As businesses grow, their financial operations become increasingly complex. At this stage, the role of a financial controller becomes even more critical. Tasked with overseeing a company’s finances, financial controllers ensure that all transactions are accurate and comply with regulatory standards.

Given the significance of this role, achieving excellence requires a strategic approach with clearly defined goals. By setting measurable targets, maintaining up-to-date financial records, identifying potential risks, and routinely auditing company data, financial controllers can stay agile and effectively guide their organizations through even the most challenging periods.

If these responsibilities align with your role, read on as we explore the core objectives every financial controller should prioritize. Mastering these goals won’t just enhance your skills—it will make you an indispensable asset to any team or organization.

What is a Financial Controller?

A financial controller is a senior-level executive responsible for overseeing an organization’s accounting and finance functions. They work closely with CFOs and other executives to ensure that business decisions are financially sound; but their role differs from that of a CFO. Financial controllers play a key role in developing and implementing finance and accounting policies, monitoring real-time data, evaluating processes, and more.

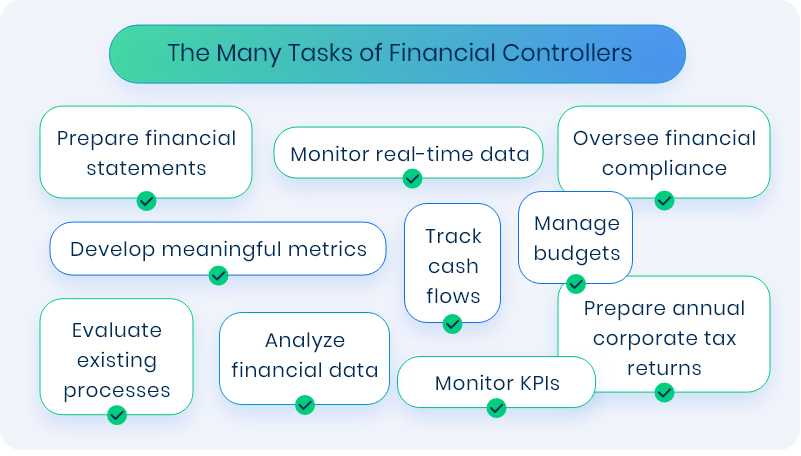

Key Responsibilities of Financial Controllers:

- Analyze financial data and create reports for executives and stakeholders.

- Develop and manage budgets, monitoring expenses and revenue.

- Prepare financial statements in compliance with Generally Accepted Accounting Principles (GAAP).

- Track cash flows to optimize resource allocation and minimize financial risks.

- Manage investments such as stocks, bonds, and mutual funds by assessing risk and return potential.

- Ensure financial compliance with internal policies and external regulations.

- Monitor real-time key performance indicators—such as inventory levels, market prices, and currency exchange rates—to maintain accurate accounting records.

- Develop meaningful metrics to measure performance against organizational or departmental benchmarks.

- Prepare and file annual corporate tax returns while keeping up with regulatory updates on a quarterly basis.

- Evaluate finance-related processes, such as accounts payable, accounts receivable and payroll, identifying areas for improvement or automation to enhance efficiency and reduce costs.

Top 9 Goals of Financial Controllers

With numerous responsibilities to juggle, financial controllers must stay organized and set clear priorities to keep their organizations running smoothly. To stay ahead, here are key goals that every financial controller should focus on:

1. Managing Cash Flow

Ensuring a strong and stable cash flow is a top priority. This involves overseeing all financial transactions and optimizing accounts payable and receivable.

To manage cash flow effectively, develop a cash flow projection that forecasts expected inflows and outflows because this helps identify potential shortfalls and allows for strategic adjustments. Establish clear policies for credit and debt management, and consider leveraging technology solutions to streamline cash flow management and enhance accuracy.

2. Financial Reporting

A crucial responsibility of financial controllers is preparing monthly, quarterly, and annual financial statements while ensuring compliance with regulatory requirements. Additionally, they must generate reports for internal stakeholders, providing insights into the company’s financial health and future projections.

Accurate and timely financial reporting is essential for maintaining stakeholder trust. Implement strong internal controls, develop comprehensive financial reporting policies, ensure data accuracy, and conduct regular internal audits to identify and resolve discrepancies.

3. Budgeting

Some financial controllers are responsible for developing and managing company budgets. To do this effectively, they must collaborate with other departments to align the budget with overall business objectives. This includes analyzing past financial performance, forecasting future financial outcomes, and identifying potential risks and opportunities.

Additionally, having a contingency plan in place is good to have to address unexpected market changes. Regularly monitor the budget, make necessary adjustments, and ensure the company stays on track financially.

4. Risk Management

Managing financial risk is another key aspect of the financial controller’s role. Risk management involves identifying potential risks and developing strategies to mitigate them, such as assessing investment potential, evaluating business performance, and ensuring proper insurance coverage.

Controllers also use analytics to assess portfolio growth and allocate resources for capital investments. Some implement credit policies and benchmarking strategies to reduce inefficiencies, secure low-cost borrowing, and maximize returns. To stay ahead, monitor economic trends and create performance reports that track progress against budget expectations.

5. Compliance

Ensuring compliance with regulatory requirements is another fundamental responsibility. Financial controllers must stay informed about changes in accounting and finance regulations and ensure their organizations remain compliant.

Staying up-to-date on laws and compliance requirements protects company assets and legal standing. Implementing emerging technologies, such as accounting automation software, can improve processes and enhance compliance accuracy.

6. Cost Control

Cost control involves identifying areas where expenses can be reduced without compromising business operations. Financial controllers must proactively seek cost-saving opportunities and revenue-generating strategies by optimizing resources and introducing new products or services.

To manage costs effectively, conduct regular reviews of company operations, renegotiate supplier contracts, implement efficient processes, and assess staffing levels to ensure financial efficiency.

7. Forecasting

A financial controller must be skilled in forecasting financial performance using data-driven insights. This requires analyzing trends and projections to anticipate financial outcomes and identify risks and opportunities.

Enhance forecasting accuracy by leveraging data analytics and technology solutions. Regularly review and adjust forecasting models based on market changes to ensure they remain relevant and reliable.

8. Strategy Development

Financial controllers play a vital role in shaping long-term business strategies. By analyzing market trends, identifying growth opportunities, and providing data-backed recommendations to executives, they help steer the organization toward financial success.

Responsibilities include developing budget models, conducting financial trend analyses, and incorporating quantitative insights into strategic decisions. By aligning financial strategies with company goals, financial controllers can drive sustainable growth and strengthen overall business performance.

9. Process Optimization and Automation

Financial controllers should focus on streamlining financial processes and adopting automation to improve efficiency. By implementing accounting software and automation tools, routine tasks like data entry, reconciliation, and reporting can be completed more quickly and accurately.

Automation reduces the risk of human error and frees up time for more strategic decision-making. Regularly assess current processes for inefficiencies and explore opportunities to introduce new technology. Optimizing workflows and embracing automation not only enhances productivity but also helps maintain accurate, real-time financial data that supports informed business decisions.

Financial Controllers FAQ

- What qualifications do I need to become a financial controller?

Most companies require at least a bachelor’s degree in finance or accounting, along with several years of experience in a related field. A financial controller typically has at least three years of relevant experience in financial analysis, strategic planning, and transaction execution.

Proficiency in spreadsheet software and other financial tools is a must-have. Certifications such as Certified Management Accountant (CMA) or Certified Public Accountant (CPA) may be required for certain positions. If you need a step-by-step guide, we recommend that you check out our article about how to become a successful financial controller.

- What skills do I need as a financial controller?

To excel as a financial controller, you must have strong analytical skills, attention to detail, and strategic thinking. These qualities help in evaluating financial performance, managing risks, and optimizing profitability.

Controllers should also have effective communication and leadership abilities to manage teams and collaborate with other departments. Interpersonal skills are key for building relationships with stakeholders, while ethical integrity ensures compliance and maintains organizational transparency. Embracing technology tools like accounting software can further enhance efficiency. Learn more about the essential skills for controllers here.

- What challenges do financial controllers face?

Financial controllers face numerous challenges, including maintaining cash flow, ensuring accurate and timely financial reporting, managing budgets, and adhering to compliance regulations. Other difficulties include maintaining internal controls, handling tax complexities, preparing for audits, and collaborating across departments.

Solutions to these challenges include adopting automation tools, fostering collaboration, utilizing rolling forecasts, and ensuring robust accounting software. Financial controllers can also improve internal controls through regular audits and staff training. For more on overcoming these challenges, visit Top Challenges Faced by Financial Controllers (and How to Overcome Them).

- How can financial controllers improve their performance?

To improve their performance, financial controllers should fully understand the organization’s goals, operations, and products. Staying updated on financial regulations, tax laws, and industry trends is key. Leveraging technology for accurate financial reporting and working cross-departmentally can help align strategies with organizational objectives.

To stay on top of essential tasks, controllers can use resources like this financial controller checklist, which offers actionable insights for optimizing performance.