For many accountants, the accounting cycle is an integral part of their professional lives—a routine they follow regularly. It’s a repetitive yet essential process.

The accounting cycle provides a structured framework for tracking, summarizing, and reporting financial data. Whether performed manually or using accounting automation software, it remains a cornerstone of sound financial management.

Does everyone approach it the same way? Not exactly, but most adhere to similar steps and guidelines.

In this article, we’ll break down the key steps of the accounting cycle, offering a comprehensive overview of each stage. By the end, you’ll have a clear understanding of how financial data flows within an organization and the importance of each step in the process.

What Is the Accounting Cycle?

Before diving into its steps, let’s first define the accounting cycle.

The accounting cycle is a systematic, repetitive process that companies use to record, classify, summarize, and report financial transactions within a specific accounting period—typically a month, quarter, or year. It serves as the backbone of financial planning and management, providing a structured framework to ensure transparency, accuracy, and adherence to accounting principles.

At its core, the accounting cycle comprises a series of interdependent steps, each building on the one before it. These steps guide accountants in tracking and processing financial data, culminating in the preparation of key financial statements.

More than just a technical routine, the accounting cycle is a vital tool that underpins sound financial practices. It transforms raw financial data into meaningful insights, enabling accounting teams to navigate complex business decisions, ensure regulatory compliance, and effectively communicate financial information to stakeholders.

What Are the 8 Steps in the Accounting Cycle?

The number of steps in the accounting cycle may vary slightly depending on the source. However, there are generally eight main steps that most organizations follow. Some sources may include additional steps, such as preparing and recording reversing entries, but these are not always considered part of the core cycle.

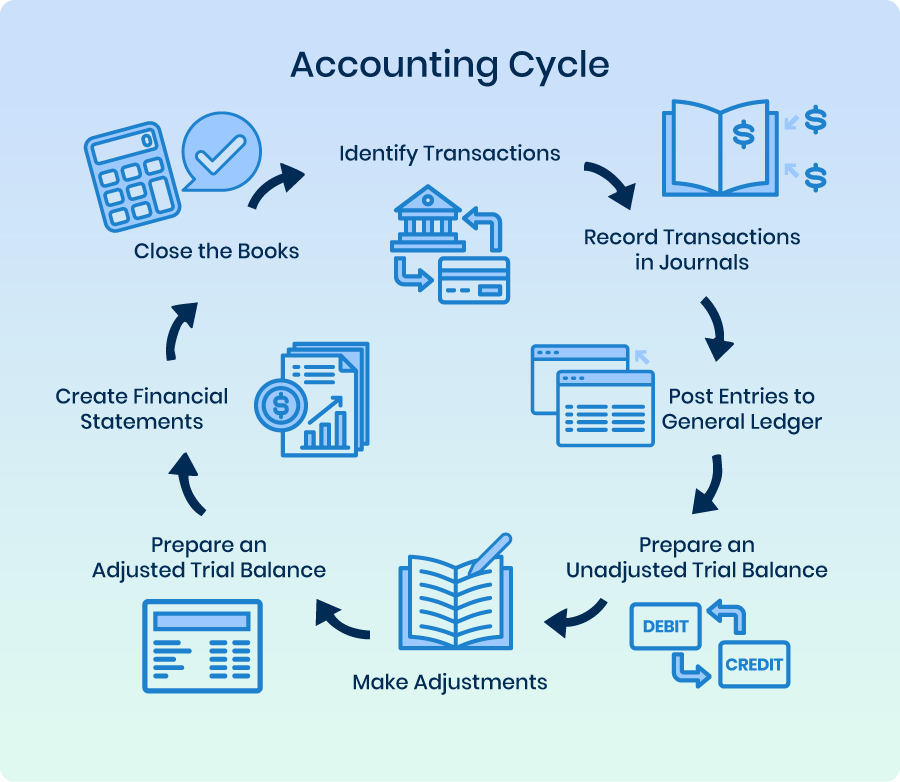

Here are the 8 main steps in the accounting cycle:

- Identify Transactions

- Record Transactions in Journals

- Post Entries to General Ledger

- Prepare an Unadjusted Trial Balance

- Make Adjustments

- Prepare an Adjusted Trial Balance

- Create Financial Statements

- Close the Books

Step 1: Identify Transactions

The first step in the accounting cycle is to identify and gather all relevant financial transactions that have occurred within a specific period.

Where to start? Begin by reviewing any cash flows, sales, purchases, expenses, or other financial activities that took place during that time. These transactions can be documented using various sources, such as invoices, receipts, bank statements, and credit card statements.

Once the transactions are identified, they must be analyzed to determine their nature. For example, is it an asset, liability, equity, revenue, or expense transaction? Proper identification ensures that every financial activity is accurately categorized, laying the groundwork for precise record-keeping.

Step 2: Record Transactions in Journals

Once a transaction has been identified, it must be recorded in the general journal. This process, known as journalizing, ensures that no transaction is overlooked. Journal entries provide a clear and chronological record of all transactions, which is essential for tracking financial activities and maintaining transparency.

Each journal entry typically includes:

- The transaction date.

- The accounts affected.

- The amounts debited and credited.

- A brief explanation or narration.

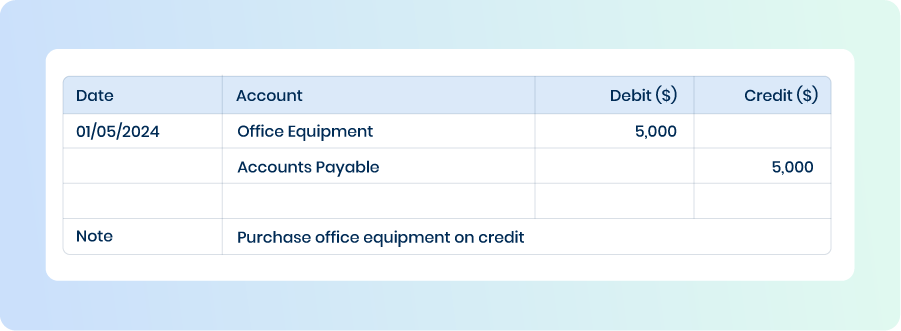

For example, if a business purchases $5,000 worth of office equipment on credit, the journal entry might look like this:

Step 3: Post Entries to General Ledger

After transactions are recorded in the journal, the next step is to transfer the details to the general ledger.

The general ledger organizes transactions by account, such as cash, accounts receivable, or sales revenue, providing a comprehensive overview of all activity within each account. It serves as the primary reference for preparing financial statements, presenting data in a way that simplifies the analysis of the company’s financial position.

Posting involves transferring the debit and credit amounts from the journal to the appropriate ledger accounts.

For example, if $1,000 is received in cash from a customer, the cash account in the ledger is increased by $1,000, while the accounts receivable account is decreased by the same amount.

Step 4: Prepare an Unadjusted Trial Balance

Once transactions are posted to the ledger, the next step is to prepare an unadjusted trial balance. This step serves as a preliminary check of the accounting records to ensure accuracy before making any further adjustments.

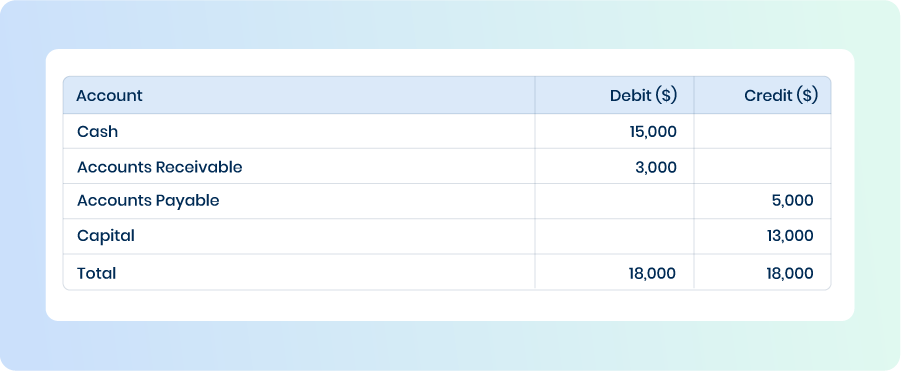

The unadjusted trial balance lists all ledger accounts and their balances at a specific point in time, with separate columns for debits and credits. It also confirms that the accounting equation (Assets = Liabilities + Equity) is balanced. If the total debits and credits are not equal, it indicates an error in the journal or ledger that must be identified and corrected.

Example of a simple trial balance:

Step 5: Make Adjustments

At the end of the accounting period, adjusting entries are made to account for revenues and expenses that may not have been recorded yet. These entries ensure that the financial statements provide an accurate and fair view of the company’s financial performance and comply with the accrual basis of accounting—which recognizes revenues when they are earned and expenses when they are incurred, regardless of cash flow.

Common types of adjusting entries:

- Accrued Expenses: Expenses incurred but not yet paid (unpaid wages).

- Accrued Revenues: Revenues earned but not yet received (services provided but not billed).

- Prepaid Expenses: Expenses paid in advance that need to be partially allocated (rent or insurance).

- Depreciation: Allocation of the cost of assets over their useful life.

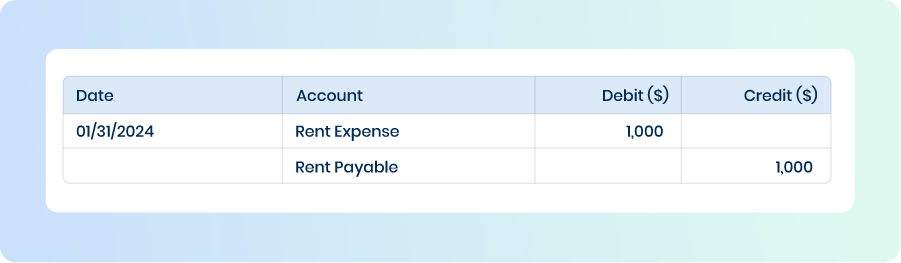

For example, if $1,000 of office rent has been incurred but not yet paid, the adjusting entry would be:

Step 6: Prepare an Adjusted Trial Balance

After making adjustments, the adjusted trial balance is prepared to ensure that all ledger accounts are up-to-date and accurately reflect the company’s financial position. This step serves as a final check before creating the financial statements.

The adjusted trial balance includes all adjusting journal entries and reflects the actual balances of each account after the adjustments have been made.

Step 7: Create Financial Statements

With the adjusted trial balance, finance teams can now prepare financial statements, the most critical outputs of the accounting cycle. These include:

- Income Statement: Reports revenues, expenses, and net income or loss.

- Balance Sheet: Shows the company’s assets, liabilities, and equity.

- Cash Flow Statement: Tracks cash inflows and outflows.

- Statement of Retained Earnings: Summarizes changes in retained earnings.

For example, if the income statement shows total revenues of $50,000 and total expenses of $30,000, the net income is $20,000. This net income will then flow into the balance sheet under retained earnings.

Step 8: Close the Books

The closing process resets temporary accounts (revenues, expenses, and dividends) to zero by transferring their balances to permanent accounts, such as retained earnings. Closing entries prepare the books for the next period, ensuring there is no overlap between accounting periods and that the new period starts fresh.

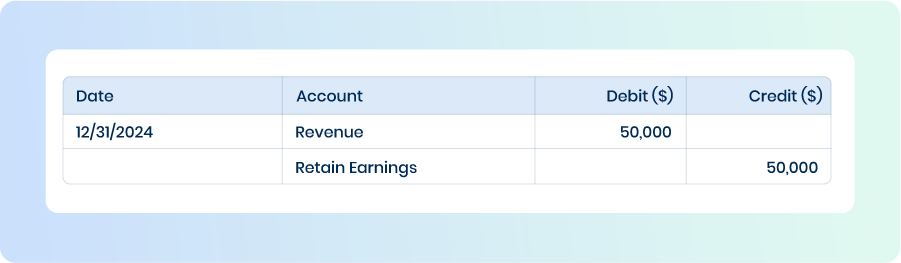

For example, if the revenue account shows $50,000 at year-end, the closing entry would be:

The final step involves rolling over balances from permanent accounts into the new accounting period. With temporary accounts cleared, the accounting cycle begins anew, continuing the systematic recording and reporting of financial transactions.

Accounting Cycle: FAQ

- Why is the accounting cycle important?

The accounting cycle ensures the accuracy and consistency of a company’s financial statements. By following these suggested steps, finance teams can identify errors or discrepancies in their records, making it easier to correct them before they become significant issues.

- Accounting process vs. accounting cycle: what’s the difference?

The accounting process refers to the overall activities and procedures involved in maintaining an organization’s financial records, while the accounting cycle specifically refers to the recurring steps taken within a specific accounting period.

- Is the accounting cycle different for small businesses vs. larger organizations?

While the basic principles of the accounting cycle remain the same, smaller businesses may have a simpler version compared to large corporations, which may have more complex processes and additional steps.

- Are there any differences in the accounting cycle for different types of businesses?

The basic steps of the accounting cycle remain the same for all types of businesses. However, certain industries or business operations may require additional steps, such as inventory adjustments and cost allocations. The frequency at which these steps are carried out may vary depending on the size and complexity of the business.

- Is it necessary to follow all 8 steps in a specific order?

Following the steps in a specific order is important for accuracy and consistency. Skipping or altering the sequence of steps can lead to errors and inconsistencies in financial reporting. This is why having a standardized accounting cycle is essential to ensure all transactions are accurately recorded and reported.

- Can the accounting cycle be automated?

To a great extent, yes. Many parts of the accounting cycle can now be automated thanks to advancements in technology. Automation can significantly improve the efficiency and effectiveness of the accounting process, saving time and reducing human error. Key tasks, such as data entry, transaction recording, and generating financial reports, can be streamlined through automation software like DOKKA.

DOKKA is a powerful tool that automates the extraction and processing of data from invoices and financial documents, transforming paperwork into structured, actionable data. This speeds up tasks such as posting transactions, reconciling accounts, and preparing financial statements.

Want to see how DOKKA can streamline your accounting cycle? Book a demo today and discover how automation can improve your workflow while maintaining accuracy.