2023 is shaping up to be a year full of challenges for CFOs.

In 2022, most CFOs found themselves in an unprecedented situation, as the after-effects of the pandemic shook industries to their core and caused a global economic upheaval. To thrive in a challenging economy, they needed to be both agile and inventive with their decisions, while managing risk and maintaining financial security.

They implemented a variety of strategies including cost-cutting measures, increased emphasis on automation and data analytics, a greater focus on forecasting and scenario planning, closer scrutiny of supplier contracts, improved cash management systems, and a heightened emphasis on working capital management. These strategies allowed them to quickly identify opportunities for improvement within their organizations and develop solutions that could be implemented quickly.

Many CFOs bolstered transparency between departments, fostering collaboration between finance teams to identify new revenue streams or cost savings measures. Finally, to ensure the successful implementation of new initiatives and processes, they invested heavily in training and development programs for both staff members operating in finance roles and those from other departments who were involved with strategic decisions.

But the new year brings new challenges. What’s coming up next and what does it take to be a better CFO in 2023?

In this article, we discuss the top 6 challenges that CFOs will face in 2023 and provide practical solutions for overcoming them.

CFO Challenges For 2023

According to PwC, CFOs can expect six main challenges in 2023:

1) Overcome economic turbulence

With unstable markets, high inflation, potential recession, political turbulences, and rising cybersecurity issues, CFOs need to be aware of risks and prepare risk-management scenarios.

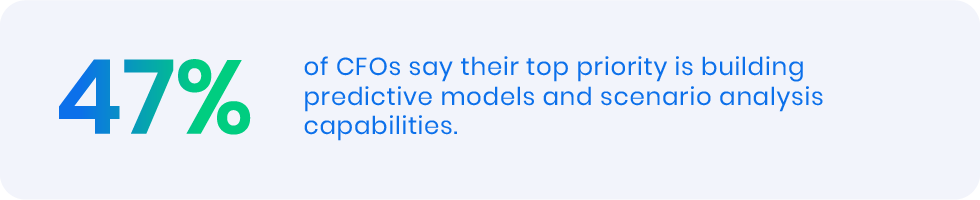

They need to prioritize the development of predictive models and strengthen their scenario analysis capabilities to create better and faster responses to the constantly fluctuating business environment and keep progressing toward long-term growth goals.

By utilizing a more flexible and data-driven approach to scenario planning, they can model the potential impacts of any market risks.

2) Secure growth

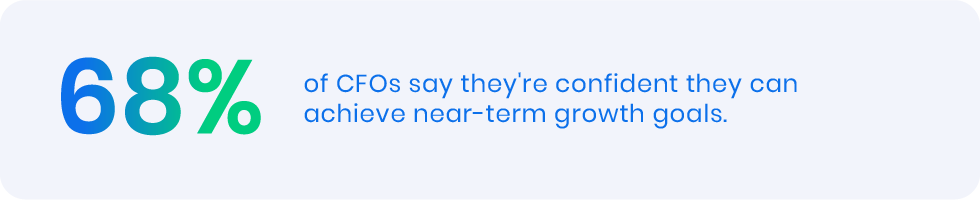

Securing growth in uncertain times is extra challenging, but not impossible.

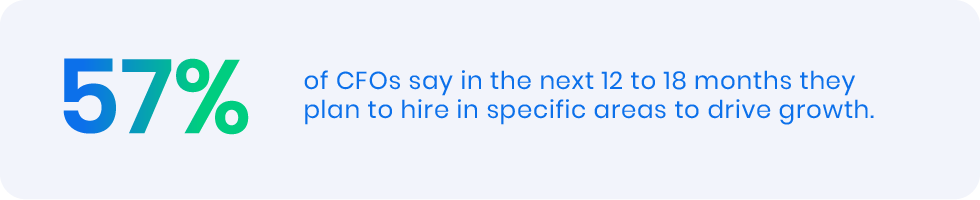

In 2023, CFOs will have to make much more calculated choices about spending and investing.

For many, this means adjusting pricing strategies and addressing demand. For others, it can be strategic hiring or mergers and acquisitions. Whatever approach they choose, they will have to work closely with the CEO and other directors on planning budgets and pricing strategies.

3) Move toward ESG reporting

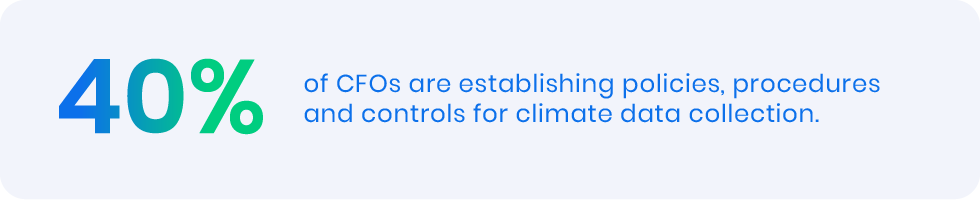

Investor-grade ESG reporting provides businesses with an in-depth look into their environmental, social, and corporate governance (ESG) impact. It allows stakeholders to understand a company’s long-term sustainability and how they are managing ethical risks.

Through comprehensive quantitative analysis and qualitative assessments, investors can make informed decisions based on the data provided by ESG reports. ESG reporting gives investors unprecedented access to a clear understanding of the dynamics of a company’s operations and performance so that they can make educated decisions about who to invest with.

In 2023 ESG stays the focus of CFOs, who will need to work toward shaping policies, procedures, and controls for climate data collection.

4) Lead digital transformation

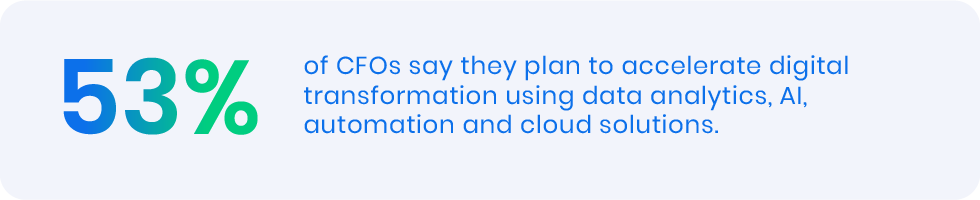

CFOs have an important role to play in leading digital transformation, as they will be responsible for delivering corporate finance operations and value-creation opportunities in an increasingly digital future.

They must show their leadership not only by driving cost controls but also by creating strategies and initiatives that will harness the power of technology to enhance organizational performance. This includes leveraging data analytics and automation tools to drive insights, identify cost savings, improve decision-making speed and accuracy, and build a foundation of trust with stakeholders.

To truly lead digital transformation in 2023, CFOs need to position themselves at the forefront of innovation while staying cognizant of emerging risks associated with any shift toward new systems and practices.

5) Hire and retain the talents

In 2023, CFOs will need to strategize and adjust their organizational structure to keep the best talent onboard and maximize the potential of their organization.

They’ll have to maintain an attractive salary package as well as give due importance to recognition and professional growth. By bringing together the right combination of talents into their team, CFOs can reach growth objectives more quickly and easily, make insightful analyses as well as forecasting with higher accuracy.

Moreover, CFOs will need to focus on creating a culture that encourages collaboration among team members by providing a supportive environment and enabling diverse thinking.

6) Build trust

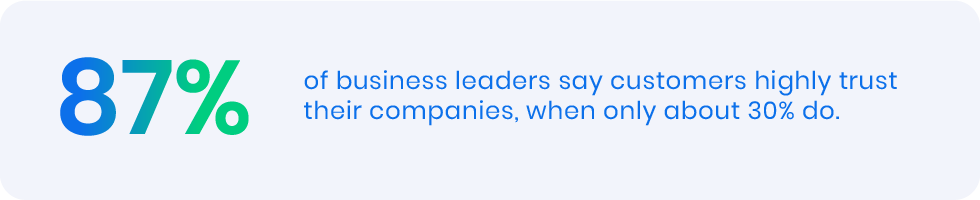

CFOs will have an increasingly important role to play in building trust in 2023. They need to focus on the development of strategies for collecting and using data that are both reliable and ethically responsible. CFOs also need to be capable of communicating the insights that come from this data in a clear, easy-to-understand manner that builds trust with stakeholders as well as internally with financial reporting teams.

Trust has become the leading currency for CFOs in today’s business climate, where it greatly shapes customer commitment and buying behavior as well as employee retention. Modern-day CFOs must cultivate trust with their stakeholders to deliver long-term, successful results and lead on both business and societal matters.

How To Be A Better CFO in 2023

1. Utilize data analytics more strategically

The use of big data has become increasingly important in recent years, and it’s only projected to grow even more influential in the next couple of years.

To be a successful CFO in 2023, you will need to improve your understanding and utilization of data analytics so that you can make informed decisions for your company. This requires becoming familiar with the benefits of new technologies like artificial intelligence (AI), machine learning, and predictive analytics so that you can take advantage of any opportunities they present.

2. Increase collaboration within finance departments

As technology continues to evolve, so should the way that finance departments collaborate internally and externally. You should strive for greater collaboration between teams as well as with customers or vendors by utilizing real-time communication tools and cloud-based sharing platforms.

This will allow your team members to be better connected across multiple projects and locations while also providing clients with quicker responses to any inquiries they have.

3. Strengthen risk management strategies

No matter what industry you’re in, taking the necessary precautions to minimize risk is always essential for smooth operations over time. In 2023, this means strengthening existing risk management strategies through more rigorous stress testing scenarios as well as creating plans for potential downsizing.

Additionally, self-assessments should be regularly conducted by your team so that all weaknesses are identified early on and corrected promptly when needed.

4. Prioritize recovering resources at all times

Having efficient processes in place to quickly recover lost resources is just as important as minimizing risks from occurring in the first place.

Companies must constantly look for ways to cut down on expenditures while still meeting customer demand levels within reasonable timeframes so that profitability remains high overall despite setbacks along the way. Your team should also focus on finding new sources of revenue, such as identifying untapped markets or exploring new product lines/services if applicable.

5 . Leverage technology investments wisely

As investments continue to pour into technological advancements like AI technology or cloud-based solutions, this money must be allocated properly throughout all areas of operations if organizations want maximum returns from these investments overall long-term. Ensure that each project produces concrete results which can easily be measured; otherwise reallocate funds elsewhere where they will be more effective instead.

With the right strategy in place, leveraging technology will be easy. One of the first steps is evaluating your company’s current tech usage and understanding where technology has had the biggest impact. With that knowledge, you can identify which areas need additional investments. Additionally, it’s important to recognize that automating certain processes – like accounting or customer support – could be more beneficial than manual entry.

Establishing strong systems which allow for accurate reporting, leveraging technologies effectively, managing risks judiciously, developing recovery processes efficiently, and maintaining collaboration between all teams are integral aspects of being a great CFO in 2023.