Compliance is the cornerstone of corporate responsibility in an ever-changing regulatory landscape. To stay ahead, organizations must continuously adapt to new rules and standards.

In finance and accounting departments, the complexity and volume of compliance tasks have grown significantly in recent years. Manual processes are inefficient and struggle to keep pace with ongoing regulatory updates.

Automation acts as both a safeguard and a driver of strategic growth. Financial automation tools enable organizations to meet compliance requirements efficiently, accurately, and proactively.

In this article, we’ll explore the specific features of automation solutions that support regulatory adherence, minimize the risk of audits and penalties, and improve visibility and control in finance operations.

![]()

Financial Compliance Is More Complex Than Ever

The regulatory landscape for finance and accounting is becoming not only more complex but also increasingly unpredictable. Corporations now operate in an environment characterized by constant regulatory updates, overlapping jurisdictions, and heightened enforcement actions.

Compliance has evolved beyond static checklists and annual audits. It now demands a dynamic, real-time approach to maintain ongoing alignment with laws and standards across various domains.

The challenge lies not only in remaining compliant but in doing so efficiently, accurately, and consistently across departments, business units, and international borders.

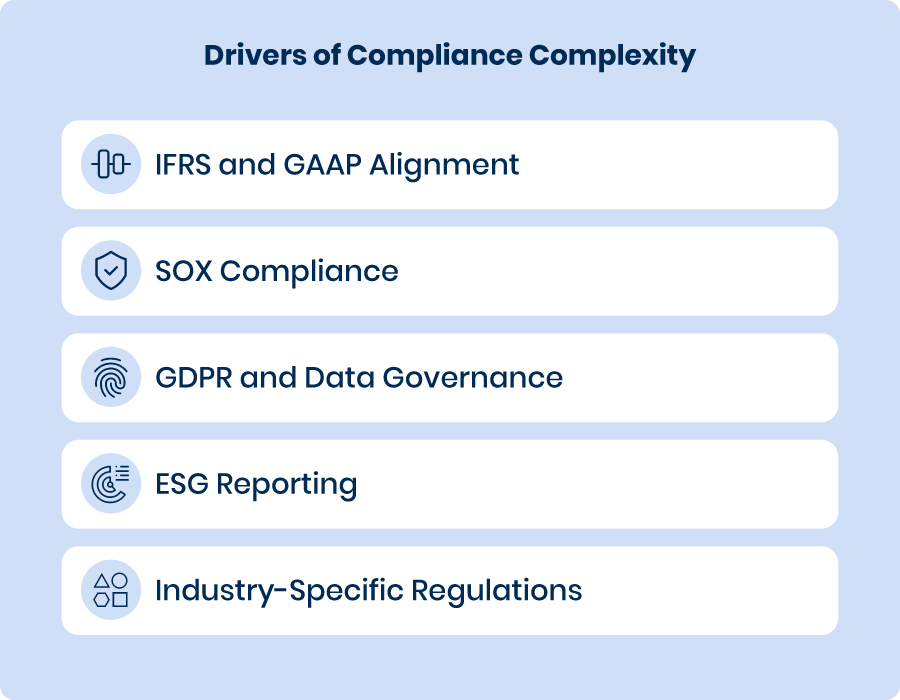

What, then, is driving this surge in compliance complexity?

![]()

![]()

1) IFRS and GAAP Convergence: Constant Evolution in Reporting Standards

The International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) are frequently updated to reflect evolving business models, the growing importance of intangible assets, and sustainability concerns.

- Changes introduced through IFRS 15 and ASC 606 significantly altered revenue recognition rules, introducing new disclosure requirements and necessitating additional accounting judgments.

- Ongoing amendments require finance teams to revise accounting policies regularly, retrain personnel, and upgrade financial systems to maintain compliance.

Companies operating globally must navigate dual reporting frameworks, which increases workloads and heightens the risk of reporting inconsistencies.

2) SOX Compliance: Internal Controls Under the Microscope

The Sarbanes-Oxley Act (SOX) imposes stringent requirements for internal controls and financial reporting accountability in public companies.

- Compliance involves maintaining verifiable audit trails, obtaining executive sign-offs, and enforcing segregation of duties to mitigate fraud and error.

- Internal audits and control testing have evolved into continuous, year-round activities rather than periodic tasks.

- Non-compliance exposes executives to criminal liability in addition to financial penalties.

As regulatory and investor scrutiny intensifies, organizations must adopt well-documented, resilient processes that clearly demonstrate transparency and effective control.

3) GDPR and Data Governance: Financial Data Must Now Be Privacy-Compliant

The General Data Protection Regulation (GDPR), along with similar laws such as the California Consumer Privacy Act (CCPA), extends compliance responsibilities beyond IT departments to financial systems that handle personal data.

- Documents such as vendor invoices, payroll records, and expense reports frequently include personally identifiable information (PII).

- Financial departments are now expected to oversee data minimization practices, implement retention schedules, and undergo regular privacy audits.

The convergence of financial compliance and data privacy obligations demands secure, traceable data management across all platforms.

4) ESG Reporting: The New Frontier in Financial Disclosure

Environmental, Social, and Governance (ESG) metrics are transitioning from voluntary guidelines to mandatory disclosure requirements in many jurisdictions.

The EU’s Corporate Sustainability Reporting Directive (CSRD), for example, requires detailed sustainability reporting alongside traditional financial statements.

- Stakeholders—including investors, regulators, and customers—are demanding transparent, verifiable ESG data, particularly in areas such as carbon emissions, labor conditions, and corporate governance.

- Integrating ESG data into financial disclosures introduces a new layer of compliance complexity.

Unlike conventional financial metrics, ESG indicators often rely on qualitative inputs, collaboration across departments, and forward-looking risk assessments.

5) Industry-Specific Regulations: Layered Compliance Obligations

In addition to global standards, businesses must adhere to their industry-specific regulations:

- Healthcare: Financial documentation must comply with HIPAA requirements concerning data confidentiality and access control.

- Finance: Brokerages and banks are governed by FINRA, SEC regulations, and Anti-Money Laundering (AML) laws, which may include real-time monitoring of transactions.

- Retail and eCommerce: Organizations must meet PCI-DSS standards for payment security and manage sales tax obligations that vary across jurisdictions.

Each regulatory regime introduces distinct reporting requirements, audit procedures, and penalty structures, further intensifying the compliance landscape.

![]()

Why Manual Compliance No Longer Works

Historically, compliance was managed through a combination of spreadsheets, policy manuals, email approvals, and periodic audits.

While such methods may have sufficed in a less dynamic regulatory environment, they are wholly inadequate today for several reasons:

- Volume of transactions: The sheer number of financial activities occurring daily renders manual monitoring impractical.

- Geographic complexity: Global operations must adhere to dozens of overlapping regulations in real time.

- Increased enforcement: Regulators now demand real-time transparency and accountability, rather than post-event reporting.

- Integration with other departments: Compliance is no longer isolated, it now intersects with IT, HR, supply chain, and other critical functions.

Manual, reactive approach to compliance introduces significant risk. It creates blind spots, delays, and vulnerabilities that can result in reputational and financial damage.

To remain competitive and resilient, organizations must adopt automation and digitization as foundational elements of a modern compliance strategy.

![]()

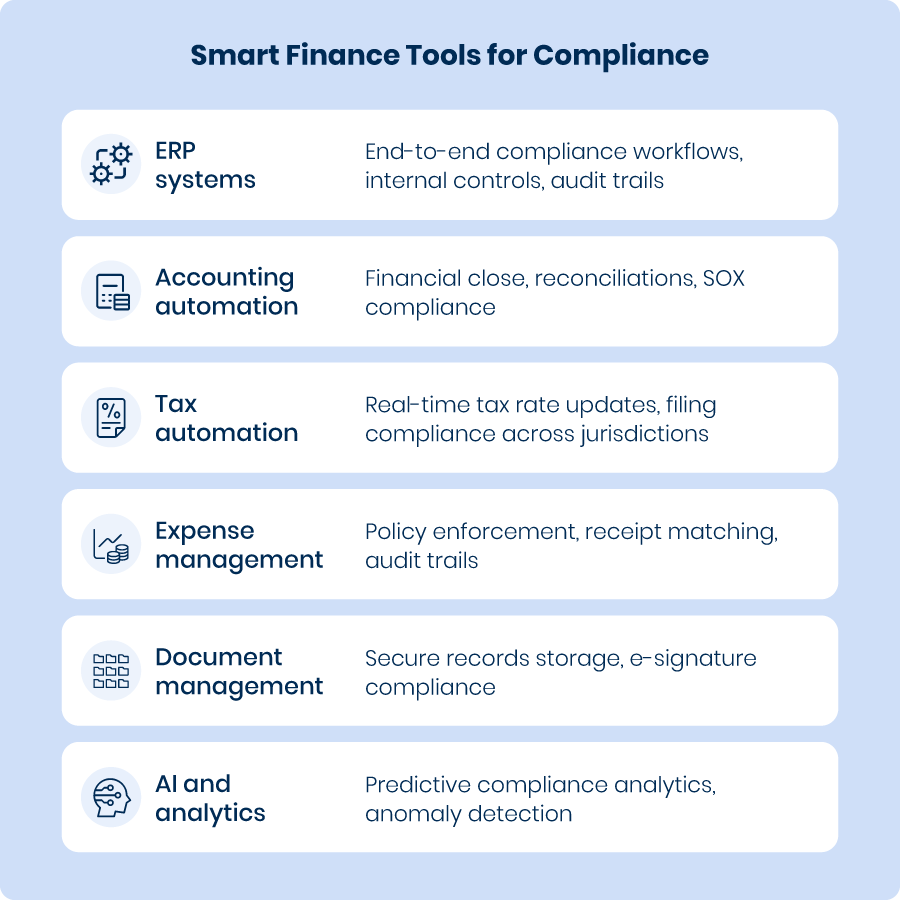

Finance Automation: A New Era of Compliance Management

When referring to automation in finance and accounting, it typically involves the use of software tools and artificial intelligence (AI) to handle repetitive, rule-based tasks with minimal human involvement.

The true value of automation, however, lies in its capacity to enable continuous compliance – a proactive, real-time approach to identifying, managing, and mitigating regulatory risks.

Let’s explore how it works.

![]()

![]()

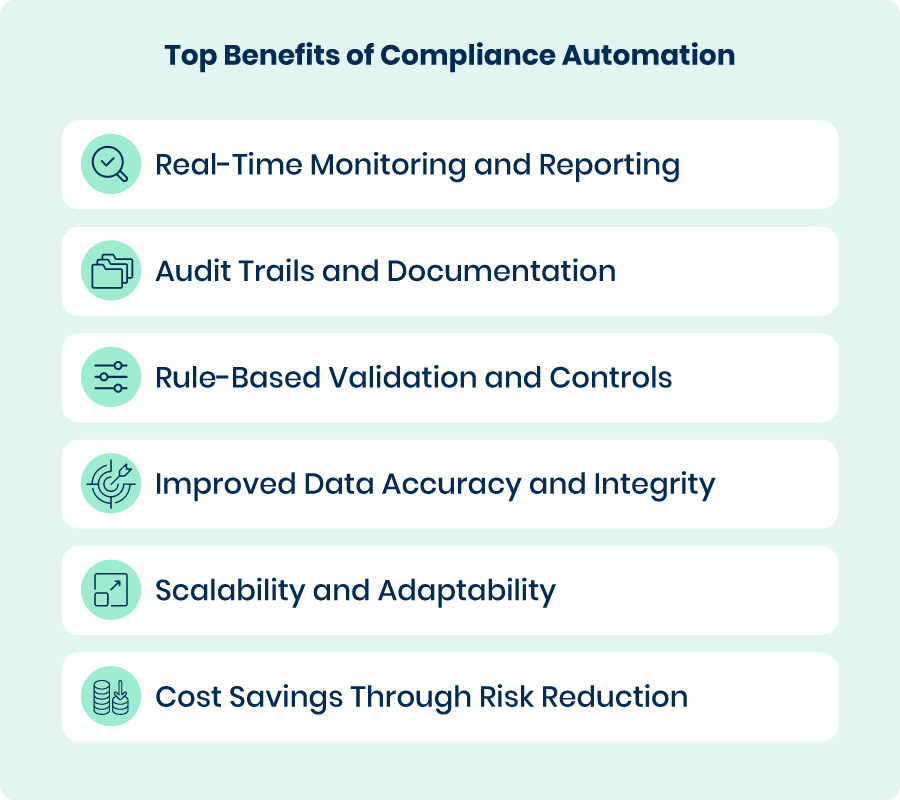

Real-Time Monitoring and Reporting

One of the cornerstones of compliance is accurate and timely reporting. Automation platforms integrate with ERP, CRM, and accounting systems to extract real-time data and generate regulatory reports with a single click.

- Automated financial statements promote consistency across balance sheets, income statements, and cash flow reports.

- Pre-configured regulatory report templates (e.g., for SOX, IFRS, ESG) help reduce the margin of error.

- Continuous monitoring tools identify anomalies or deviations in financial metrics that may indicate fraud or non-compliance.

- Real-time insights support timely reporting and offer early warnings, enabling corrective action before issues escalate.

Audit Trails and Documentation

Auditors and regulators require organizations to maintain meticulous records of financial transactions and internal processes. Automation tools offer the following advantages:

- Automatic audit trails: Every transaction, change, or approval is timestamped and traceable.

- Version control: Tracks document changes to ensure accountability.

- Centralized data repositories: Store all supporting documents in an easily retrievable, standardized format.

As a result, the necessary documents are readily available during an audit – organized, consistent, and regulator-ready.

Rule-Based Validation and Controls

Automation solutions can be configured with internal rules aligned with regulatory standards. For example:

- Validation rules for invoice processing (e.g., matching with purchase orders, tax regulations)

- Approval workflows to maintain segregation of duties

- Threshold alerts that flag unusual financial activity or compliance breaches

Embedding policies directly into systems helps reduce human error and ensures consistent practices across operations.

Improved Data Accuracy and Integrity

Manual data entry remains one of the primary causes of financial discrepancies. Automation mitigates this risk through:

- System integration that eliminates duplicate entry

- OCR (Optical Character Recognition) for accurate digitization of physical financial documents

- AI-driven reconciliation tools that match transactions, identify inconsistencies, and correct mismatches automatically

These improvements enhance data integrity and strengthen trust in financial reporting provided to regulators and auditors.

Scalability and Adaptability

As organizations grow, either across geographies or business units, compliance complexity tends to increase. Automation tools offer scalability through:

- Managing high transaction volumes without added headcount

- Accommodating multi-jurisdictional compliance rules using localized configurations

- Integrating with systems such as tax, HR, and procurement to deliver a comprehensive compliance overview

Such capabilities ensure that compliance mechanisms evolve alongside the business without requiring proportional staff increases.

Cost Savings Through Risk Reduction

Non-compliance can result in significant financial and reputational costs. Automation reduces this risk through:

- Minimizing errors that might lead to penalties

- Proactively identifying risks to reduce exposure to fraud or regulatory violations

- Supporting efficient internal audits that catch issues before they escalate

Over time, the return on investment (ROI) in automation stems not only from labor savings but also from avoiding costly compliance failures.

![]()

![]()

The Future of Compliance Is Proactive, Not Reactive

As AI and machine learning continue to reshape the finance landscape, the next frontier in compliance automation is predictive compliance. This evolution moves beyond identifying current risks, it leverages behavioral patterns, historical data, and market indicators to anticipate potential violations before they occur.

At the same time, regulatory bodies are embracing digital transformation. Agencies such as the IRS and HMRC are shifting toward real-time digital submissions, raising expectations for transparency and responsiveness. In this environment, only digitally equipped organizations will be able to keep pace.

Modern finance and accounting tools do more than streamline workflows—they empower organizations to be proactive, resilient, and audit-ready. Eliminating manual bottlenecks, improving data accuracy, and establishing robust digital controls turns compliance into a strategic advantage rather than a reactive burden.

DOKKA equips finance teams with real-time automation, AI-driven document processing, and seamless integrations, helping them stay one step ahead of compliance demands.

From capturing and organizing financial data to supporting audit trails and digital submissions, DOKKA enables a shift from reactive to predictive compliance—efficiently, accurately, and confidently.

Ready to future-proof your compliance strategy? Book a demo with DOKKA today and discover how automation can transform your finance operations.