Accounts payable (AP) teams often build their processes around purchase orders (POs).

PO invoices are predictable, structured, and easier to automate. But what about the non-PO invoices—the one-off charges, services, and vendor bills that don’t match an existing purchase order?

Even if non-PO invoices account for only 5–10% of total invoice volume, they can still create bottlenecks that slow down the entire AP process.

The problem arises because manual AP workflows are only as strong as their weakest link, and non-PO invoices often become that weak link.

In this post, we’ll cover the hidden costs of manually handling non-PO invoices, explain why hybrid PO/non-PO approval flows frequently break down, and show how automation with DOKKA eliminates these challenges for ERP users, whether you’re running NetSuite, SAP Business One, or another mid-market ERP.

The Problem With Non-PO Invoices in Manual AP Workflows

When every invoice has a corresponding PO, life is simple: match, approve, and post to your ERP. But in reality, finance isn’t 100% PO-based.

Non-PO invoices show up in nearly every business: utility bills (electricity, water, internet), professional services (consultants, freelancers, legal fees), marketing expenses (advertising platforms, sponsorships), travel reimbursements, one-time vendor charges or emergency purchases etc.

Without an originating PO, these invoices fall outside the standard AP process. That creates several challenges:

- AP clerks must manually verify invoices against budgets or vendor contracts.

- Approvals are chased down through email, Slack, or hallway conversations.

- Invoices pile up in inboxes as deadlines approach.

- Data entry into your ERP is delayed—or worse, duplicated.

Even if only 5% of invoices fall into this category, they introduce risk, cost, and delays that ripple across the entire AP workflow.

The Hidden Costs of Manual Non-PO Invoice Handling

Finance leaders often underestimate the impact of “just a few” non-PO invoices. On the surface, 5% seems small. Yet when each one requires extra manual steps, the costs compound quickly.

Here’s what really happens when they’re managed manually:

- Approval delays: Without predefined rules, AP teams spend valuable time chasing down the right approver. Some invoices remain stuck for days.

- Inconsistent coding: Different approvers assign different general ledger (GL) accounts, resulting in misclassified expenses and messy reports.

- Audit challenges: Non-PO invoices frequently lack sufficient documentation, creating headaches when auditors request proof of authorization.

- Compliance risks: Missing approvals or inconsistent handling increases exposure in industries with strict financial controls.

- Morale drain: AP staff waste hours chasing signatures, sending reminders, and fixing errors instead of focusing on exceptions or analysis.

When these inefficiencies multiply across hundreds of invoices in a year, even a small percentage of non-PO invoices can slow down the entire month-end close.

Why Hybrid PO/Non-PO Workflows Break Without Automation

Whether you’re using NetSuite, SAP Business One, Microsoft Dynamics, or another ERP, the pattern is consistent:

- PO invoices flow smoothly when matched and coded.

- Non-PO invoices, however, require more manual intervention—AP staff must enter them line by line, determine coding, and route for approval.

As volumes increase, the two processes diverge, leaving AP teams to manage separate workflows: automated PO handling and manual non-PO exceptions.

The split creates blind spots, bottlenecks, and approval delays that undermine the efficiency of an otherwise automated AP process. In other words, a process that is 95% automated is still broken if the remaining 5% is left manual.

The Solution: Automate Hybrid AP Workflows With DOKKA

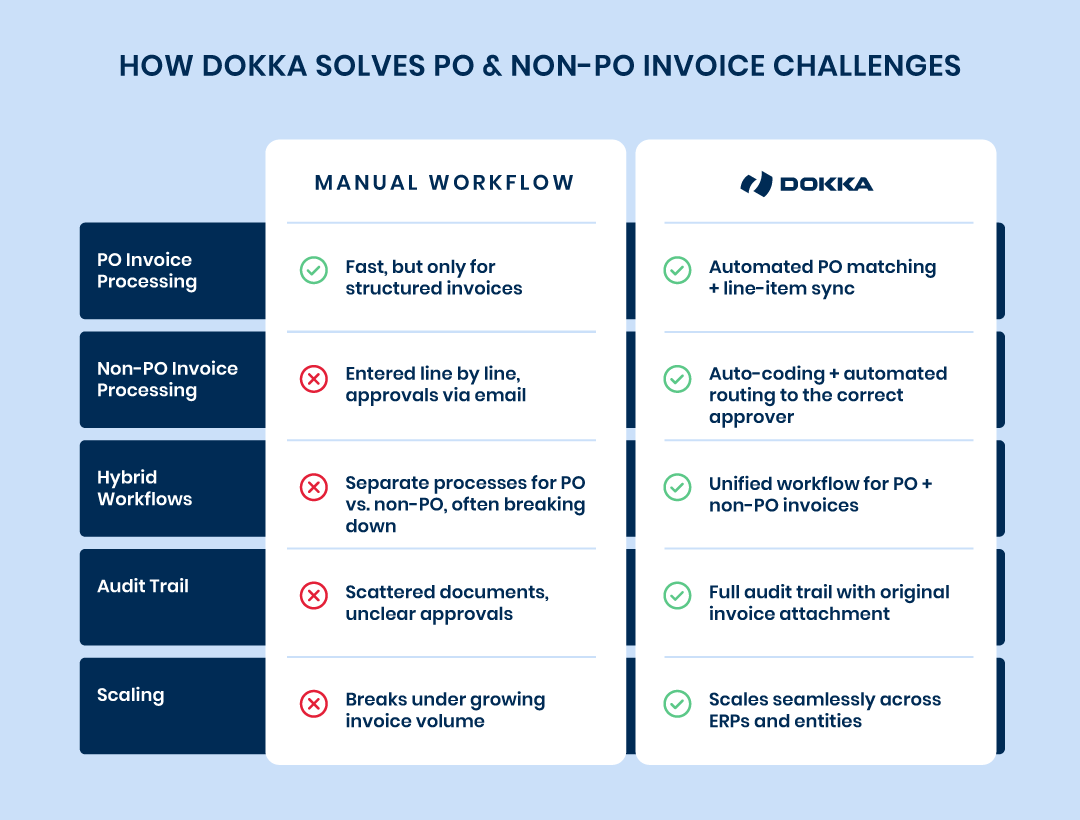

Unlike basic OCR tools that only process structured invoices, DOKKA is built to handle both PO and non-PO invoices seamlessly. It doesn’t just extract data—it manages the entire workflow, from data capture to approvals to ERP posting.

AP teams no longer need to juggle two processes; everything moves through a single, intelligent platform.

4 Ways DOKKA Solves the PO/Non-PO Hybrid Challenge

1) Captures Every Invoice

Invoices from any source (email, cloud storage, or your existing document management system) are captured by DOKKA. Both PO and non-PO invoices flow into one centralized workflow.

2) Intelligent Data Extraction

DOKKA automatically extracts all key invoice details, including:

- Vendor information

- Invoice number and date

- Line items

- GL coding (suggested based on historical entries)

For PO invoices, DOKKA performs automatic 2-way or 3-way matching. For non-PO invoices, it suggests coding and routes them to the correct approver.

3) Automated Routing & Approvals

Non-PO invoices follow predefined approval workflows. Instead of chasing signatures, AP teams can rely on DOKKA to ensure the right people review and approve promptly. Approvers approve with a single click or request clarification directly within the platform.

4) ERP Sync With Full Audit Trail

Once approved, invoices are posted directly into your ERP system. Each invoice is linked to its original PDF, ensuring compliance and complete audit readiness.

Real Impact: Why Even 5% Non-PO Invoices Matter

Finance teams relying on manual processes often find that non-PO invoices cause the most friction, even when they represent a small fraction of total invoices.

With DOKKA, users report:

- 80–90% faster processing for non-PO invoices

- Consistent GL coding, reducing month-end cleanup

- Stronger controls and enhanced visibility for auditors

- Elimination of dual workflows, unifying AP under a single system

The result: AP teams spend less time firefighting exceptions and more time managing cash flow.

FAQs on Non-PO Invoice Automation in ERPs

Q: Can non-PO invoices be reviewed before posting?

DOKKA allows all non-PO invoices to undergo full review and approval prior to synchronization with the ERP, ensuring that finance teams maintain control over each transaction.

Q: Is DOKKA compatible with multi-entity ERP environments?

Yes. DOKKA supports multi-entity configurations across platforms such as NetSuite, SAP Business One, and Microsoft Dynamics, automatically assigning the correct subsidiary when posting invoices.

Q: Can custom approval rules be applied to non-PO invoices?

DOKKA enables organizations to configure approval workflows based on invoice amount, vendor, department, project, or any other business-specific criteria, ensuring that all non-PO invoices follow the appropriate authorization path.

Q: How does DOKKA manage GL coding for non-PO invoices?

DOKKA leverages historical transaction data to suggest accurate GL coding. Over time, this capability improves accuracy, reduces manual effort, and minimizes errors in financial reporting.

Q: Will non-PO invoice automation impact PO invoice processing?

No. DOKKA processes PO and non-PO invoices within the same unified workflow, maintaining efficiency across both invoice types without creating separate processing streams.

Q: Can invoices stored in document management systems be processed?

Yes. DOKKA integrates with common document management platforms, including SharePoint and Google Drive. Invoices can also be uploaded in bulk or forwarded by email for automated ingestion.

Q: Are original invoices attached to ERP records?

Every processed invoice retains its source PDF attached to the ERP record, providing a complete and auditable history for compliance and review purposes.

Final Thoughts: Hybrid Workflows Don’t Have to Break Your AP

It’s easy to assume that 5% of invoices won’t make a difference. But when those invoices demand extra manual work, multiple approvals, and ad-hoc handling, they can create disproportionate delays and risks.

DOKKA’s ERP integrations unify PO and non-PO invoice workflows, eliminate manual entry, and ensure compliance—all while giving your AP team back valuable time.

Curious how DOKKA manages both PO and non-PO invoices in your ERP? Book a demo to find out all the details.