Imagine running an accounts payable (AP) department without knowing exactly where things stand – it would be like navigating without a map.

That’s where AP key performance indicators (KPIs) come in, providing critical insights into your operations and helping you pinpoint inefficiencies. KPIs serve as the roadmap for AP departments, offering a clear picture of how well your team is performing and where improvements can be made.

While many organizations stick to basic, well-known metrics to drive business success, the most effective AP departments dive deeper, using specific AP KPIs to unearth hidden issues and streamline their processes.

Most AP software solutions provide data for consistently tracking and analyzing these indicators. This data-driven approach turns raw numbers into actionable insights, helping AP departments reduce errors, cut costs, optimize workflows, and maintain strong vendor relationships.

So, where should you start, and how can you make the most of the data already at your fingertips? In this article, we will discuss 10 important KPIs that every organization should keep track of in order to optimize their accounts payable process.

- Days Payable Outstanding (DPO)

- AP Turnover Ratio

- Invoice Processing Time

- Cost per Invoice Processed

- Invoice Approval Time

- Discount Captured Rate

- Late Payment Rate

- Invoice Exception Rate

- Percentage of Electronic Payments

- AP Error Rate

1) Days Payable Outstanding (DPO)

The DPO metric measures the average number of days it takes for a company to pay its invoices after receiving them. This metric is crucial for understanding cash flow.

A higher DPO means you hold onto cash longer, which can be beneficial for working capital. However, an excessively high DPO can strain supplier relationships.

Maintaining an optimal DPO balance is important; a low DPO indicates quick payments, which might hurt cash flow, while a high DPO might signal payment delays, potentially harming supplier relationships.

- Average Accounts Payable: The average amount owed to suppliers, typically calculated by averaging the beginning and ending accounts payable balances for the period.

- Cost of Goods Sold (COGS): The direct costs attributable to the production of the goods sold by the company.

- Number of Days: The number of days in the period being analyzed, usually 365 for a year.

2) AP Turnover Ratio

The Accounts Payable (AP) Turnover Ratio indicates how many times a company pays off its accounts payable during a period, typically a year.

This ratio reflects the efficiency of the AP department in managing and paying off supplier obligations. A higher turnover ratio suggests prompt payments, enhancing supplier trust. Conversely, a lower ratio might indicate issues with cash flow or payment processes.

Balancing this ratio is crucial to ensure liquidity while fostering strong relationships with suppliers.

- Total Supplier Purchases: The total value of purchases made from suppliers over a specific period.

- Average Accounts Payable: The average amount owed to suppliers, typically calculated by averaging the beginning and ending accounts payable balances for the period.

3) Invoice Processing Time

Invoice Processing Time measures the average number of days it takes for an invoice to be processed and approved for payment. This KPI reflects the efficiency of AP processes, including invoice receipt, data entry, review, and approval.

A shorter processing time indicates streamlined workflows and prompt payments, while a longer processing time could indicate bottlenecks or inefficiencies in the AP department.

- Total Processing Time for All Invoices: The cumulative amount of time taken to process all invoices within a specific period.

- Total Number of Invoices: The total number of invoices processed during that period.

4) Cost per Invoice Processed

The cost of processing each invoice can vary based on factors such as manual labor, software subscriptions, and other expenses. By tracking this KPI, you can identify opportunities to reduce costs and improve efficiency in your accounts payable process.

Average Cost per Invoice Processed measures the average cost incurred by the AP department to process one invoice. A high cost per invoice could indicate inefficient processes or a heavy reliance on manual tasks.

- Total AP Processing Costs: The total expenses incurred in the AP process, including labor, technology, and overhead costs.

- Total Number of Invoices Processed: The total number of invoices processed in the given period.

To find out the approximate cost of processing an invoice, you can try DOKKA’s invoice processing cost calculator here.

5) Invoice Approval Time

Similar to invoice processing time, tracking how long it takes for an invoice to get approved is crucial for understanding potential bottlenecks in your accounts payable process. Delays in approval can result in late payments and missed opportunities for early payment discounts.

By monitoring Invoice Approval Time, you can identify inefficiencies and work towards improving the approval process.

- Total Approval Time for All Invoices: The cumulative time taken to approve all invoices during a specific period.

- Total Number of Invoices: The total number of invoices that required approval in that period.

6) Discount Captured Rate

Many vendors offer discounts for early payments to incentivize timely payments from their customers. Tracking the percentage of early payment discounts captured by your accounts payable department can provide insight into the effectiveness of your company’s cash management strategies.

The Discount Captured Rate measures the percentage of available early payment discounts that a company takes advantage of. A high rate indicates effective cash management and efficient invoice processing, leading to significant cost savings.

- Total Discounts Captured: The total value of early payment discounts that the company successfully utilized.

- Total Discounts Available: The total value of early payment discounts that were available to the company.

7) Late Payment Rate

Late payments not only damage relationships with vendors but can also result in costly late fees. Tracking the percentage of invoices paid on time can help you identify any issues with your payment process and ensure that payments are made promptly.

The Late Payment Rate measures the percentage of invoices paid after their due dates. A high late payment rate could indicate cash flow issues or inefficiencies in the AP department, while a low rate reflects prompt payments and strong relationships with suppliers.

- Number of Late Payments: The number of invoices paid after their due date.

- Total Number of Payments: The total number of invoices paid in the given period.

8) Invoice Exception Rate

Invoice exceptions refer to invoices that require additional review or approval due to errors or discrepancies.

A high exception rate could indicate issues with data accuracy or delays in the AP process. A lower rate indicates streamlined processes and a focus on data accuracy.

Tracking this KPI can help identify areas for improvement and streamline invoice processing.

- Number of Invoices with Exceptions: The number of invoices that had issues during processing.

- Total Number of Invoices: The total number of invoices processed in the given period.

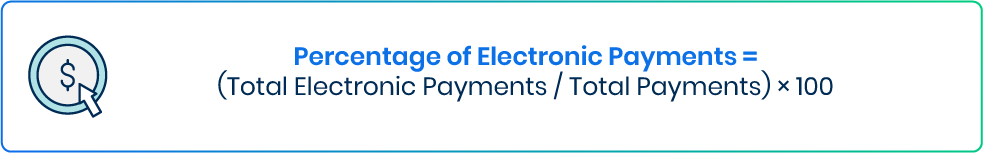

9) Percentage of Electronic Payments

Electronic payments are faster, more secure, and often come with lower transaction fees compared to paper checks. Tracking the percentage of electronic payments made by your accounts payable department can provide insight into the level of adoption and potential cost savings from transitioning to electronic payments.

The Percentage of Electronic Payments measures the proportion of payments made electronically versus traditional methods. A higher percentage indicates a more modern, efficient AP process, which can reduce processing times and lower costs.

- Total Electronic Payments: The number of payments made electronically in a specific period.

- Total Payments: The total number of payments made in that period.

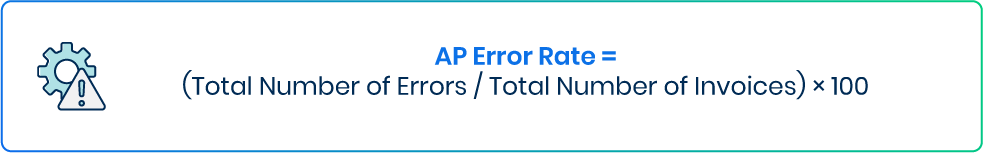

10) AP Error Rate

The AP Error Rate measures the frequency of errors in the accounts payable process, such as incorrect payments or data entry mistakes. High error rates can lead to financial losses, strained vendor relationships, and increased processing times.

Monitoring this KPI helps organizations identify the root causes of errors and implement measures to reduce them. Reducing this rate is crucial for maintaining accuracy, reducing costs, and ensuring smooth operations.

- Total Number of Errors: The number of errors encountered in the AP process.

- Total Number of Invoices: The total number of invoices processed in the given period.

Why are Accounts Payable KPIs Important?

For many finance leaders, the success of an organization relies heavily on the efficient and accurate management of accounts payable. Accounts payable KPIs are used to measure and track the performance of accounts payable processes, providing insights into how well a company is managing its vendor relationships and cash flow. Therefore, having clear and measurable KPIs is vital to ensure that the AP team is operating efficiently and effectively.

Some other reasons why AP KPIs are essential include:

- Identifying Potential Issues: By tracking and analyzing KPIs, companies can identify potential issues or bottlenecks in their AP processes. This allows them to address problems proactively before they escalate into bigger concerns.

- Setting Benchmarks: KPIs provide a benchmark for companies to measure their performance against industry standards and best practices. This helps identify areas where the company is excelling and areas that need improvement.

- Improving Vendor Relationships: Effective management of accounts payable contributes to building strong relationships with vendors. By monitoring KPIs related to vendor payment cycles and processing times, companies can ensure timely payments and maintain good relationships with their suppliers.

- Driving Cost Savings: AP KPIs can help identify areas where costs can be reduced, such as late payment fees, duplicate payments, and inefficient processes. By optimizing these areas, companies can achieve cost savings and improve their bottom line.