In 2022, the U.S. SEC issued $6.4 billion in penalties, showing how serious the consequences of inaccurate financial reporting can be.

To reduce risks and stay compliant, more companies are adopting advanced financial close software that minimizes errors and simplifies reporting.

The same source notes that the financial close software market is expanding rapidly and is projected to reach $4.15 billion by 2033, driven by stricter compliance requirements, increasingly complex global operations, and the push toward digital transformation.

And for good reason: these tools automate manual tasks, reduce errors, and deliver real-time insights, making financial reporting faster and more reliable. Cloud-based solutions and AI integration further promise more scalable, intelligent, and continuous financial close processes.

Even so, high implementation costs, resistance to change, and data security concerns can slow adoption. For many finance teams, the challenge is balancing the need for innovation with the realities of tight budgets, legacy systems, and limited resources.

That is why it’s important to select the best financial close software to fit your budget and needs.

Which one is it? Let’s see.

Best Financial Close Automation Software

The benefits of using it are clear, yet many finance teams still struggle to choose the right solution. With a rapidly growing market and tools adding countless new features, it can feel overwhelming to determine which option best fits your organization.

- DOKKA: Best for mid-sized companies seeking enterprise-grade close automation at a mid-market cost.

- BlackLine: Best for organizations needing robust, end-to-end reconciliation and close automation across multiple entities.

- FloQast: Best for accounting teams that want Excel-friendly automation without disrupting existing workflows.

- Adra by Trintech: Best for mid-sized organizations looking for a comprehensive yet intuitive close automation suite.

- Stacks: Best for high-volume, multi-entity finance teams needing proactive error detection and AI-driven reconciliations.

- Nominal: Best for fast-paced or distributed teams requiring real-time subledger integration and collaboration.

- Aico: Best for large enterprises with complex ERP environments needing modular, end-to-end automation.

- Planful: Best for organizations that want an integrated financial consolidation, planning, and reporting platform.

- Prophix: Best for teams seeking a unified platform that combines close, budgeting, and forecasting workflows.

- LiveFlow: Best for spreadsheet-heavy teams wanting automated multi-entity consolidation while staying in familiar tools.

- DataRails: Best for Excel-centric finance teams who want centralized, real-time insights without abandoning spreadsheets.

- Numeric: Best for modern accounting teams looking for AI-assisted real-time reconciliation and variance detection.

- Workiva: Best for organizations that require centralized reporting with strong compliance, GRC, and ESG capabilities.

- LucaNet: Best for companies with complex structures needing detailed consolidation, budgeting, and forecasting automation.

- Vena Solutions: Best for teams who want Excel-based workflows combined with cloud-powered automation and audit control.

- OneStream: Best for large enterprises with complex multi-GAAP, multi-entity, and multi-currency consolidation requirements.

- JustPerform: Best for organizations wanting cloud-native consolidation, self-service workflows, and real-time performance insights.

- Board: Best for companies needing tightly integrated consolidation, planning, and reporting with scenario modeling.

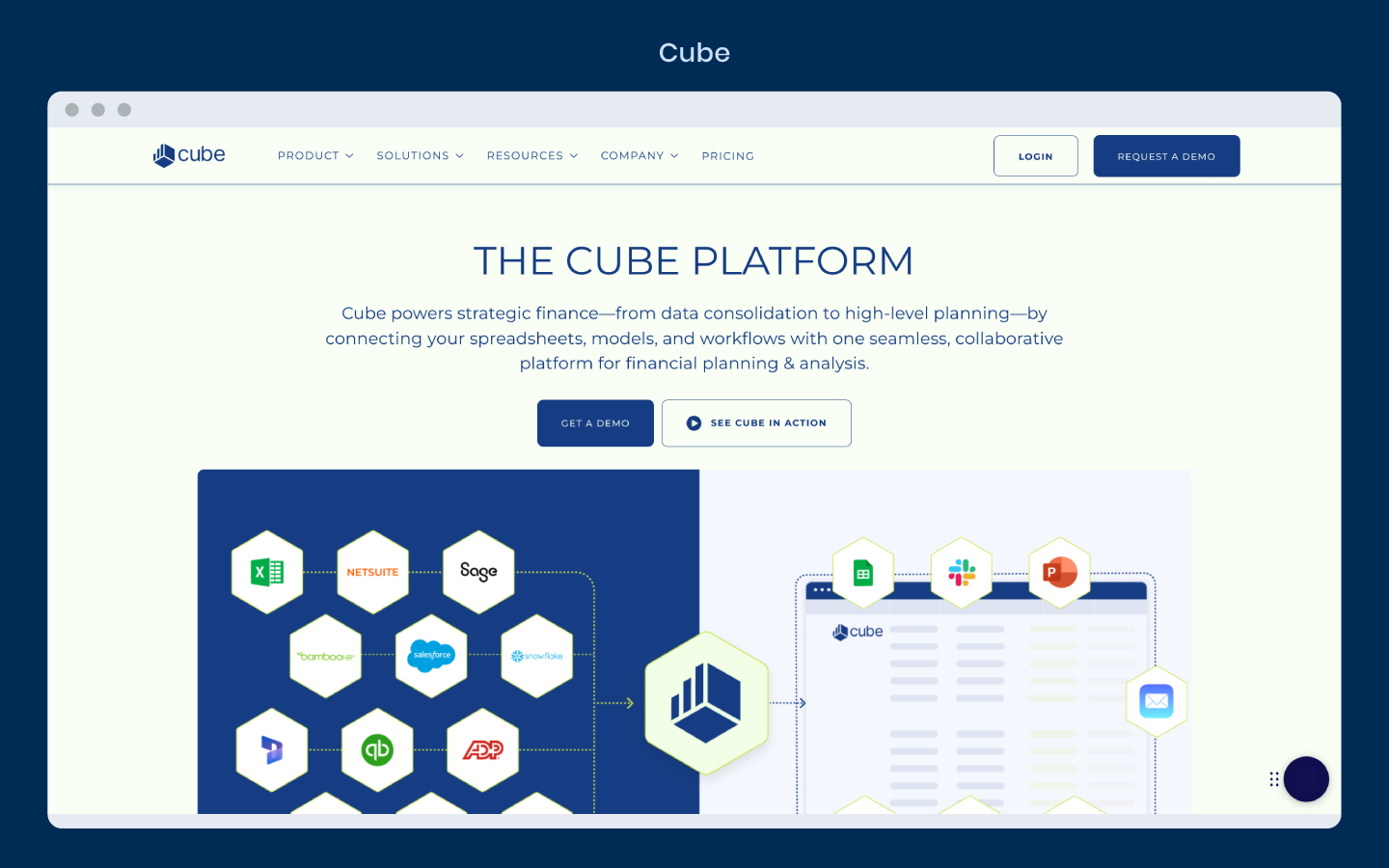

- Cube: Best for mid-sized organizations that want spreadsheet-based FP&A and consolidation automation with minimal disruption.

- Redwood Software: Best for SAP-centric enterprises aiming for near “touchless” record-to-report automation.

1) DOKKA

DOKKA Close is an intelligent financial close automation platform built for modern finance teams that want enterprise-grade outcomes without enterprise-grade complexity. It automates reconciliations, journal entries, flux analysis, and close workflows in a single, Excel-like workspace—helping teams close faster, with fewer errors and far less manual effort.

Unlike traditional close tools that sit downstream and rely heavily on rigid rules, DOKKA improves the close at its source by cleaning and structuring financial data before it reaches the close process. The result is fewer breaks, fewer adjustments, and a smoother, more predictable close.

Key Features

- Automated Reconciliations: High-volume transaction matching with intelligent exception handling. DOKKA automatically matches entries, flags discrepancies, and surfaces only what truly needs attention.

- Journal Entry Automation: Create and post accurate journal entries directly to the ERP based on reconciliations, approvals, and predefined logic—without manual rekeying.

- Flux & Variance Analysis: Automatically explains balance movements and highlights unusual changes, eliminating spreadsheet-based variance analysis.

- Close Workflow & Approvals: Task management, approvals, comments, and ownership tracking built directly into the close—no emails or offline trackers required.

- Centralized Audit Trail: Every reconciliation, adjustment, approval, and document is logged and traceable, giving auditors instant visibility without last-minute scrambling.

- Excel-Like Workspace: A familiar interface designed for accountants, combining the flexibility of spreadsheets with the control and automation of a system.

Differentiation

DOKKA Close is designed specifically for mid-market finance teams that need speed, accuracy, and clarity—but don’t want the cost, complexity, or rigidity of enterprise close platforms.

By unifying upstream AP automation with close automation, DOKKA prevents errors before they reach reconciliations, rather than just reacting to them. This approach delivers faster closes, cleaner data, and significantly better ROI compared to tools that only automate checklists and task tracking.

Pricing

DOKKA uses a modular, subscription-based pricing model based on team size and required capabilities. Pricing is tailored to each organization to ensure teams only pay for what they actually use. You can book a demo of DOKKA to scope and confirm final pricing.

Pros

- Significantly faster close cycles driven by automated reconciliations and reduced manual adjustments

- Cleaner, more reliable close data thanks to upstream automation

- Familiar Excel-like experience that accelerates adoption

- Quick implementation with minimal process disruption

- Strong audit readiness with built-in documentation and traceability

Cons

- Not designed for highly bespoke, enterprise-only accounting structures

- Deeply customized or legacy ERP environments may require additional integration effort

2) BlackLine

BlackLine is a comprehensive financial close automation platform that provides a suite of tools that automate reconciliations, journal entries, transaction matching, and task management, all aimed at improving accuracy, efficiency, and compliance in financial operations.

Key Features:

- Account Reconciliations: Automates and standardizes the reconciliation process, reducing manual effort and errors.

- Transaction Matching: Ingests and transforms high volumes of transaction-level data from multiple systems to match transactions efficiently.

- Smart Close: Delivers real-time visibility into the close process, enabling teams to manage tasks and deadlines effectively.

- Journal Entries: Streamlines the creation, approval, and posting of journal entries to ensure accuracy and compliance.

- Compliance and Reporting: Provides tools to maintain audit trails and generate compliance reports, supporting regulatory requirements.

Differentiation:

BlackLine sets itself apart with robust automation capabilities and a comprehensive suite of tools covering multiple aspects of the financial close. Emphasis on automation and standardization helps organizations cut down on manual tasks, minimize errors, and accelerate the close cycle.

Pros:

- Comprehensive automation of reconciliations and close tasks reduces manual workload and accelerates the month-end process.

- Real-time tracking and visibility provide finance teams with insights into task status and bottlenecks, improving accountability.

- Scalable solution accommodates growing organizations and complex multi-entity structures.

Cons:

- Implementation can be complex and time-consuming, requiring dedicated resources to configure workflows and integrations.

- User interface may be less intuitive for new users, necessitating additional training.

3) FloQast

FloQast is a financial close automation platform made to streamline and enhance the month-end close process for accounting teams. It integrates seamlessly with existing accounting software or ERP systems, providing tools for managing reconciliations, documenting the close, and tracking accounting workflows.

Key Features:

- Automated Reconciliations: Automates reconciliations, reducing manual effort and errors.

- AI Transaction Matching: Utilizes artificial intelligence to match transactions efficiently, saving time and improving accuracy.

- Journal Entry Automation: Streamlines the creation, approval, and posting of journal entries, ensuring consistency and compliance.

- Close Task Management: Centralizes and standardizes the period-end close process, facilitating communication and ensuring accurate, timely, and repeatable results.

- Integrated Record-to-Report: Provides a comprehensive solution connecting various aspects of the financial close process, from reconciliations to reporting.

Differentiation:

FloQast enables accounting teams to continue using Excel, a tool many are already familiar with, while adding automation and centralization features. This approach reduces the learning curve and supports a smoother transition to automated processes.

Pros:

- User-friendly interface and familiar spreadsheet integration enable fast adoption and minimal training for finance teams.

- Collaboration features improve team efficiency by centralizing tasks, approvals, and communications during the close.

- ERP integrations ensure data consistency and streamline journal entry posting and reconciliation processes.

Cons:

- Limited transaction-level detail may reduce visibility for detailed variance analysis.

- Data refresh rates may lag behind some competitors.

- Excessive notifications can lead to fatigue, requiring careful configuration of alerts.

4) Adra by Trintech

Adra by Trintech is a financial close automation platform designed to simplify and optimize the financial close process for mid-sized organizations. It provides a suite of tools that automate reconciliations, journal entries, close task management, and reporting, enhancing efficiency, accuracy, and compliance.

Key Features:

- Account Reconciliations: Automates and standardizes balance sheet reconciliations, improving the integrity of financial statements.

- Transaction Matching: Eliminates error-prone, time-consuming manual tasks during the month-end close by automating transaction matching.

- Close Task Management: Centralizes the entire close cycle in one platform, increasing visibility, speed, and accuracy of the month-end close.

- Journal Entry Automation: Streamlines journal entry creation, approval, and ERP posting using AI-driven automation and intelligent workflows.

- Reporting and Analytics: Delivers meaningful insights with full access and visibility into the month-end close through customizable reports and dashboards.

Differentiation:

Adra by Trintech stands out with a comprehensive suite of tools tailored for mid-sized organizations. It focuses on automating key financial close tasks to improve efficiency and accuracy, while AI-driven automation and integration capabilities distinguish it from competitors.

Pros:

- Intuitive interface and streamlined reconciliation workflows reduce manual effort and simplify the financial close.

- ERP compatibility provides flexibility and ensures seamless integration across various accounting systems.

- Scalable platform supports growing organizations and multi-entity operations efficiently.

Cons:

- Customization may be limited, affecting adaptability for highly specialized accounting processes.

- Integration with legacy systems can require additional resources and planning.

- Some advanced features present in other platforms may be lacking, which could require workarounds or additional tools.

5) Stacks

Stacks streamlines month-end close for teams managing high volumes of transactions, using AI to automate reconciliations, journal entries, and variance analysis. The platform proactively identifies discrepancies, highlights exceptions, and centralizes workflow management, enabling finance teams to close faster and reduce errors in complex, multi-entity environments.

Key Features:

- AI-Powered Reconciliations: Automates the matching of high-volume transactions, reducing manual effort.

- Journal Entry Automation: Speeds up creation, approval, and posting with built-in workflows.

- Variance Analysis: Detects anomalies using AI and provides actionable insights.

- Centralized Workflows: Tracks tasks across teams for improved visibility and accountability.

- Audit-Ready Documentation: Automatically generates reports and audit trails.

Differentiation:

Stacks combines AI-driven automation with proactive anomaly detection. Many platforms only automate repetitive tasks, while Stacks identifies potential errors before they escalate and centralizes task management across multiple entities. This focus on proactive accuracy makes it especially suitable for organizations with high-volume or multi-location finance operations.

Pros:

- AI-driven reconciliations significantly reduce manual matching for high-volume accounts.

- Exception flagging lets teams prioritize investigations instead of spending time on clean accounts.

- Centralized close tracking ensures multi-entity teams can manage dependencies and deadlines in one hub.

Cons:

- Requires strong initial data integration to realize full AI benefits.

- Change management effort may be high for teams accustomed to spreadsheets.

6) Nominal

Nominal accelerates the financial close by linking subledgers in real time and automating reconciliation and reporting workflows. Customizable dashboards allow teams to track progress, collaborate seamlessly, and quickly identify bottlenecks, making it especially effective for fast-paced or distributed finance teams.

Key Features:

- AI-Powered Automation: Reconciliations, variance analysis, and reporting are automated using AI.

- Subledger Integration: Connects seamlessly with multiple subledgers to ensure data accuracy.

- Collaborative Workflows: Supports real-time collaboration throughout the close process.

- Customizable Dashboards: Monitors tasks, KPIs, and overall close status in real time.

- Audit Trail: Maintains detailed records to support compliance and transparency.

Differentiation:

Nominal stands out by combining AI automation with live integration of subledger data and real-time collaboration tools. Unlike platforms that rely on batch processing, it allows accounting teams to address discrepancies immediately, making it ideal for organizations that require agility and visibility during the close process.

Pros:

- Live subledger integration avoids stale data issues common in batch processes.

- Task dashboards give clear visibility into who owns each close step and current bottlenecks.

- Collaboration features help distributed finance teams resolve reconciliation issues quickly.

Cons:

- Limited ecosystem compared to older vendors — fewer prebuilt connectors outside of core ERPs.

- Requires user training to get the most out of real-time reconciliation and dashboards.

7) Aico

Aico is a comprehensive financial close platform designed for large enterprises with complex accounting processes. It provides a suite of interconnected solutions that streamline and automate the month-end close, ensuring accuracy and compliance across multiple entities.

Key Features:

- Closing Task Manager: Organizes and tracks close tasks to ensure timely completion.

- Journal Entries: Automates the creation and posting of journal entries.

- Account Reconciliations: Facilitates efficient reconciliation of accounts.

- Transaction Matching: Automatically matches thousands of transactions from any data source.

- Intercompany Invoicing: Ensures accurate processing of intercompany transactions.

- Compliance Monitoring: Tracks adherence to financial regulations.

Differentiation:

Aico stands out with industry-leading live ERP integrations that enable real-time accounting. The platform combines powerful interconnected solutions to deliver a comprehensive approach to financial close automation.

Pros:

- Native ERP integrations (SAP, Oracle, Microsoft Dynamics) provide true real-time posting and reconciliation.

- Modular automation suite allows gradual rollout (journal entries, reconciliations, intercompany).

- Strong compliance controls built into workflows to satisfy auditors and regulators.

Cons:

- Implementation complexity makes it best suited for larger enterprises with IT support.

- Training investment is needed for finance teams new to ERP-embedded close automation.

8) Planful

Planful is a financial performance management platform that transforms the way organizations plan, close, and report. It consolidates data from multiple enterprise systems, enabling accurate and agile financial processes.

Key Features:

- Financial Consolidation: Automates the consolidation process for accurate reporting.

- Close Task Management: Tracks and manages close tasks to ensure timely completion.

- Compliance Reporting: Facilitates adherence to regulatory requirements.

- Data Integration: Integrates data from various enterprise systems.

- Audit Trail: Maintains a comprehensive audit trail for transparency.

Differentiation:

Planful differentiates itself by offering a unified platform that integrates financial close, consolidation, and reporting processes. This integration streamlines workflows, enhances data accuracy, and facilitates compliance, making it a comprehensive solution for financial close management.

Pros:

- Unified planning + close platform reduces system silos between FP&A and accounting.

- Multi-entity consolidation with automated eliminations speeds up enterprise closes.

- Robust reporting layer supports both statutory compliance and management insights.

Cons:

- Implementation requires cross-team coordination (accounting + FP&A).

- Learning curve for advanced reporting features beyond standard consolidation.

9) Prophix

Prophix is a comprehensive financial performance management platform that automates and accelerates the financial close process. It integrates data from various accounting systems to streamline reconciliations, consolidations, and reporting, enabling finance teams to close faster and with greater accuracy.

Key Features:

- Automated Reconciliation: Streamlines account reconciliations, reducing manual effort.

- Consolidation Management: Supports multi-entity and multi-currency consolidations.

- Journal Entry Automation: Automates the creation and posting of journal entries.

- Audit-Ready Reporting: Produces reports that are ready for internal and external audits.

- Data Integration: Connects with various accounting and ERP systems for seamless data flow.

Differentiation:

Prophix stands out by providing a unified platform that combines financial close automation with budgeting, forecasting, and reporting capabilities. The integration enables a more cohesive financial management process, minimizing the need for multiple disparate systems.

Pros:

- Tight integration of close, budgeting, and forecasting improves visibility across the finance cycle.

- Automation of recurring journal entries helps reduce repetitive manual work.

- Audit-ready reporting makes regulatory submissions smoother.

Cons:

- Longer implementation cycles when rolled out alongside other FP&A modules.

- Customization needs IT or Prophix consultants for advanced setups.

10) LiveFlow

LiveFlow is a financial close and consolidation platform designed for multi-entity organizations. It integrates with Google Sheets and Excel, enabling finance teams to automate consolidation processes, perform real-time reporting, and streamline workflows across multiple entities.

Key Features:

- Multi-Entity Consolidation: Automates the consolidation of financial data across multiple entities.

- Real-Time Reporting: Delivers up-to-date financial reports to support decision-making.

- Customizable Dashboards: Allows users to create dashboards tailored to specific needs.

- Data Integration: Connects with various data sources for seamless data flow.

- Template Library: Provides a library of templates to expedite reporting processes.

Differentiation:

LiveFlow stands out with its direct integration with Google Sheets and Excel, allowing finance teams to leverage existing tools while automating consolidation and reporting. This approach reduces the learning curve and ensures a smoother transition to automated workflows.

Pros:

- Direct Google Sheets/Excel integration makes adoption fast for spreadsheet-heavy teams.

- Multi-entity consolidation is automated without needing IT-heavy ERP projects.

- Template library accelerates setup for recurring reporting and consolidation tasks.

Cons:

- Limited feature depth compared to enterprise-grade close platforms.

- Dependence on spreadsheets may not suit organizations aiming to move away from Excel.

- Scalability can be an issue for very large enterprises with complex consolidation needs.

11) DataRails

DataRails is an FP&A platform that enhances Excel-based workflows through automation of financial close processes, consolidations, and reporting. It centralizes data from multiple sources, providing finance teams with real-time insights and minimizing manual errors.

Key Features:

- Excel Integration: Expands Excel capabilities with automation and centralized data.

- Financial Close Automation: Accelerates the financial close process to shorten cycle times.

- Consolidation Management: Automates consolidation of financial data across entities.

- Real-Time Reporting: Delivers up-to-date financial reports to support decision-making.

- Audit-Ready Documentation: Produces documentation suitable for audits.

Differentiation:

DataRails stands out by enhancing Excel-based workflows, allowing finance teams to use familiar tools while introducing automation and centralized data. This approach enables a smoother transition to automated financial processes without disrupting established workflows.

Pros:

- Excel-native experience reduces learning curve for finance teams.

- Data centralization layer ensures consistency while keeping Excel front-end flexibility.

- Real-time dashboards and variance tracking speed up management reporting alongside the close.

Cons:

- Primarily focused on Excel users, less relevant for teams seeking full ERP-based automation.

- Implementation still requires mapping multiple data sources before benefits are realized.

- Complex features (scenario planning, advanced dashboards) may require consultant support.

12) Numeric

Numeric is an AI-assisted financial close platform designed for modern accounting teams. It integrates seamlessly with popular accounting systems such as NetSuite, QuickBooks Online, Xero, and Sage Intacct, automating workflows and providing real-time insights to streamline the month-end close process.

Key Features:

- Automated Reconciliation: Reduces manual effort by streamlining account reconciliations.

- Journal Entry Tracking: Links journal entries to specific tasks for improved traceability.

- Audit-Ready Documentation: Maintains a comprehensive audit trail to ensure transparency.

- Real-Time Variance Detection: Detects discrepancies promptly for timely resolution.

- Customizable Task Management: Organizes tasks by department, entity, or control to improve coordination.

Differentiation:

Numeric differentiates itself through deep integrations with leading accounting systems, enabling real-time data synchronization and automation. AI-driven capabilities, such as journal entry linking and variance detection, enhance both the accuracy and efficiency of the financial close process.

Pros:

- Real-time reconciliation and variance alerts help catch discrepancies before they impact reporting.

- Strong ERP integrations (NetSuite, QuickBooks, Xero, Sage Intacct) allow automated syncing without manual exports.

- Task management linked to journal entries improves accountability across teams and reduces overlooked items.

Cons:

- Advanced AI features may require initial training for finance staff to fully utilize.

- Setup for multi-entity organizations can be complex and time-consuming.

13) Workiva

Workiva is a cloud-based platform that centralizes financial reporting, governance, risk, compliance (GRC), and sustainability management. It connects data across departments, enabling real-time collaboration and ensuring audit-ready reporting within a secure environment.

Key Features:

- Integrated Reporting: Combines financial and non-financial data for comprehensive reporting.

- Real-Time Collaboration: Supports teamwork across departments with live updates.

- Audit-Ready Documentation: Maintains compliance with regulatory standards.

- Data Integration: Connects with multiple data sources for seamless information flow.

- Sustainability Management: Facilitates ESG reporting and compliance.

Differentiation:

Workiva stands out by offering a unified platform that integrates financial reporting with GRC and sustainability management. This holistic approach streamlines workflows, improves data accuracy, and simplifies compliance, providing a comprehensive solution for financial close management.

Pros:

- Centralized reporting and GRC integration reduces errors from siloed spreadsheets.

- Real-time collaboration enables multiple finance team members to work on reports simultaneously, improving efficiency.

- Audit-ready documentation is automatically generated, simplifying compliance and reducing preparation time for auditors.

Cons:

- Initial implementation can be resource-intensive, especially for large organizations with multiple data sources.

- Complexity of platform may require ongoing training for new team members.

14) LucaNet

LucaNet is a financial performance management platform that automates consolidation and financial planning processes. It offers a comprehensive suite of tools for budgeting, forecasting, and reporting, supporting complex organizational structures and enabling detailed financial analysis.

Key Features:

- Financial Consolidation: Automates consolidation for accurate and efficient reporting.

- Budgeting and Forecasting: Streamlines planning and forecasting to support strategic decisions.

- Management Reporting: Delivers detailed reports tailored to internal stakeholders.

- BI and Dashboarding: Provides business intelligence tools for advanced data analysis.

- Intercompany Reconciliation: Ensures consistency and accuracy across entities.

Differentiation:

LucaNet stands out by delivering a robust suite of financial management tools designed for complex organizational structures. Its emphasis on automation and granular financial analysis allows organizations to optimize processes and make data-driven strategic decisions.

Pros:

- Automation of multi-entity consolidation reduces manual errors and shortens month-end close cycles.

- Integrated budgeting and forecasting allows finance teams to analyze scenarios and plan strategically in one platform.

- Intercompany reconciliation and BI dashboards provide transparency across all entities, supporting accurate reporting.

Cons:

- Setup for complex structures requires dedicated implementation resources and can take several weeks.

- Advanced features (BI and dashboards) have a learning curve and may require finance team training.

15) Vena Solutions

Vena Solutions is a financial close management platform that combines a native Excel interface with cloud-based workflow automation. It centralizes data from existing financial systems, automates reconciliations, consolidations, and tax provisioning, and enhances visibility and audit control—all while allowing finance teams to continue working in tools they know best.

Key Features:

- Account Reconciliation: Includes reconciliation checklists and journal entry tracking within the familiar Excel environment.

- Financial Consolidations: Supports intercompany eliminations, multiple currencies, partial ownership, and alternate roll-ups.

- Tax Provisioning: Provides tools to estimate taxes using current, historical, or projected financials.

- Workflow Automation: Automates inputs, uploads, approvals, reminders, and report distribution.

- Version Control: Maintains spreadsheet and file history to ensure auditability and data integrity.

Differentiation:

Vena stands out by combining the familiarity of Excel with the power of cloud-based workflow automation and strong consolidation features. Teams can import Excel files, leverage version control, and deploy pre-built templates—accelerating adoption, shortening deployment times, and reducing the need for custom builds.

Pros:

- Excel compatibility lowers training time for teams already comfortable with spreadsheets.

- Strong multi-entity consolidation and intercompany support makes it reliable for global finance operations.

- Audit-friendly features like version control and transparent workflows reduce compliance risk.

Cons:

- Dependence on Excel can still create versioning risks if offline copies are used.

- Performance can degrade with very large datasets compared to purpose-built platforms.

- Workflow setup and consolidation rules require skilled resources to configure properly.

16) OneStream

OneStream is a unified close and consolidation platform designed to replace fragmented legacy systems and reduce spreadsheet dependency. It offers robust support for global accounting standards (US GAAP, IFRS), automated intercompany eliminations, foreign exchange management, and flexible data integration—making it well suited for large or complex enterprises requiring rigorous control and visibility in their close processes.

Key Features:

- Data Integration: Automated connectors with ERPs, GLs, and other source systems, with drill-back to source transactions for full transparency.

- Account Reconciliation: Transaction matching plus pre- and post-load validations to minimize errors before close.

- Complex Consolidations: Handles intercompany eliminations, foreign currency translation, acquisition accounting, and more.

- Compliance & Audit Support: Provides full audit trails, multi-standard reporting, and support for tax provision and ESG/regulatory requirements.

- Guided Workflows: Standardizes data quality, reporting, and close tasks to improve consistency and reduce manual effort.

Differentiation:

OneStream excels at managing scale and complexity. Its drill-back functionality—from consolidated reports down to underlying GL transactions—enhances both audit transparency and error resolution. By unifying consolidation, close, intercompany, and currency processes into a single platform, OneStream reduces reliance on multiple standalone tools and spreadsheets.

Pros:

- Handles complex global structures with intercompany eliminations, FX translations, and multiple GAAPs.

- Data drill-back to source transactions improves auditability and speeds issue resolution.

- Strong compliance and audit trails support regulatory and internal control requirements.

Cons:

- High implementation cost and timeline make it best suited for large enterprises.

- Feature-rich platform can overwhelm smaller finance teams, creating unnecessary complexity.

17) JustPerform (insightsoftware)

JustPerform is a cloud-native platform that unifies budgeting, forecasting, financial close, consolidation, and reporting in one environment. With an emphasis on user self-service, governance, and real-time insights, it helps organizations streamline group consolidations, modernize performance reviews, and reduce reliance on manual spreadsheets.

Key Features:

- Consolidation & Close: Supports multi-entity and multi-GAAP consolidations alongside financial close tasks, reporting, and dashboards.

- Real-Time Analysis: Provides reporting, “what-if” simulations, and dashboards to support decision-making during close and forecasting cycles.

- Self-Service Workflows: Role-based access controls and governance tools allow business users to manage tasks without heavy IT or finance dependency.

- Compliance & Security: Built-in controls including SOC 2 Type II, ISO 27001, and full audit trails for financial consolidations and reporting.

Differentiation:

JustPerform stands out through its cloud-native architecture, which delivers faster updates, scalable data handling, and a modern user experience. The platform empowers business users with self-service workflows and governance, reducing reliance on centralized teams. Its templates and virtual model capabilities help organizations move away from legacy spreadsheets, while strong compliance credentials reassure enterprises migrating from less-secure systems.

Pros:

- Cloud-native and user-friendly interface accelerates adoption and reduces IT dependency.

- Built-in consolidation hub with multi-GAAP support ensures compliance across jurisdictions.

- Real-time reporting and simulation tools give finance teams faster insight during the close.

Cons:

- Drill-down flexibility is limited for very detailed transaction-level analysis.

- Initial setup and configuration still require effort, despite vendor’s emphasis on simplicity.

- Training materials and documentation are not as comprehensive, increasing reliance on vendor support.

18) Board

Board’s Group Consolidation & Reporting (GCR) provides a unified platform that combines financial consolidation, planning, and reporting in one system. Finance teams can collect, validate, and reconcile data from multiple legal entities, generate statutory reports, and perform scenario modeling with self-service analysis. The solution is well suited for organizations aiming to shorten cycle times, improve transparency in consolidation, and reduce reliance on disparate tools.

Key Features:

- Automated data input and validation: Streamlines data collection and ensures accuracy.

- Intercompany reconciliation dashboards: Provides visibility into discrepancies and facilitates resolution.

- Support for multiple reporting standards: Complies with US GAAP, IFRS, and local statutory frameworks.

- Scenario modeling capabilities: Allows for the definition and analysis of multiple consolidation scenarios.

- Integrated planning and reporting: Unifies financial consolidation, planning, and reporting in a single platform.

Differentiation:

Board stands out by tightly integrating consolidation, planning, and reporting in a single platform, enabling smooth transitions from scenario planning to statutory reporting. Unlike tools that focus only on consolidation or reporting, Board unifies these functions. Strong self-service capabilities—such as dashboards and scenario modeling—paired with robust governance make it accessible without requiring deep technical or coding expertise.

Pros:

- Significant time savings in close cycles by automating data collection, validation, reconciliation, and reporting.

- High transparency and governance through intercompany dashboards and submission monitoring.

- Flexibility for scenario analysis and planning integrated into the same system ensures that the “what-if” modeling feeds into actual close/financial reporting.

Cons:

- Setup and configuration complexity can be nontrivial, particularly if there are many entities, complex consolidation rules, or multiple reporting standards.

- Performance considerations when dealing with very large data volumes—users may experience latency if many entities or many dimensions are involved.

- User training needed to get full value from scenario modeling and self-service reporting tools, especially for finance staff unfamiliar with such integrated platforms.

19) Cube

Cube is a spreadsheet-centric financial close and FP&A solution that syncs financial data from ERPs, CRMs, and other systems into Google Sheets or Excel. Finance teams can continue using familiar spreadsheet tools while gaining automation for consolidation, reporting, and scenario analysis. The platform reduces manual data gathering and improves accuracy through structured workflows and audit trails.

Key Features:

- Automated data syncing: Integrates financial data into spreadsheets, reducing manual entry.

- Multi-currency support: Facilitates consolidation across different currencies.

- Scenario analysis tools: Enables modeling of various financial scenarios.

- Audit trails and permissions: Tracks changes and manages access to sensitive data.

- Custom reporting capabilities: Allows for the creation of tailored financial reports.

Differentiation:

Cube stands out by letting finance teams continue using spreadsheets while adding structure, automation, and control. Many other platforms require a switch to proprietary interfaces or complex modules. Cube bridges source systems and spreadsheets, preserving workflow familiarity while enhancing data integrity, automation, and oversight.

Pros:

- Rapid adoption because finance teams can keep using Excel or Google Sheets, which lowers friction and training time.

- Strong visibility into data accuracy via audit trails and automated syncing, reducing “spreadsheet drift” and errors.

- Good value for mid-sized organizations needing FP&A and consolidations without the cost/complexity of full EPM suites.

Cons:

- Scaling limitations: when operations get very complex (many entities, many currencies, many integrations), spreadsheet-centric approaches may strain performance or get unwieldy.

- Dependency on external tools: spreadsheets are still used front and center; any weaknesses in those (e.g. versioning, offline use) can affect outcomes.

- Feature limitations relative to full financial consolidation platforms: some advanced consolidation logic, deep statutory reporting, or audit-level features might be less rich or require workaround.

20) Redwood Software

Redwood’s Record-to-Report (R2R) Automation provides deep integrations, particularly with SAP-flexible deployment modes, and coverage of areas often overlooked by traditional close tools, including journal entries, intercompany transactions, accruals and reclassifications, and the broader R2R workflow. It is designed for organizations seeking to move toward “touchless close” approaches.

Key Features:

- Automation of financial close tasks: Reduces manual effort in journal entries, reconciliations, and intercompany accounting.

- Deep ERP integration: Seamlessly connects with ERP systems, especially SAP.

- Flexible deployment options: Supports both cloud-based and on-premises solutions.

- Audit and compliance features: Maintains regulatory adherence with comprehensive audit trails.

- Centralized dashboard: Provides a unified view of the financial close process.

Differentiation:

Redwood distinguishes itself by offering end-to-end R2R automation rather than focusing solely on reconciliation or close task management. Its deep SAP integration enables organizations already using SAP—or SAP-centric systems—to automate more of their R2R workflow within that environment. Handling both “inside-ERP” and “outside-ERP” tasks allows coverage of close process areas that many other platforms leave manual.

Pros:

- Very high automation potential, reducing manual effort significantly.

- Strong fit for SAP environments with deep integration that reduces duplication and enables more “touchless” close workflows.

- Broader R2R coverage, including accruals, provisions, reclassifications, journal entries—handles parts many other platforms may only partially support.

Cons:

- Implementation and change management can be heavy, especially for organizations with deeply manual or legacy close processes.

- Some “outside-ERP” tasks may still require manual oversight or adjustment, depending on how well existing systems are organized and integration maturity.

Why DOKKA Is the Top Choice for Financial Close Automation

DOKKA stands out by transforming the financial close from a slow, error-prone process into a fast, accurate, and fully auditable operation.

And DOKKA is the only platform that seamlessly combines accounts payable and financial close in a single system, allowing transactions to flow directly from AP into the close process. Such integration eliminates reconciliation gaps, reduces manual data entry, and ensures that all payables are accounted for before period-end reporting.

AI-powered automation captures data, posts journal entries, reconciles accounts, and flags discrepancies in real time, preventing costly mistakes. Finance teams collaborate on one centralized platform, where every task is visible, accountable, and compliant with regulations.

DOKKA scales effortlessly across multiple entities and complex operations, removing the need for additional staff as the business grows.

Companies choose DOKKA because it delivers faster closes, reduces risk, and provides complete control over financial operations—all within an intelligent, easy-to-use platform.

FAQ: Financial Close Software

Q1: How to know which software solution is best for my business?

Choosing the right financial close software depends on your company’s size, complexity, and existing systems. Assess your workflow bottlenecks, integration needs, and required automation features, then compare platforms based on scalability, ease of use, and support. Request demos and trial periods to see how each solution fits your team’s processes before committing.

Q2: How long does it take to implement a financial close software like DOKKA?

Implementation timelines vary based on company size, complexity of existing systems, and level of ERP integration. For mid-sized organizations, the core setup—including user training, workflow configuration, and system integration—can typically take 1–2 weeks. Larger enterprises with multiple subsidiaries or highly customized ERPs may require 3 months. DOKKA offers phased deployment options, allowing teams to automate high-priority processes first, reducing initial disruption.

Q3: Can financial close software handle multi-currency and multi-entity consolidation automatically?

Yes. Modern platforms, including DOKKA, support multi-currency conversions, intercompany eliminations, and minority interest calculations. These capabilities are designed to reduce manual reconciliations and errors during month-end or quarter-end consolidation, providing near real-time visibility into global financial results.

Q4: What level of ERP dependency does financial close software require?

While some close platforms require deep ERP integration, DOKKA is designed to pull data from multiple sources without heavy ERP reliance. This reduces IT overhead and makes it possible to automate workflows even if your ERP is legacy or partially customized.

Q5: How does financial close software ensure compliance with regulations like SOX or IFRS?

Compliance is maintained through automated audit trails, role-based access, version-controlled documentation, and pre-configured workflow approvals. Exception management and validation rules ensure that adjustments, journal entries, and reconciliations meet regulatory standards. DOKKA logs every action to support internal audits and external regulatory inspections.

Q6: Can finance teams continue using Excel or other familiar tools?

Yes. Platforms like DOKKA and certain competitors offer Excel and spreadsheet integration, allowing teams to leverage familiar tools while automating repetitive tasks. Unlike standalone Excel-based workflows, DOKKA ensures that data integrity is maintained, real-time reconciliation occurs, and audit trails are preserved.

Q7: How does financial close software improve collaboration across distributed teams?

By centralizing tasks, workflows, approvals, and communication, financial close software removes the dependency on emails or siloed spreadsheets. Team members can track ownership, monitor deadlines, and resolve exceptions in real time, ensuring a coordinated month-end close across locations or entities.

Q8: What KPIs can finance leaders track using financial close software?

Common KPIs include close cycle time, reconciliation completion rates, variance resolution time, exception trends, and approval turnaround times. DOKKA and similar platforms provide dashboards that visualize these metrics in real time, enabling proactive management of bottlenecks and workload balancing.

Q9: Is AI in financial close software reliable for critical accounting tasks?

Yes, but AI should be viewed as an assistant rather than a replacement. DOKKA’s AI focuses on tasks like data extraction, anomaly detection, and pattern recognition to reduce manual work and errors. Human oversight remains essential for approvals, judgment-based adjustments, and compliance-sensitive decisions.

Q10: How does financial close software scale as a business grows?

Modern platforms are designed to handle increased transaction volumes, additional subsidiaries, and multi-entity consolidations without requiring proportional increases in staff. Automated workflows, AI-driven reconciliations, and centralized dashboards ensure efficiency and consistency as the organization expands.

Q11: What support and training are typically offered during implementation?

Vendors provide a combination of guided onboarding, documentation, live training sessions, and ongoing support. DOKKA, for example, offers step-by-step implementation assistance, workshops for finance teams, and continuous product updates to ensure teams can maximize automation benefits.

What is Financial Close Software?

Financial close software is a purpose-built system that automates, coordinates, and documents the steps required to “close the books” and produce audit-ready financial statements.

Instead of relying on disconnected spreadsheets, email threads, and manual checklists, financial close software centralizes source data, automates reconciliations and recurring journal entries, orchestrates task workflows and approvals, and maintains an unbroken audit trail.

Key features of financial close software include:

- automated account reconciliations and exception detection

- recurring and accrual journal generation and posting (often with ERP integration)

- task and workflow management (checklists, owners, deadlines, escalation rules)

- consolidation and intercompany eliminations for multi-entity groups

- real-time dashboards, variance analysis, and close KPIs

- strong audit controls (versioning, role-based access, complete logs)

Financial close software ranges from lightweight workflow tools for small teams to feature-rich enterprise suites designed for complex consolidations.

Many platforms now incorporate AI and machine learning (ML) for anomaly detection, along with OCR (optical character recognition) for document intake. Most also provide cloud/SaaS deployment options and APIs for ERP connectivity.

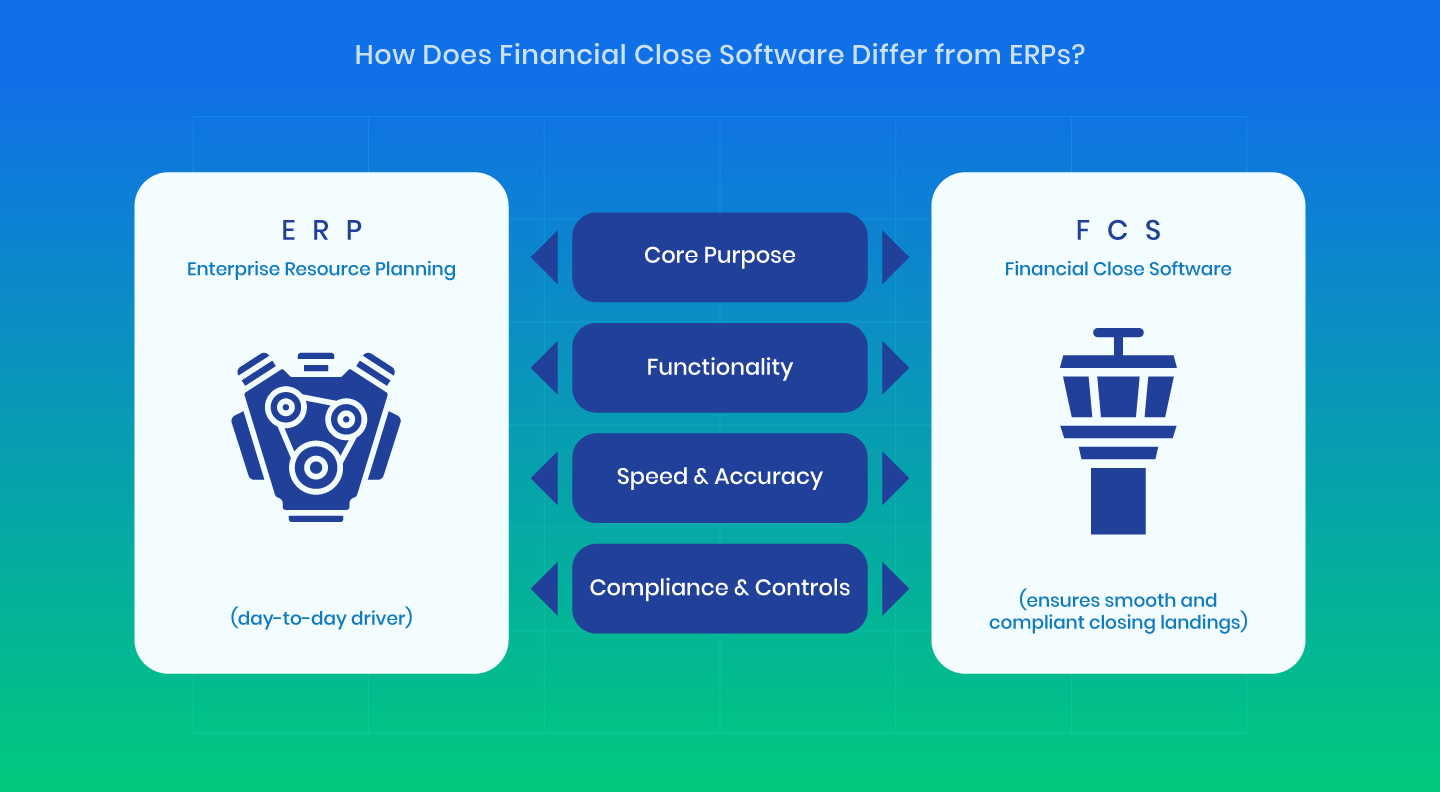

How Does Financial Close Software Differ from ERPs?

Firstly, ERPs focus on managing various business operations, such as inventory management, supply chain management, and human resources.

Financial close software is designed specifically for finance teams to manage closing processes and perform tasks such as reconciliations, journal entries, and consolidations.

Secondly, ERPs are typically used by all departments within an organization, while financial close software is tailored for finance teams.

As a result, financial close software (FCS) provides more specialized features and functionalities that address the specific needs of finance professionals.

1) Core Purpose

- ERP: A broad system that manages day-to-day business operations across departments—accounting, procurement, HR, supply chain, sales, and more. In finance, it records transactions (AP, AR, GL).

- FCS: A narrower, specialized tool built specifically to manage the closing and reporting cycle (month-end, quarter-end, year-end).

2) Functionality

- ERP: Records and processes transactions, maintains the general ledger, and integrates with operational areas (inventory, payroll, etc.).

- FCS: Automates account reconciliations, manages journal entry approvals, handles intercompany eliminations and consolidations, and provides task lists, workflows, and dashboards for the close process.

3) Speed & Accuracy

- ERP: Provides a single source of truth for financial data but often requires manual work (Excel, emails) to finalize the close.

- FCS: Works on top of the ERP, pulling data in and automating the bottlenecks that ERPs don’t handle well.

4) Compliance & Controls

- ERP: Offers audit trails for transactions but isn’t designed for period-end certifications, sign-offs, or compliance workflows.

- FCS: Built with compliance in mind, supporting SOX controls, sign-offs, audit evidence, variance analysis, and more.

Think of it this way: ERP is the engine that runs daily finance operations, while financial close software is the control tower that ensures the books are accurate, complete, and officially closed on time.

The Financial Close Process

The financial or month-end “close” is the process of finalizing a company’s books for a specific reporting period. It ensures a complete, accurate, and reliable set of books through reconciled balances, necessary adjustments, verified intercompany transactions, and the production of required statements and disclosures.

In more detail, the financial close involves reconciling accounts, recording accruals and adjustments, consolidating data across entities, comparing results to budgets or forecasts, and preparing financial statements such as the income statement, balance sheet, and cash flow statement.

Consolidation

For organizations with multiple legal entities or subsidiaries, consolidation is a critical step: combining each entity’s results into a single, coherent set of group financials.

Consolidation involves:

- Translating foreign-currency financials into the group reporting currency

- Eliminating intercompany transactions and balances

- Applying minority interest or non-controlling interest rules

- Rolling up trial balances into group statements in accordance with reporting standards such as IFRS or GAAP

A clean, timely close at each entity is the foundation for fast, accurate group consolidation.

In multi-entity organizations, consolidation often creates the biggest delays due to intercompany mismatches, currency translation issues, and late adjusting entries. Many companies address these challenges by adopting financial close software to automate reconciliations, intercompany eliminations, and reporting.

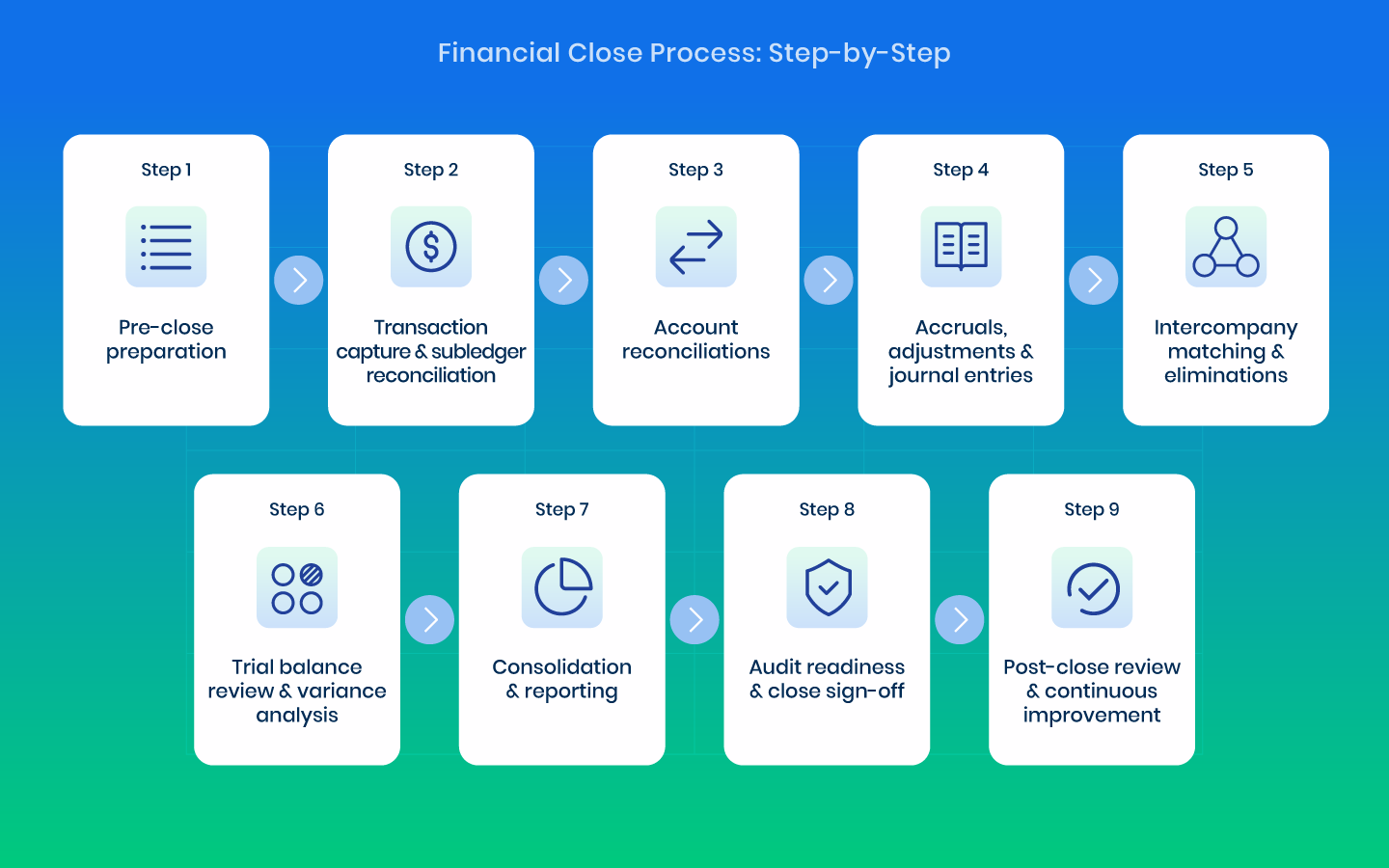

Financial Close Process: Step-by-Step

The financial close process typically starts with pre-close preparation, confirming deadlines and distributing the close calendar. Finance teams then handle transaction capture and subledger reconciliations, followed by account reconciliations for cash, bank, and accruals.

Next come accruals, adjustments, and journal entries, ensuring accuracy before moving to intercompany matching and eliminations across entities.

A trial balance review and variance analysis highlights unusual results, which feed into consolidation and reporting of final statements. The cycle ends with audit readiness and sign-off, and a post-close review to identify improvements for the next period.

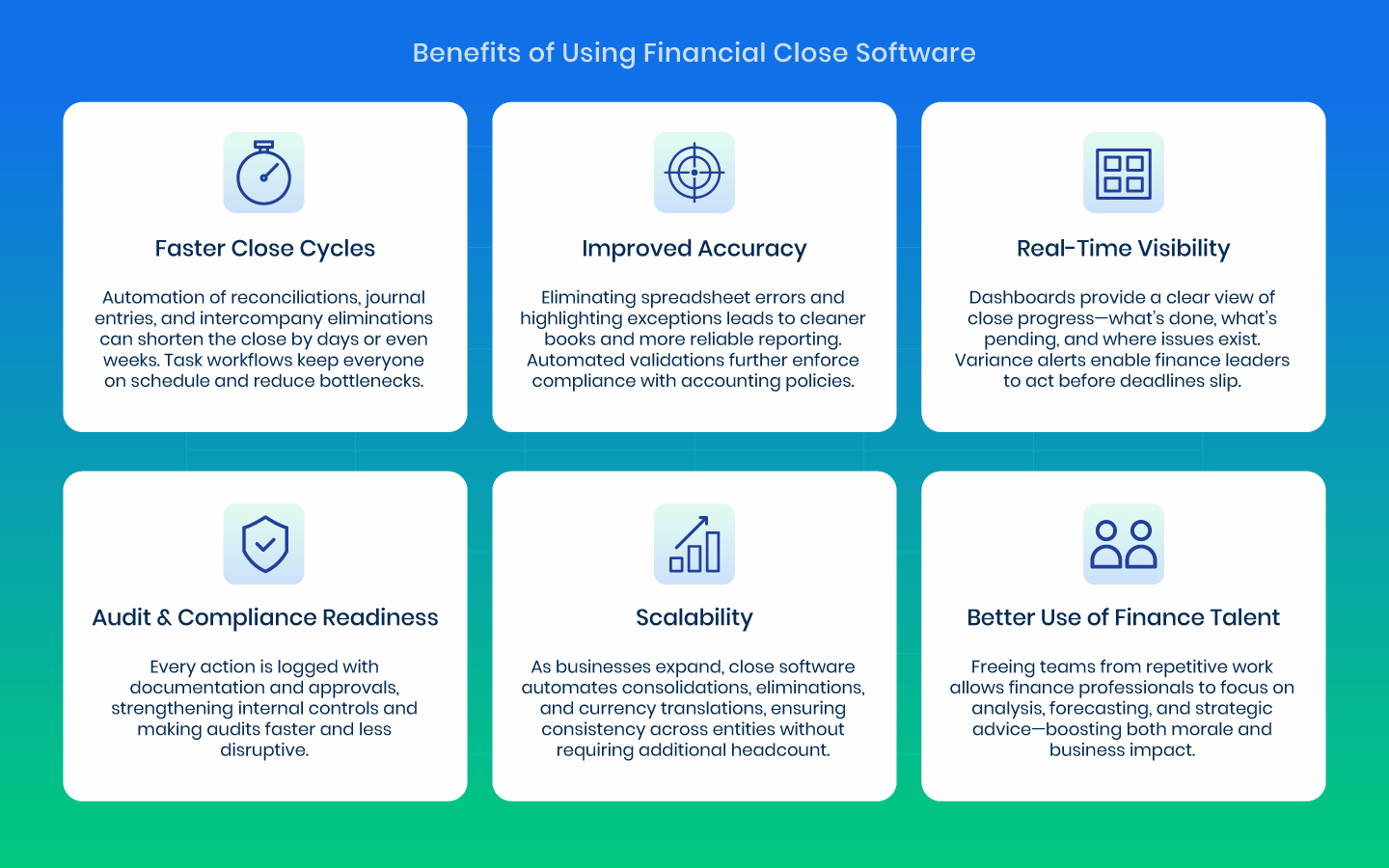

Benefits of Using Financial Close Software

Throughout the close process, common pain points arise: late receipts from subteams, manual spreadsheet consolidation, unclear ownership of reconciliations, and last-minute audit requests.

Financial close software addresses these challenges by centralizing data, clarifying responsibilities, automating routine tasks, and attaching supporting evidence to every transaction.

Financial close software transforms a painful, reactive process into a predictable, auditable, and value-adding cycle that supports smarter decisions and a stronger finance function.

Disclaimer:

All information presented about third-party products, pricing, or features is based on publicly available sources at the time of writing and is intended for general informational purposes only. DOKKA makes no representations or warranties regarding the accuracy, completeness, or correctness of competitor data. All trademarks and brand names are the property of their respective owners.

We encourage readers to verify details with the respective vendors before making any purchasing decisions.