Accounts payable (AP) is a critical process in any company, as it involves managing payments to vendors and suppliers. It is also considered one of the most vulnerable areas for fraud, making proper controls essential. This is where an accounts payable risk and control matrix comes into play.

A risk and control matrix, also known as an RCM, is a tool used to identify potential risks within a specific business process and document the controls in place to mitigate those risks. In simple terms, it helps businesses understand what could go wrong in their AP process and how to prevent it from happening.

Don’t worry, it’s not as complicated as it sounds. In this blog post, we’ll break down the concept of an AP risk and control matrix, discuss its benefits, and provide some tips for creating one for your company.

What Is an AP Risk and Control Matrix?

A Risk and Control Matrix (RCM) is a framework used to identify, assess, and manage potential risks in the accounts payable process. This matrix serves as a roadmap for ensuring the integrity of financial transactions and safeguarding against inefficiencies, errors, and fraud in the payment cycle. It systematically categorizes potential risks, evaluates their impact and likelihood, and prescribes control measures to mitigate them.

As mentioned earlier, the accounts payable process is highly susceptible to fraud. This underscores the importance of having proper controls in place to prevent and detect fraudulent activities within the AP process.

The RCM is instrumental in identifying risks such as fraudulent invoices, duplicate payments, and unauthorized transactions, thereby aiding in the development of a clear framework for maintaining robust financial controls. It plays a critical role in enhancing the accuracy of financial reporting and ensuring compliance with regulatory requirements. Furthermore, the matrix focuses not only on preventing risks but also includes detective controls for addressing issues after they occur, making it an essential component of a company’s financial governance strategy.

Identifying Risks in Accounts Payable

To understand the necessity of the risk and control matrix (RCM), it’s important to differentiate between inherent and residual risks. Inherent risk refers to the level of risk present in a process without any controls in place. In contrast, residual risk is the level of risk that remains after controls have been implemented. Let’s take a closer look:

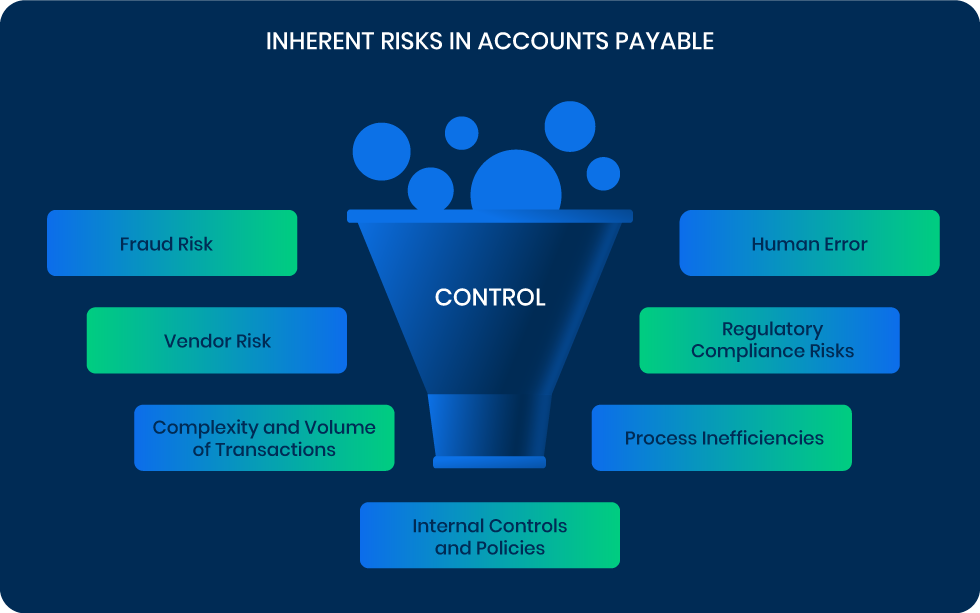

Inherent Risks in Accounts Payable

Inherent risks in accounts payable refer to the potential for errors, fraud, or other issues that naturally exist within the AP process before the application of specific controls or mitigation strategies. These risks are intrinsic to the nature of the transactions and the complexity of the process itself. Understanding them is important for any company looking to develop effective control measures.

Fraud Risk

Fraud risk includes risks such as the submission of fraudulent invoices for services not rendered or goods not received, and internal fraud like unauthorized payments or setting up fictitious vendors. Collusion between employees and vendors to overbill or create fraudulent transactions is also a concern. Effective fraud detection and prevention require robust verification processes and strict internal controls.

Human Error

Given the manual nature of many AP tasks, errors can occur in data entry, such as entering the wrong amount or paying the wrong vendor, or misinterpreting invoice terms (leading to incorrect payment schedules), or failing to apply discounts correctly. These errors can result in financial losses, strained vendor relationships, and extra workload to rectify mistakes.

Vendor Risk

This encompasses risks related to vendor reliability (such as late deliveries or supply disruptions), accuracy of billing such as overcharging or billing for unfulfilled services, and potential fraud. Not maintaining updated vendor information can lead to communication breakdowns and transactional errors.

Regulatory Compliance Risks

Compliance with tax laws, accounting standards, and industry-specific regulations is complex. Risks include failing to update systems and processes in line with changing regulations, leading to non-compliance penalties. Multinational companies face additional complexity with varied regulations across different regions and countries.

Complexity and Volume of Transactions

High transaction volumes increase the risk of missing fraudulent or erroneous payments and challenge maintaining detailed records for each transaction. The complexity of transactions, especially in diverse business operations, can lead to difficulties in tracking and reconciling accounts.

Process Inefficiencies

Inherent inefficiencies may be due to outdated procedures, lack of automation, or poor workflow design, leading to slow invoice processing and payment delays. This can strain vendor relationships and increase the workload for AP staff, potentially causing burnout and further errors.

Internal Controls and Policies

If internal controls are not adequately designed or implemented, they may fail to detect errors or prevent fraud. Poorly defined policies can lead to inconsistent practices across the organization. Overly rigid controls can hinder efficiency, while too lax controls can increase the risk of errors and fraud.

The presence of inherent risks in AP requires the establishment of robust internal controls, regular audits, employee training, and the use of advanced AP automation software to minimize the potential for errors and fraud. It’s important for finance teams to continuously assess and update their risk management strategies in order to adapt to evolving risks in their AP processes.

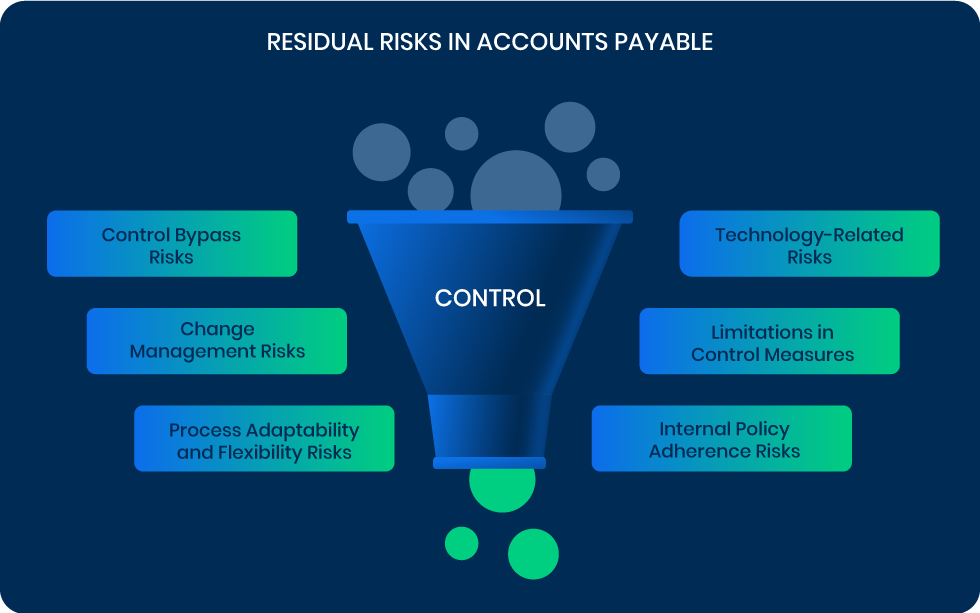

Residual Risks in Accounts Payable

Even if you do everything right, some risks may still remain in your AP process. These residual risks can be reduced but never completely eliminated. They include risks that are beyond the company’s control, such as natural disasters or supplier bankruptcy. Additionally, even with strong controls in place, there is still the possibility of human error and fraud. Common examples of residual risks include:

Control Bypass Risks

Despite strong controls, there’s always a possibility they might be bypassed or become less effective over time. Employees might circumvent procedures, either intentionally or due to lack of knowledge, leading to potential errors. An over-reliance on certain controls can create blind spots in unmonitored areas.

Technology-Related Risks

Technology improves efficiency, but residual risks like system failures, software bugs, or cybersecurity vulnerabilities persist despite security measures. These risks evolve with technological advancements and can result in data breaches, loss of financial information, or AP process interruptions.

Change Management Risks

Organizational growth and changes can introduce complexities not fully covered by existing controls. This includes risks associated with implementing new AP systems or procedures, which may bring transitional risks until employees adapt.

Limitations in Control Measures

No control system is perfect, and there are inherent limitations due to budget constraints, resource availability, or practical considerations. Consequently, some risks may not be fully mitigated if the cost or effort is disproportionate to the risk.

Process Adaptability and Flexibility Risks

There’s a risk that the AP process may not quickly adapt to new business models, technologies, or market conditions, potentially leading to inefficiencies or increased error rates.

Internal Policy Adherence Risks

Even with well-defined policies, there’s a risk of non-adherence by employees, whether due to misunderstanding, disregard for procedures, or organizational culture issues, leading to inconsistencies in AP process execution.

While it’s true that AP risks can never be completely eliminated, having robust risk management strategies in place is essential. Continuously assessing and updating these strategies helps minimize potential losses. By combining strong internal controls, advanced technology, and thorough employee training, companies can mitigate the impact of both inherent and residual risks in their AP processes. Whether you’re a small business just starting out or a large enterprise with complex operations, prioritizing risk management in your AP processes is crucial to ensure financial stability and maintain strong vendor relationships. Now, how to use RCM in your AP process? Let’s explore that next.

How to Create an Accounts Payable Risk and Control Matrix

The RCM consists of two main components: risk assessment and control activities. Risk assessment identifies potential risks in your AP process, while control activities outline steps to prevent or detect these risks.

The matrix typically begins with risk identification. Once risks are identified, the matrix evaluates the likelihood and potential impact of each risk. This assessment helps in prioritizing risks, guiding organizations in effectively allocating resources for risk management. Control activities are then outlined to mitigate the identified risks. These controls can be either preventative or detective. Preventive controls aim to stop errors or fraud before they occur and include measures like proper authorization procedures, segregation of duties, and vendor verification processes. Detective controls, such as regular audits and reconciliation processes, help identify and address issues after they occur.

So, how do you get started? We will provide you with step-by-step instructions to create your own AP risk and control matrix in the next section.

Step-by-Step Guide to Creating an Accounts Payable Risk and Control Matrix

1) Risk Identification

Begin by identifying all potential inherent and residual risks in the AP process, considering everything from internal fraud to external economic changes. Engage different departments and use a variety of sources like audit reports, financial reviews, and industry trends to ensure a comprehensive risk identification. This stage sets the foundation for the RCM, so thoroughness here is key.

2) Control Mapping

For each risk, identify existing controls. These might include automated checks, manual review processes, employee oversight, and regular financial audits. The goal here is to have a clear understanding of what measures are already in place to mitigate each identified risk, and how these controls are implemented and monitored.

3) Risk Assessment

Evaluate the likelihood and potential impact of each identified risk. High-likelihood, high-impact risks need more immediate and stringent controls. This assessment should be revisited periodically, as the likelihood and impact of risks can change over time.

4) Control Effectiveness Evaluation

Analyze how effective each control is in reducing or eliminating its corresponding risk. This can involve reviewing historical incident data, conducting control testing, and getting feedback from staff involved in the AP process. Controls that are found lacking either in design or execution need to be addressed promptly.

5) Gap Analysis

Determine where there are gaps in the control framework—where risks are either not controlled at all, or existing controls are insufficient. This step is crucial for prioritizing which areas of the AP process need immediate attention and resources for control improvement or implementation.

6) Action Plan Development

Develop specific action plans for addressing identified gaps. This involves outlining steps to enhance or add controls, setting timelines, and assigning responsibilities. The action plan should be realistic, considering the available resources and the severity of the risks.

7) Documentation and Communication

Clearly document the RCM and communicate it effectively across the organization. This documentation should be user-friendly, making it easy for all stakeholders to understand their roles and responsibilities in risk management. Regular communication and training sessions can help reinforce the importance of the RCM and ensure compliance.

8) Continuous Monitoring and Review

Regularly review and update the RCM to reflect changes in the business environment, new risks, and the effectiveness of controls. This might involve scheduled reviews, ad-hoc analyses in response to incidents, and continuous monitoring of key risk indicators.

9) Integration with Overall Risk Management

Align the AP RCM with the company’s wider risk management strategies. This ensures a unified approach to risk across different departments and processes, facilitating better decision-making and resource allocation at the organizational level.

10) Leveraging Technology

Use technology solutions, like advanced AP software, to automate controls, enhance monitoring, and improve the accuracy of risk assessments. Technology can also aid in data collection and analysis, providing valuable insights for ongoing risk management efforts.

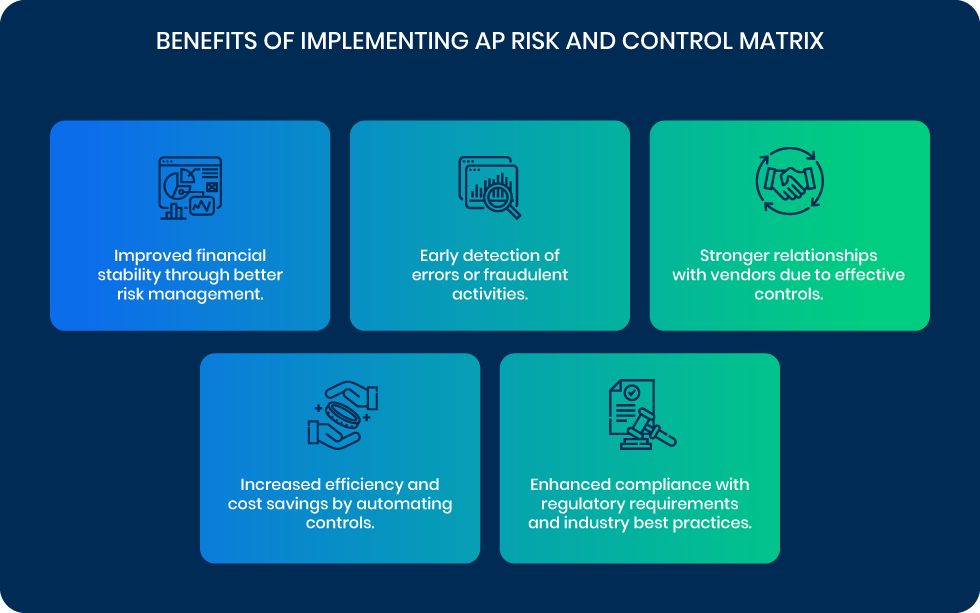

Benefits of Implementing AP Risk and Control Matrix

Effective risk management is crucial for any organization, and the AP process is a critical area that requires careful attention. The RCM is specifically designed to identify and manage the unique risks associated with AP operations, and implementing this matrix can significantly enhance a company’s ability to pinpoint potential risks in the AP process. This proactive approach to risk identification and mitigation leads to a substantial reduction in the likelihood of financial losses and compliance issues.

Implementing an AP risk and control matrix offers several benefits, including:

- Improved financial stability through better risk management.

- Early detection of errors or fraudulent activities.

- Stronger relationships with vendors due to effective controls.

- Increased efficiency and cost savings by automating controls.

- Enhanced compliance with regulatory requirements and industry best practices.

Furthermore, the matrix streamlines AP processes, leading to fewer errors and quicker processing times, which in turn improves overall operational efficiency. It also provides a systematic framework for staying compliant with evolving regulatory requirements, an invaluable asset in today’s dynamic regulatory environment. The matrix isn’t just a tool for risk management; it facilitates continuous improvement in AP processes, ensuring they remain efficient and effective over time.