Enterprise Resource Planning software provides an operational backbone for companies by streamlining daily operations and management.

It integrates various functions into a single system, providing real-time insights and data visibility across the organization. This holistic approach to business management facilitates better decision-making, improves productivity, and reduces operational costs.

Naturally, as companies reach a certain size or complexity, they often outgrow their current ERP solution. That is why there are three tiers of ERP software, to suit the needs of companies of all sizes.

Tier 1 typically caters to large enterprises, while Tier 2 and Tier 3 are better suited for small to medium-sized businesses.

Tier 2 ERPs have emerged as a viable solution for mid-sized companies, offering a balance between functionality and cost. However, to fully leverage the capabilities of Tier 2 ERPs, augmenting them with accounts payable automation software has become a strategic move for finance teams aiming to enhance efficiency, reduce errors, and achieve a competitive edge.

In today’s post, we’ll explore key aspects of Tier 2 ERPs, the significance of AP automation, and why integrating these technologies might be a good idea.

What Is Tier 2 ERP Software?

Tier 2 ERP software offers a wide range of capabilities tailored for mid-sized companies, enabling the automation of various business processes such as finance, inventory management, human resources, CRM, and sales.

These systems are generally more affordable than Tier 1 solutions and provide industry-specific functionality, scalability, and flexibility for growth.

Popular Tier 2 ERPs include Microsoft Dynamics 365, Oracle NetSuite, and SAP Business One.

ERP software comparison: Tier 1 vs Tier 2

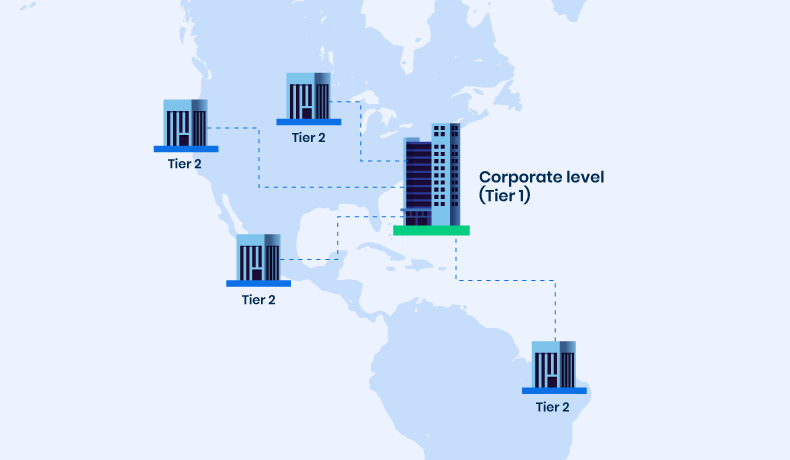

The choice between Tier 1 and Tier 2 ERP software hinges on the organization’s size, complexity, and specific needs.

Tier 1 solutions deliver the comprehensive functionality required by large, global enterprises at a higher cost, while Tier 2 solutions offer a more accessible, cost-effective alternative for medium-sized businesses or simpler operations within larger corporations.

Let’s further compare them in more detail.

Tier 1 ERPs

- Users: Designed for large, global enterprises with complex processes and requirements. These organizations typically manage diverse operations across multiple countries and need a system capable of handling large transaction volumes and complying with various international regulations.

- Customization: Offers extensive customization options to meet the intricate needs of large organizations. This includes a broad range of features and modules for managing global operations, such as finance, HR, procurement, and supply chain management.

- Integration Timeframe: Implementing Tier 1 ERP systems can be time-consuming and costly, reflecting the scale and complexity of the organizations they cater to. Projects may span several years and require substantial investment in both software and consulting services.

Tier 2 ERPs

- Users: Medium to large businesses or subsidiaries of larger corporations that require robust ERP functionality but face less complexity and scale than Tier 1 organizations.

- Customization: While still offering comprehensive functionality, Tier 2 systems are typically more straightforward and easier to implement than Tier 1 solutions. They provide flexibility and customization but are designed to be more user-friendly and less expensive to modify.

- Integration Timeframe: Tier 2 ERPs are more cost-effective and quicker to implement than Tier 1 solutions, suitable for businesses with tighter budgets or those in need of a faster deployment.

As companies grow, their ERP system is not the only business software they need.

While Tier 2 ERP software offers a range of features to streamline business processes, it often lacks advanced functionality in certain areas.

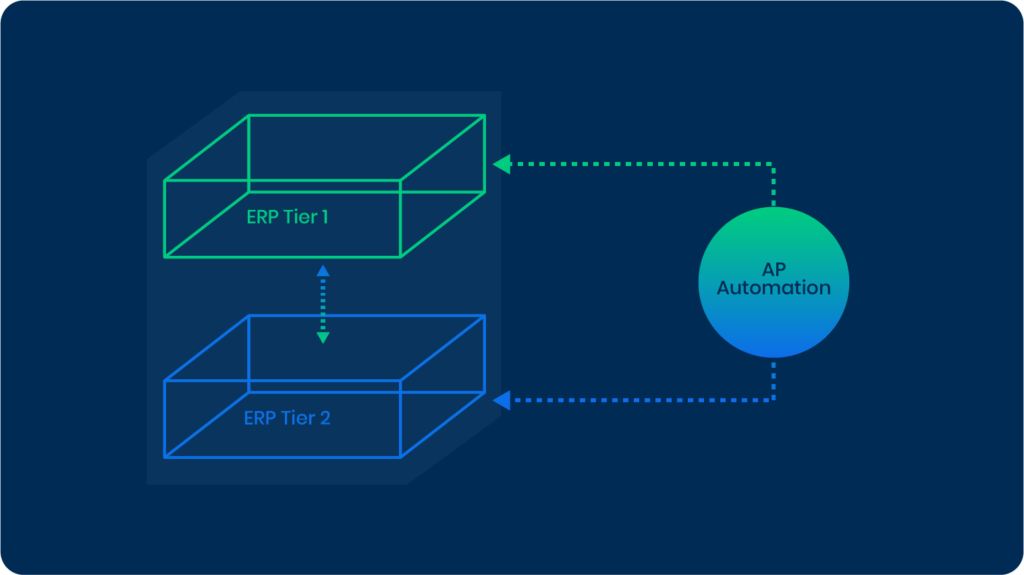

To address specific needs, such as accounts payable (AP) automation, many companies opt for specialized AP automation software that integrates seamlessly with their ERP solution.

How Can AP Automation Enhance Tier 2 ERP Software?

AP automation can significantly enhance Tier 2 ERP software by transforming the traditionally labor-intensive and error-prone accounts payable process into a more streamlined, efficient, and accurate operation.

Through the digitization and automation of tasks such as data entry, invoice matching, and payment scheduling, AP automation minimizes human error.

This allows finance teams to dedicate more time to strategic activities instead of routine administrative tasks.

Such a shift not only improves the accuracy of financial operations, but also accelerates the entire invoice processing cycle, enabling faster payment approvals and contributing to a more efficient cash management strategy.

Moreover, AP automation offers the advantage of real-time visibility into the status of invoices and overall cash flow.

Immediate access to financial data is essential for effective decision-making and forecasting. Integrating AP automation with Tier 2 ERP software ensures a seamless flow of financial information across departments, providing all stakeholders with a unified and comprehensive view of the company’s financial health.

Enhanced capabilities provided by AP automation, such as electronic invoicing and automated approval workflows, support a more environmentally friendly paperless office environment.

This not only contributes to corporate sustainability goals but also reduces the costs associated with paper-based processes.

Ultimately, the combination of AP automation and Tier 2 ERP software empowers businesses to achieve a higher level of operational efficiency, financial accuracy, and strategic financial management. It sets a solid foundation for growth and competitive advantage in their respective markets.

Key Benefits of Integrating AP Automation With Tier 2 ERP Software

Augmenting Tier 2 ERPs with AP automation software represents a strategic business decision for companies aiming to streamline their accounts payable process and enhance overall efficiency.

Is it worth it? To answer that question, let’s summarize the key benefits of this integration:

- Streamlined AP process

By integrating AP automation software with Tier 2 ERP systems, companies can streamline the entire AP process—from invoice capture and data extraction to approval workflows and payment processing. This integration eliminates manual data entry, reduces the risk of errors, and significantly speeds up the process.

- Real-time data sync

With AP automation software integrated into Tier 2 ERP systems, data automatically synchronizes between the two platforms in real-time. This ensures the accuracy and timeliness of financial data in both systems, simplifying tracking and financial management.

- Improved visibility

The integration of AP automation and ERP software grants companies enhanced visibility into their financial data. This facilitates more accurate forecasting, strategic decision-making, and the identification of potential areas for cost savings.

- Cost savings

Automating the AP process and eliminating manual tasks lead to significant time and resource savings, thereby reducing operational costs. Improved data accuracy and visibility also enable businesses to pinpoint cost-saving opportunities and optimize their financial operations.

- Scalability

As businesses expand, their financial needs grow. Integrating Tier 2 ERPs with AP automation software offers the flexibility to scale systems and processes seamlessly, ensuring financial operations can evolve alongside the business.

- Better compliance

AP automation software helps businesses adhere to regulatory and internal policies more effectively. Integration with Tier 2 ERPs enhances control and visibility over the accounts payable process, minimizing the risk of errors or fraud.

- Enhanced collaboration

Integration facilitates improved collaboration across finance teams by providing a unified platform for managing financial operations. This shared environment fosters better communication and coordination among team members. Additionally, advanced analytics capabilities of integrated systems enable businesses to extract valuable insights from their financial data, helping to refine strategies and make data-driven decisions.

- Stronger vendor relationships

Efficient and timely processing of invoices and payments strengthens vendor relationships. The enhanced transparency and reliability provided by an integrated AP automation and ERP system ensure that vendors receive timely payments, contributing to better negotiation terms and fostering trust.

Best Practices for Integrating AP Automation With Tier 2 ERP Systems

To ensure a smooth and successful integration, here are some best practices to follow:

1. Conduct a thorough needs assessment

Before embarking on integration, conduct a comprehensive assessment of your current AP processes and identify specific pain points and requirements. Understanding the scope of your AP operations and how they align with your business objectives is crucial for selecting the right AP automation solution that complements your Tier 2 ERP solution.

2. Choose a compatible AP automation software

Select an AP automation solution that is compatible with your ERP system in terms of technology, data formats, and communication protocols. Compatibility ensures seamless data exchange and process synchronization between the two systems, minimizing the need for manual intervention and reducing the risk of errors.

If you’re interested in seeing DOKKA’s state of the art AP automation platform, please book a 30-minute demo here.

3. Involve stakeholders early

Engage key stakeholders from finance, IT, and other relevant departments early in the process. Their insights can help identify potential challenges and requirements that may impact the integration. Stakeholder buy-in is also critical for smooth adoption and change management.

4. Plan for scalability

Consider the future growth of your business and how it may affect your AP and ERP needs. The chosen AP automation solution should be scalable, allowing for an increase in transaction volumes and the addition of new features or functionalities as your business evolves.

5. Ensure data integrity and security

Data integrity and security are paramount when integrating AP automation with your ERP system. Implement robust data validation, error handling mechanisms, and adhere to industry-standard security practices to protect sensitive financial information against unauthorized access or breaches.

6. Automate end-to-and AP processes

Maximize the benefits of AP automation by automating the entire invoice-to-pay cycle. This includes invoice receipt, data capture, matching, approval workflows, and payment processing. An end-to-end automated process reduces manual touchpoints, speeds up cycle times, and improves operational efficiency.

7. Provide comprehensive training and support

Ensure that all users receive thorough training on the integrated AP automation and ERP system. Adequate training enhances user adoption and proficiency. Additionally, establish a support framework to address any issues or questions that arise during and after the integration process.

8. Monitor and optimize continuously

After integration, continuously monitor the performance of the integrated system to identify any areas for improvement. Collect feedback from users and regularly review process efficiencies, data accuracy, and compliance. Use these insights to make iterative enhancements, optimizing the AP automation and ERP integration over time.

9. Maintain compliance and stay updated

Keep abreast of regulatory changes that may affect your AP processes and ensure that your integrated system remains compliant. Additionally, stay informed about updates and enhancements to both your AP automation solution and ERP system to leverage new functionalities that can further improve your financial operations.

How DOKKA Can Amplify Your Tier 2 ERP

DOKKA is a cutting-edge AP automation software that revolutionizes the way businesses manage their accounts payable operations.

Specializing in seamless integration with world-renowned Tier 2 ERP solutions such as Microsoft Dynamics and SAP Business One, DOKKA leverages the power of artificial intelligence and machine learning to offer a robust platform for the automation of end-to-end accounts payable processes.

This integration is not just about simplifying the invoice handling and payment procedures; it’s about transforming the entire financial workflow to achieve unparalleled operational efficiency, enhanced transparency and control, and superior compliance adherence.

One of the standout features of DOKKA is its ability to cater to the unique needs of businesses operating with different Tier 2 ERP systems.

Whether it’s the diverse functionalities required by users of Priority ERP, or the specific demands of Oracle NetSuite environments, DOKKA’s flexible platform ensures a tailored fit to enhance the existing ERP infrastructure.

This compatibility empowers businesses to streamline their AP processes, from invoice capture and data entry to approval workflows and payment execution, all within a unified, user-friendly interface.