuming and unclear.

Automation platforms solve this with intuitive dashboards that show real-time updates on task completion, bottlenecks, and overall progress.

Finance leaders can quickly spot areas that need attention, while drill-down capabilities provide access to detailed data. Increased transparency supports better decision-making and more efficient resource allocation.

![]()

Consolidation & Reporting

Financial consolidation across multiple entities, systems, and currencies often ranks among the most complex parts of the close process.

Automation simplifies the workload by aggregating data in real time, applying consolidation rules, and automatically eliminating intercompany transactions.

Robust reporting tools deliver standardized financial statements, dashboards, and tailored reports aligned with GAAP, IFRS, or internal performance metrics. Adjustments, eliminations, and foreign currency translations are processed seamlessly, ensuring consistency and accuracy across the board.

![]()

Top 8 Benefits of Financial Close Automation

![]()

- Faster Close Cycles

- Higher Accuracy & Audit Readiness

- Stronger Compliance & Controls

- Real-Time Insight & Strategic Focus

- Better Morale & Talent Retention

- Long-Term Cost Efficiency

- Easy Scalability Across Entities

- Ongoing Process Optimization

1) Faster Close Cycles

![]()

![]()

![]()

![]()

Financial close automation drastically shortens the time required to finalize books. Eliminating repetitive tasks such as manual reconciliations, data imports, and status tracking allows finance teams to focus on analysis rather than administration. Automation reduces dependencies on spreadsheets and email threads, standardizing processes across departments and geographies.

![]()

2) Higher Accuracy & Audit Readiness

![]()

Human error represents one of the biggest risks in finance. Mistyped numbers, broken spreadsheet links, or duplicated entries can create costly mistakes. Financial close automation mitigates these risks through rule-based validations, ensuring data integrity and enforcing consistent processes.

![]()

3) Stronger Compliance & Controls

![]()

![]()

![]()

Compliance remains non-negotiable in today’s regulatory landscape. Whether following SOX, IFRS, ASC 606, or industry-specific requirements, finance teams must demonstrate that controls are in place and properly followed.

![]()

4) Real-Time Insight & Strategic Focus

![]()

![]()

Finance professionals spend less time gathering and cleaning data, allowing them to concentrate on interpreting it. Real-time dashboards and reporting enable leadership to monitor financial health daily, rather than only at month-end.

![]()

5) Better Morale & Talent Retention

![]()

The traditional month-end close is notorious for long hours, repetitive work, and intense stress. Over time, these factors contribute to burnout and turnover—especially among high-potential employees seeking more fulfilling roles.

![]()

6) Long-Term Cost Efficiency

![]()

Although implementing financial close automation requires upfront investment, the return on investment proves substantial. Time saved, errors avoided, audits simplified, and reduced compliance costs all contribute to tangible bottom-line benefits.

![]()

7) Easy Scalability Across Entities

![]()

![]()

As companies grow through acquisitions, global expansion, or new product lines, financial consolidation complexity increases exponentially. Automation helps prevent process chaos and risk during scaling.

![]()

8) Ongoing Process Optimization

![]()

![]()

Many automation platforms include embedded analytics, benchmarking, and performance tracking tools, enabling finance teams to continuously optimize processes by identifying delays, inefficiencies, or control gaps.

How DOKKA Close can help with automating your financial close process

DOKKA is an all-in-one platform for efficient close management, offering automated reconciliations, adjusting journal entries and seamless integrations into leading ERP systems. Designed to support businesses of all sizes, the scalable platform simplifies complex consolidations and drives ongoing process improvements.

Interested in how it could work for your specific use case? Book a demo with our team and discover how automation can elevate your finance function.