What do you think is the most time-consuming part of the invoice processing cycle?

One might argue that it’s manual data entry, but we believe the most time-consuming part extends beyond data entry to the matching and approval processes.

After sorting and organizing invoices, AP teams must manually verify invoice details across multiple documents, in the best case scenarios just purchase orders (POs) and goods receipts. This back-and-forth process consumes significant time as teams cross-check quantities, pricing, and terms. Then, discrepancies must be identified, investigated, and resolved—all of which can lead to further delays.

Equally—if not even more—time-consuming is the manual approval workflow. Traditionally, invoices are routed through a chain of email exchanges or paper trails for review by multiple stakeholders. Each approver must sift through documents, verify details, and make decisions, creating bottlenecks. Without a clear system in place, invoices can get stuck in limbo, waiting for approvals that never seem to come. Worse, the wrong person might approve them, leading to compliance risks or unauthorized payments.

Is there a better way to do it? Absolutely. Let’s explore how.

Understanding Invoice Matching and Approvals

Invoice Matching: Ensuring Accuracy Before Payment

At its core, invoice matching serves as a safeguard against overpayments, fraud, and billing discrepancies. It ensures that businesses only pay for goods and services that were ordered, received, and correctly billed.

Depending on the level of control needed, organizations use different types of invoice matching:

- Two-way matching: The most basic level, where the invoice is compared against the purchase order (PO) to verify that the billed amount and quantities align with what was ordered. 2-way matching method is useful when receiving discrepancies are rare, but it doesn’t confirm whether the goods were actually received.

- Three-way matching: Adds an extra layer of verification by incorporating a goods receipt, ensuring that the items were delivered before payment is processed. 3-way is the most common matching method, as it helps prevent payments for missing or incomplete deliveries.

- Four-way matching: Extends verification further by including an inspection report to confirm that the goods meet quality standards before payment approval. 4-way matching is often used in industries where product quality is critical, such as manufacturing or pharmaceuticals.

Each level of matching strengthens financial oversight, but when done manually, the process is highly inefficient and drains time and resources. Errors or mismatches lead to additional delays, as AP teams must investigate discrepancies, track down missing information, and resolve issues—often through lengthy email chains or phone calls with vendors—before processing payments.

Invoice Approvals: Avoiding Bottlenecks and Payment Delays

Even after an invoice is verified, it must go through an approval process before payment can be released. For companies that still manage approvals manually, this often means routing invoices through email chains or physical paperwork, requiring relevant stakeholders—such as department heads, procurement teams, and finance managers—to review and approve payments.

Without a structured workflow, approvals can become a major source of delay. Invoices may sit in inboxes for days, get lost in email threads, or end up with the wrong approver—something that happens all too often. These inefficiencies not only slow down processing but also disrupt cash flow and strain vendor relationships.

The solution? Automation. By streamlining both matching and approval workflows, accounts payable (AP) automation eliminates inefficiencies, reduces errors, and accelerates invoice processing. Let’s explore how automation makes this possible.

Why Automate Invoice Matching and Approvals?

First of all, for companies still relying on manual methods, invoice processing can be a logistical nightmare. Errors in data entry, lost invoices, and unauthorized approvals can lead to financial losses.

Automating the process eliminates many of these risks while also improving efficiency. But don’t just take our word for it—hear directly from our clients in our case studies, where they share their success stories and the benefits they’ve achieved through AP automation.

- Speed

One of the most immediate and tangible benefits is speed. While manual matching requires AP teams to spend significant time cross-checking invoice data, an automated system can complete the process in seconds. By instantly matching invoices to supporting documents, automation drastically reduces processing time and eliminates approval bottlenecks.

- Accuracy

Accuracy also improves significantly with automation. Human error is one of the leading causes of overpayments, duplicate invoices, and fraudulent transactions. AI-powered software can detect discrepancies that might go unnoticed in a manual review, ensuring that only correct and validated invoices move forward for approval.

- Cost savings

Beyond speed and accuracy, automation delivers substantial cost savings. By eliminating paper-based workflows, reducing manual oversight, and accelerating approvals, companies cut administrative expenses and free up employees for higher-value tasks. On top of that, automation strengthens compliance by enforcing structured approval workflows and maintaining a clear audit trail, reducing the risk of regulatory violations.

Technologies Powering Invoice Matching and Approvals Automation

The success of invoice automation depends on several core technologies working together to streamline data capture, validation, and workflow execution.

Optical Character Recognition (OCR): The Foundation of Data Extraction

At the heart of invoice automation is Optical Character Recognition (OCR), a technology that extracts and digitizes invoice data—whether from PDFs, scanned documents, or paper copies. OCR eliminates the need for manual data entry, ensuring that invoices in various formats are seamlessly integrated into automated workflows. Advanced OCR solutions use intelligent data capture to recognize different invoice layouts, accurately identifying key details such as invoice numbers, dates, amounts, and vendor information.

Artificial Intelligence (AI) and Machine Learning (ML): Driving Smart Processing

AI and ML enhance automation by enabling pattern recognition, anomaly detection, and predictive analytics. Over time, these technologies learn from historical invoice data, improving their ability to:

- Detect discrepancies between invoices and purchase orders.

- Identify duplicate or fraudulent invoices.

- Predict approval workflows based on past patterns.

- Suggest corrective actions when mismatches occur.

AI-driven automation software doesn’t just automate tasks—it continuously improves by learning from exceptions and refining its accuracy. This adaptability makes AI a game-changer in invoice processing.

Robotic Process Automation (RPA): Automating Repetitive Tasks

Robotic Process Automation (RPA) handles repetitive, rule-based tasks, such as:

- Capturing invoices from emails or portals.

- Validating invoice details against POs and goods receipts.

- Routing invoices through predefined approval workflows.

- Posting approved invoices into Enterprise Resource Planning (ERP) or accounting systems.

When integrated with ERP platforms, RPA enables real-time data synchronization, eliminating manual data entry while significantly reducing errors. Acting as a bridge between different systems, RPA ensures seamless communication and minimizes human intervention in routine tasks.

Choosing the Right Invoice Matching and Approvals Software

With so many vendors and solutions available, how do you choose the right invoice matching and approval software? Careful evaluation of features, compatibility, and costs is a good starting point. You can find a comparison of some of the best AP automation software for 2025 at this link.

Key features to look for include AI-powered matching, real-time data synchronization, fraud detection, and compliance tracking. The best solutions integrate seamlessly with ERP systems like SAP, Oracle, and others, ensuring smooth operations without requiring drastic changes to existing workflows.

Cost is another crucial factor. While invoice automation delivers long-term savings, initial investment costs can vary significantly. Before making a decision, consider licensing fees, implementation costs, and ongoing support. For a detailed breakdown of costs and pricing models, check out our dedicated article on AP automation pricing to gain a clearer understanding of the financial investment involved.

How DOKKA Elevates Your Matching and Approvals Process

DOKKA is an AI-powered accounting automation platform designed to streamline accounts payable processes, including invoice matching and approval. By integrating seamlessly with your existing ERP system, DOKKA automates the collection, processing, and management of AP documents, reducing manual tasks and enhancing overall efficiency.

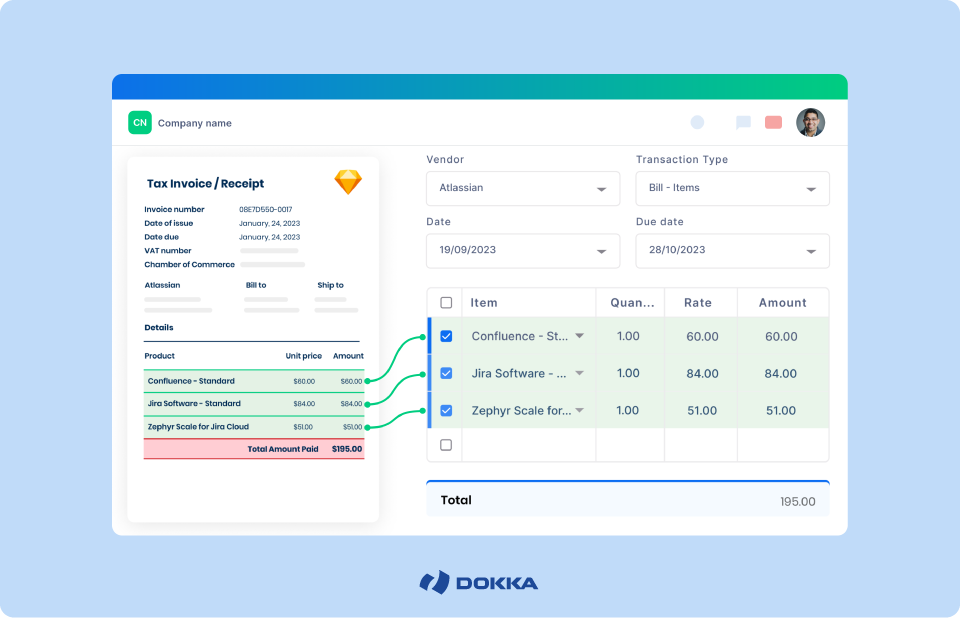

Automating Invoice Matching in DOKKA

DOKKA offers advanced invoice matching capabilities, supporting both two-way and three-way matching to simplify the verification process. Its AI-driven solution automatically extracts data from invoices and purchase orders, identifying discrepancies to ensure accuracy before payment approval.

For three-way matching, DOKKA takes verification a step further by incorporating goods receipts, cross-referencing all relevant documents to confirm that the ordered items were received as expected. With DOKKA, you can reconcile invoices more efficiently, minimize errors, and improve the accuracy of your accounts payable operations.

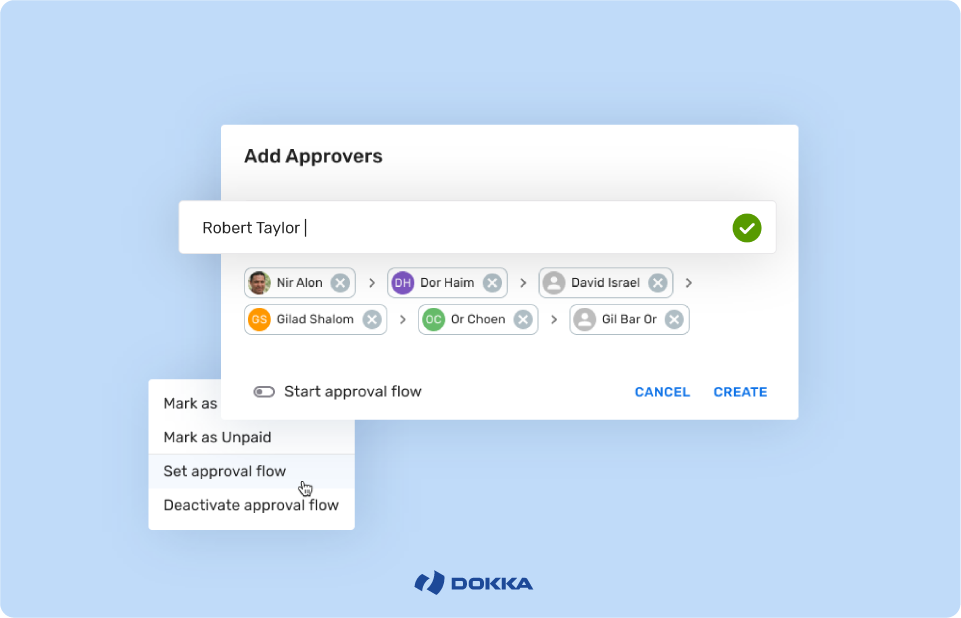

Streamlining Invoice Approvals with DOKKA

DOKKA eliminates bottlenecks and inefficiencies by automating the approval workflow, ensuring invoices are processed promptly and accurately.

With DOKKA, you can define approval rules based on various parameters such as invoice amount, vendor, or department. Once an invoice is received and matched, it is automatically routed to the appropriate approver(s) according to predefined rules. Approvers receive notifications and can review and approve invoices directly within the platform, keeping the process on track and ensuring invoices are processed within the desired timelines.

Additionally, DOKKA’s AI capabilities can suggest approvers based on historical data, further reducing manual intervention and accelerating the approval process.

See DOKKA in Action

Want to learn how DOKKA can transform your AP processes? Schedule a demo today and discover how automation can enhance efficiency, accuracy, and control in your invoice processing workflow.