Accounts payable (AP) is a vital part of your business’s financial ecosystem. Why? Because it represents the money leaving your company—payments to suppliers, service providers, contractors, and landlords for the goods and services required to operate.

With so much cash flowing out, regular accounts payable audits become an essential component of your finance department’s operations. A well-executed audit helps prevent overpayments, reduce the risk of fraud, and uncover opportunities for savings.

In this guide, we’ll cover:

- What an accounts payable audit is

- Why AP audits are important

- The 8-step AP audit process

- Common mistakes to avoid

- Best practices for ongoing success

- How automation can transform your audit strategy

By the end, you will know exactly how to safeguard cash flow and strengthen financial controls.

What Is an Accounts Payable Audit?

An accounts payable (AP) audit is a detailed review of the financial information recorded in a business’s AP records. It covers everything paid to suppliers—in other words, all outgoing payments.

When conducted thoroughly, an AP audit doesn’t just check numbers on a spreadsheet, it provides visibility into the efficiency, reliability, and integrity of financial processes.

It also gives stakeholders confidence that money is leaving the business for the right reasons and under the right controls.

The AP audit process ensures that:

- Payments match invoices and purchase orders

- Vendors are legitimate and properly authorized

- Liabilities are accurately recorded

- Fraudulent or duplicate transactions are detected

In addition to catching mistakes, an AP audit can highlight opportunities to improve workflows, strengthen vendor relationships, and optimize cash flow.

Why Is Auditing Accounts Payable Important?

According to the Association of Certified Fraud Examiners (ACFE), businesses lose an estimated 5% of revenue annually to fraud. The accounts payable process is among the most vulnerable areas, as it touches nearly every part of an organization. Weaknesses in AP can result in unnecessary losses, compliance issues, and reputational damage.

Regular audits help organizations strengthen AP controls and deliver measurable benefits, such as:

- Detecting unrecorded liabilities (ensures all expenses are properly captured in financial records)

- Mitigating fraudulent payments (identifies fake vendors, inflated invoices, or unauthorized disbursements)

- Verifying accuracy (confirms payments align with purchase orders, invoices, and contracts)

- Preventing duplicate payments (addresses issues caused by vendors submitting multiple invoice copies)

- Recovering overlooked credits or discounts (avoids missed savings opportunities)

- Ensuring compliance (supports adherence to tax laws, internal policies, and regulatory standards)

- Improving vendor relationships (strengthens trust through timely, accurate payments)

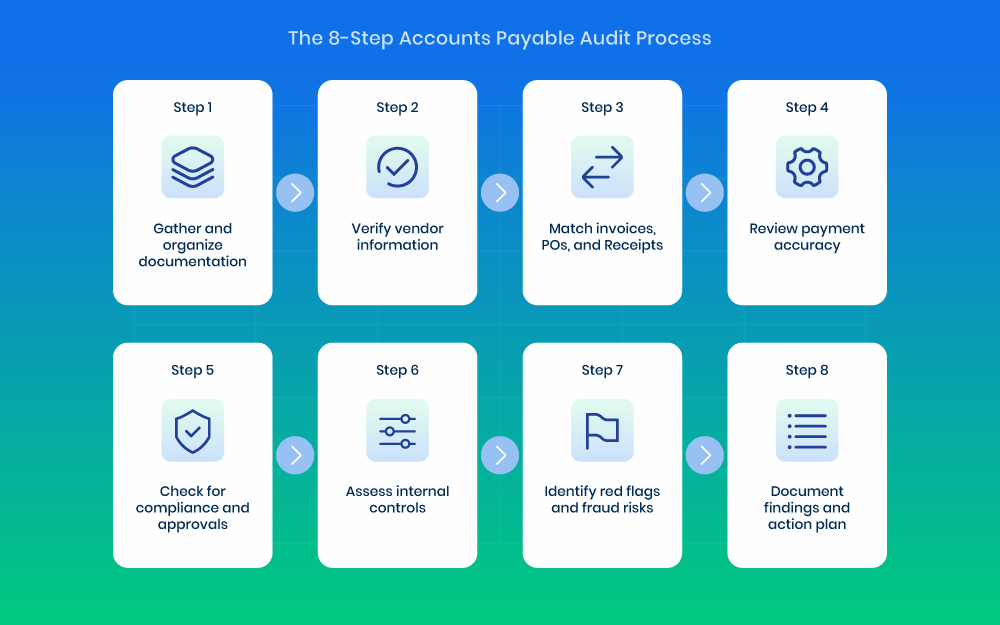

The 8-Step Accounts Payable Audit Process

Now that we know why AP audits matter, let’s dive into how.

The following 8 steps outline the process for a successful audit:

- Gather and organize documentation

- Verify vendor information

- Match invoices, POs, and Receipts

- Review payment accuracy

- Check for compliance and approvals

- Assess internal controls

- Identify red flags and fraud risks

- Document findings and action plan

Step 1: Gather and Organize Documentation

Begin by collecting all relevant records, including invoices, purchase orders, payment receipts, vendor contracts, expense reports, and bank statements. Complete documentation gives auditors a full view of payables activity, while missing records can create blind spots and weaken audit findings.

Categorize documents by vendor, date, and type of expense to streamline the review process.

Using digital filing or a document management system reduces errors and allows auditors to access records efficiently. Proper organization at this stage saves significant time later in the audit.

Step 2: Verify Vendor Information

Confirm the legitimacy of all vendors before reviewing transactions.

Cross-check the vendor master file for duplicates, outdated or inactive entries, incomplete contact or tax information, and suspicious entries. Vendor fraud often occurs when fake entities are added to the vendor list, making this step critical.

Perform background checks for new vendors and verify banking details to prevent fraudulent payments. Maintaining an updated vendor database improves communication, reduces errors, and strengthens overall vendor management.

Step 3: Match Invoices, Purchase Orders, and Receipts

3-way matching (PO, goods receipt note, and invoice) is a best practice in accounts payable. Auditors compare these documents to ensure quantities, prices, and payment terms align. Discrepancies, such as invoicing for more than was delivered, serve as red flags.

Matching process also uncovers pricing errors, missing approvals, or unreceived goods billed incorrectly.

Regular 3-way matching prevents financial leaks before payments are made and provides a clear audit trail that supports internal and external compliance requirements.

Step 4: Review Payment Accuracy

Auditors next verify that payments are correct, executed on time, free of duplicates, and directed to the proper bank accounts. This step catches overpayments, misapplied credits, or payments sent to the wrong vendors.

Reviewing payment timing against early payment discounts and cash flow needs is equally important. Delayed or incorrectly processed payments can damage vendor relationships and affect company credibility.

Systematic verification of payment accuracy strengthens both financial control and operational efficiency.

Step 5: Check for Compliance and Approvals

Strong internal controls ensure that all payments are authorized according to company policy and relevant regulations.

Auditors confirm proper sign-offs, multi-level approvals for high-value transactions, and adherence to tax requirements. Weak or missing approval workflows increase the risk of fraud and errors.

Adherence to contract terms and company expense policies should also be reviewed. Compliance at every stage reduces the risk of fines or legal issues and promotes accountability across departments.

Step 6: Assess Internal Controls

Auditors evaluate the overall accounts payable process, including segregation of duties, access controls, policy enforcement, and the frequency of reconciliations. This step identifies systemic weaknesses that could enable fraud or inefficiency.

Assessment also includes verifying that staff follow procedures consistently and that technology is used effectively to reduce manual errors.

Stronger internal controls improve audit outcomes and foster a robust, risk-aware culture.

Step 7: Identify Red Flags and Fraud Risks

AP fraud can appear in many forms, including ghost vendors, inflated or altered invoices, round-dollar invoices without supporting details, and rush payments pushed through without approvals.

Auditors use data analysis, sampling, and anomaly detection to flag unusual patterns. Other red flags include payments to unfamiliar vendors, sudden spikes in vendor billing, and frequent changes to banking information.

Early identification of these risks prevents significant financial losses.

Step 8: Document Findings and Create an Action Plan

Auditors compile a report detailing errors, discrepancies, and risks found, along with recommendations and prioritized action items. The report serves not only to identify problems but also to help the business strengthen financial integrity.

Action plans may involve updating policies, improving controls, retraining staff, and implementing automation or monitoring tools.

Following up on the plan ensures improvements are executed and the accounts payable process becomes more efficient, accurate, and secure over time.

Common Mistakes to Avoid in AP Audits

Even seasoned finance teams can fall into common traps when auditing AP. These mistakes can reduce efficiency, compromise accuracy, create compliance risks, and expose the business to fraud.

Key pitfalls to watch out for include:

- Over-reliance on manual checks – Manual data entry and spreadsheet reviews are time-consuming and error-prone. In high-volume environments, even small mistakes can snowball into costly inaccuracies.

- Ignoring small discrepancies – Minor mismatches may appear insignificant but often signal larger issues such as duplicate payments, fraud, or weak controls.

- Neglecting vendor file clean-up – Duplicate or inactive vendors increase the risk of overpayment or unauthorized payments.

- Treating the audit as a one-time event – Restricting audits to year-end reviews misses the chance to catch risks earlier and continuously strengthen processes.

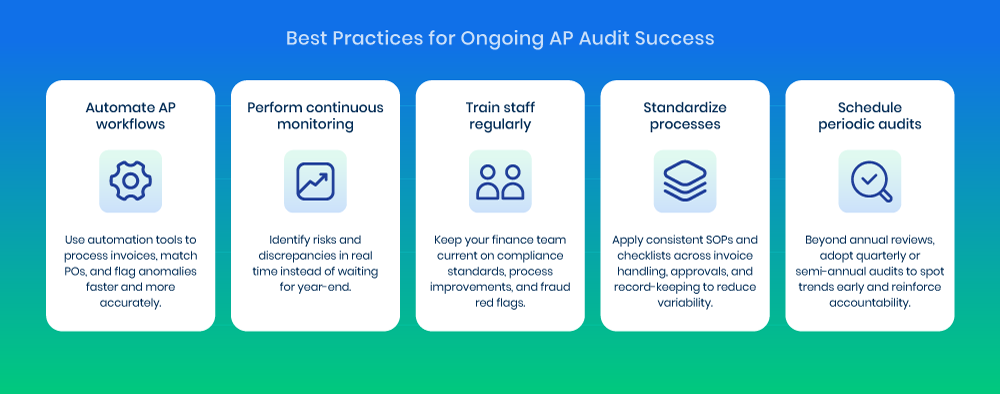

Best Practices for Ongoing AP Audit Success

An audit works best when viewed not as a reactive compliance requirement but as a proactive strategy for financial control and risk reduction. To maximize the value of AP audits, apply these best practices:

- Automate AP workflows: Use automation tools to process invoices, match POs, and flag anomalies faster and more accurately.

- Perform continuous monitoring: Identify risks and discrepancies in real time instead of waiting for year-end.

- Train staff regularly: Keep your finance team current on compliance standards, process improvements, and fraud red flags.

- Standardize processes: Apply consistent SOPs and checklists across invoice handling, approvals, and record-keeping to reduce variability.

- Schedule periodic audits: Beyond annual reviews, adopt quarterly or semi-annual audits to spot trends early and reinforce accountability.

Embedding these practices into daily operations turns audits from a burden into a strategic advantage, helping your finance team shift from firefighting to forward-looking risk management.

The Benefits of Accounts Payable Audit Automation

Accounts payable auditing is critical but traditionally one of the most time-consuming and resource-heavy aspects of financial operations. Finance teams often spend weeks reconciling invoices, chasing documentation, and manually verifying vendor records.

Automation changes the game. Leveraging modern AP automation tools streamlines audits, reduces manual workload, and improves accuracy. Instead of replacing auditors, automation equips them with cleaner data, faster insights, and stronger controls.

DOKKA’s AI-powered accounts payable automation is built for this purpose. Integrated with your existing ERP, DOKKA simplifies AP audits and delivers measurable benefits:

- Eliminated manual data entry and improved accuracy – Documents are automatically captured, categorized, and validated.

- Built-in compliance at every stage – Automated workflows enforce tax rules, approval hierarchies, and company policies.

- Accelerated audit processes – Audits that once took weeks can now be completed in days.

- Real-time visibility into bills and invoices – Immediate access to data makes discrepancies easier to detect.

- Stronger ERP integration and data quality – Financial information stays consistent, up to date, and audit-ready.

With DOKKA, AP audits evolve from a reactive, stressful exercise into a proactive, value-generating function. Instead of drowning in paperwork, your finance team can focus on higher-level priorities such as strategic planning, vendor optimization, and fraud prevention.

Want to see DOKKA in action? Book a demo call to learn how DOKKA can help your team.