Companies of all sizes have at least one dedicated person to manage the bills. Whether it’s just one individual or an entire team of accounting professionals, the accounts payable (AP) department plays a vital role in the financial success of any organization. Why? Simply because they are responsible for ensuring that all payments owed by the company are processed accurately and on time.

Beyond just processing invoices, the AP department fosters smooth relationships with suppliers, avoids costly late fees, and upholds the organization’s reputation for financial responsibility. Their work also helps maintain cash flow stability, which is crucial for funding operations, investments, and growth initiatives.

What is Accounts Payable?

Accounts payable (AP) is an accounting term that refers to the money a company owes its vendors or suppliers for goods and services received. It is recorded as a liability on the company’s balance sheet until the debt is paid.

Accounts payable can include a wide range of expenses, from office supplies and utility bills to larger expenditures such as equipment and inventory purchases. These payments are typically due within a set period, known as the payment terms, which can range from 15 days to 90 days or more.

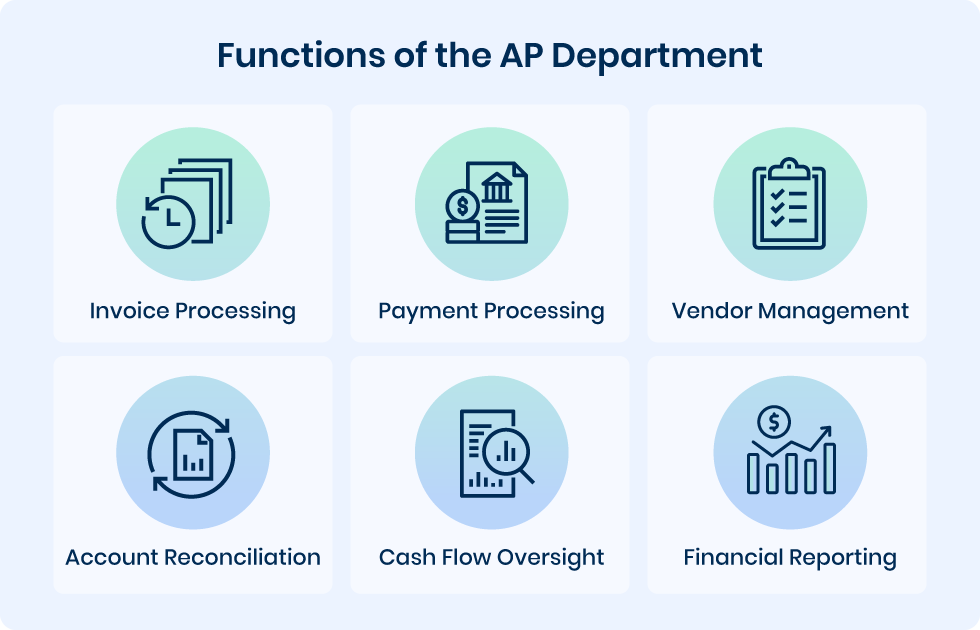

6 Key Functions of the Accounts Payable Department

The Accounts Payable (AP) department is responsible for processing invoices and ensuring timely payments to vendors. Beyond this core task, the department plays a vital role in maintaining accurate financial records by tracking outgoing payments, reconciling vendor accounts, and properly recording expenses.

Efficient cash flow management is another critical responsibility. The AP team ensures payments are made on time to maintain financial stability and avoid late fees or penalties. Their reporting and analysis of accounts payable data provide valuable insights for budgeting, forecasting, and identifying cost-saving opportunities.

To fulfill their responsibilities effectively, the AP department performs several essential functions and tasks daily:

1) Invoice Processing

The AP department manages the review, verification, and processing of vendor invoices to ensure accuracy and legitimacy. Once validated, invoices are entered into the company’s accounting software for payment.

- Receiving invoices: Collect invoices via email, mail, or electronic platforms.

- Verifying invoices: Check for accuracy, legitimacy, and compliance with purchase orders or contracts.

- Invoice coding: Assign appropriate account codes for accurate bookkeeping.

- Data entry: Enter invoice details into the accounting software or enterprise resource planning (ERP) system.

- Matching invoices: Match invoices with purchase orders and receiving documents (3-way match).

2) Payment Processing

The AP department is responsible for issuing payments to vendors through checks, wire transfers, or other electronic methods after obtaining proper approval. Employee expense reports are also processed under this function.

- Approval workflow management: Ensure invoices are reviewed and approved by the appropriate personnel before payment.

- Payment preparation: Prepare payments through echecks, wire transfers, ACH, or other electronic methods.

- Scheduling payments: Set up payment schedules to ensure timely processing while maintaining optimal cash flow.

- Executing payments: Process approved payments to vendors or suppliers.

- Handling exceptions: Address payment issues, such as failed transfers or incorrect payment amounts.

3) Vendor Management

Vendor management is another key function of the AP department. They handle vendor relationships by negotiating payment terms, resolving disputes, maintaining accurate vendor records, and managing purchase orders and contracts. Regular communication with vendors ensures smooth operations and timely resolutions.

- Vendor onboarding: Collect and verify vendor details, including tax identification numbers and banking information.

- Maintaining vendor records: Update vendor profiles with accurate and current information.

- Communicating with vendors: Respond to inquiries about payment status and resolve disputes or discrepancies.

- Negotiating payment terms: Work with vendors to establish favorable payment terms and schedules.

4) Account Reconciliation

The AP department ensures that accounts payable transactions align with the general ledger, maintaining accuracy and integrity in the company’s financial records.

- Monthly reconciliation: Compare accounts payable transactions with general ledger accounts to ensure accuracy.

- Vendor statement reconciliation: Match vendor statements with company records to identify and correct discrepancies.

- Bank reconciliation: Verify payment transactions with bank statements to ensure alignment.

5) Cash Flow Oversight

Payment schedules and accounts payable activities are monitored to ensure stable cash flow management and prevent penalties.

- Monitoring payment schedules: Track due dates to avoid late payments and ensure optimal cash flow.

- Forecasting cash flow: Analyze payable data to predict future cash needs and advise management on financial planning.

- Avoiding penalties: Ensure timely payments to avoid late fees, interest charges, or damaged vendor relationships.

6) Financial Reporting

The AP department prepares detailed and timely reports on accounts payable activities. These reports provide management with valuable insights for informed decision-making regarding budgeting, forecasting, and cost-saving opportunities.

- Tax compliance: Ensure adherence to local and international tax regulations, such as withholding taxes or VAT.

- Audit support: Maintain thorough documentation to support external or internal audits.

- Preparing reports: Generate regular reports on AP KPI metrics, such as outstanding payables, payment cycle times, and vendor aging reports.

- Regulatory compliance: Ensure compliance with financial laws and corporate policies to mitigate risks.

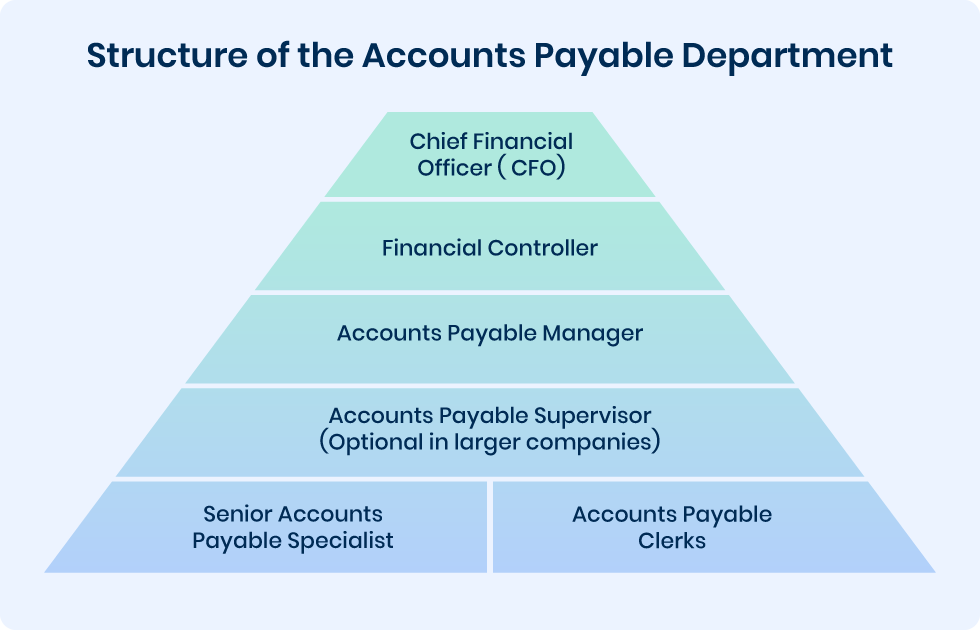

Structure and Hierarchy of the AP Department

The AP department typically follows a hierarchical structure, with different levels of responsibilities and reporting lines. The size and complexity of the organization may influence this structure, but it generally includes some or all of the following roles:

Accounts Payable Clerk

At the entry level, the AP clerk plays a fundamental role in the daily operations of the department. This individual is primarily responsible for processing invoices, matching purchase orders to invoices, scheduling payments, and ensuring that all transactions are properly coded for accurate financial reporting.

AP clerks are typically the first point of contact for invoice processing, working under the supervision of the Accounts Payable Supervisor or Manager to ensure that all payments are made on time and in accordance with company policies.

Senior Accounts Payable Specialist

The senior AP specialist takes on more advanced responsibilities. This role is often filled by an experienced AP professional who manages more complex or high-value transactions.

The senior specialist is also tasked with reconciling discrepancies between accounts, troubleshooting issues that arise with vendors, and providing guidance and training to junior staff members.

They also report directly to the Accounts Payable Manager or Supervisor, helping to support the overall efficiency of the department and ensure that more intricate aspects of the accounts payable process are handled correctly.

Accounts Payable Supervisor

The accounts payable supervisor is typically responsible for overseeing the daily operations of the AP team. Their job involves supervising the work of clerks and specialists, ensuring that invoices are processed in a timely manner, and that the team adheres to the company’s established policies and procedures.

The Supervisor may also address any operational issues that arise within the department. Although this position is essential in larger organizations, it may not be present in smaller companies, where these responsibilities may be handled by the Accounts Payable Manager. The AP supervisor reports directly to the Accounts Payable Manager, and in larger organizations, the role may also serve as a bridge between the staff and higher management.

Accounts Payable Manager

The AP manager is responsible for overseeing the entire accounts payable function within the organization, but also plays a critical role in maintaining strong relationships with suppliers and ensuring the accuracy of financial records.

AP manager typically reports to the Financial Controller or, in some cases, directly to the CFO, depending on the size of the company. They are responsible for making sure that the AP processes align with the broader financial goals of the organization.

Financial Controller

The financial controller is a senior role that directs the financial policies of the company and manages all accounting operations, including the oversight of accounts payable.

Financial controllers ensure that the company’s internal controls are in place, including those that govern the AP department. This position plays a key role in aligning the department’s processes with the company’s overall financial strategy and ensuring compliance with regulatory requirements. The financial controller reports to the CFO and may also have oversight of other accounting functions, such as financial reporting and budgeting.

Chief Financial Officer (CFO)

Finally, the chief financial officer (CFO) oversees the financial health of the company, including all aspects of accounting, financial reporting, budgeting, compliance, and internal controls.

The CFO is responsible for high-level decision-making and strategic planning, with the AP department being one of the key areas under their supervision. The CFO typically reports to the CEO or the Board of Directors, providing insights into the company’s financial status and ensuring that the organization’s financial practices align with long-term goals and regulatory requirements.

Why an Efficient AP Department is a Game-Changer

As mentioned before, beyond simply processing invoices and payments, the AP department contributes significantly to maintaining healthy cash flow, fostering strong vendor relationships, and ensuring financial accuracy and compliance. So the effectiveness of the AP department often determines how well a company manages its operational expenses and avoids costly errors or delays.

A well-run AP function is integral to the overall financial health and operational success of the company. It supports not just the finance team, but the entire business by promoting stability, cost savings, and trust across all stakeholders.

Whether through adopting innovative solutions, fostering collaboration within the team, or ensuring meticulous attention to detail, the benefits of an efficient AP department are both immediate and far-reaching. In fact, an efficient AP team helps the business stay ahead of the competition, strengthen supplier relationships, and protect the company’s reputation for financial responsibility.

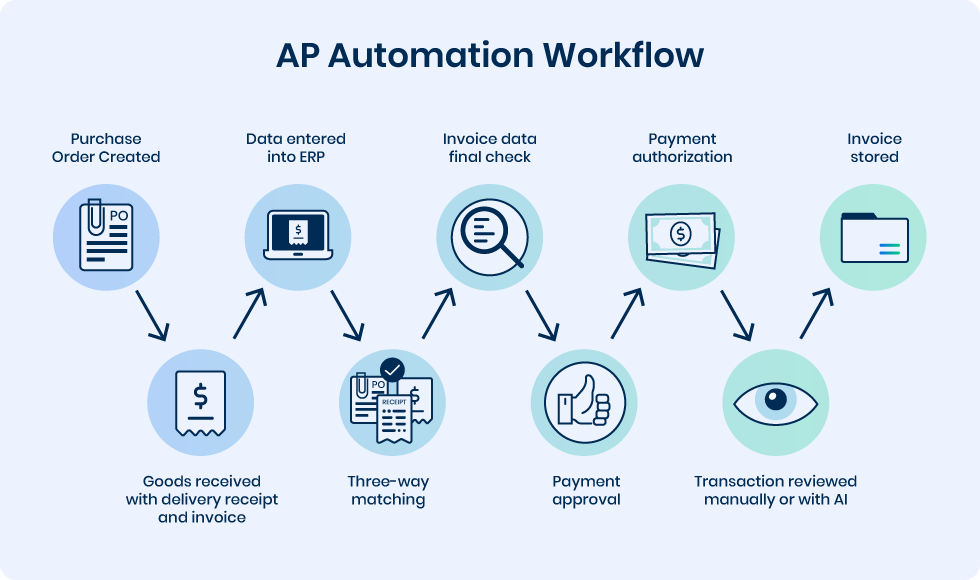

How AP Automation Software Improves the Efficiency of the AP Department

When workflows in the AP department are optimized, the company benefits from streamlined processes that save time and reduce the risk of manual errors.

Automation and technology are key drivers in achieving this, allowing teams to focus on strategic tasks rather than being bogged down by repetitive, labor-intensive actions. By implementing tools that enable quicker invoice processing, better data accuracy, and real-time reporting, the department becomes more agile and capable of adapting to changing business needs.

Automation reduces administrative costs by eliminating paper-based workflows, manual data entry, and the need for physical storage. With automated AP software such as DOKKA, employees can track invoices, approvals, and payments more easily and accurately, leading to faster resolution of issues and fewer discrepancies.

AP automation not only improves the efficiency of the department but also enhances the organization’s overall financial management. Most of the AP automation software are easy to integrate with existing accounting systems, providing the AP team with a seamless experience and ensuring that all data is centralized and easily accessible.