Imagine this: You’re running a business, and let’s say you’re managing a company where the most critical aspect of operations is ensuring the smooth and efficient procurement of goods.

You regularly order supplies from multiple vendors. As your business grows, manual or informal procurement processes can become disorganized, leading to miscommunication and an increased risk of mistakes.

Without an automated procurement software in place, orders may get mixed up, suppliers can miss deadlines, and your accounting team might struggle to keep track of spending.

The obvious solution is to implement a standardized purchase order system that simplifies procurement, ensures accountability, and maintains clarity throughout the purchasing process, right? Yet, despite its importance, many companies still overlook or underutilize the power of well-organized purchase orders.

What Is a Purchase Order?

A purchase order, commonly abbreviated as PO, is a formal document issued by a buyer to a supplier, detailing the products or services the buyer intends to purchase.

It serves as an official request to the vendor and typically includes important information such as item descriptions, quantities, prices, delivery dates, and payment terms.

For example, if a company needs to order 100 units of office chairs from a supplier, it creates a PO specifying the type, quantity, and agreed-upon price. The supplier reviews the PO, and once both parties agree, it becomes a binding agreement, providing the buyer with a legal record of the order.

Not all purchase orders are identical, as companies may use different types of POs depending on the situation. We’ll explore these types and their purposes, but first, let’s look at how a purchase order can benefit your business.

Why Do You Need Purchase Orders?

At first glance, using POs may seem like extra paperwork, especially for smaller businesses.

But POs are incredibly valuable for keeping your business organized and running smoothly. They help prevent misunderstandings or mistakes when dealing with suppliers by providing a clear record of the agreement. If anything goes wrong, you can refer back to the PO to resolve disputes.

Beyond organization, POs help you stay on top of your finances. They allow you to easily track spending and ensure you’re sticking to your budget. POs also help prevent unauthorized purchases, giving you better control over what’s being bought and when.

For the accounting team, POs are a lifesaver because they make it easy to match invoices to actual orders, ensuring payments are accurate and timely.

When it comes to managing inventory, POs are equally helpful. They provide a record of what’s been ordered and when it’s expected to arrive, helping you avoid running out of stock or overordering. This ensures you always have the right amount of inventory on hand, keeping your operations efficient.

Top Benefits of Using Purchase Orders:

- Clear Communication

Purchase orders (POs) make it easy to avoid misunderstandings between buyers and suppliers. With a clear, detailed document in hand, both sides are on the same page about what’s being ordered, the price, and the delivery terms. This helps prevent miscommunication that could lead to expensive mistakes.

- Better Legal Protection

A PO isn’t just paperwork—it’s a legally binding agreement. If issues like delayed deliveries, wrong products, or pricing problems come up, having the PO as proof can protect your business by showing the terms both parties agreed to.

- Budget Management

POs are great for keeping an eye on spending. Every order is tracked, so you know exactly where your money is going and can stay within your budget. They also help stop unauthorized purchases. Plus, the accounting team can match invoices to POs, making sure payments are accurate.

- Inventory Control

Using POs helps you keep your inventory in check. You have a clear record of what was ordered and when it’s arriving, which means fewer chances of ordering too much or too little. It makes restocking more efficient too.

- Audit Trail

POs create a solid paper trail, which can be super helpful for audits. They offer proof of your buying decisions and can be a lifesaver when it comes to financial reviews or audits.

- Improved Supplier Relationships

When you use POs, it shows suppliers that your business is organized and professional. Smooth procurement process can build trust and even help you negotiate better deals, like bulk discounts or faster delivery.

4 Common Types of Purchase Orders

Depending on your business needs, you may use different types of POs. All types include common information such as PO details, buyer and seller information, shipping details, order specifics, summary, notes, and signatures. However, additional information may vary. Below, we’ve listed key elements that different types of POs may or may not include.

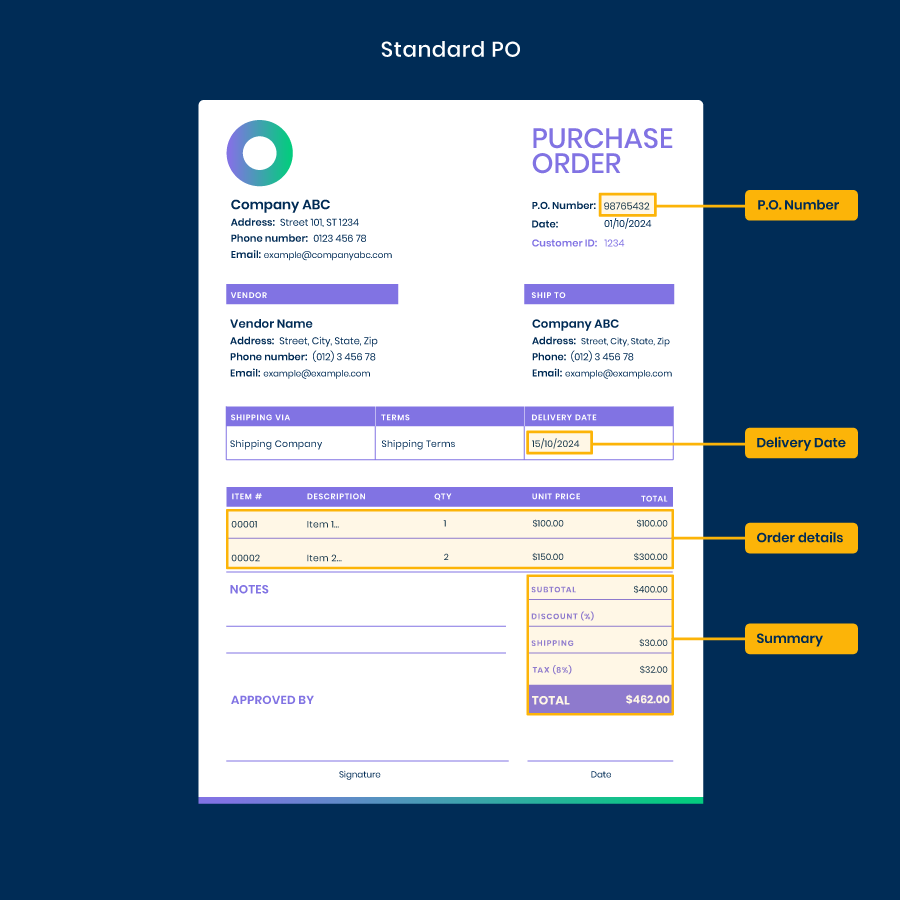

1) Standard Purchase Order (SPO)

A Standard Purchase Order (SPO) is the most commonly used type of purchase order in procurement. The SPO is used when the buyer knows precisely what they want to purchase and requires the supplier to fulfill the order as defined.

SPOs are typically used for one-off purchases where the need is clearly defined at the time of the order. This type of purchase order provides both the buyer and supplier with a legally binding contract once accepted.

Key Elements of a Standard Purchase Order (SPO):

- Purchase Order Number: A unique identifier for tracking and referencing the order.

- Buyer and Supplier Information: Details such as the names, addresses, and contact information of both parties.

- Item Description: A detailed description of the product or service being purchased.

- Quantity: The exact amount of items or services requested.

- Price: The agreed-upon unit price or total cost of the items/services.

- Delivery Terms: Information on the delivery date, location, and any shipping terms.

- Payment Terms: The terms and schedule of payment, including any discounts or credit offered.

- Terms and Conditions: Any additional stipulations or clauses that govern the purchase, such as penalties for late delivery or quality standards.

When to Use an SPO?

SPOs are best used in situations where:

- The buyer has a clear understanding of what needs to be purchased.

- The transaction is a one-time or infrequent event.

- The buyer wants to ensure the exact delivery of goods or services at specific prices and terms.

For example, if a company needs to purchase office supplies, they can use an SPO to order specific items, quantities, and prices from their preferred supplier. The buyer knows exactly what they need and the terms of payment and delivery, making it easy to create a standard PO and complete the transaction.

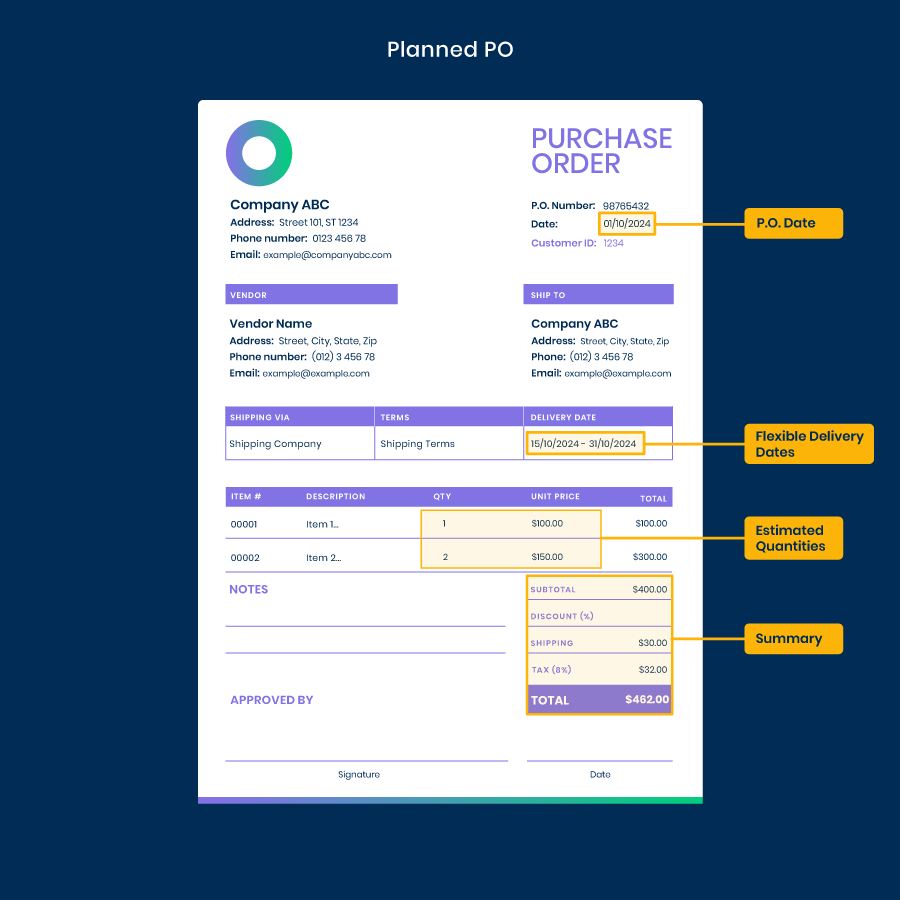

2) Planned Purchase Order (PPO)

A Planned Purchase Order (PPO) is a type of purchase order that allows buyers to plan and schedule purchases in advance. The PPO outlines the items or services required, but the actual delivery dates and quantities are not fixed at the time of issuance. Instead, these details are specified later through release orders (or “call-offs”) based on demand or production schedules.

The PPO is typically used for recurring purchases where the buyer has a general idea of the need but requires flexibility in scheduling deliveries. It is particularly useful for organizations with long-term agreements with suppliers, allowing them to plan purchases without committing to specific dates or quantities upfront.

Key Elements of a Planned Purchase Order (PPO):

- Buyer and Supplier Information: Identifies the parties involved in the transaction.

- Item Description: A detailed description of the items or services to be purchased.

- Estimated Quantities: The expected quantities, which can be adjusted later based on actual demand.

- Price and Payment Terms: The agreed-upon price per unit and the payment schedule.

- Delivery Framework: The overall timeframe for deliveries, with specific dates to be determined later through release orders.

- Release Orders: A mechanism by which the buyer issues a request for delivery against the PPO when needed.

When to Use a PPO?

PPOs are most suitable in scenarios such as:

- When a company has a long-term contract with a supplier for goods needed over time.

- When the buyer wants flexibility in delivery schedules to match production needs or fluctuating demand.

- In industries like manufacturing, where the buyer might not know the exact quantities needed at the outset but has a general understanding of future requirements.

For example, a company that produces seasonal products may use PPOs to plan and schedule orders with their suppliers. This allows them the flexibility to adjust quantities and delivery dates as needed, without having to create new purchase orders each time.

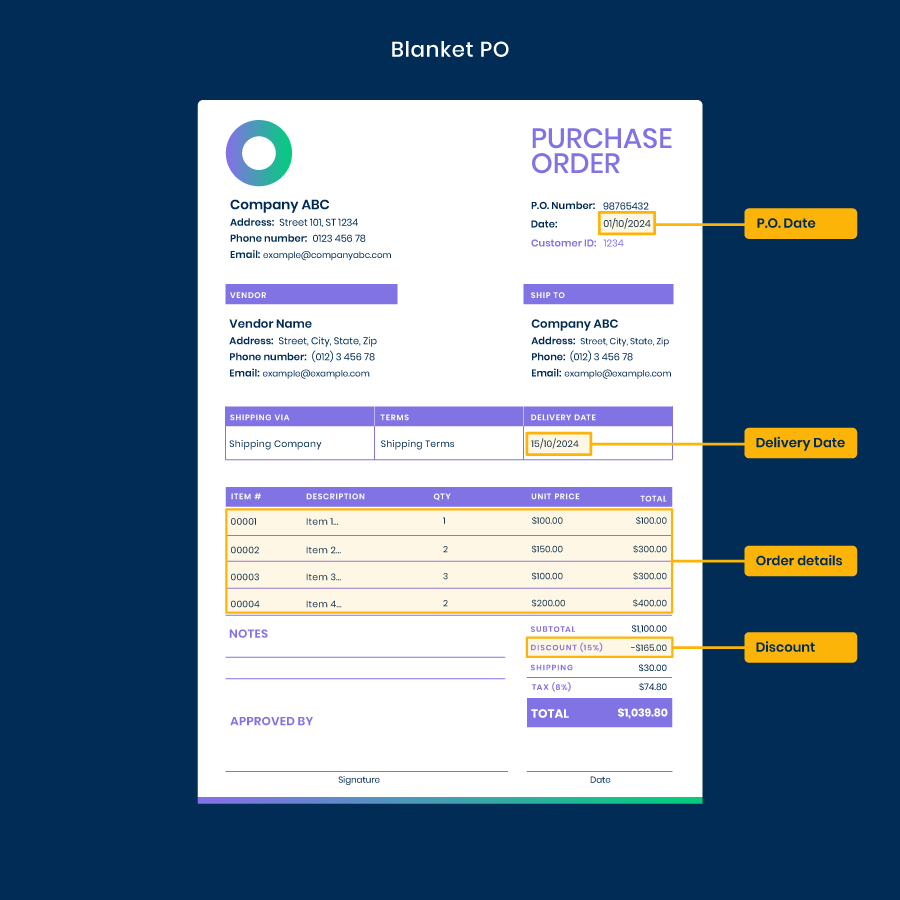

3) Blanket Purchase Order (BPO)

A Blanket Purchase Order (BPO) is a long-term agreement between a buyer and a supplier that allows the buyer to order multiple goods or services over a period without issuing a new purchase order for each transaction.

The BPO is ideal for repetitive or continuous purchases where the buyer does not know the exact quantity or timing of the items they will need upfront. It typically sets a maximum dollar limit and defines general terms, while specific deliveries are arranged over time as needs arise.

This type of PO is commonly used by organizations that require regular supplies, such as office equipment or maintenance services, and want to streamline the procurement process.

Key Elements of a Blanket Purchase Order (BPO):

- Duration of the Agreement: The timeframe during which the BPO is valid.

- Goods or Services Covered: A general description of the items or services that can be ordered under the BPO.

- Maximum Order Value: A limit on the total amount that can be spent under the BPO.

- Pricing and Terms: The agreed-upon pricing, payment terms, and any volume discounts that apply.

- Release Mechanism: The process by which the buyer requests deliveries as needed.

- Terms and Conditions: General terms governing the relationship, including renewal options, termination clauses, and delivery terms.

When to Use a BPO?

BPOs are commonly used in the following scenarios:

- When a company needs to regularly order consumables, such as office supplies, over a specified period.

- When a buyer wants to lock in pricing and terms with a supplier for recurring services, such as equipment maintenance.

- When an organization wants to reduce the administrative effort required to process frequent small transactions with a trusted supplier.

For example, a university may enter into a BPO with a local printing company for all its printing needs over the course of an academic year, rather than issuing individual purchase orders each time they need printed materials. This allows them to save time and effort while also ensuring consistent pricing and quality from their supplier.

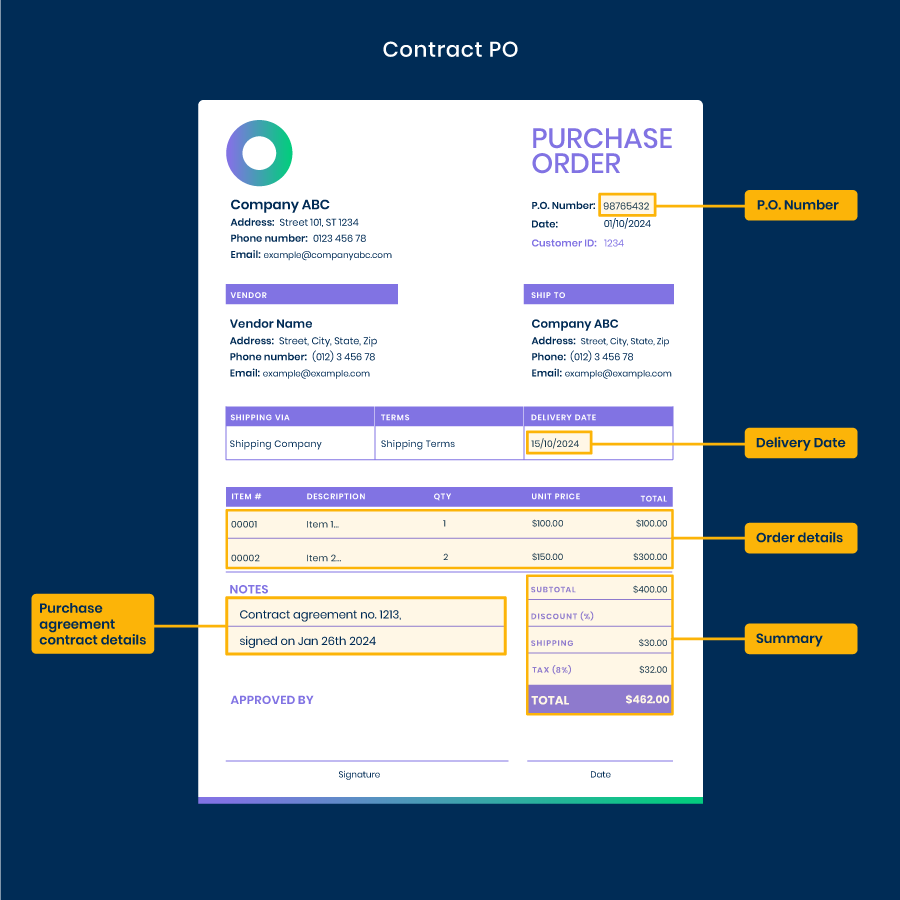

4) Contract Purchase Order (CPO)

A Contract Purchase Order (CPO) is a legally binding agreement between a buyer and a supplier that combines the features of both a purchase order and a contractual agreement. Unlike other types of purchase orders, the CPO is typically used for complex or high-value transactions that involve detailed terms and conditions.

The CPO specifies the goods or services to be purchased, the pricing, delivery terms, and any other legal or performance requirements that both parties must adhere to. It is commonly used for long-term, strategic procurement relationships where both parties need to define roles, responsibilities, and obligations in detail.

Key Elements of a Contract Purchase Order (CPO):

- Contract Number and Duration: A unique identifier for the contract and the period during which it is valid.

- Detailed Scope of Work: A thorough description of the goods or services to be provided, including any technical specifications or performance requirements.

- Pricing and Payment Terms: The agreed-upon pricing structure, including any milestone payments, discounts, or penalties.

- Performance Obligations: Detailed terms specifying the obligations of both the buyer and the supplier.

- Legal Clauses: Terms covering liability, warranties, dispute resolution, and termination rights.

- Delivery and Inspection Requirements: Clear terms on delivery timelines, acceptance criteria, and inspection procedures.

- Compliance and Regulatory Requirements: Any industry-specific regulations or standards that must be followed.

When to Use a CPO?

CPOs are ideal in situations where:

- The transaction involves a large financial commitment or a long-term supply of critical goods or services.

- There is a need for custom-built products or specialized services that require detailed specifications.

- The buyer and supplier want to formalize their relationship with clear legal protections.

For example, a construction company may issue a CPO to a supplier for the purchase of materials and equipment needed for a large-scale project. The contract would outline the exact requirements, specifications, and delivery timelines to ensure that both parties are on the same page and minimize potential risks or disputes.

How Does a Purchase Order Work?

Let’s take a closer look at the purchase order process and break it down step-by-step so you can clearly understand what to do at every stage.

1) Identify the Need for Goods or Services

The first step in the PO process occurs when someone within the organization recognizes a need for goods or services. This could be anything from office supplies to raw materials for production.

The individual or department in need prepares a purchase request (often called a requisition). This internal document includes details like the type of product or service, quantity, and any necessary specifications.

The request is then sent to the purchasing or procurement department.

2) Approval of the Purchase Request

Once the purchase request is submitted, it must be reviewed and approved by the appropriate authority. This could be a department head, manager, or the procurement team, depending on the company’s internal approval structure.

The approver evaluates whether the request aligns with the company’s budget, policies, and needs, ensuring that the requested items are necessary and that funds are available for the purchase. If the request meets all criteria, it moves forward for purchase order creation. If not, it may be returned for revision or rejected.

3) Create the Purchase Order (PO)

After the purchase request is approved, the purchasing department creates a purchase order. Using a standardized format for the PO ensures consistency.

Many businesses automate this process using procurement software to generate POs quickly and accurately. It is important to ensure the PO is detailed, clear, and error-free, as this document serves as a binding agreement.

4) Send the Purchase Order to the Supplier

Once the PO is created, it is sent to the selected supplier for review and approval. The supplier evaluates the purchase order to ensure they can fulfill the order as requested.

The PO should be sent via the agreed-upon communication method (usually email or through an automated procurement system). The supplier will either accept the PO as is or request modifications, such as changes in quantity, delivery dates, or pricing.

When the supplier confirms the order and accepts the PO, the document becomes a legally binding contract between the buyer (your company) and the supplier. Be sure to obtain this confirmation in writing.

5) Receive the Goods or Services

After the supplier accepts the purchase order, they begin fulfilling the order. This step involves shipping the products or providing the services as specified in the PO.

When the goods arrive, carefully inspect the delivery to ensure it matches the details of the purchase order. Check for:

- The correct quantities

- The right products (according to specifications)

- The condition of the items (free from damage)

- Compliance with the agreed-upon delivery date

If there are any discrepancies (wrong products, quantities, or damaged goods), note them immediately and notify the supplier. In some cases, companies may reject a delivery if it doesn’t meet the terms of the PO.

6) Match the Invoice to the Purchase Order

Once the supplier has delivered the goods or services, they will send an invoice to your business. This invoice serves as a request for payment and will reference the purchase order number.

The accounts payable team should verify the invoice by matching it against the original purchase order and the delivery receipt (also called a goods received note or delivery note). This three-way matching ensures that:

- The goods or services were received as ordered.

- The quantities and prices match those in the PO.

- There are no discrepancies between what was ordered, delivered, and billed.

If everything checks out, the business can proceed with payment according to the terms agreed upon in the PO. Any discrepancies should be resolved with the supplier before payment is issued.

7) Make the Payment

After confirming and matching the invoice with the PO and delivery receipt, the final step is to make the payment to the supplier. The payment terms established in the purchase order dictate the timeline for when the payment is due.

Process the payment according to the supplier’s terms. Typically, payment is made through bank transfers, checks, or another approved method.

8) Record-Keeping and Audit Trail

Once the transaction is completed (goods delivered, invoice paid), maintaining accurate records of the entire process is crucial for future reference, audits, or disputes.

Store copies of the purchase order, invoice, delivery receipt, and any communication regarding the order in an organized manner. If you’re unsure of the best way to do this, read this article: How to Keep Track of Invoices and Payments.

Many businesses use automated procurement software that keeps digital records of all transactions, simplifying record-keeping and audit processes.

These records are important for internal audits, tax compliance, and managing supplier relationships. They also provide transparency and accountability in the purchasing process.

How To Improve the PO Process With Automation

Automating your purchase order (PO) process can significantly enhance efficiency, reduce errors, and save valuable time.

First, invest in a reliable procurement software solution that suits your business needs. These platforms streamline the entire purchasing process by allowing users to create, send, and manage POs electronically. Look for software that integrates seamlessly with your existing accounting and inventory management systems, including Enterprise Resource Planning (ERP) systems.

Next, standardize your PO templates within the software. Having a uniform template ensures that all necessary information is captured every time a purchase order is created.

Then, set up automated approval workflows. Automation allows you to define specific approval hierarchies based on the size or type of purchase. For example, higher-value orders might require management approval, while smaller purchases can be approved by lower-level employees.

In addition, consider implementing accounts payable automation to streamline the payment process. Integrating your PO system with accounts payable can significantly reduce the time spent on manual invoice matching and payment approvals. This integration ensures that invoices are paid accurately and on time while also minimizing the risk of discrepancies between what was ordered and what was billed.

FAQ: Purchase Orders (POs)

- What is the difference between an SPO and a PPO?

A Standard Purchase Order (SPO) is a one-time order used for specific purchases, while a Planned Purchase Order (PPO) is used for ongoing or scheduled orders over a period of time. SPOs are typically created for immediate needs, whereas PPOs facilitate longer-term procurement strategies and inventory management.

- What is the difference between a PO and an invoice?

A PO is a document created by the buyer to request goods or services from a supplier, detailing what is to be purchased and under what terms. An invoice, on the other hand, is issued by the supplier after the goods or services have been delivered, requesting payment for the items listed. While a PO indicates intent to purchase, an invoice serves as a bill for completed transactions.

- What is the difference between a PO and a Purchase Requisition?

A PO is a formal document sent to a supplier to authorize the purchase, while a Purchase Requisition is an internal request made by an employee to obtain approval to purchase specific items. Essentially, a requisition initiates the purchasing process within a company, and once approved, it can lead to the creation of a PO.

- What are some common challenges with purchase orders?

Common challenges with purchase orders include miscommunication between buyers and suppliers, potential delays in approvals, and difficulty in tracking orders or matching them with invoices. Additionally, manually managed POs can lead to errors, increased processing time, and issues with compliance and documentation. These challenges can hinder efficient procurement and impact overall business operations.